“More money has been lost because of four words than at the point of a gun. Those words are ‘This time is different.’” - Carmen M. Reinhart

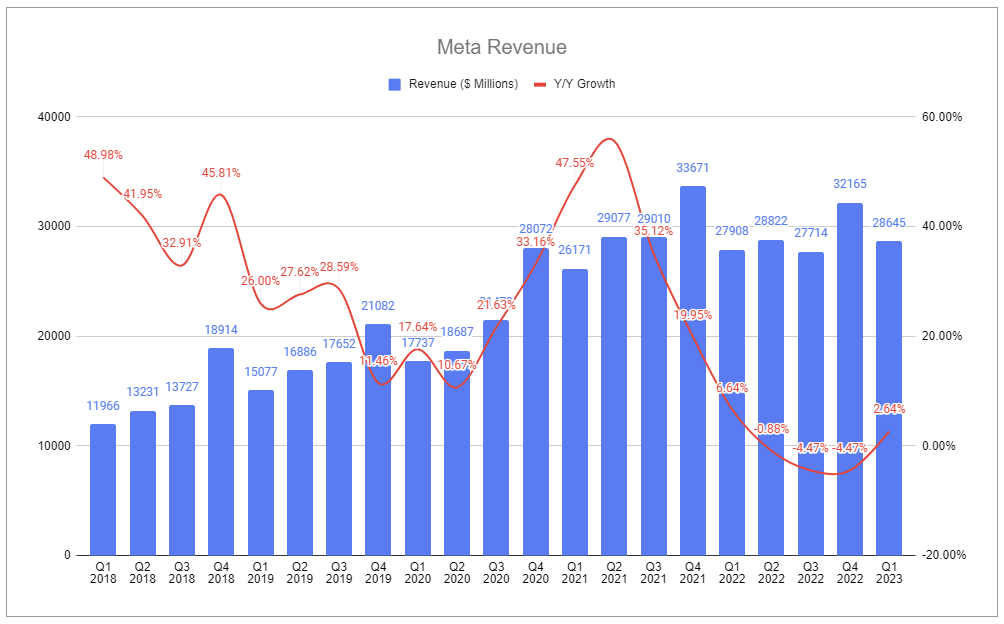

Most of the time, the collective wisdom expressed by financial markets appears sound, but occasionally things spiral out of control. It was only half a year ago that Meta appeared to be swirling the drain - a bleak picture painted by stagnating growth, ballooning expenses, growing competition, and other threats. While some of the specific concerns were new, it all seemed eerily reminiscent of 2018, which I wrote about in Meta: Pain and Patience.

Most discourse also lacked respect for WhatsApp, which was examined in WhatsApp: Meta’s Next Growth Engine.

These were followed by reiterating that most of what was being framed as definitive headwinds would likely flip to tailwinds during a longer timeframe, as covered in The Zuckerberg Flop.

It is undeniable that the narrative and expectations pushed by the market have shifted dramatically. But are things really all that different? I’m focused on a handful of points:

Expenses - Not just the year of efficiency

The formula - Users x Time on platform x Ad density x Ad value

WhatsApp Business and click-to-message

Regulation

Let’s explore.

Not just the year of efficiency

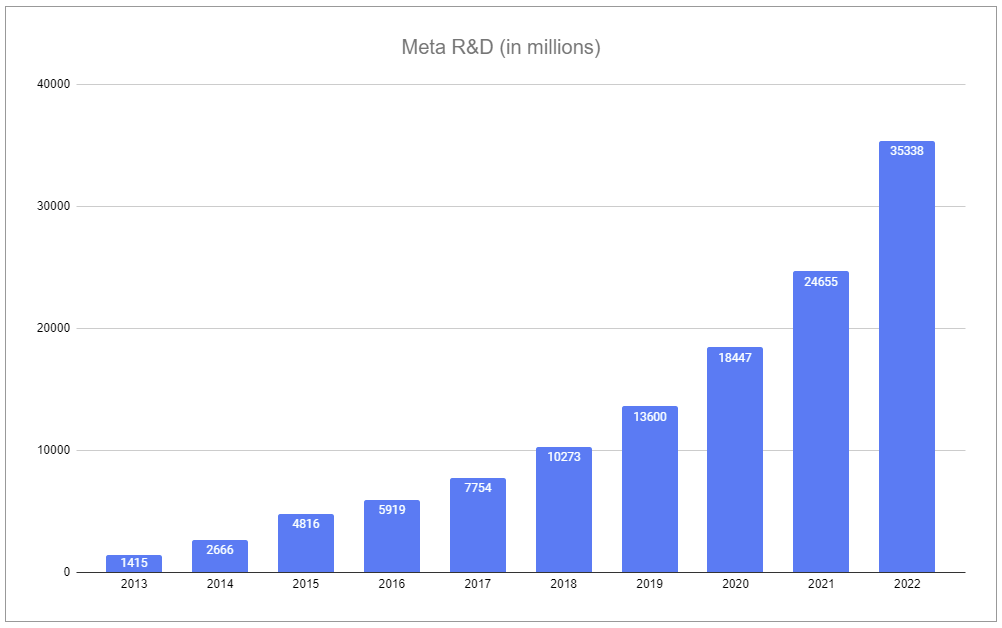

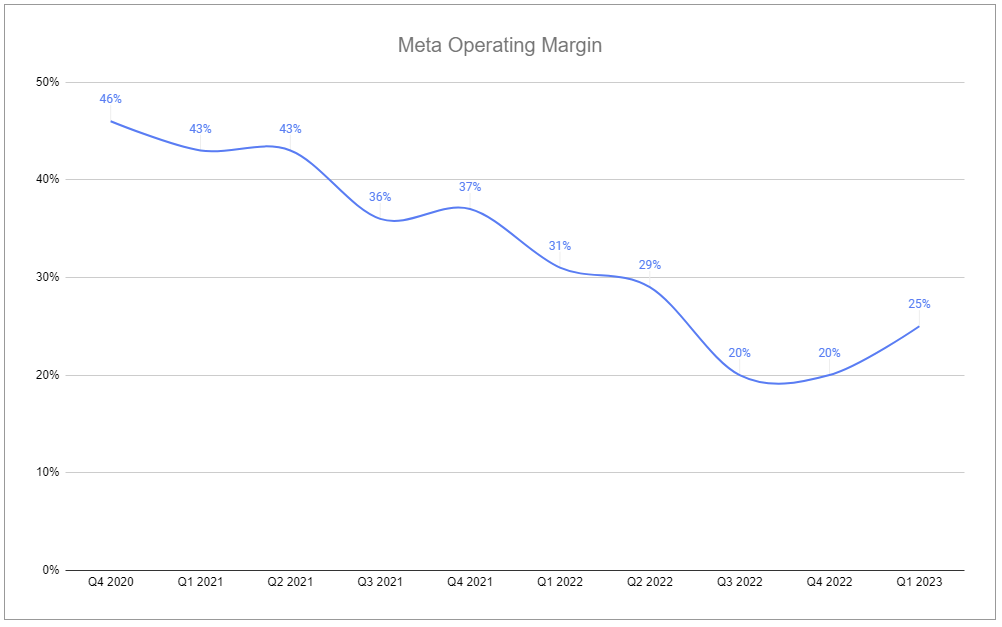

I had previously expected Meta’s increase in spending to slow after 2023. I was not only wrong on the timing but also the degree, with what is widely referred to as the year of efficiency more akin to the year of brutality, with Zuckerberg cutting costs as if wielding a chainsaw rather than a scalpel, leading to full-year expected capex to be within $30-33 billion, only potentially slightly higher than 2022.

And regarding headcount, perhaps it’s more apt to say that Zuckerberg is using a guillotine.

Q1 2023 above reflects the entirety of the headcount reduction announced on November 9, 2022. The estimate made for Q2 2023 reflects the headcount reduction announced on March 14, 2023, encompassing 9,500 of the 10,000 reductions in Q2, estimating the remaining 500 occurring sometime during the rest of the year.

In Q1, R&D increased 22% over last year, though this was largely from restructuring charges by way of facilities consolidation and severance expenses and headcount-related costs. G&A increased 22%, again from similar headcount-related expenses; however, other such operating expenses were slashed, with Q1 reporting marketing and sales down 8%. Total full-year expenses are guided to be between $86 and $90 billion. Moving forward, lapping $3-5 billion in total restructuring charges for the full year, total expenses appear under control, a distinct reversal from the past several years. Zuckerberg stated on the Q1 call:

A couple of years ago, I asked our infra teams to put together ambitious plans to build out enough capacity to support not only our existing products but also enough buffer capacity for major new products as well.

And this has been the main driver of our increased CapEx spending over the past couple of years. Now at this point, we are no longer behind in building out our AI infrastructure, and to the contrary, we now have the capacity to do leading work in this space at scale. As these new models and use cases continue scaling, we're going to need to continue investing in infrastructure, although we'll have a better idea of the trajectory of that investment later in the year once we can gauge usage of some of the new products we'll launch.

The formula

Balanced against expenses, everything Meta does comes down to the formula:

Users x Time on platform x Ad density x Ad Value

Users

Once again, reports of Meta’s death have been greatly exaggerated.

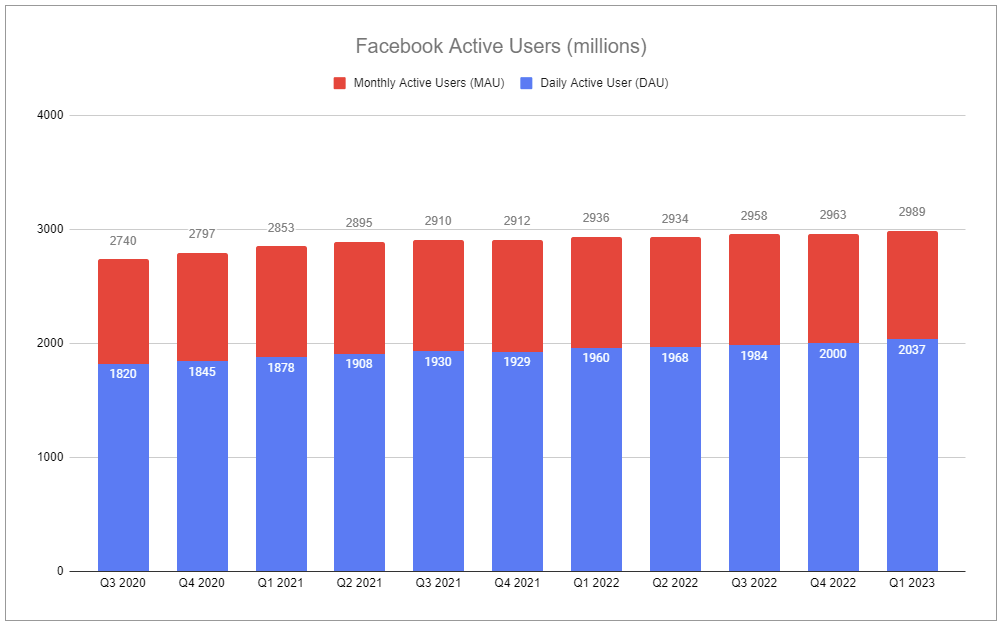

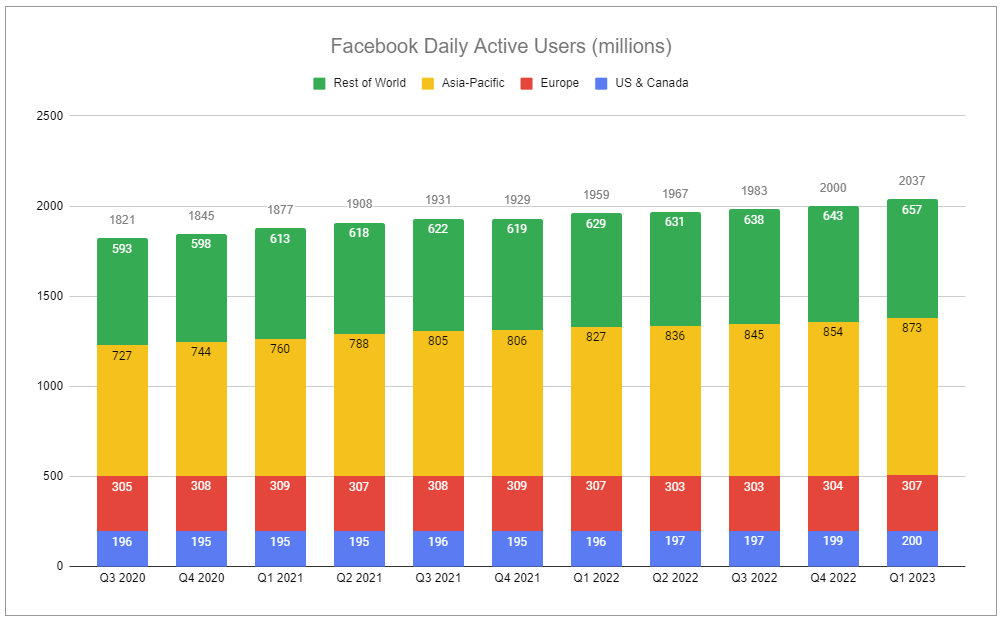

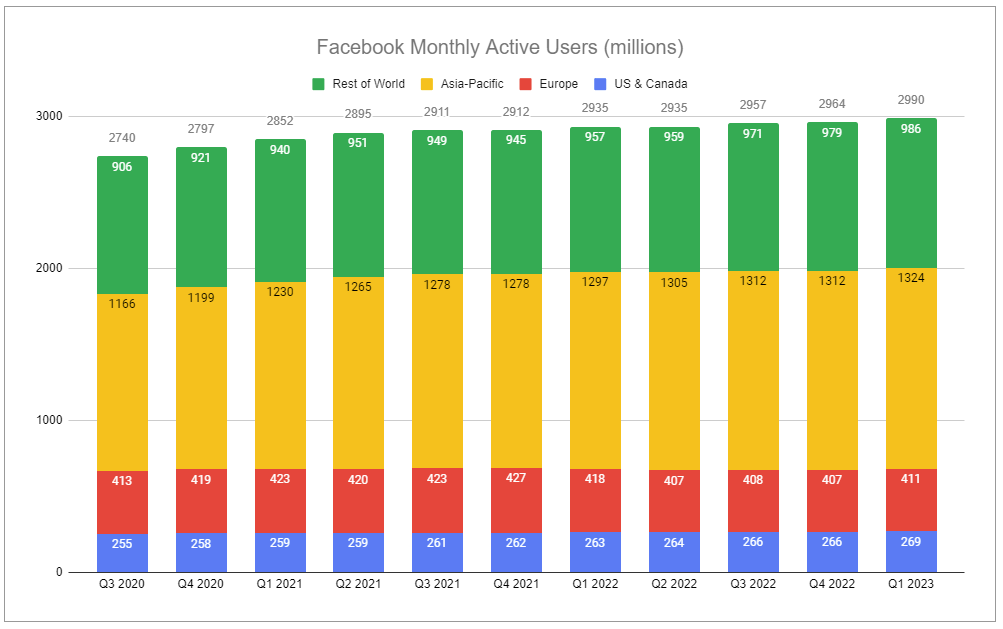

Despite anecdotal reports of users abandoning Facebook and Instagram, more people than ever use the platforms.

x Time on platform x Ad density x Ad value

I wrote in Meta: Pain and Patience:

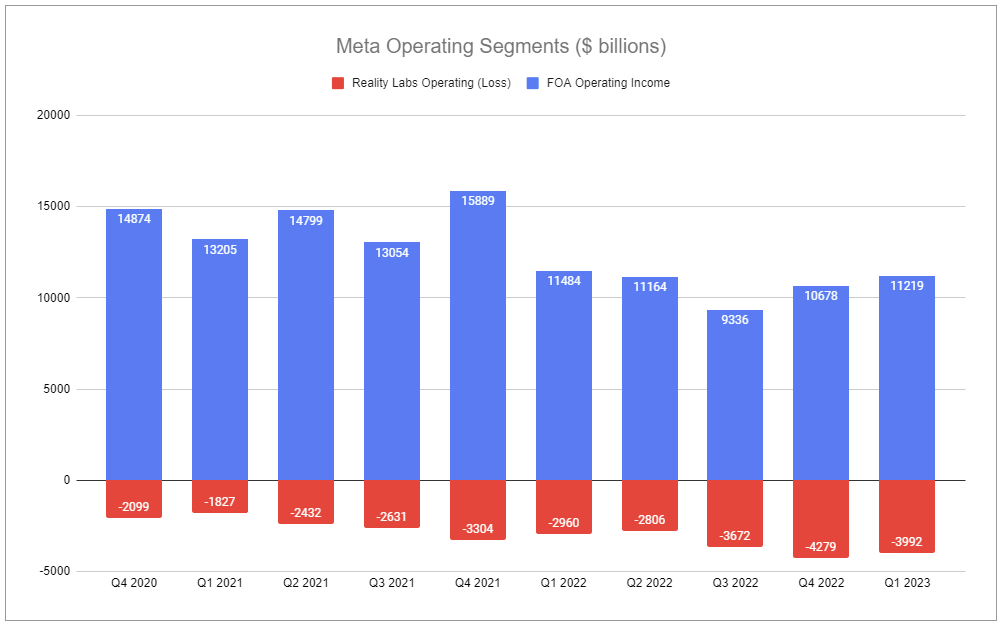

The vast majority of spending is not related to the pursuit of the metaverse and is, rather, focused on the core business, the Family of Apps:

Rebuilding ad infrastructure post-ATT, creating probabilistic modeling to regain signal, both for ad targeting and attribution.

Expanding huge amount of requisite compute to support short-form video (Reels).

Shifting from a social graph to an open graph, optimizing personally served content from a much deeper pool.

Throughout last year management provided insights into some of the returns they were seeing from early investments in the three initiatives listed above, and the start to 2023 has been even more promising based on Mark Zuckerberg’s comments during the Q1 call (emphasis added):

Now moving on to our products and business. We're seeing strong engagement growth across our apps and good progress on monetization efficiency, which combined to drive good business results. Reels continues to grow quickly on both Facebook and Instagram. Reels also continue to become more social with people resharing Reels more than 2 billion times every day, doubling over the last 6 months. Reels are also increasing overall app engagement, and we believe that we're gaining share in short-form video, too.

I've emphasized for a number of these calls now that there are 2 major technological waves driving our road map: a huge AI wave today and a building metaverse wave for the future. And our AI work comes in 2 main areas: first, the massive recommendations and ranking infrastructure that powers all of our products from Feed to Reels, to our ad system, to our integrity systems and that we've been working on for many, many years; and second, the new generative foundation models that are enabling entirely new classes of products and experiences. Our investment in recommendations and ranking systems has driven a lot of the results that we're seeing today across our discovery engine, reels and ads. Along with surfacing content from friends and family, now more than 20% of content in your Facebook and Instagram Feeds are recommended by AI from people groups or accounts that you don't follow.

Across all of Instagram, that's about 40% of the content that you see. Since we launched Reels, AI recommendations have driven a more than 24% increase in time spent on Instagram. Our AI work is also improving monetization. Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter. Daily revenue from Advantage+ shopping campaigns is up 7x in the last 6 months.

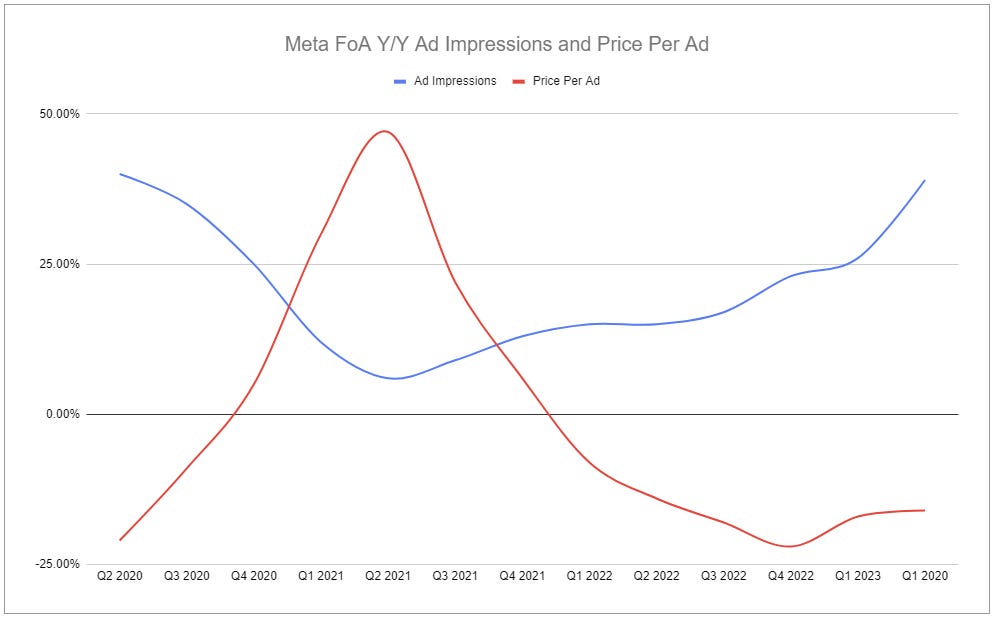

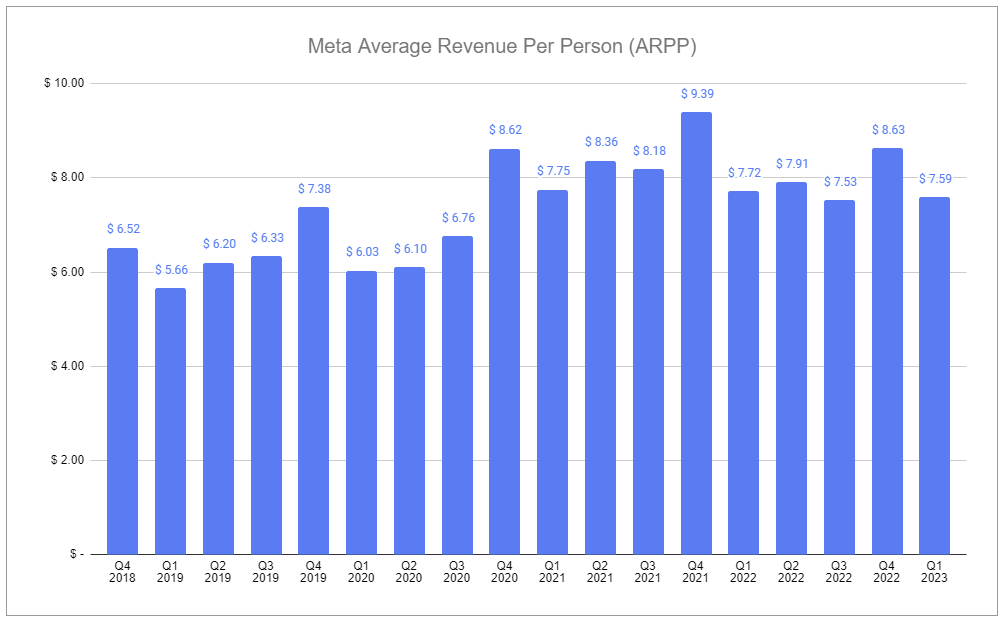

One clear pushback is the trend in ad pricing, except that this can be explained by several functions. First is that—along with a pullback in advertising spending largely from the impact of ATT—price, fundamentally, is not just a function of demand but also supply. As users and time spent on the platforms grow, along with efficiency and shifting toward an open graph, the total supply side grows. At the same time, even with price going down, the value from the lens of the advertiser can grow as other efficiency efforts, such as Advantage+ campaigns, reduce cost per action and increase conversion rates. Additionally, a great deal of this downward pressure is due to Reels, which launched on Instagram in 2020 and on Facebook in early 2021. Reels, despite experiencing a quarter-over-quarter monetization efficiency increase of 30%, is still a monetization headwind for the company as it cannibalizes higher monetizing media that would be consumed otherwise. There are structural challenges with Reels in this regard, with the company highlighting Reels taking more time than Feed and Stories content, inherently limiting total opportunities to interject ads. However, the company expects Reels to reach revenue neutral by the end of the year or early 2024.

An ongoing concern is that while the multiplicative effects of the formula paint a virtuous cycle, large-scale missteps can have an extremely large effect as well, and any future momentum in the wrong direction may prove difficult to reverse. Nonetheless, it seems that many criticisms the core business has faced are quashed - at least for now.

The impact of ATT, while unmistakably pronounced, was not insurmountable.

Reels wasn’t a flop.

Incorporating an open graph didn’t kill engagement.

TikTok is not an unmatched foe.

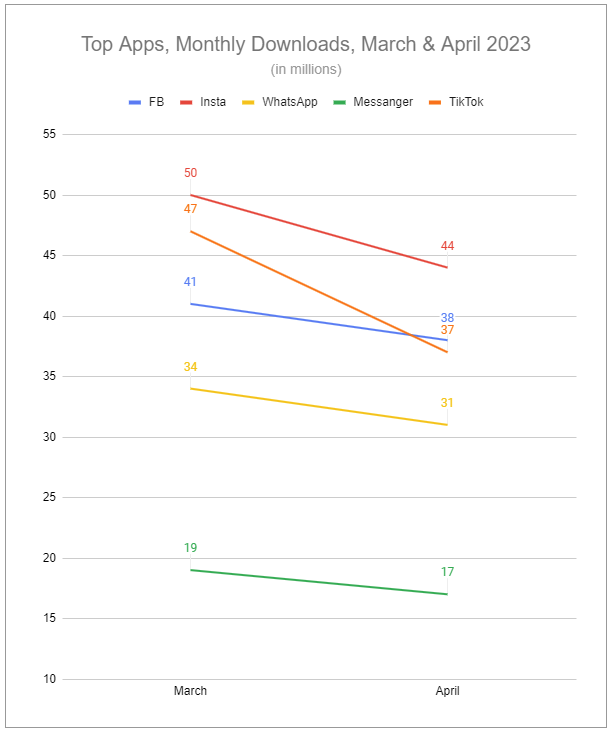

TikTok could very well continue to grow and succeed, but the above dispels it as the bogeyman it was claimed to be. Not only does Meta believe it’s gaining share in short-form video, but TikTok’s total worldwide downloads have fallen not just behind Instagram but also below Facebook as of late.

The standalone app WhatsApp Business is not shown in the graph above. However, it has been a top-ten most downloaded app on the Google Play store for the past several months, with 16m downloads in March and 13m downloads in April, with usage growing rapidly.

WhatsApp Business and click-to-message

I continue to believe WhatsApp is Meta’s least appreciated asset, and click-to-message ads as a whole aren’t too far behind. I wrote in WhatsApp: Meta’s Next Growth Engine:

Even ignoring other potential forms of monetization such as Business Subscriptions, and assuming continued headwinds related to gaming payments, Other Revenues can likely grow at an HSD or LDD rate for the foreseeable future. Click to WhatsApp growth is likely to decelerate. But even so, growth in nominal terms off of a $1.5 billion base will, in fact, turn into a rather significant number in short order and can ultimately become a material driver of growth for the company as a whole.

At that time, the Q3 TTM run rate for WhatsApp click-to-message was $1.5 billion, and the total click-to-message run rate was $9 billion. In Q4 2022, that TTM run rate grew to $10 billion. While we don’t have a granular number for Q1 2023 or a guide moving forward, we do know that the number of businesses using the paid business messaging service on WhatsApp grew by a staggering 40% quarter over quarter. Susan Li, Meta’s CFO, commented on the Q1 call (emphasis added):

We see continued opportunity to scale click-to-message, particularly in WhatsApp and the click to Instagram direct area. Both of those are earlier on the growth curve. And we're investing in a few areas to continue making it easier for people and businesses to connect. First, we're really investing in trying to make it easier to create ads. So in the last year, we've invested in a revamped experience in ads manager, native ad creation experiences directly in WhatsApp.

We're also scaling partners. So with the cloud-hosted API, we now have hosted API solutions across WhatsApp, Messenger and Instagram so that our ecosystem of developers can help build good best-in-class experiences for businesses. And then we're also working on making these ads more performant by driving more action further down funnel, so we're working on ranking and optimization to yield better conversion from these ads and introduce new ways to drive outcomes. We've introduced new features like in-thread payments and other commerce tools. So we think that there's a big opportunity here.

We're trying to make every part of the experience for advertisers easier, better and more performant, and we're excited to also see growth beyond the core markets here in Southeast Asia and Latin America, where messaging is already common as a way for businesses to engage with customers and -- for businesses to engage with customers and their customer prospects. But we're hopeful that we'll see this also take off in other markets. We're seeing strong growth in the U.S. and Canada, but it's just earlier there today.

The opportunity ahead can be compellingly distilled as follows:

Business messaging and click-to-message ads are largely incremental to the business and enhance the platforms with additional functionality rather than cannibalizing other ad formats.

These are still fairly new offerings for Meta, and the company will be able to refine them to drive better business outcomes as they scale. This is on top of a larger shift in which consumers are preferring engaging with businesses via message instead of other channels - especially younger cohorts.

Over time, Meta will aim to automate aspects of business messaging by utilizing ‘AI agents’, ie. advanced chatbots and other functionality. Currently, businesses using related messaging features obviously need to train employees and pay them, etc. Automating such tasks will produce more consistent outcomes, asynchronously, 24/7, and will likely be far cheaper for businesses.

You do not need to get terribly creative to ballpark the financial contribution to Meta. Even ignoring business messaging, automated support, payments, and other future verticles, the growth of click-to-message ads can begin to add several billion dollars to the top line annually, which again, is largely incremental.

Regulation

Headlines were made last week when the EU, at the hand of Ireland’s Data Protection Commissioner, issued Meta with a $1.3 billion fine for its continued transferring of EU users’ data to the United States following a ruling in 2020 stomping out the EU-U.S. data transfer pact. Meta now has 5 months to comply, though it looks like there is an opportunity for a new data pact to be reached before the deadline. If such an agreement is not reached, Meta will be forced to house EU data in the EU and only in the EU. Susan Li had previously touched on the dynamics in the Q1 call:

On your second question on what the potential impact to our European business is of the transatlantic data transfer rule, so first, I want to emphasize, we continue to be hopeful that the new EU-U.S. privacy framework will be implemented before our deadline for suspension. But if it comes to that, there's a lot that we don't know in terms of the specifics of a final order and how long a suspension order would last, which would be important variables in determining the overall impact. What we do know is that roughly 10% of worldwide ad revenue comes from ads delivered to Facebook users in EU countries but there are more details that we would need to understand, including the impact on advertisers in EU countries before we'd be able to really provide a more accurate or fulsome estimate of that impact.

Upon the EU’s action, Meta put out a statement with the response including:

The ability for data to be transferred across borders is fundamental to how the global open internet works. From finance and telecommunications to critical public services like healthcare or education, the free flow of data supports many of the services that we have come to rely on. Thousands of businesses and other organisations rely on the ability to transfer data between the EU and the US in order to operate and provide services that people use every day.

Without the ability to transfer data across borders, the internet risks being carved up into national and regional silos, restricting the global economy and leaving citizens in different countries unable to access many of the shared services we have come to rely on. That’s why providing a sound legal basis for the transfer of data between the EU and the US has been a political priority on both sides of the Atlantic for many years.

This is far from the first time Meta has clashed with regulators. It will not be the last. But privacy-oriented regulation is not a net negative for Meta, as I wrote in The Zuckerberg Flop:

But the greatest returns may come from the unexpected angle of privacy.

Privacy-oriented regulations are often cited to be the bane of Meta. However, relative to other platforms, Meta will produce magnitudes more high-quality first-party data, and probabilistic modeling will allow incremental improvements while using limited sensitive data. While the company will certainly be impacted by new regulations, sometimes severely, it is almost assuredly best positioned each and every time. Even in worst-case scenarios, Meta will contest and appeal ad nauseam, which delays each threat for potentially years. Add on several more years until Meta is forced to choose between caving to said policies or continuing business as usual and assessing the forecasted fines as a cost of doing business - something which only those with deep pockets can afford. Naturally, the fines themselves will also be challenged, drawn out, and perhaps settled down and only paid many years later. Either way, most current competition simply can’t afford to navigate the space in the same capacity, and new competition is disincentivized from entering. To many people’s disappointment, rather than killing Meta, these pressures are more likely to ultimately insulate the company and protect its supernormal profitability.

The situation in the EU may be a hit to Meta, but it is difficult to see how the core concept above changes. We are only in the early innings of privacy-oriented regulation, and if massively scaled infrastructure and deep technological capabilities—which come with steep capital requirements—are the only way to operate on such a level, what are nascent platforms to do? Some may very well grow and succeed, but it’s unlikely to be from going toe to toe with Meta.

The foundation

Meta has built a foundation with multiple distinct competitive advantages. With the formula’s components acting as multiplicative levers to drive growth, along with the company becoming more discerning toward each dollar reinvested, we should witness continued improvement in margins.

Pushback is expected from excluding RL and “the metaverse”, which will act as a growing headwind for the company as a whole. Nonetheless, associated losses, while certainly material, are not a long-term concern. The dead simple thesis on the segment remains: either it gains traction, losses soften, and it flips to profitability, or it starts to get chopped.

However, even if not chopped, the company’s consolidated operating margin should likely continue to improve, albeit at a slower rate.

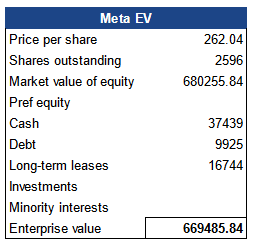

The starkest difference between now and the valuation discussed in December is the dramatic increase in Meta’s market cap, enterprise value, and multiples.

The firm’s equity has increased from $311b to $680b, and enterprise value from $296b to $669b. Despite clear positive improvements in operations and the company’s communications, related earnings have not moved anywhere near as such, with its EV/EBITDA and EV/EBIT multiples now being x15.7 and x20, respectively - a stunning change from 6.75 and 8.33 late last year. However, normalizing EBIT by nixing the midpoint of the guided FY2023 restructuring expense and ex-growth produces an adjusted EV/EBIT multiple of x17.9.

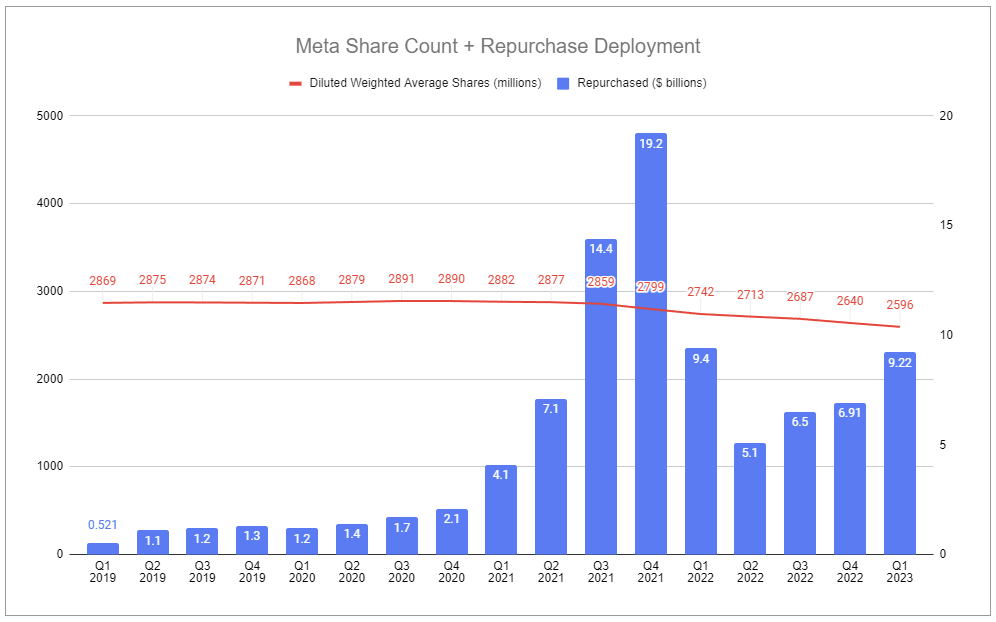

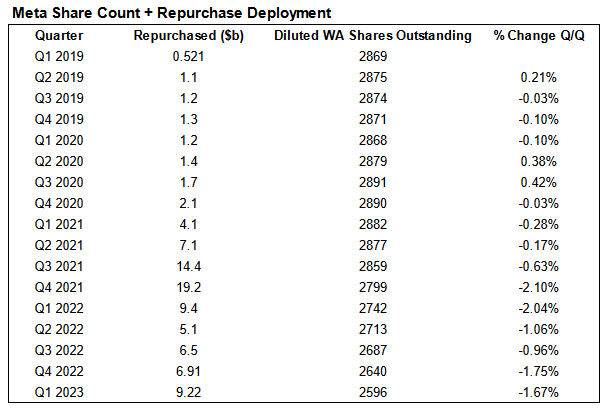

Could the company rerate higher? Sure, just as any can, and just as any could go lower. That’s not an assumption I’d make. What seems more probable is a path to msd-hsd topline growth paired with efficiency gains and disciplined spending to drive better margins and free cash flow conversion and materially higher absolute FCF over the long term. And on a per-share basis, this is likely to be notably increased, with buybacks re-ramping and retiring a meaningful percentage of shares outstanding, which may occur at an even faster rate as the company aims to wield greater debt to reduce its cost of capital.

Questions or thoughts to add? Comment here or message me on Twitter.

Ownership Disclaimer

I own positions in Meta.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: META 0.00%↑

Great post, both on the substance and the form. You were spot on late last year about Meta. The stock has surged 150% since then. I also like how you use graphs to illustrate your point convincingly. The capex, headcount, and user count diagrams perfectly tell your story -- costs are under control and users are not fleeing FB/IG. Thank you Devin!

Excellent writing and the charts are telling!