“In the midnight hour she cried, “More, more, more”

With a rebel yell she cried, “More, more, more”, aho

In the midnight hour, babe, “More, more, more”

With a rebel yell she cried, “More, more, more”

More, more, more” - “Rebel Yell,” Billy Idol

With the top portfolio of combustible products led by the flagship Marlboro brand and a headstart in next-gen categories with IQOS, further cemented by the acquisition of Swedish Match, Philip Morris International is seen as the industry leader and continues to trade at a notable premium to its peers. It's a clean story, and the company's 2023 results included various figures underscoring such an advantaged position. More aggregate volumes. More brand loyalists. More market share growth. But at the same time, several points raise the question of if the story is too clean: more adjustments and more headwinds. Depreciation of the Argentine Peso immediately snaps us back to a reality that has continuously provided significant FX pressures; the Wellness & Healthcare segment continues to need medical aid; heightened costs and reinvestment mute reported results. In Q4 2023, the seasonally weak adjusted operating margin appeared even more feeble. People are questioning if the downward movement in operating margin over the last several years is a structurally permanent feature of the business as it shifts to a greater mix of smokeless products. I think not.

More more more

Philip Morris International continues to spend more and more resources on next-gen products, with IQOS leading the pack. Undoubtedly, many will be fixated on the US rollout of IQOS beginning in a few month’s time. I maintain my skepticism of both the speed and success of the initial rollout, and while related US investment will add to margin pressures, it remains clear that costs in existing markets will be a much greater headwind. The group’s cost of sales increased by more than 13% in 2023, equating to an increase of nearly $1.5 billion. Marketing, administration, and research costs increased by 24%, a jump of close to $2 billion. Inflationary pressures, namely input materials and wages, are poised to moderate. However, it is evident that the operating margin will take longer to recover and more to improve materially. But this isn’t new. From last year to last quarter, this has been a consistent tune:

However, this continuation is absolutely welcomed. One of the greatest difficulties for new products in the nicotine space is convincing users to try them. With legacy products carrying tremendous loyalty, it can be painstakingly time intensive and costly to convert. As IQOS ILUMA continues to take share, it will automatically act as social proof, validating the platform for others. It’s important to note that the growing number of IQOS users is a lagging indicator for volumes since there is usually a ramp time between trial, adoption, and fully switching to the device. Today’s margin loss is tomorrow’s gain.

Margins are likely to face pressures as reinvestment remains elevated. Share repurchases get pushed back a year further as it becomes apparent that leverage ratios will improve mainly from growth in denominator rather than a reduction in numerator. The future will assuredly surprise us with negative events and true problems to worry about. For now, it appears rather than merely scratching the surface of problems, we are only scratching the surface of this firm’s ability to generate value over the long term.

Unquestionably, added incremental value, as reflected in free cash and EPS, remains elusive, but that does not mean that it will remain so. PMI continues to play for the long term. Throughout 2023, IQOS ILUMA was rolled out to the majority of markets in which PMI operates. The product is a significant step up in quality, reliability, and user experience by all measures, which continues to be reflected in the evolution of HTU units, IQOS users, and share. IQOS HTU shipment volumes increased by 6.09% in Q4 2023 and by 14.74% for the full year. The number of IQOS users continues to climb, adding 1.2 million in Q4 2023 and a robust 3.7 million since Q4 2022.

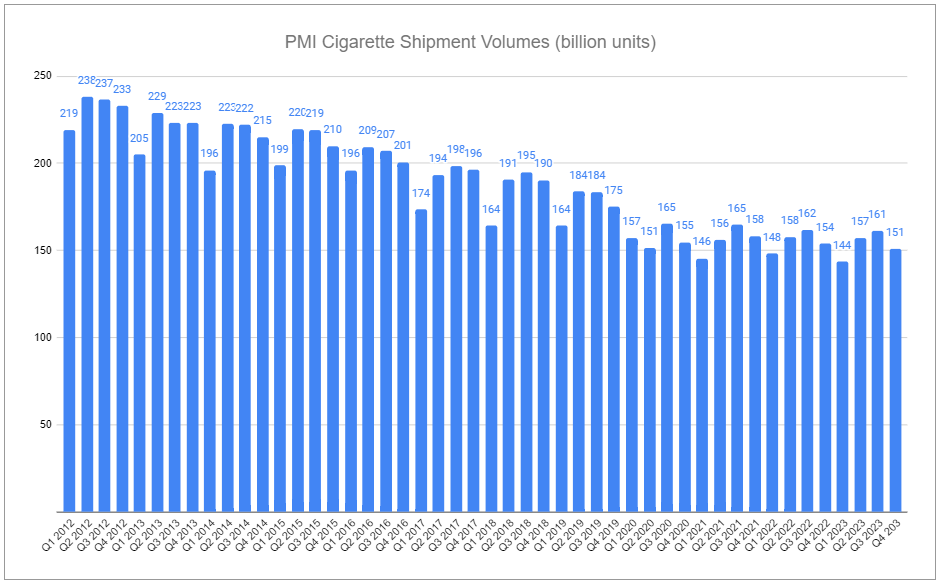

Philip Morris International’s cigarette shipment volumes declined by 1.9% in Q4 2023 and 1.44% for the full year.

Adding cigarettes alongside HTUs, while volumes decreased by 0.53% year-over-year in Q4 2023, aggregate volumes increased by 0.98% for the full year, marking three years of consecutive gain.

The strength of both PMI’s cigarette and heated tobacco products is further reflected in the incremental share taken.

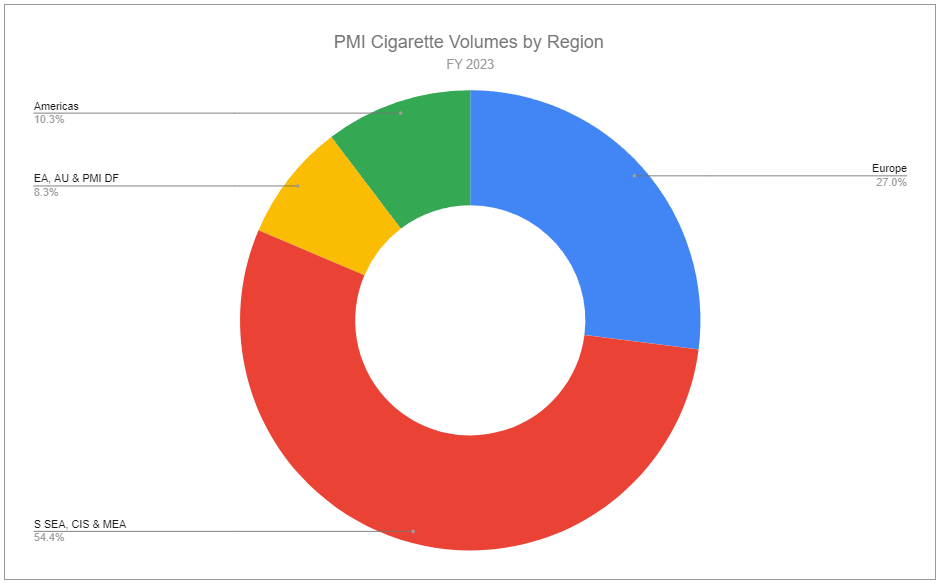

As remarkable as aggregate volume and share growth appear—undoubtedly receiving an inappropriate amount of focus by investors collectively—more impressive is that it was achieved despite aggressive pricing of legacy products. Organic combustible pricing variance measured 8.9% for the year, far above years prior. While this is set to revert toward mid-single digits in coming periods, it speaks to the dominance of the combustible portfolio, with consumers willing to pay a step up for PMI’s products. Conversely, not all combustible volumes should be thought of as equal. PMI’s geographic mix evolves toward volume growth markets sporting lower margin profiles, costs have continued to rise, and FX impacts persist, leading to financial results notably weaker than price take would suggest on a surface level. For 2023, combustible net revenues were up 3.5% and up 5.5% organically for the year, and gross profit was up a mere 0.3%.

Critics will say that while PMI’s legacy combustible business may be stable, competition is coming to eat IQOS’s lunch. I myself have been skeptical that a single brand can continue to hold the majority of category share. However, while new iterations of competing products have entered the market, they appear destined to be competing for a distant second place. As merely one example, I point to British American Tobacco’s newest glo launch. While the company touts positive consumer response relative to previous versions, the company’s share of HTP and its category contribution remain challenged. Comparing the qualitative aspects between glo Hyper Pro and IQOS ILUMA, it isn’t hard to see why—glo HP still falls short in session duration and consistency and lacks auto-start, all while being priced relatively similarly. Most critically, glo Hyper Pro has not solved the aspect of cleaning, which is a considerable pain point in user experience that further jeopardizes consistency and reliability. IQOS ILUMA’s induction technology has overcome this major hurdle, requiring no cleaning at all—a sole value proposition I view as trouncing all others. I recommend reading Recital’s writeup on the glo Hyper Pro launch, which concisely supports this position and offers further comparative insight.

Philip Morris International and British American Tobacco recently signed a global patent settlement. This will allow both to remain ahead of the pack, saving each other from costly and drawn-out litigation between each other and allowing the refocusing of related resources toward navigating regulation evolving around the category. This is further supported by the implicit fact that heated tobacco is by far the most complex and costly of next-gen products to develop, presenting a multi-billion dollar hurdle, and intellectual property further shields from competition. As for how PMI’s dominant position translates into an incremental value driver, it does not take much creativity:

Of next-gen categories, heated tobacco most closely mirrors the sensorial aspects of cigarette smoking.

IQOS has scientifically substantiated its lower risk profile relative to cigarettes.

IQOS ILUMA provides a superior user experience relative to other heated tobacco products.

IQOS heated tobacco units sport net revenue ~2.5x that of combustibles on a per-unit basis and carry a higher contribution margin.

In the Q4 remarks, Jacek Olczak stated that IQOS has surpassed Marlboro as the group’s leading brand in net revenue, and despite heightened pricing of combustibles, cigarettes were actually margin-dilutive for group results. Looking at the select markets of Europe, PMI’s heated tobacco share of the total tobacco market grew in 4 out of 5, with France being flat year over year. The company’s HTU product gained share year over year in all other countries it reports and lost share in none. With the ILUMA rollout essentially complete, associated elevated expenses are likely to wane, and as the product continues to build critical mass, net revenue growth is set to fall further toward the bottom line.

Like wildfire

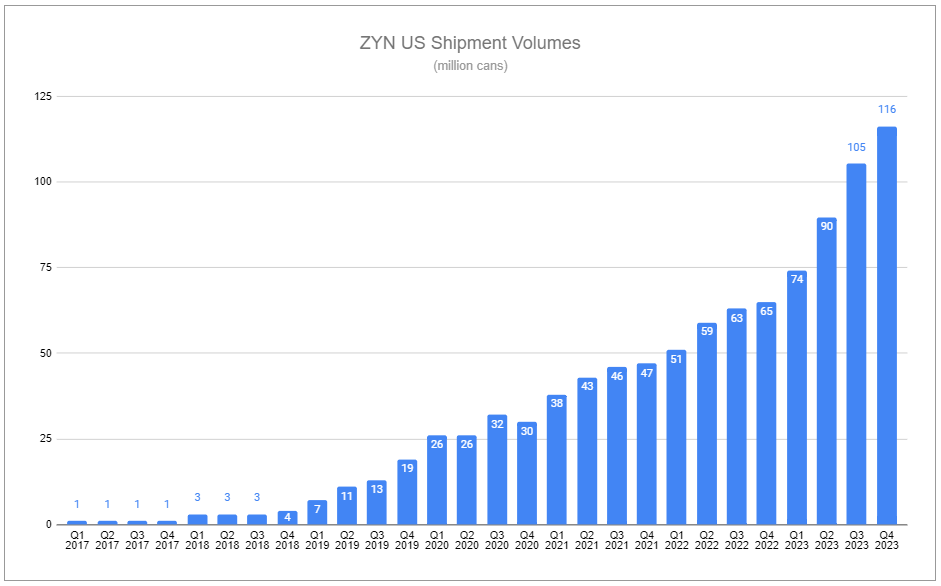

ZYN continues to spread across the United States like wildfire, with 12-month rolling shipped volumes increasing to 384.8 million, up 61.8% from last year. Disaggregating quarterly shipped volumes further shows the recent acceleration, with Q4 shipped volumes reaching 116.3 million, up ~78% from last year's quarter.

This precipitous rise has introduced the question of how popular this product is becoming with underaged groups, suggesting ZYN might face a similar fate to JUUL. This is very much a bad-faith comparison. The underage usage prevalence of nicotine pouches in the United States is incredibly low, far lower than the usage prevalence of vaping, even accounting for the fact that vaping usage prevalence has declined considerably over the last four years. The absurdity concerning the alarm raised of the category was explored in detail in last month’s piece:

Conversely, also highlighted in The ZYNpocalypse is the fact that the FDA has authorized zero new products through the PMTA process since Brian King became the director of the CTP in mid-2022. However, for ZYN specifically, context suggests far higher odds of receiving a Marketing Granted Order than a denial: underage usage is low; Swedish’s Match’s General Snus, a product containing tobacco, reduced risk relative to cigarettes but above that of nicotine pouches, has already received Modified Risk Orders via the MRTP process; marketing and distribution has been incredibly disciplined in the US; the rise of ZYN-focused content across social media appears entirely organic and in no way related to PMI. If ZYN’s dry pouch PMTA is denied, the outcome will undoubtedly be contested, and if recent court decisions are any indication, the FDA is poised to embarrass itself once again.

Counterintuitively, legal escalations do pose a separate threat from a competitive standpoint. ZYN, dominant in the United States, is largely so because it is the best of the first generation of dry pouches currently on the market. If the FDA concedes translating scientific substantiation of the product class’s reduced-risk profile into future modifications of its application process, it stands to reason that the door could potentially open wider for the hundreds of innovative products competing in Scandinavia. Although PMI has a pending PMTA for its moist pouch variant, heightened competition would challenge both the ability to retain market share as well as exercise price take. Further, while less likely on a federal level, it is reasonable to expect further actions against the product class and NGPs broadly on a state level, primarily certain states potentially limiting flavors, which would further compound product favorability.

Swedish Match’s other oral volumes, including a decrease in Snus of 13.8% and a 6.1% volume increase of ZYN in Scandinavia, increased total oral product volumes by 17.1% for the full year and by 16.8% on a pro forma basis. Group cigar volumes continued to make the tradeoff of volume declines, 12.2% for the year, for increased net revenues and profit on the back of significant price increases. For the full year, segment adjusted operating margin increased by 7.8pp to 48.6%, largely a function of the continued growth of oral volumes.

Moving forward, reported figures related to Swedish Match should become cleaner. Lapping the acquisition date, pro forma numbers are less fuzzy, and PMI has expressed that beginning in Q1 2024, related figures will be consolidated into its existing reporting regions.

The other buts

Despite the continued success of its product categories, Philip Morris International continues to face an additional mix of “what ifs?” and “buts,” namely surrounding its less-than-glamorous Wellness & Healthcare segment, leverage, and FX headwinds.

The Wellness & Healthcare segment continues to produce tepid net revenues and unimpressive operating losses. There were murmurs that the company was considering selling a partial stake in the segment in an effort to find a partner to scale its drug manufacturing outsourcing business. Will things improve? Worsen? Nobody knows because no further disclosure was provided, and the segment was entirely avoided during the quarterly call. Perhaps the value produced by this segment is merely reminding us that PMI’s management is not infallible.

Financing has continued to rise—a function of higher rates and the additional debt burden following the acquisition of Swedish Match. As notes roll forward, net interest expense will increase to $1.3-1.4 billion in 2024. However, driven by growth, the company is aiming to deleverage by a 0.3-0.5x range in 2024, which may also be accelerated by additional cost-efficiency efforts.

While management appears a bit more upbeat on FX impacts in 2024, such headwinds will likely remain non-trivial. However, as stated before, the growth of USD-derived revenues courtesy of Swedish Match, further aided by a potential moderate success of IQOS in the US in coming years, will undoubtedly help balance the swings. I remain steadfastly focused on the notions that nicotine is a global growth industry, PMI has a unique position, and that position will provide ability to grow at a high-single-digit clip while actively deleveraging and returning capital to shareholders. As the company moves closer to its target leverage of x2, share repurchases are to resume, likely in 2025, further supporting growth on a per-share basis.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Philip Morris International and other tobacco companies such as Altria, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 0.00%↑ BTI 0.00%↑ MO 0.00%↑

Additional Resources:

Philip Morris International - Reports and filings. Source

Not sure if this has ever come up in a Q&A, but why does PMI exclude traditional oral in presentations and press releases? e.g. 2023Q4 slide 8 note (a): "[Oral nicotine category e]xcludes snuff, snuff leaf and U.S. chew." Is PMI possibly preparing to sell traditional brands such as General, Göteborgs Rapé, and Grov?

I don’t smoke but sometimes I feel like trying out some of these new generation products, just so I know what my companies invest in. Alas here in the nanny state of Oz I need a prescription to purchase a vape, I kid you not. So I haven’t bothered. I might have to invest in a Japanese research trip :)