“Net sales increased from DKK 6.7 billion in 2018 to DKK 8.7 billion in 2023, an increase of close to 30%. The EBITDA margin has improved from about 20% in 2018 to 24.1% in 2023. And the free cash flow before acquisitions has each year been above DKK 1 billion. And adjusted earnings per share and return on invested capital have taken significant step change. And you add to this that for the past 5 years, we returned more than DKK 5 billion to investors, we believe the financial results have been good.” - Niels Frederiksen, STG CEO, Q4’23 Remarks

It would be easy to dismiss Scandinavian Tobacco Group by painting a rather dismal narrative: the company was overearning during covid; increasing costs mute price take; net sales are bound to plunge. Margins will continue to be squeezed, resulting in operating income that was all the less flattering. New acquisitions have saddled on additional debt, adding to net financing costs. Extrapolate the perceived issues; the company is pathing toward dire circumstance.

Of course, the ease of endlessly extrapolating is bound to be proven incorrect. Without question, Scandinavian Tobacco Group’s operations have faced challenges across the board. However, the margin pressure and subsequent muting of operating earnings will continue to be primarily from elevated rates of reinvestment in Growth Enablers: NGPs in EUB, international handmade sales in NABROW, and retail expansion in NAOR. I must concede that execution has exceeded my expectations. In 2023, these Growth Enablers comprised 8% of group net sales, increasing to 10% in Q4, far above the 5% for all of 2022. 2024 guidance includes:

NGP growth of more than 50%, driven by increased market share and expansion into new markets.

Four new retail superstores will be invested in, three of which will open by the end of 2024 and one in 2025 (presumably H1). This would complement the existing nine superstores, which currently contribute 9% of NAOR segment net sales. While not explicitly guided, similar investment is likely to continue in the following years.

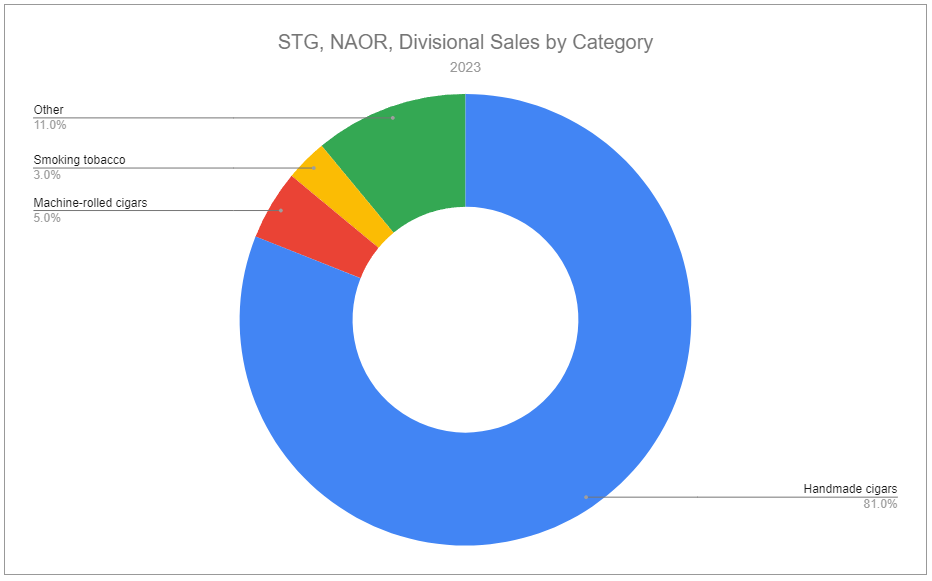

Investment in the continued international expansion of handmade cigars—a sizable long-tail opportunity highlighted last quarter that can likely sustain a 10-15% annualized growth rate for the foreseeable future. Presently, Rest of World, outside of the Americas and Europe, makes up only 5.7% of group net sales, and handmade cigars comprise only a smaller part.

I previously highlighted the ERP investment costs weighing on STG while the majority of benefits are not set to be realized until 2025 and beyond. At the same time, I have unquestionably underestimated the group’s commitment to the related reinvestment rate. Altogether, these items will collectively represent costs of DKK 300mn in 2024, well above previous expectations. This fosters a considerable degree of uneasiness. While the group has historically done an exceptional job at managing the core business and generating considerable returns for shareholders, the group has a far shorter track record with NGPs, and there is less clarity on international expansion relative to retail expansion within the United States. Moreso, the depressed levels at which the group’s equity sits had always made share repurchases appear as the obvious go-to route to enhance equity returns with the least amount of uncertainty.

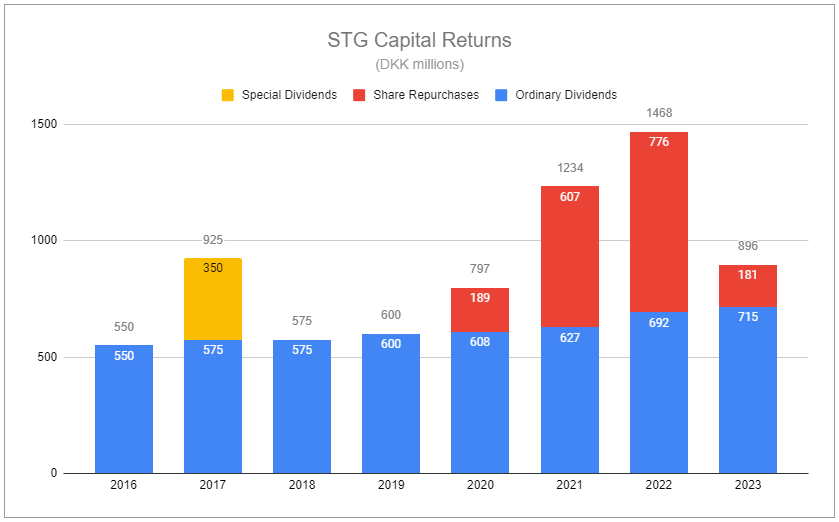

Fortunately, a large portion of the DKK 850mn repurchase program announced in November 2023 remains and is set to run through February 2025. The company stays comfortably under its target leverage ratio of 2.5x, currently at 1.9x. Even with elevated reinvestments, the company remains extremely cash-generative, and not much is needed to produce rather stellar results. In the eight years of being public, the company has returned 70% of its initial market capitalization to shareholders while continuing M&A at a steady pace.

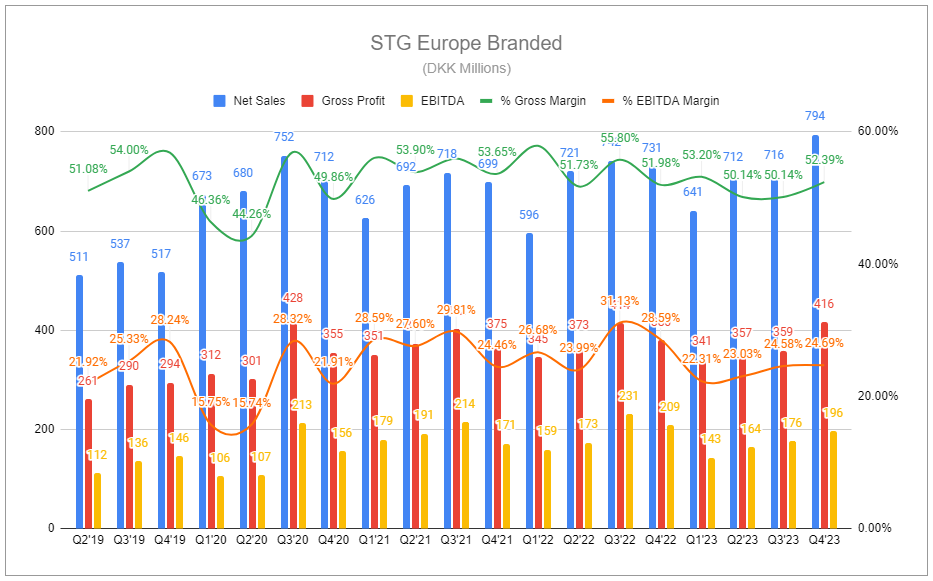

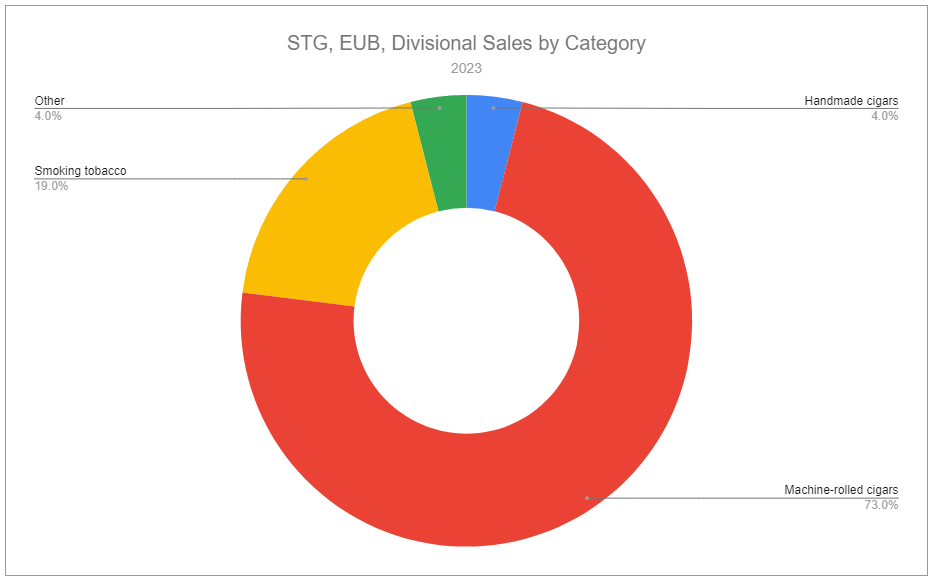

Europe Branded

Europe Branded faced notable challenges throughout 2023. Market share was ceded, and volumes continued to decline. Yet pricing remained robust and largely offset the impact. Full-year net sales increased 2.6%, 2% driven organically. Gross profit was down a modest -2.5%, while EBITDA decreased by a not-so-modest -12%. The notably higher operating expense ratio was a function of investments to bolster the core business as well as investments made related to NGPs STRÖM and XQS. It is assuredly too early to claim a decisive reversal in the core, but Q4 did suggest promise: a sequential 50bps recapture of market share to 29.8%, stunting the full-year loss to a mere 10bps, down to 29.9%. Net revenues and gross profit increased by 8.6% and 9.5%, respectively, while EBITDA declined by -6.2% as elevated opex continued.

North America Branded & Rest of World

NABROW faced challenges on multiple fronts in 2023. Lower contract manufacturing resulted in suboptimal resource utilization. Fine-cut tobacco sales were impacted by unrest in the Middle East. Handmade cigar sales within the US declined as expected, following post-pandemic trends. Full-year net sales decreased by -5%, and gross profit fell by the same. Integration of the Alec Bradley acquisition helped bolster volumes, but FX rates effectively erased all positive contribution. Likewise, the international expansion of handmade cigars has continued a strong double-digit growth trajectory, but investments made to support continued expansion muted period results. In all, EBITDA fell by -10% for the year.

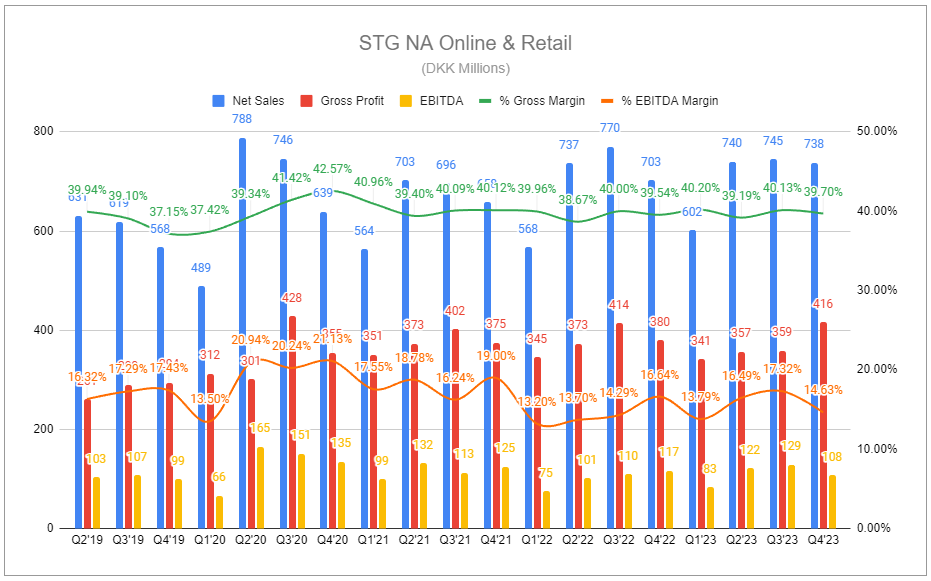

North America Online & Retail

NAOR’s performance was unquestionably strong in 2023, with the continuance of the post-pandemic normalization leading to outsized growth from physical retail. While slower than ideal, the company opened two new retail superstores in 2023, though both have begun to meaningfully contribute to the retail footprint. Net sales increased by 2%; 5% organic growth was offset by FX headwinds. Gross profit increased in kind, and EBITDA increased by 10% for the period. Q4 organic net sales increased by nearly 10%, though FX headwinds resulted in reported net sales growth of 5% and gross profit increasing by 5.4%. EBITDA in the quarter fell by -7.7%, largely a function of increasing costs and promotional spending. Only touched on briefly in the company’s interim report was the company’s agreement with a third-party nicotine pouch brand utilizing STG’s distribution capabilities. While not cited specifically in the report, this would be PMI’s ZYN. Although still a negligible contributor to group performance, the sustained growth rate suggests that may not always be the case.

Not much is needed

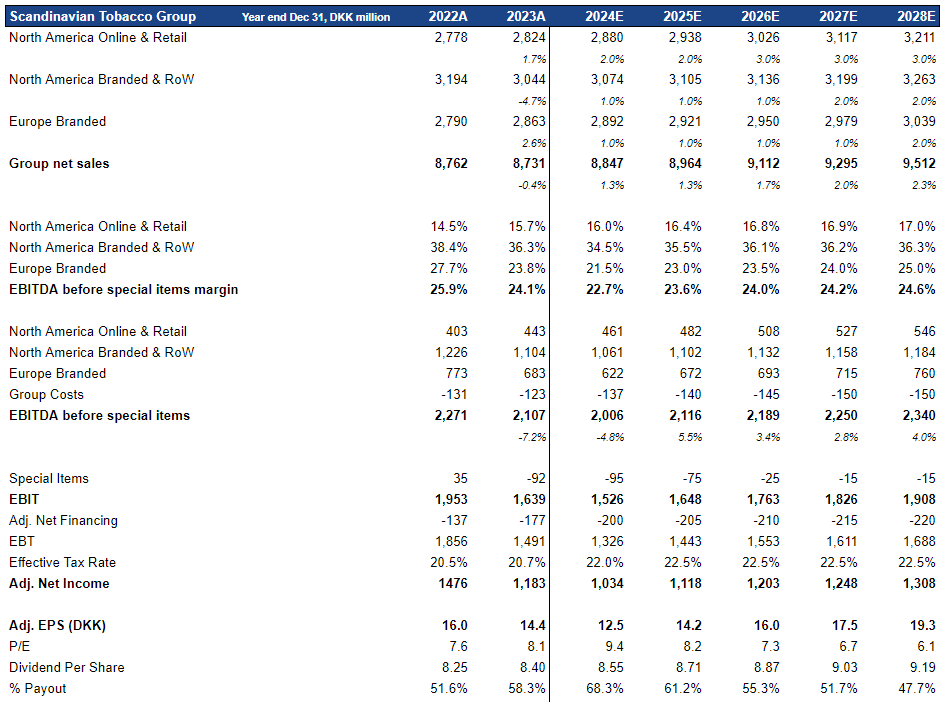

Scandinavian Tobacco Group’s 2024 guidance included:

Net sales: DKK 8.8-9.1bn

EBITDA Margin: 22-24%

Free Cash Flow: DKK 0.8-1bn

Adjusted EPS: DKK 12.5-14.5

This implies top line growth of 0.8-4.2%, with earnings and FCF both weighed down by mix/shift and pricing far unable to offset the rate of elevated reinvestment. We can paint a straightforward model that illustrates how this could play out.

Attempted conservatism stems from a number of sources:

The growth rates of all three segment Growth Enablers have been muted, resulting in group net sales at the low point of guidance.

EBITDA margins for NABROW and EUB have been compressed further, reflecting elevated reinvestment. Special items, costs predominantly related to the ERP rollout, persist beyond 2025—a continued headwind rather than recognized cost savings.

Net financing is a touch heavy-handed, and the effective tax rate proves less kind.

Still, the earnings output is steady, with 2024 EPS firmly at the bottom of the guided range, partly aided by the execution of the existing share repurchase program. Trading at 6.75x EV/EBITDA and at a half turn under the target leverage ratio, the per-share performance will largely benefit from the continuation of share repurchases in future periods. Margin recovery is expected following 2025, and should Growth Enablers deliver, the topline will appear all the more robust. Even with sustained reinvestment, and if zero topline growth were to occur, normalized free cash flow would be over DKK 1bn on a market cap of DKK 10bn. If willing to look multiple years out, this provides a number of paths in which the company is generating much more cash and each share is entitled to much more of it.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Scandinavian Tobacco Group and other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑