“After 3-plus years as a public company, in which we’ve grown new equipment share, expanded operating margins, grown EPS, built a formidable backlog, and returned approximately $2.7 billion in cash to shareholders, we’re designing Otis for the next phase to ensure high performance and resiliency regardless of the economic environment we may face in the future.” - Judith Marks, Otis CEO, Q2 ‘23 Call

In February’s Flywheel Growth, I concluded:

Therefore, despite the model suggesting OTIS shares are fairly valued, I have no intention of adjusting my position. I believe the company represents an incredibly durable asset that can likely create long-term value above what is modeled. Additionally, there is the old adage “markets take the stairs up and the elevator down.” I would love nothing more than to see OTIS shares partake in a broad selloff with fundamentals intact. Perhaps there’d be an opportunity to take the escalator back up.

We have yet to see a steep selloff. Although the company reported a strong H1, shares are priced barely under what they were at the start of the year—a likely expression that concerns around China and competition have been amplified. However, when looking at the company as a whole, the outlook is markedly positive.

Let’s break it down.

Revisiting the flywheel

Otis is an old dog (169 years) with new tricks - in the form of modernization and digitization.

New Equipment is a low-margin business producing elevators and similar devices that allows Otis to establish relationships and convert units to long-term service contracts.

Modernization and digitization improve conversion and retention rates, allowing the company to steadily build its portfolio of serviceable units. This also provides opportunities to upsell subscriptions and other features, as well as remote analytics and diagnostics, improving response times and reducing downtimes and total maintenance.

More efficient portfolio management requires fewer total service technicians and allows each to be far more productive, reducing total costs.

Efficiency gains and pricing allow service—the larger and higher-margin segment—to continue to compound.

Further profitability leads to more bolt-on M&A, development of differentiated New Equipment, and greater sales resources, further increasing portfolio density and improving service efficiency, acting as a virtuous cycle.

Due to Otis’s low capital intensity and efficiency, it converts >105% of NI to FCF, which, alongside M&A, is used to pay a modest dividend while steadily repurchasing shares.

This is a straightforward formula for long-term value creation, but it’s been somewhat shadowed by concerns surrounding China.

New Equipment & China worries

The market for New Equipment in China has been rather lackluster, and while many have expected a recovery, it has yet to materialize. How detrimental is this to Otis’s results? It’s worth walking through some comparative numbers between H1 2023 and several years prior.

Looking at the sales geographic mix, China has indeed grown to take ~2% of the total in the last several years, up from 15.6% in H1 2020 to 17.5% in H1 2023.

But weakness in New Equipment orders, down 12% in Q2 2023, fails to recognize several key points:

While new orders were down, organic NE sales were up 9.5% in Q2, including a 10.8% increase in Asia, with Asia Pacific up double digits and China up MSD.

Additionally, it’s key to recognize that NE performance and Service performance are markedly dissimilar, with the latter facing much fewer pressures.

Not only are NE and Service dissimilar in pressures faced, but it’s integral to recognize that the margin profile of Service is substantially higher, resulting in it being the primary contributor to operating income.

Granted, this does downplay NE’s importance. While lower margin (currently hovering between 6-7% OI margin), the conversion rate post warranty supports growing the Service portfolio. Additionally, new offerings, such as the Gen3 core elevator, in which Otis’s connected Otis One is preinstalled, should support a greater conversion and retention ratio, as evidenced by results from the installed base already using Otis One. All in all, even with prolonged weakness in China, aggregate NE sales should be able to grow at a modest low to mid-single-digit rate, thanks in part to strength from demand in other countries such as India.

Further supporting the company’s trajectory is its ever-growing backlog, reaching its highest level as of Q2. NE has experienced 6 consecutive quarters of LSD price increases, which flow through as old contracts are worked through and replaced with higher-margin contracts with higher pricing.

At this size, the company estimates that they’re looking out 18-24 months with the backlog. These numbers support continued operations, as decommits are at a low single-digit level due to the critical nature of work and the nonrefundable deposits the company takes. And even as they work through it—and even if there is weakness through H2 of this year—there is not an expectation that the backlog shrinks when entering 2024. During the Q2 call, Anurag Maheshwari, Otis CFO, offered excellent insight regarding how the backlog can actually continue to grow even without order growth (emphasis added):

Even if we assume there's no orders growth, we would expect our backlog to be up low single digit by the end of the year. And the reason for that, Julian, is because we tend to book more orders in any given year than we ship as some of the orders are larger projects and multiyear in nature.

So clearly, I mean it's not the right analogy, but if you look at our book-to-bill, it's definitely been far higher than 1. So we booked definitely more orders than we ship over here. But let's even assume if conditions worsen from here and there is -- new equipment orders even slightly decline to even mid-single digit, I think we will end the year with backlog at least being higher. More importantly, if you look at our backlog mix today, in Americas, it's still fairly high, which is a multiyear backlog that we have. Asia Pacific is fairly good.

And that should convert into revenues next year, with China being the highest book to ship. So it gives us kind of confidence as we go into next year to see our new equipment revenue growing in line of medium-term guidance.

At this rate, in H2 of next year, we could be looking at a backlog that spans closer to 30 months, providing an exceptional buffer and allowing the company to continue to fully deploy its resources to grow both NE and Service.

Service strength

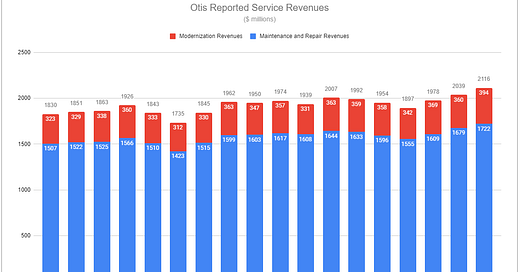

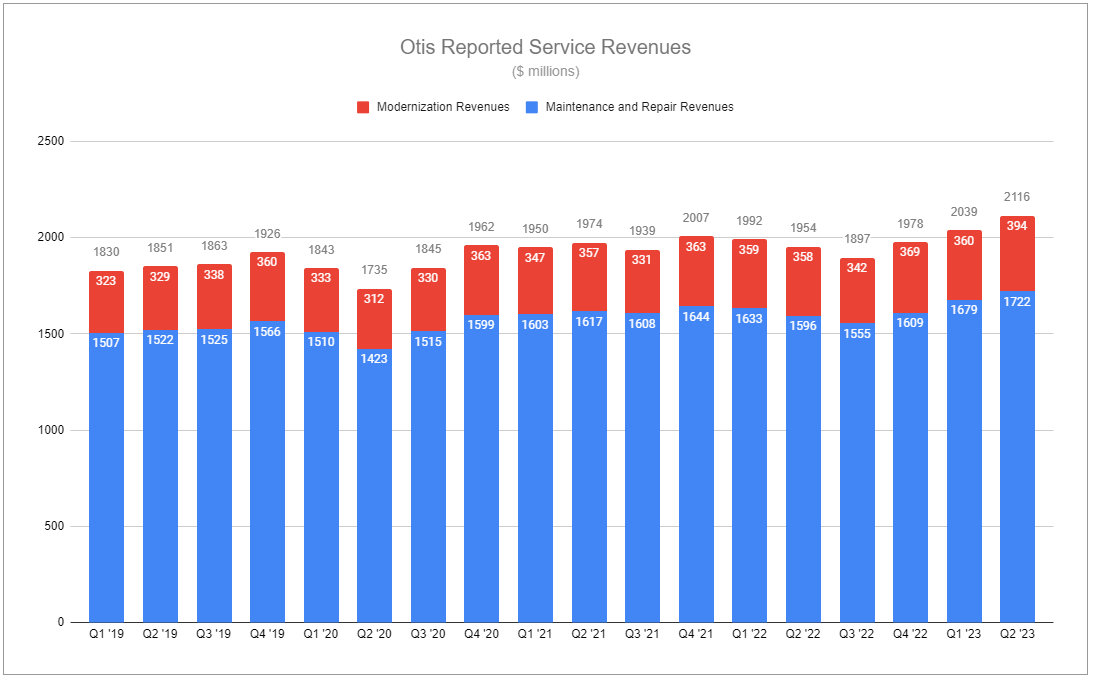

While concerns about NE orders persist, Service is on a completely different trajectory. The segment carries an operating margin of more than x3 of NE and represents ~84% of operating income—it is also more stable, less cyclical, and has a full suite of distinct growth drivers.

In Q2 2023, Service saw its installed base of maintenance units grow by 4.2% y/y, with growth in every region. This base is likely to grow ~5% for FY 2023 and at 4-5% per year going forward.

Further highlighting the difference in relative performance between Service and NE, Q2 was the 8th consecutive quarter of high-teens maintenance portfolio growth in China.

Price take has been at around 4% annually, in which step-up clauses are included in multi-year service contracts. On a whole, y/y Service net sales grew at 9.4% organically (8.8% adj., 8.3% GAAP), and OI grew by 11.1% adj., 13.1% GAAP.

And then there is Modernization, the small sub-segment of Service that is deserving of greater focus.

Modernization made up 18.62% of total Service revenues in Q2 2023, but it is going to be a major growth driver moving forward. In Q2, Mod orders were up 16% at constant currency, and the Mod backlog grew by 14%. Critically, this sub-segment also represents a massive opportunity for repurposed buildings as the shift to multi-use and WFH persists, as Judith Marks highlighted on the quarterly call (emphasis added):

Once we do a mod, our ability to retain that and put that -- keep that on Otis Service is in the high 90s. So much more significant than the conversion rates even in our industry-leading retention rate. So that's why mod is important to us. It not only gives us additional customer intimacy, both for the units that were on our portfolio, it lets us bring other units back to our portfolio, drives great customer value, energy efficiency, gets them ready for another multiple years, especially as you think about all the buildings now that are being repurposed. There's a huge amount of opportunity for us as well with the offices changing to multiuse.

The first bolded portion should also be taken note of. Otis’s total service retention has run between 94-95%, and Mod is likely 97-98%. While this difference appears inconsequential, it represents 50-66% reduced churn. With this context, while growing at a higher rate, it should be noted that Mod is currently margin dilutive to the segment. This is due to the nature of the work: often time-intensive and complex and customized on a unit-by-unit basis. Otis aims to streamline the process with more uniform Mod offerings, which should act as a positive tailwind for segment margins. Conversely, it will be critical to observe how less tailored offerings may alter growth. Notwithstanding, this sub-segment appears to have a long runway ahead, with deferred repairs on top of a further aging global installed base ensuring demand remains robust.

The success of Mod runs alongside further digitization and connectivity, which should continue to improve retention and margins for the entire segment, as Judith Marks’s continued comments highlight (emphasis added):

So where in the past we would tell you about 100,000 a year, that number is going to be up significantly more in 2023, which is what continues us along that journey in our medium-term guide. Right now, we've got over 800,000 of our units connected in general, more than just Otis ONE, but now Otis ONE is picking up a bigger proportion of that, and you'll see far more than 100,000 units this year connecting. It is making a difference. If you look at China alone, I would tell you, it's part of their significant Service productivity, the majority of that is being driven by Otis ONE or running on arrivals are down across the globe and that we are getting -- anytime we have a connected product, our ability not just to convert but to retain that, especially from the ISPs who really -- they don't want to come into an Otis elevator that's got an eView screen and figure out how to maintain that. And they can't offer that same connectivity.

So we provide all those numbers on an annual basis. We'll do that in fourth quarter, but it is an integral part of our strategy. It is working. It's helping us with Service pricing. And as Anurag said, on Service pricing, like-for-like we're up 4 points. Our strategy, again, to define that connection versus having people -- customers opt-in from a subscription. We're getting subscription services,, too. But again, we chose to invest the CapEx and we chose how we were going to deploy Otis ONE. And I would tell you, you're seeing it in our Service margins.

Efficient capital

Alongside efforts to further improve each of the company’s operating segments is the newly coined program Uplift, in which Otis aims to recognize $150m in annualized cost savings that will be in turn reinvested back into the business. The program will be predominantly aimed at G&A and improving aspects of the company’s supply chain. It should be noted that this is entirely additive to other cost-saving measures, and Otis remains an obscenely capital-light business, with Capex and working capital combined making up <5% of net sales. With the previously mentioned >105% conversion rate of net income to free cash flow, the end result is significant capital to return after reinvestment needs. Continued excellence in this regard can be observed by the company increasing its 2023 share repurchase target from $700m to $800m.

My valuation, last published in February, remains largely unchanged—an attempt to remain conservative by not adjusting to what I view as favorable developments. To distill simply, at Friday’s closing price of $83.73, the forward yield is 1.62%, the company will likely be able to retire >2% of shares outstanding per year, and free cash flow can grow at a rate of 5-7% per year. This durable asset—effectively a tax on human mobility—has the potential to compound near a ~10% rate.

If you enjoyed reading, hit “♡ like” and share this piece with someone.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Otis Worldwide.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: OTIS 0.00%↑

Thanks for sharing!

appreciated !