“Ultimately, we remain very bullish about the overall sector—guidance for the thrift industry. We love where we are from a value positioning perspective, and I'd just like to reiterate we continue to run the business to maximize EBITDA, generating growth, enabling free cash flow to invest in stores, supply, and inorganic opportunities.” - Mark Walsh, SVV CEO, Q3 2023 Call

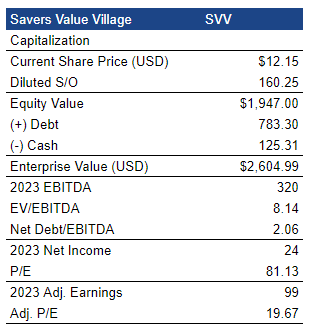

The glowing words above have been overshadowed by Savers Value Village reporting Q3 EPS of -$0.10 and providing soft guidance for Q4 and marginally lower net sales for the full year. Shares have transitioned from a steady grind lower to being thrown off a cliff—now down more than 50% from their peak in August. Despite the turmoil, I stand by my previous assessment that Savers is an intriguingly durable enterprise. At the same time, durable operations and durable enterprises make no promise to related equity. I have not been shy about that fact, having upheld my June conclusion in September:

Despite the durable model and clear mechanics to produce value, I have no interest in rushing to build a position in this name—I am much more inclined to let the IPO pass and patiently track the company’s progress as we are provided more granularity over time. Trading at a pro forma net debt/EBITDA ratio of x3.95 and an interest coverage ratio of x3.97, on top of variable-rate debt and other sensitivities, any misstep in execution or sudden shift in macro conditions could present a dislocated opportunity to acquire this thrifty retailer at a bargain price.

Here we are. More attention to provide.

SVV’s negative reported EPS in Q3 was largely a function of the readily anticipated $48 million expense of additional stock-based compensation plus other charges relating to the IPO. A similar $21 million SBC expense is to be recognized in Q4. These are certainly real and substantial costs but, due to their nature, are not to be reoccurring. Setting aside the additionally unfavorable CAD/USD rate, Q3 was, unmistakably, weaker than Q2. Yet, the revised FY guide on net sales appears to be an inconsequential change from $1.51 billion to $1.49 billion. Despite all of the above, full-year EBITDA guidance was unchanged, and both net income and net income adjusted for IPO-related charges were raised marginally.

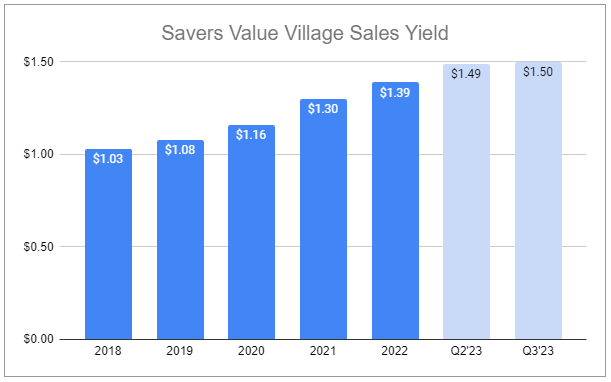

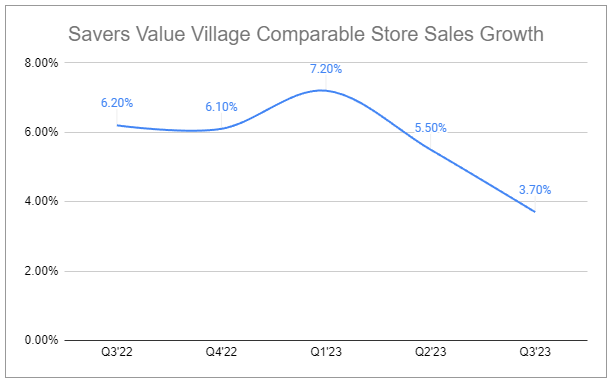

In a mere two months, SVV’s adjusted earnings multiple for the full year has fallen from over x30 to ~x20. But what of it? Even when assuming such normalized earnings are sensible, plenty of questions remain. Are there reinvestment opportunities with attractive incremental return profiles? Over what duration can such reinvestment continue? Can operations become more efficient and to what extent? The formula largely boils down to store count, comparable store sales, Sales Yield (retail sales generated per pound of processed volume), cost controls, and Centralized Processing Centers.

SVV opened three new stores in the quarter and maintains its full-year store target and ambitious ramp of new stores in 2024 and beyond—a growth rate considerably higher than what has been achieved over the last several years. To accomplish this, the company will be reliant on smaller, more efficient storefronts that rely on Centralized Processing Centers, as CEO Mark Walsh elaborated on during the call (emphasis added):

This is a multi-year strategic investment. We continue to make very solid progress. As a reminder, we have 4 in operation today. The Calgary CPC opened at the end of July. We have one more CPC for this year in our Minnesota market, and in 2024, we plan to open a facility in Southern California and possibly one additional facility if we can find the right location that makes economic sense. But, we're very pleased with the month-on-month improvement, continuous improvement, of the yield that's coming out of those facilities—the production efficiency. And, most of all, new store opportunities. As we just talked about, is what we remain focused on. New sites that are very attractive to us that are only made possible by the presence of the CPC.

Successful execution of CPCs poses both the greatest risk and reward for the company. Not only can they enable accelerated new store opens, but they are imperative to help drive down labor expenses—the largest component of COGS, at around 60% of the total. Further controlling labor costs, 63 stores are benefitting from Automated Book Processing systems. For the many stores not immediately impacted by CPCs, further identifying workflow improvements and increasing ABP impact (to be 85-90 store EoY) will be integral to optimizing labor, which COO Jubran Tanious further touched on (emphasis added):

It is all about tying labor to processing, modulating that labor, those numbers of hours we utilize to process the amount of goods we put out on the floor. Our ability to do that, and that vertical supply chain, really drives efficiency. You see it over the last quarter. We were able to do that in the second quarter. We feel very bullish about our ability to do that moving forward.

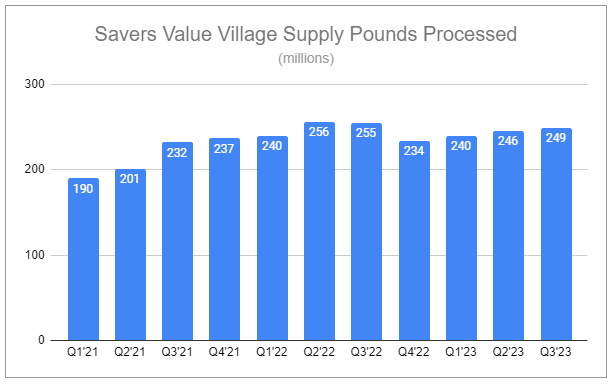

Growth in total processed supply over the last year has been non-existent. But the total supply pounds processed is not the be-all and end-all metric. Savers is explicitly focusing on quality over quantity and shifting toward more data-focused initiatives to generate the greatest value from donations. It would actually be far easier for the company to acquire much higher supply volumes—but they would be sourced externally, which carries higher costs despite being of generally lower quality. Instead, On-Site Donations and GreenDrop pods have continued to become a larger piece of sourcing, improving on both cost and quality. Tanious touched on GreenDrop during the Q3 Q&A (emphasis added):

On the GreenDrop side, we are at roughly 60 locations. Now, for this year, we will have line of sight to approximately 30 locations that we will have opened—all doing well in terms of their early performance with what we modeled. We're very happy about that. The one thing I will say about GreenDrop is that it is such an attractive different method. They are visible, clean, well-maintained locations as opposed to the standalone bin and all the problems that those can create. But the fact that they are different does make it challenging in some unique municipalities to get the permitting. To fill the permitting form for the city can be challenging. So there are occasions where we have to work through the permitting process in different municipalities, but again, I would go back to there is such tremendous white space, and we are looking to grow GreenDrop for years and years into the future. We are prospecting lots of markets, and that robust pipeline is what ensures we are going to realize that into the future. One thing to bear in mind is that we're very bullish on GreenDrop—to be able to collect high-quality supply in high-traffic affluent areas.

Permitting, posing as a challenge, also presents a potential advantage versus any competitor attempting to emulate this part of the model. But it should be noted that GreenDrop is a small percentage of total sourcing, and even with consistent annual growth in units is unlikely to significantly move the needle in the near term. It is much more critical that the company continues to succeed in strengthening On-Site Donations. It remains to be seen how far each can be pushed as a total percentage of sourcing, as they together already represent ~75%. SVV COO Jubran Tanious reiterated the critical impact sourcing has on Sales Yield (emphasis added):

I would say, when it comes to Sales Yields, you know, we are always looking at price with regard to item ratio. And again, the definition of item ratio being the number of items that we put out vs. the number of items that we sell within a particular category. So when we think about price, we think about reacting to what is selling really well with the customer and we take price very surgically at the category and subcategory level. And that's an ongoing process that we do, that's not just category, but also geographically—regionally, if you will.

There's a lot that goes into it. The last that I'd say on Sales Yield is that—Mark mentioned this earlier—there's very robust On-Site Donation performance in both countries. And what we know, over the years of measuring this, is that when the donor takes the time and care to bring their goods to our donation centers and our GreenDrops, generally, we'll create a higher sales yield in our stores vs. the rest of the supply.

In Q3, SVV’s Sales Yield increased 5.63% y/y, from $1.42 to $1.50. When asked about any consumer sensitivity to pricing actions, Walsh made it clear (emphasis added):

So, I'll answer the first question, and I'll turn it over to Jubran on Sales Yield, Brooke. Thank you for the question. We have not seen any impact on price. None whatsoever.

Concerning economic cycles, Tanious elaborated:

Does the quality, or even volumes, change in a challenged economy? What I can tell you is we're not seeing that in our business. In fact, On-Site Donation volume has been robust in both Canada and the U.S., and a lot of that goes to execution. We've talked about this in the past. When it comes to being the donation destination of choice for the donor, convenience is king, like we talked about, and they need to have that reliable, fast, friendly, experience that our team members are trained to give each and every time. Doing that consistently—doing that well ensures that destination of choice.

And in terms of whether there were heightened competitive pressures, Mark Walsh stated (emphasis added):

No. Not any negative influence from the competitive set. We're well-positioned—feel good about our presentation from a merchandising perspective, as we've discussed. We know from consumer research that our merchandising is superior to our competitive set. So we feel great about where we sit today, our value proposition, and how we're standing, and how we look to that consumer once they walk through that door.

To add to the rosy highlights, SVV’s loyalty program—in which program members shop more frequently and have notably larger basket sizes than non-members—saw member growth of 10% y/y in Q3, now at over 5.2 million. Yet the above, comparable store sales growth markedly decelerated in the quarter. Cited was the unusually warm weather during the shoulder season as we transition to seasonally colder months. Q4 is guided to show 0-1% CSS growth. This recent degrading is concerning, but there are always tradeoffs—adjusted margins continue to widen.

Despite the concerns illustrated, it isn’t unreasonable to think that many of the above points are merely growing pains as the company revamps its model—improving upon its 70-year history to take advantage of secular growth in a fragmented industry in which it is the largest for-profit operator. But with new stores carrying ~70% productivity and a 3-5 year period to maturity, the uncertainty around CPC integration, and CAD/USD rates, it is clear that further demonstration of execution is necessary. To boot, the company authorized a $50 million repurchase program—funds perhaps better earmarked toward its variable-rate debt. After all, the company restructured in 2019 due to mounting debt. To add, the lockup period for the remaining 86% of shares, owned by Ares, ends on December 28th. Rather than thrifting, future updates may be more akin to exploring the beautiful art of dumpster diving. One can patiently hope.

If you enjoyed reading, take a second to hit “♡ like” on the site and share it.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

At the time of publishing this piece, I have no direct positions in Savers Value Village. I may take such positions (long or short) in the future.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: SVV 0.00%↑ ARES 0.00%↑

what happens in areas where 100% non-profit charitable thrifts have local networks of scale? looks like a winner-takes-all setup.