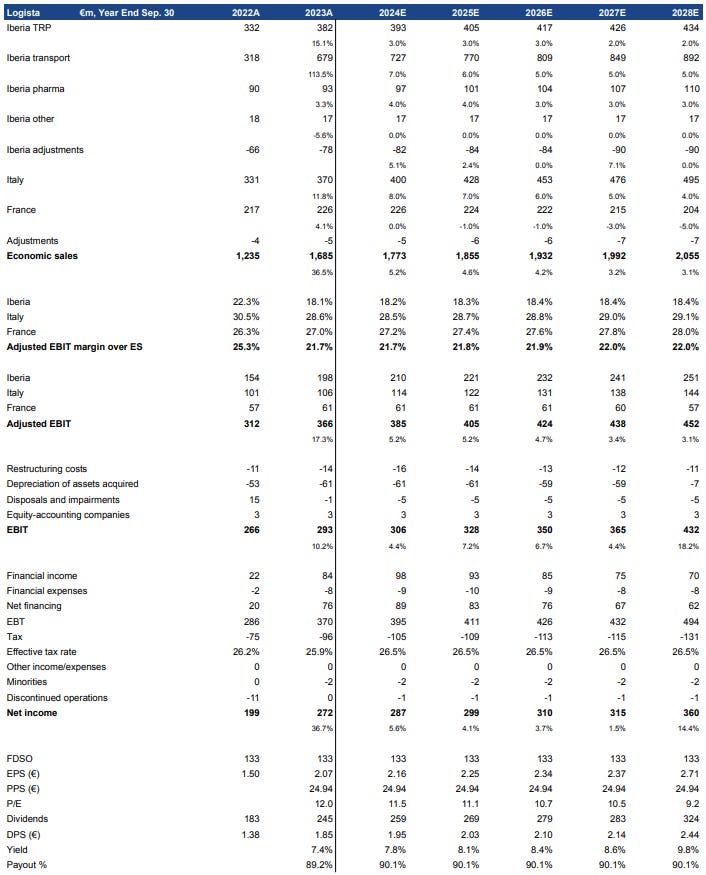

“Logista will continue to record sustained growth for the year 2024, estimating mid-single digit growth in Adjusted EBIT over that achieved in 2023. This expected growth excludes the effect of the €30 million impact on the value of inventories recorded in 2023 given its exceptionality and any new acquisitions that may be made during the year.” - Logista, Q1’24 Results

With tobacco majors' equities sporting what can only be described as unduly depressed multiples, last week provided considerable reasons to cheer as British American Tobacco and Altria announced trimming major investment stakes in ITC and Anheuser-Busch, respectively, with the proceeds aimed at accelerating share repurchases. Having incessantly howled about the stakes, it will be refreshing to write on the redeployments as fact rather than hypothetical in upcoming pieces. At the same time, Imperial Brands sits as the low man on the totem pole of public opinion. Yet, it trades at some of the lowest multiples of the bunch, with perhaps one of the clearest paths set by management. Along with its massive free cash flow production supporting its 8.7% dividend yield, the company is set to retire more than 7% of its share capital in the forward year and remains steadfast in its commitment to maintaining the pace. This repurchase program dwarfs even the new accelerated program authorized by Altria, and critically, it has not required the selling of any investment stake in the slightest. Imperial’s 50.1% stake in Logista remains undisturbed, and its results continue to glow.

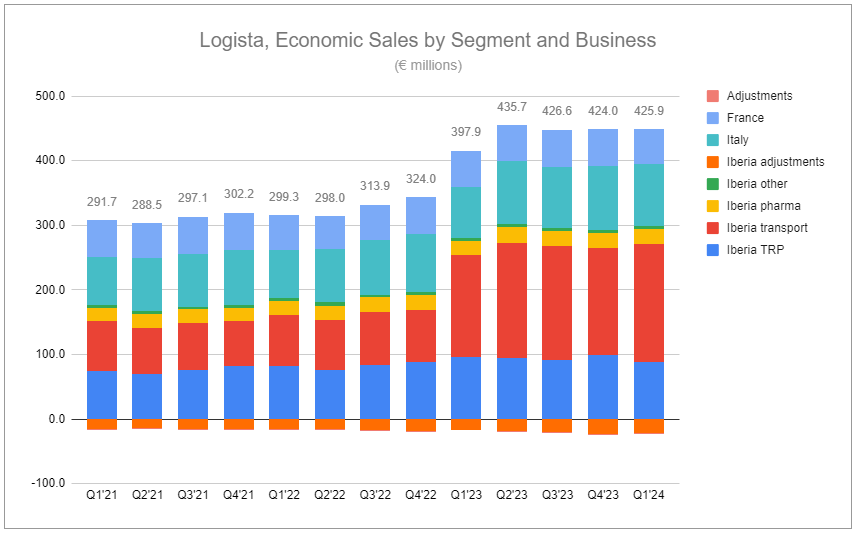

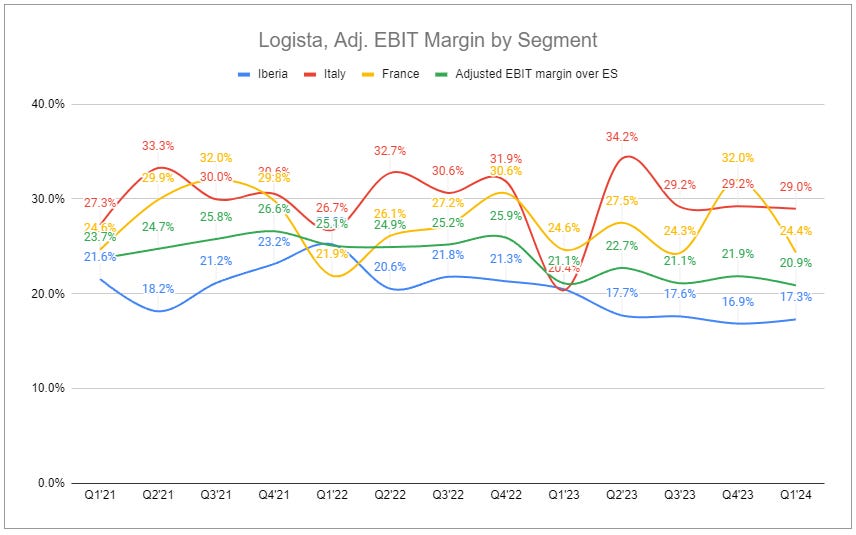

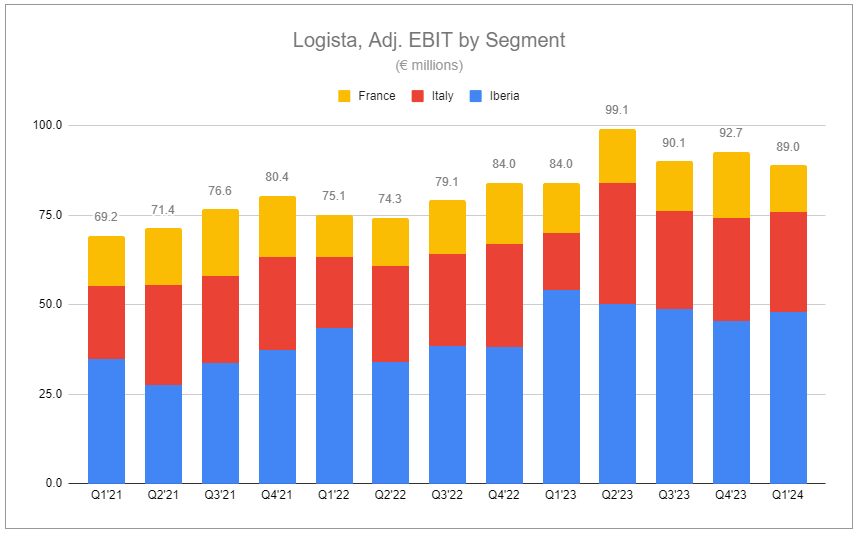

Logista’s Q1’24 continued the same core trends demonstrated throughout 2023. Total revenues increased 6% and economic sales were up by 7%. Adjusted EBIT margin over ES was down by 20bps to 20.9%, driving adjusted EBIT and EBIT growth of 6% and 2%, respectively.

Logista acquired BPS (Belgium Parcels Service) at the end of December for €8mn. While a small and seemingly inconsequential acquisition, it further fortifies the company’s ability to distribute products, primarily pharmaceuticals, throughout Belgium, Luxembourg, the Netherlands, France, and Germany, and provides insight into Logista’s strategy and long-term M&A runway. Pharmaceutical distribution requires numerous special licenses and certifications. It also includes products that are ultra-sensitive, requiring precision temperature-controlled environments and resources to ensure proper chain of custody. There remains a long list of private targets, and by rolling up smaller specialty operators, Logista will be able to attract larger mission-critical contracts with major healthcare facilities while rationalizing back-of-house expenses. Despite carrying a lower economic sales margin relative to transport and other operations within Iberia, these dynamics can support EBIT margin recovery over time, following constant sales growth despite a post-COVID unwind.

Alongside the sustained growth of pharmaceuticals and transport distribution, Logista’s Tobacco and Related Product distribution business has remained strong. In Q1’24, Iberia’s TRP revenue increased by 7.6%, while economic sales decreased by -8.6% largely due to changes in inventory values following the previous year. This was more than offset by revenue and economic sales growth in the other two geographic segments. Italy experienced revenue and economic sales growth of 7.6% and 22.3%, respectively, due to minimal growth in both cigarette and RYO volumes alongside more robust NGP volumes, notably double-digit growth in heated tobacco and lapping a considerably large loss on inventory in 2022. France saw revenues increase by 2.9% and economic sales decrease by -4% due to heightened legacy volume declines offsetting double-digit growth in vaping products. As a whole, group operating profits have continued to creep higher.

Incremental value

Logista’s core business is positioned to grow operating earnings at a mid-single-digit clip, excluding the potential contribution of future acquisitions. More acquisitions are near certain, though, unless the company decides to increase its leverage ratio, they will likely be on the smaller side, as the company maintains its 90% payout ratio. Added to the long-term growth drivers of the core business is the reciprocal credit agreement with majority shareholder Imperial Brands, to which Logista lends its large cash pile—currently at a rate of 5.25%, 75bps over the average reference rate of the European Central Bank. Far outweighing the debt burden of the company, this has led to notably positive net financing. Changes to the reference rate may have an impact on net results equal to or greater than the core but are not something that can be predicted with any degree of certainty. This is far less consequential as my preferred exposure remains Imperial Brands, owning 50.1% of Logista, which trades at nearly half the earnings multiples and continues to retire share capital voraciously.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own no direct position in Logista (Compañía de Distribución Integral Logista Holdings, S.A). I own an indirect stake in Logista via positions in Imperial Brands. I own positions in other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑PM 0.00%↑ BTI 0.00%↑

Great article. Thank you.

Crazy things will happen once that buy back approaches 80 %. I like the divvy (of course) and the new CEO seems good