Savers Value Village: Cracking the Thrift Code

“We love where we are in terms of brand awareness in Canada standing at 90%+, so you certainly have a bullseye on our ability to continue to monetize and drive growth in Canada. We’ve had some remarkably successful store openings in the last six months—we feel really good about our Canadian presence. That said, in the U.S., we’re even more excited, because of the strength of the growth pattern in thrift and what we represent. These are hyper-local stores, hyper-local markets. We get our supply and our demand from within an 8-10 mile radius of each store. Generating that awareness through influencers, through great signage, through great presence, through great real estate; we’re cracking the code on that.” - Mark Walsh, SVV CEO, Q2 2023 Q&A

On occasion, you come across a business model so purely brilliant that you can’t shake it from your mind. Savers Value Village has such a model. The company is the largest for-profit thrift store operator in North America, with the majority of its inventory being simply given to it as donations, which are then sorted, stocked, and sold. This profitable endeavor traces back to 1954, with the company steadily growing ever since. But it was only recently, in June, that it became public via an Initial Public Offering. Shortly before the deal, I published Second-Hand Retail: A First-Class Market.

Since its IPO, Savers Value Village has continued to execute a strategy that I believe can create substantial long-term value. In August, the company held its first quarterly call as a publicly traded company—showcasing results above management’s expectations. Excerpts from that call, as well as a discussion I had with a retail specialist, further paint the opportunity ahead.

In Q2 2023, SVV net sales increased by 4% to $379.1 million, and by 6.2% ($387.4 million) at constant currency. For the same period, comparable store sales increased by 5.5%. While these growth rates may not be eye-popping, it should be noted that the CSS growth marks a 15+ year continuation (ex. Covid 2020), in which the company grew CSS even during the GFC. More importantly, there are several key components driving what management has referred to as the company’s new growth phase, driven by new store openings paired with a number of efficiency gains.

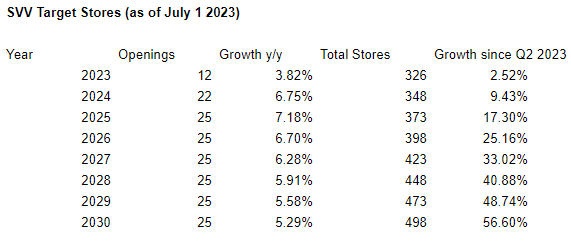

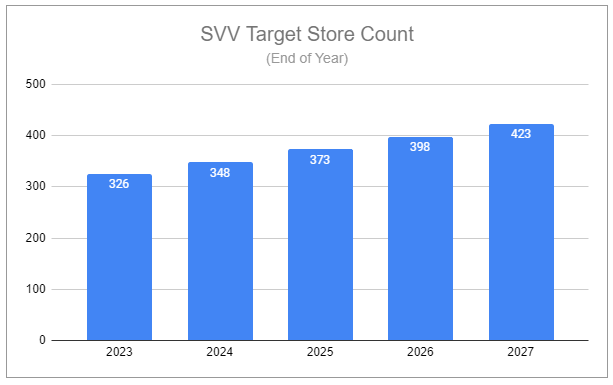

New store openings are fairly straightforward. At the time of SVV’s S-1/A filing, it operated a total of 317 stores, with an aim to open 12 total in 2023, and 20+ in each following year. In Q2, the company opened 1 new store, with 11 more aimed to be opened throughout the remainder of 2023, 22 in 2024, and 25 per year thereafter.

At an end-state potential of 2,200+, SVV’s new store opening can lead to store count growth at a mid-single-digit rate well into the future. And with a target payback period of ~3 years, new store economics are compelling. This is especially true when you layer on potential efficiency gains.

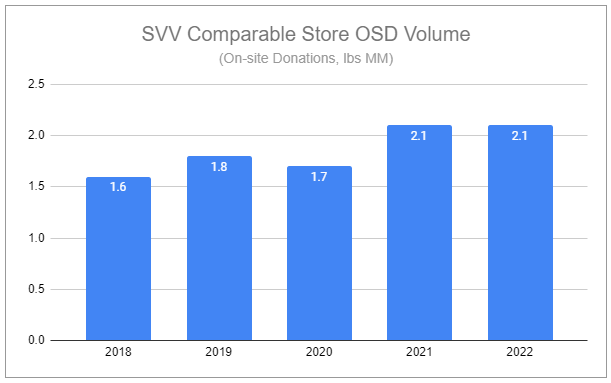

A primary driver of SVV store efficiency is the amount of inventory that is from on-site donations. These donations are both, generally, higher-quality, and also carry far fewer additional costs, such as paying partner organizations additional sums and transport costs.

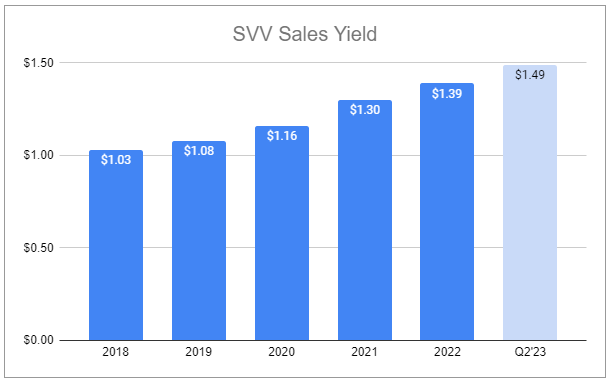

On-site donations (OSD) have continued to become a larger piece of the overall value equation, which has been continually reflected in SVV’s progressively higher sales yield—a function (using comparable store sales at constant currency) of retail sales per pound of processed volume. In Q2, sales yield increased 8% y/y to $1.49.

As powerful a driver as a shift from delivered supply to OSD may be, the future benefits may result in diminishing returns. Merchandise supply already skews toward OSD, with it making up 63% of all sourcing. Paired with GreenDrop—mobile collection sites—delivered supply has already been pushed down to 27%. And other definitive efficiency improvements, such as installing self-checkout units, have already reached complete saturation across stores. Such focuses have continued to pay off, as articulated during a particular exchange during the Q&A of the call (emphasis added):

Brooke Roach, Goldman Sachs:

I was hoping we could dive a bit deeper into the strong sales yield growth that you’ve been delivering—particularly in this (Q2) quarter. Can you talk a little more about the strategic initiatives that are driving that and your outlook on the sustainability of that momentum as you enter the back half and as you comp some of these tougher compares into early 2024?

Mark Walsh, SVV CEO:

Well, contextually let’s start—and Brooke, thanks for the question—look, we run our business to maximize cash flow and for future growth, and we’re doing this by increasing sales in every pound of product we process, and Jubran (Tanious) and the operations team, they’re focused on improving productivity across every possible element of our business model. Our store managers focus on sales four-wall contribution, inclusive of both those front and back-of-house expenses. I think you’re seeing the fruits of that effort play out as we’ve articulated over the last four years and I think that we’ll continue to go forward. And we’re very—you know, you’re right—we have a great quarter in terms of sales yield improvement. But we’re not done.

Jubran Tanious, COO:

Yeah, I think that’s right Brooke. And I would say that we talk a lot about that we match processing levels to demand. So, if we see that a particular store is enjoying a nice trend of strong transaction comp growth, our operators will see that and see that accordingly to keep the flywheel going. You gotta start with processing levels and managing that well and matching it to demand to continue to enjoy robust sales yield. But beyond processing levels, as we’ve talked about, there are other factors that really come into play. We talk about use of price, we talk about use of space—all of those things are very data-driven through dashboards that our operators have at the store level. So, to give you a very timely and salient example, as we think of transitioning from summer into fall, each of our stores has dashboards that can tell them exactly what the sales performance is by square foot and by linear foot in our stores, so that you migrate through the season, and you match what customers are buying in that particular moment in time, as opposed to what a traditional retailer might do, which was a whole-floor-flip to fall. So, we try to match the customer exactly where they’re at in terms of space, price, processing levels, and we continue to do that in a data-driven way. We expect sales yields to be robust and strong as we go forward.

This points to the importance of integrating Central Processing Centers.

I wrote in June that the benefits of CPCs were unmistakable. After speaking with a retail specialist familiar with SVV operations, those benefits have been fully reaffirmed, as per key statements provided by them during our conversation (emphasis added):

Central Processing is huge—a total game-changer—because most payroll is spent in production. Stores have teams of 20-30 people keeping up with sorting. There is natural inefficiency.

Some categories of items are over-donated at specific locations, but due to shipping costs and complexities regarding treatment/classification with non-profit partners, stores are largely unable to ship products to other locations where inventory would fetch far higher sums rather than recycling via wholesale.

Due to seasonality, and even the weekly cadence of promotions, and despite manually sort + stock operations having been observed to be markedly more efficient compared to large non-profit competitors, SVV’s manual processing can force teams to push high-quality inventory to wholesale recycling before it ever hits the shelves simply to maintain prioritization of overall velocity. On deep discount days (up to 50% off marked prices), high-velocity stores have repeat customers standing around eagerly waiting for new racks of products to be brought out to the floor. It’s a lot to keep up with.

With CPCs, sales trends can be reviewed and the right amount of each product can get shipped to each store. CPCs can be set in high-density areas. Short routes. Product arrives pre-sorted and priced. It just needs to be placed on the sales floor. You get better quality control. You can also store out-of-season items better. And again, those payroll costs come down.

The immense benefits of CPCs can amplify continued strong consumer behavior, as well as continued signup rates for the Savers loyalty program, as highlighted in an all-over-yet-candid response provided by SVV CEO Mark Walsh during the call:

Matthew Boss, JPM:

So, Mark, could you elaborate on comp trends that you saw as the second quarter progressed? Or just any change in momentum or customer behavior that you’ve seen in July? And then, larger picture, could you speak or elaborate on new customer acquisition trends and initiatives in place to retain these new customers?

Mark Walsh, SVV CEO:

Certainly through the quarter, we—the second quarter and into July—the trends have been pretty consistent, Matt. You know, in the second quarter, transactions were up 6.8%, baskets were still down on an enterprise level—around 1%. That trend hasn’t really changed much into July. Donation volume remains steady. Transactions continue to drive good comps, and we’re really excited about particularly strong member transaction trends—remain solid. Both transaction growth from the member and non-member sides have been continuing to grow through the second quarter and into July. The loyalty database has grown at a solid pace—high single digits. The store teams are really focused on signing up new individuals. That’s probably one of the principal things our front-end supervisors are focused on. So we’re very happy with the continued progress of loyalty signups moving forward. And I think one of the other things that I would like to mention is we continue to see through our own internal survey metrics an influx of younger customers. That’s obviously very encouraging for us in the long term. What’s really interesting is our boutique stores in Canada were over-indexing in these new loyalty customer signups which is equally exciting. Um, I think that answers pretty much all your questions, right?

Matthew Boss, JPM:

Absolutely.

The positive alignment of the factors above provides an interesting context for management’s full-year guidance. Net income is aimed to be ~$23 million. Using Friday’s closing price of $19.74/share, and an FDSO number of 160 million (current level plus rights from IPO), provides an EoY market capitalization of $3.158 billion—and thus an implied P/E of x137. However, it should be noted that within that net income figure is stock-based compensation related to the IPO of $69 million— $48 million to be recognized in Q3 and $21 million in Q4. While real costs, these specific SBC figures are non-recurring. Normalizing net income for them, as well as certain financial charges related to changes in the capital structure post-IPO, present a more normalized net income figure of $98 million, or x32.2. At an enterprise level, management expects SVV to produce ~$320 million in EBITDA for FY’23. Using the same market capitalization calculated alongside current levels of cash and debt roughly presents an EV of $3.86 billion and an EV/EBITDA multiple of ~x12, with net debt/EBITDA of ~2.2, guided to shift down closer to x2 by the end of the year.

Are these multiples fair for a model that appears to have exceptional qualities? I’m still uncertain. Despite the durability of the business and the numerous drivers that can likely lead to HSD topline and improvement to margins for (what appears to be) a very long time to come, the greatest potential driver—CPCs—also pose the greatest risk. With only several currently operational, it becomes essential to better understand the true economic costs, tradeoffs, ability to continually integrate, and verification of long-term benefits to justify investing in this venture. For this reason, my previous conclusion remains: I find it most prudent to sit back, continue to provide attention to this name, and patiently wait for any dislocations to present a skewed opportunity to acquire this thrifty operator at a bargain price. With execution coming in above expectations while the initial excitement of the IPO fades, such an opportunity may not be too far off.

If you enjoyed reading, take a second to hit “♡ like” on the site and share it.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

At the time of publishing this piece, I have no direct positions in Savers Value Village. I may take such positions (long or short) in the future.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: SVV 0.00%↑ WINA 0.00%↑ ARES 0.00%↑ TDUP 0.00%↑ POSH 0.00%↑

Great analysis. This looks like a solid investment for the macro environment we will be in for years. Just went long.

Have you researched UVV?