Scandinavian Tobacco Group: The Artisanal Serial Acquirer

“Smoking cigars is like falling in love. First, you are attracted by its shape; you stay for its flavour, and you must always remember never, never to let the flame go out!” - Winston Churchill

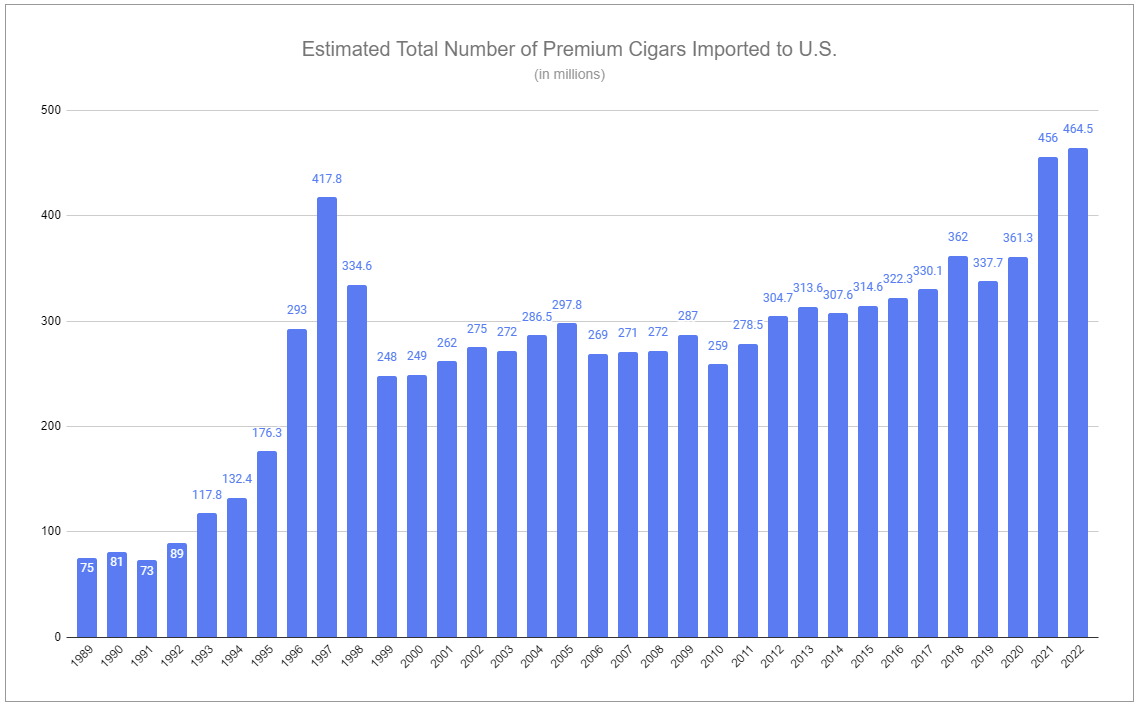

Premium handmade cigars are an exceptional class of product. They are an artisanal luxury with complexities that make them difficult to copy and produce, with leading brands having heritages tracing back centuries. The only people who truly understand the nuances of the industry are producers and devoted consumers. Most investors and analysts - even those focused specifically on tobacco - pay almost no mind to this category, with institutional-grade research reports failing to provide coverage. That lack of attention is a mistake—one that represents opportunity. Hinting towards the possibilities is an image that runs counter to narratives proclaiming that demand for all legacy tobacco products is quickly fading:

Premium handmade cigars are niche, dwarfed by cigarettes, and overlooked in favor of new and flashy nicotine products. Broadly, cigars as a whole make up only ~1% of total global industry volumes and ~6% of global retail value, with premium handmade varieties being even less. But ex-China, this niche still represents a multi-billion dollar category, with the United States being about 1/3 of the global retail market value. I believe there is a single company best positioned to capitalize: Scandinavian Tobacco Group.

Investment thesis

Cigars are one of the oldest tobacco product formats that exist, premium handmade varieties have especially compelling qualities, and total demand is likely to remain robust. While the global industry is somewhat fragmented, there are several large participants that hold substantial market share, and Scandinavian Tobacco Group (STG) is the closest thing to a pure play that exists in public markets, with a majority of its sales and operating income derived from cigars and high exposure to handmade cigars in the United States.

STG is able to exercise significant pricing power on an impeccable portfolio of high-quality brands and holds uniquely advantaged vertically integrated infrastructure.

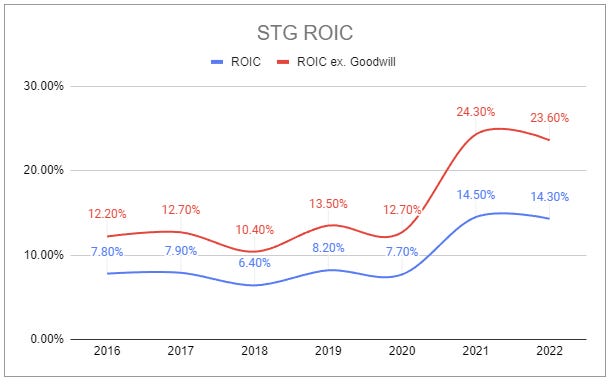

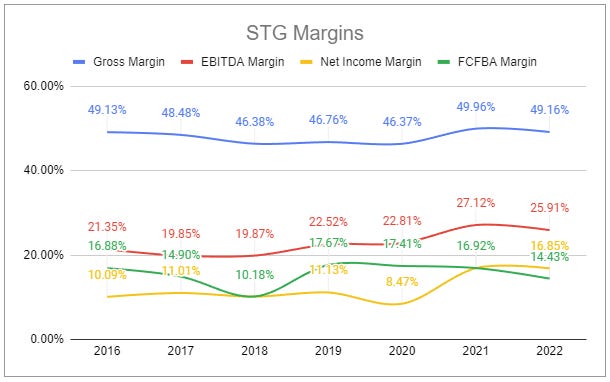

Management has a strong track record of execution, including growing the company via M&A, and has remained focused on making continuing operations more efficient.

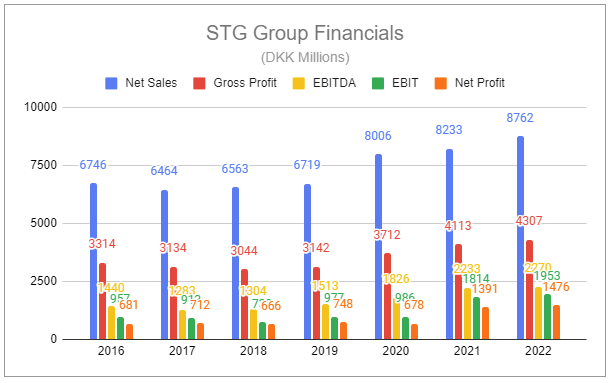

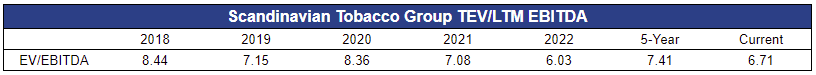

STG currently trades at x6.7 EV/EBITDA and less than x10 FCF.

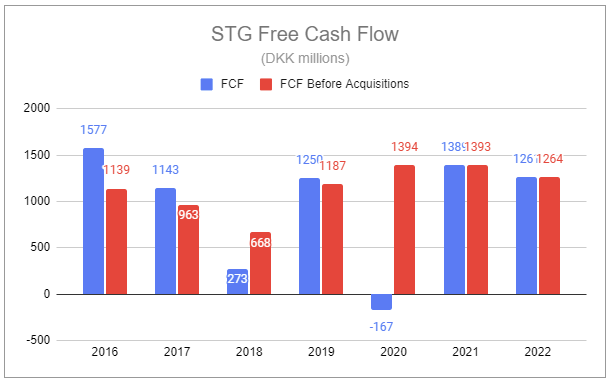

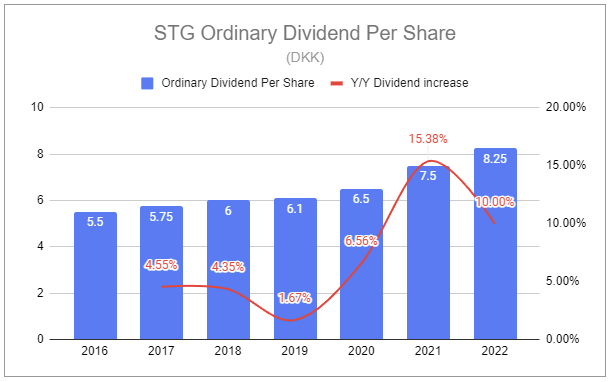

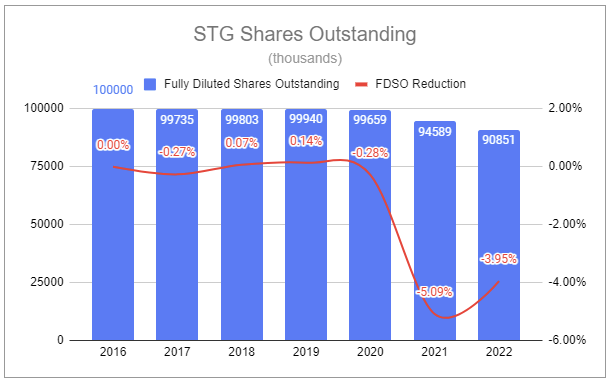

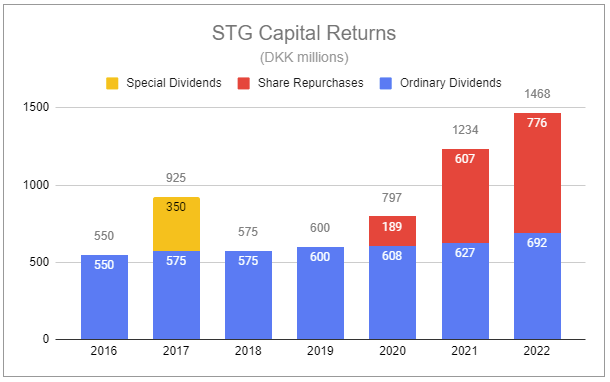

Management has aggressively returned capital to shareholders in the form of dividends and share repurchases. Since STG became public in 2016, total capital returned represents 61.5% of the IPO market capitalization. Even while reinvesting in the business, capital returned to shareholders in 2021 and 2022 equated to 12% and 11% of beginning-of-year market capitalization, respectively. With an under-levered balance sheet and high free cash generation, I believe management is poised to grow the business, increasingly produce value, and return substantial capital to shareholders at a rapid rate.

Why does this opportunity exist?

STG is a relatively small company, with a current market capitalization of ~DKK9.85 billion ($1.44 billion) and a current enterprise value of ~DKK14.16 billion ($2.07 billion). As a small cap, STG remains outside the purview of most investors.

Scandinavian Tobacco Group is headquartered in Copenhagen, Denmark, and is listed under the ticker “STG” on the Nasdaq Copenhagen Stock Exchange, which further restricts accessibility and interest.

Cigars - especially premium handmade cigars - are completely ignored by most investors and analysts, even those focused on the tobacco industry. This niche isn’t just an afterthought; it receives practically no thought.

The entirety of the following analysis explores the STG investment thesis and sheds light on the nuances of premium handmade cigars as a unique product class.

Let’s light it up.

The rise of the cigar

“Sublime tobacco! which from East to west Cheers the Tar’s labour or the Sultan’s rest; Which on the Moslem’s ottoman divides His hours and rivals opium and his brides; Magnificent in ‘Stamboul, but less grand, Though not less loved, in Wapping or the Strand; Divine in Hookahs, glorious in pipe, When tipped with amber, mellow, rich and ripe; Like other charmers, wooing the caress, More dazzlingly when daring in full dress; Yet thy true lovers more admire by far Thy naked beauties - give me a cigar!” - George Gordon Byron, commonly known as Lord Byron, The Island, poem, 1823

Tobacco had been cultivated and used by the indigenous peoples of the Americas for thousands of years. It was only in the late 15th century when European explorers were introduced to it—However, there was opposition; viewing the act of pipe smoking as a bizarre and uncivilized act. But naturally, curiosity led to experimentation, which was followed by adoption.

European governments - even monarchs and dictators - could not stop the rising popularity of tobacco. Despite their best efforts, they were ultimately forced to concede its use and embrace the immense tax revenue it produced. Demand grew steadily in the 17th century, with consumption largely comprised of pipe smoking, cigars, and snuff (finely-powdered tobacco which is lightly inhaled into the nasal cavity, creating an unavoidable burn and an unmistakable nicotine buzz). But then, demand accelerated, nearly going exponential. To meet the fast-growing demand, cultivation spread throughout the new world, and by the mid-18th century, tobacco made up nearly half of all export value from North America.

Spain, following Napolean’s defeat, and having ceded most of its presence in the new world, relaxed its government-held monopoly on tobacco production in 1817 in hopes of retaining Cuba’s loyalty.1 Rapidly expanding production met a surge in demand for Cuban cigars, predominantly from the United States. European demand for Cuban cigars also grew, as it was realized that cigars manufactured in Cuba held their quality better than tobacco transported in bulk across the Atlantic. Cigars also became a preferred product for those in the military, as they were easier to maintain than pipes while active or on horseback. Aristocrats and politicians drove demand further, seeking the finest varieties from the new world. By the mid-19th century, tobacco had replaced sugar as Cuba’s largest export.

Scandinavian Tobacco Group’s roots trace back to this proliferation; 273 years, several decades before the founding of the United States. In 1961, three of the earliest-formed Danish tobacco companies merged to form Skandinavisk Tobakskompagni A/S. The company was restructured in 1990, placing all cigarette manufacturing into one subsidiary and all cigar manufacturing into another. In 2008, the cigarette and snus operations were acquired by British American Tobacco, leaving the firm with its cigar, pipe tobacco, and fine-cut tobacco businesses. That same year, the remaining firm, Skandinavisk Tobakskompagni, changed its name to Scandinavian Tobacco Group. Two years later, in 2010, Swedish Match merged its premium cigar segment into STG, retaining a large stake in the related operations. In 2016, Swedish Match sold its stake in the cigar segment back to STG, and STG became a publicly listed company on the Nasdaq Copenhagen Stock Exchange, with 40% of shares sold to new shareholders, and Skandinavisk Holding II A/S and Swedish Match remaining as major shareholders, followed by Swedish Match selling its total stake. These transactions and a continued string of acquisitions have given Scandinavian Tobacco Group a leading portfolio of products, incredible vertically integrated infrastructure, and a concise formula to generate tremendous long-term value for shareholders.

Through major wars, geopolitical events, and other strife, many cigar labels have disappeared; forever relegated to the history books. But, fascinatingly, many of the leading premium brands that survived have been acquired by just a few operators like STG, Altadis, and Swisher. With heritages and name recognition spanning back over a century, these names are exceedingly difficult to compete against—to best contend, you’d need a time machine. But even then, the complexities of this industry are so immense you’d still be fighting an uphill battle. To appreciate how remarkable this is, you must understand the nuances of premium handmade cigar production.

Premium cigar production

Premium cigars are typically handmade, larger than most machine-made cigars, and significantly larger than cigarettes. They have three components:

Filler - generally at least 50% natural long-leaf tobacco, which is delicate and can be of individual or a mixed variety of strains and leaf types.

Binder - tobacco leaves that hold the filler firmly in place.

A single unblemished wrapper leaf - further reinforces the structure and provides a great deal of the cigar’s flavor, smell, and observable color.

When it comes to manufacturing premium cigars, there are a tremendous number of shapes, sizes, and styles. These make up what is known as a cigar’s vitola. In the United States, a cigar’s length is measured in inches, and its diameter is measured in ring gauge (rg). This leads to an immense convention of traditional varieties, such as the intimidatingly-long Gran Corona, formidable Churchill, impressively thick Robusto, and the more easily approachable Petit Corona.

Producing these fine products is arduous. The process begins with carefully selecting seeds and cultivating them in a greenhouse, following which the plants are transplanted in open fields. Some grown varieties are fully exposed to sunlight while others are shaded under tents, altering nicotine content, flavor, and color. Even leaves from different parts of a tobacco plant hold different qualities. At maturity, tiers of leaves are harvested, mostly by hand, and then hung in a curing barn, then, once cured, taken to facilities to unpack and pile for fermentation. Then the leaves are unpacked and repacked for aging, followed by sorting, processing, and then rolling and molding (traditionally wooden, with modern approaches relying on plastic). Once cigars are produced, they are then examined for quality and consistency and once again aged. Only after all of this are they banded, boxed, and shipped out to distributors. The entire process from seed to shelf, in which up to hundreds of skilled people touch each cigar, can take years (many brands average between 3-5).

Every small detail can challenge a premium brand’s ability to maintain the consistency and quality expected. Seed type, soil, water, temperature, pests, disease, humidity, how workers handle the plant and leaf, and how exactly the tobacco is stored and cigar produced can change the end yield, appearance, and flavor. Even with strict processes, variables such as weather, slight changes to filler blends, and subtle differences in curing, fermentation, and aging lead to varying results on a year-to-year basis, leading to certain years becoming renowned vintages. Portions of those produced yields are sometimes further aged by their manufacturers, or often, purchased by aficionados to age in their own humidors. If all of this sounds eerily similar to the dynamics of premium wine and craft spirits, good. It is! And also like premium alcohols, premium handmade cigars are enjoyed for their widely complex flavors, with notes including nuts, grains, woods, leather, earth, pepper, spices, caramel, chocolate, grass, coffee, and more, all ranging from mellow to bold.

New entry into this market is not impossible but is difficult and risky. Are you interested in trying to compete with long-lived premium brands by tying up large amounts of your capital for years on end, potentially across multiple countries, each with a myriad of natural and geopolitical hazards, to produce a uniquely-regulated product with no name recognition that you might struggle to sell? What a proposition! Of those undeterred, many fail. To de-risk the venture, a route more common for new entrants is to outsource much of the process, including their production to facilities owned by established manufacturers. But doing so further reduces one’s ability to manage quality and consistency over the long term, and without a pulse on the market and strong supply chains, it remains exceedingly hard to anticipate and meet future demand, as evidenced by past cigar cycles.

Cigar cyclicality: booms and busts

Following the end of WWI, the United States was ushered into the roaring 20s. With an economic boom and cultural revitalization, demand for cigars ballooned. Unsurprisingly, this was deflated in 1929 by the Great Depression. It was only during and after WWII that demand for cigars renewed, adding to the massive profits enjoyed by the tobacco industry. Cigar sales remained stable through the 1950s, with the majority of American cigars made by machine. Premium cigars were only a small amount of those consumed, with American tastes gravitating towards the Cuban varieties.

When Fidel Castro nationalized Cuba’s tobacco industry in 1960, it sent the industry into an uproar, compounded by JFK signing an Embargo prohibiting trade between the U.S. and Cuba in 1962. This directly caused the ascent of the non-Cuban cigar industry in countries such as Columbia, Honduras, Nicaragua, Ecuador, Brazil, and the Dominican Republic. Following those actions, American consumption of cigars picked up through the rest of the decade before steadily declining for the following twenty years. But then everything changed—radically.

In September 1992, the first issue of Cigar Aficionado magazine came out. Created by wine and cigar connoisseur Marvin R. Shanken, the magazine featured detailed articles covering anything and everything related to cigars. Producers, brands, blends, ratings, tastings, and lifestyle—it sparked a fiery interest that appeared unstoppable. Imported volumes grew substantially year after year, and in 1995, Shanken said:

What has changed? It's easy to find various explanations. Younger men have discovered cigars for the first time. Veteran smokers are experimenting with a wider variety of brands. Women have started smoking cigars. Despite the number of new antismoking laws, the advent of cigar dinners and cigar events have actually increased the number of places smokers can enjoy a hand-rolled cigar. And, finally, many people view cigars as a very public statement that they want to freely enjoy one of life's great pleasures. Whatever the reason, it all adds up to a boom for the premium cigar industry.

Just as one would expect, the boom led many entrepreneurs to see dollar signs in their eyes, and they rushed into the market. Countless new brands sprung up. Sourcing tobacco was a challenge as demand far outpaced supply, leading to tobacco prices skyrocketing. There are claims that the shadiest of producers even began to sneak in dried banana leaves as filler for their cigars. Then, fortunes once again reversed. With a major glut of low-quality products having flooded the market, prices collapsed, bankrupting a huge number of participants. It appeared that the industry was imploding. Yet, it didn’t. Annual imported volumes peaked in 1997 and fell by 40% over the next two years, but a new base was formed that was well over double the volumes before the boom. Following, volumes remained steady, even through the GFC, and then they began to slowly creep upwards.

Until Covid.

However, the pandemic had the opposite effect of what most would expect. The world temporarily ground to a halt, including many cigar factories. But people found themselves at home, with far more time to enjoy cigars. Paired with a string of government payments puked onto the masses, demand rocketed north. With that context, it’s worth revisiting the chart showcased at the beginning of this piece:

The obvious question is: Is the recent spike in imported volumes simply a repeat of 1997? I don’t believe it is—not exactly. The boom of the 90s overestimated demand, creating an excess supply that was not wanted nor needed, leading to a precipitous fall. Presently, while the windfall of discretionary income courtesy of the U.S. government is no longer here, the change in consumption patterns persists, and although return-to-office has picked up, remote work continues to become more widespread, further increasing smoking occasions.

In Q1 2023, premium import volumes to the U.S. were down 8.8% year-over-year. However, import volumes and consumption volumes, while correlated, aren’t apples-to-apples, and Scandinavian Tobacco Group is now estimating a 2% annual structural decline rate. But focusing strictly on cigar volumes, just like for other tobacco product categories, is myopic. While future economic pressures may alter purchase rates and lead to downtrading, STG has a variety of tools, including immense pricing power, to manage. Of course, outcomes will be dictated in part by how cigars are regulated and taxed.

Cigar regulation and taxation in the United States

U.S. cigar regulation

In 2016, the FDA extended its regulatory authority over tobacco products to all tobacco products, including cigars. It now regulates the manufacture, import, packaging, labeling, advertising, promotion, sale, and distribution of cigars. In 2022, the FDA issued a proposed product standard that would ban all non-tobacco characterizing flavors in cigars. This seemed to be based on the FDA’s focus on reducing underage use of tobacco products, which I am somewhat sympathetic to. To reiterate my unwavering stance:

…it seems most practical to cheer for regulation that further thwarts underage access and usage of tobacco and nicotine while at the same time providing ample information, resources, and options for adult consumers to make informed choices.

The FDA’s precious resources should not be focused on these products, but rather on sensible initiatives like age validation technology, with increased surveillance, inspections, and heightened penalties for non-compliance. Nonetheless, I don’t expect the FDA to be sensible. However, I don’t see that as problematic for the premium cigar industry:

According to the most recent government data, underage cigar usage is already incredibly low.

Of that low underage use, most are not gravitating toward spending large amounts of money on premium cigars, but rather on more affordable machine-rolled small cigars and cigarillos.

Even if non-tobacco characterizing flavors are banned for cigars, it’s nearly irrelevant. While some cigars are infused with alternative flavors, the vast majority of premium cigars are enjoyed for the complex flavors naturally provided by the tobacco itself.

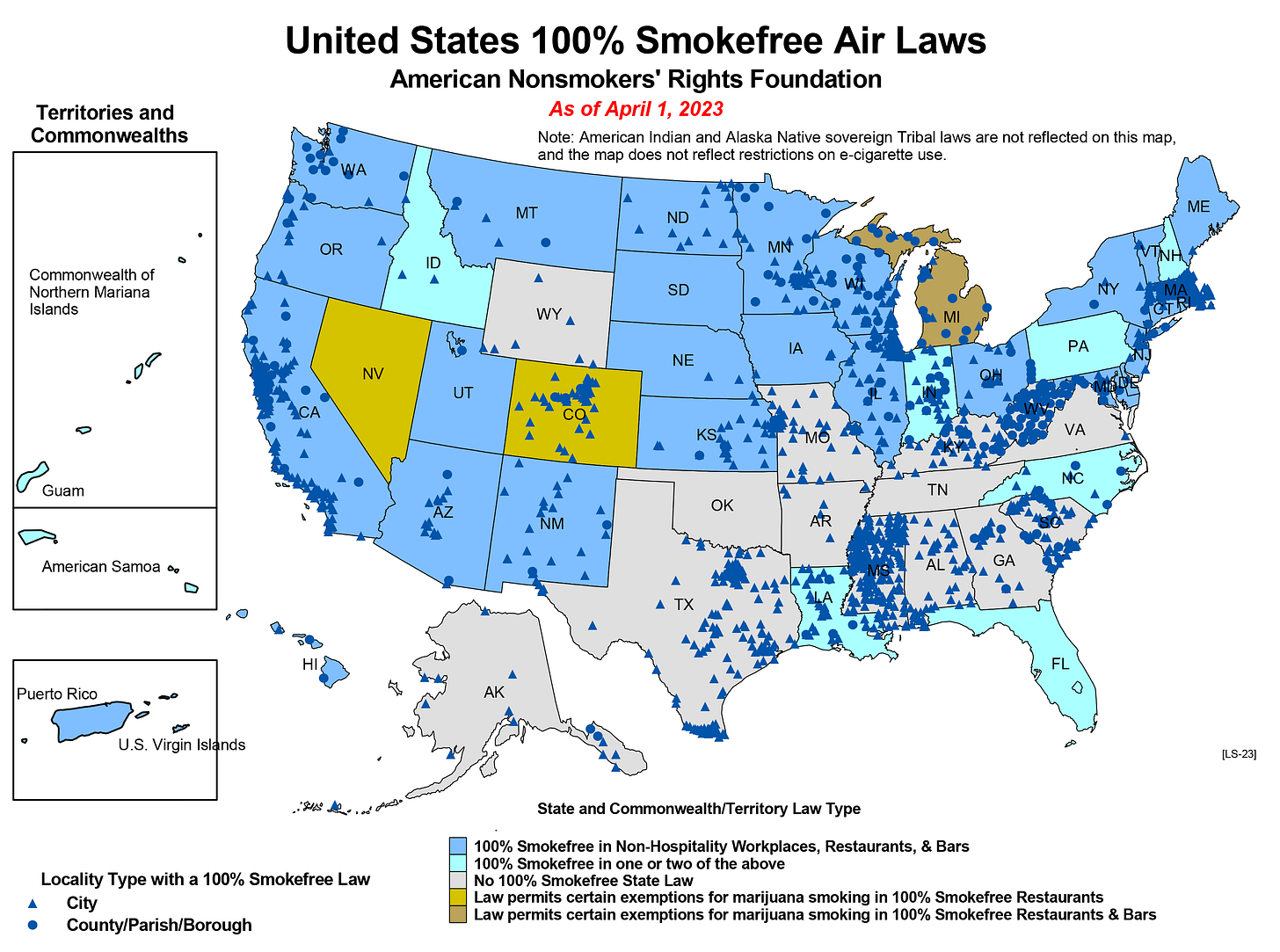

Along with efforts to reduce underage use, continued measures have been taken to reduce adult usage of all tobacco products. This includes laws to restrict indoor usage. However, even amongst states with smoke-free air laws, there are special exclusions for designated cigar bars.

As always, there remain other regulatory concerns, such as future rules forcing plain packaging or oversized graphic health warnings, such as in Singapore. This will likely occur in certain markets that STG has exposure to, though it is unlikely to materialize for premium cigars in the United States thanks to the 1st amendment of the Constitution and considerable opposition to such measures.

U.S. cigar taxation

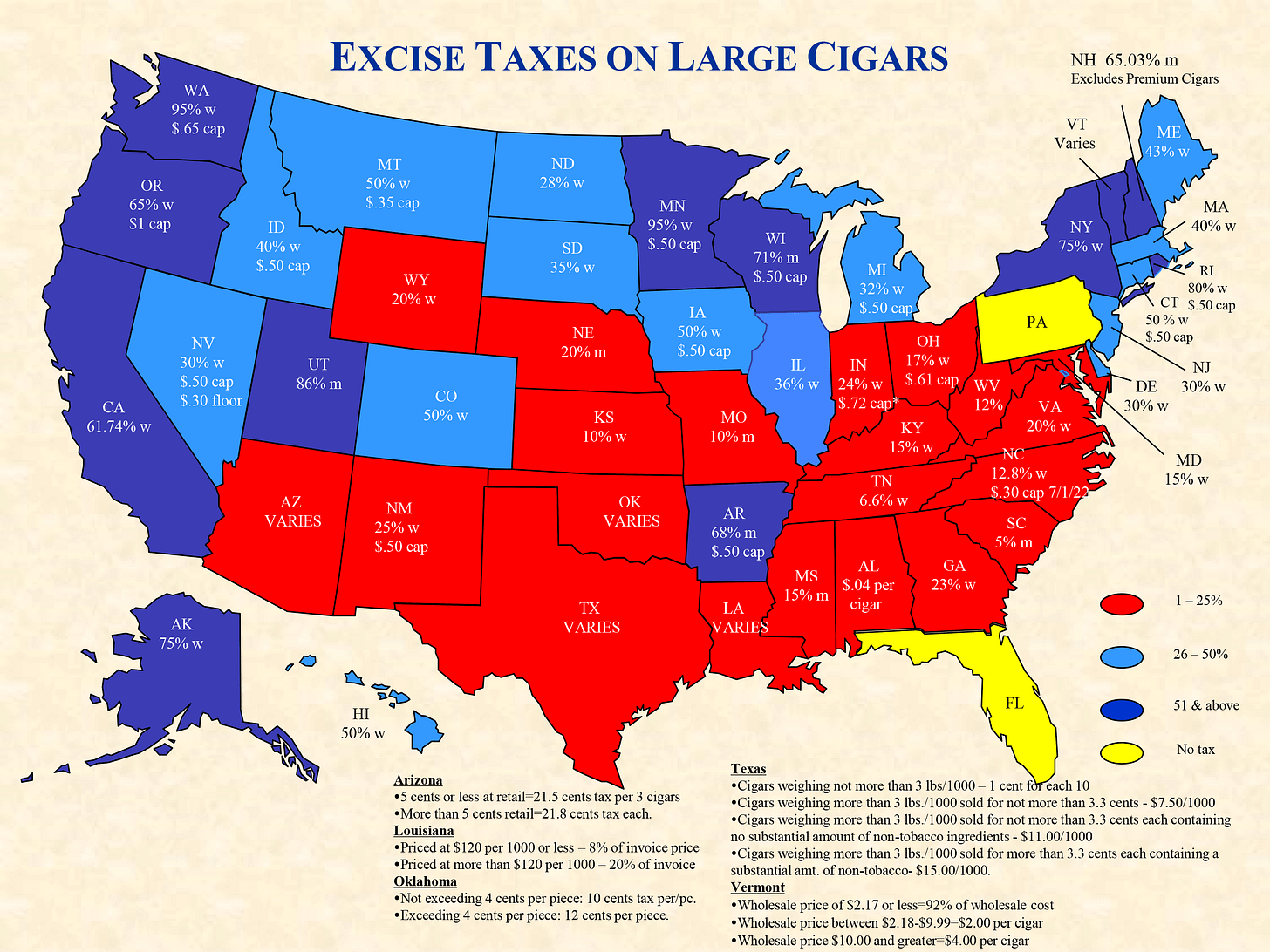

United States federal excise taxation varies widely across tobacco product categories. While cigarettes are currently taxed at a rate of $1.01 per pack of 20, large cigars (cigars that weigh more than 3 pounds per 1,000) face a federal excise tax of 52.75% of the manufacturer’s sales price, with a maximum tax of $0.4026 per cigar. Additionally, unlike cigarettes, large cigars face no MSA payments.

State-level excise tax rates paint an even more unique picture. While some states like Alaska and New York have 75% state-level excise taxes on large cigars, Texas holds a negligible effective tax rate, and Florida and Pennsylvania have no tax at all. These taxation dynamics benefit larger cigars, especially premium varieties which carry much higher prices.

Though future excise tax increases and other regulatory changes can be expected, a number of groups, including manufacturers, continually work to protect the industry and consumers who enjoy cigars and engage in issues that affect consumer choice through lobbying and litigation.

This brings us to the enviable position Scandinavian Tobacco Group is in.

Scandinavian Tobacco Group operations

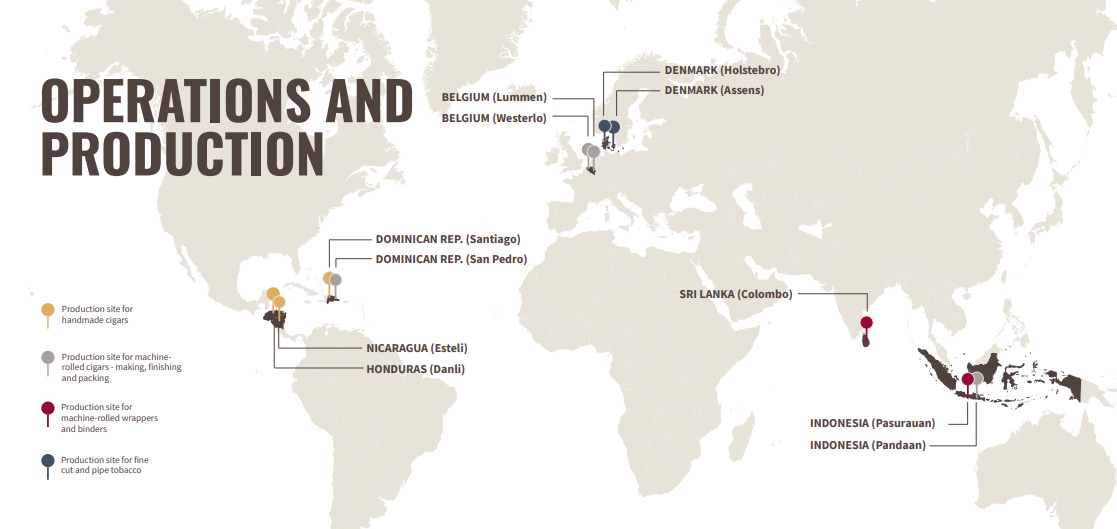

Since divesting its cigarette business in 2008, Scandinavian Tobacco Group has more than tripled in size, more than quadrupled earnings, and is delivering larger and more consistent cash flows. The company employs over 10,000 people globally, with vertically integrated operations managing every step of the supply chain from tobacco fermentation to retail sales, and holds over 200 leading brands sold in over 100 countries, including the #1 machine-rolled cigar in Europe and the #1 handmade cigar in the United States. To reinforce its position in the U.S., the company manages an impressive portfolio of e-commerce sites and 9 retail superstores (with plans to build many more). Cementing its position globally, STG also continually engages in acquisitions that provide clear synergies and further consolidate the industry.

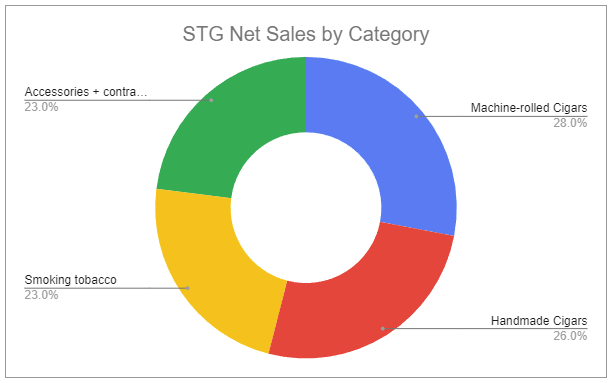

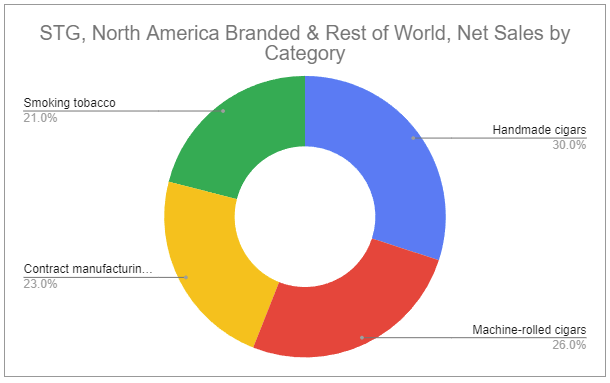

STG’s sales are comprised of 4 categories:

Machine-rolled cigars

Handmade cigars

Smoking tobacco

Accessories + contract manufacturing

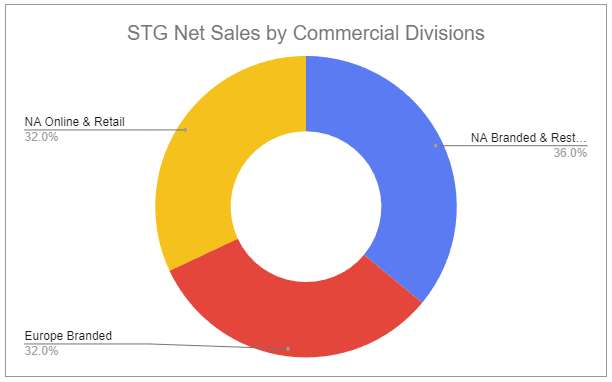

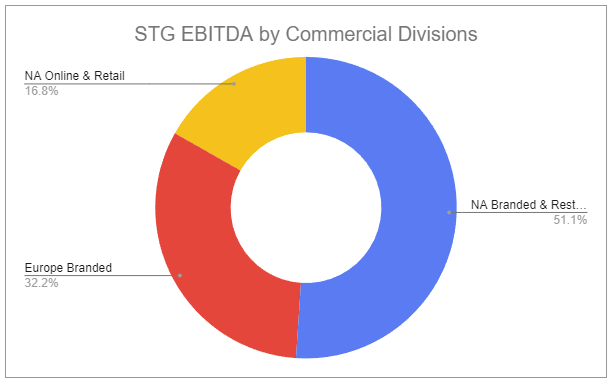

STG’s operations are divided into three commercial divisions:

North America Branded & Rest of World

North America Online & Retail

Europe Branded

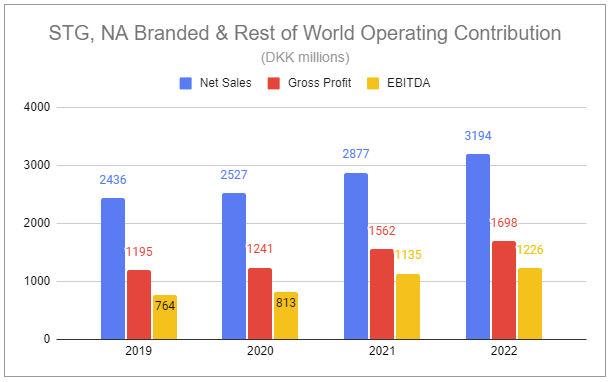

North America Branded & Rest of World

STG’s North America Branded & Rest of World division is split 57% North America and 43% Rest of World (ex-China). The company owns a number of top premium cigar brands, including Macanudo, CAO, Punch, Cohiba, Hoyo de Monterrey, and Partagas, with Macanudo being the largest premium handmade cigar brand in the United States based on sales volumes. If you are unfamiliar with these brands, let me assure you, they are widely acclaimed and can be found in every respectable retail outlet. It should be noted that the Cuban company Habanos SA (in conjunction with Altadis) produces Cuban versions of many of the same brands. These versions can not be imported commercially into the U.S. as the embargo is still in effect. Although Cuban cigars are still renowned, Cuba is no longer the premier origin it once was, with new world cigars having equal quality and often higher consistency.

While some market participants have discounted products recently, STG has avoided following that same path, instead opting to focus on premiumization. Embedded in this category is exceptional long-term pricing power. In the 1950s, the 5-cent cigar was commonplace, in 1990 a premium cigar averaged $1.76, and now, in 2023, premium cigars range dramatically in price, with some between $7-9, many around $10-13, and certain ultra-premiums pushing $20-35 or even higher.

STG’s portfolio also holds a number of other mainstream cigar brands, as well as an assortment of machine-made cigars and smoking tobaccos. While volume and retail share vary greatly around the world, the company’s diverse offerings and continual price take have allowed the company to grow value significantly over time.

Contract Manufacturing and Accessories (CMA) includes producing lighters, matches, cutters, humidors, and other related items—most of which carry lower margins as there is a considerably lower barrier to entry. Contract Manufacturing is also lower margin but allows STG to sell idle capacity - largely to ‘Big Tobacco’ - to make overall operations more efficient.

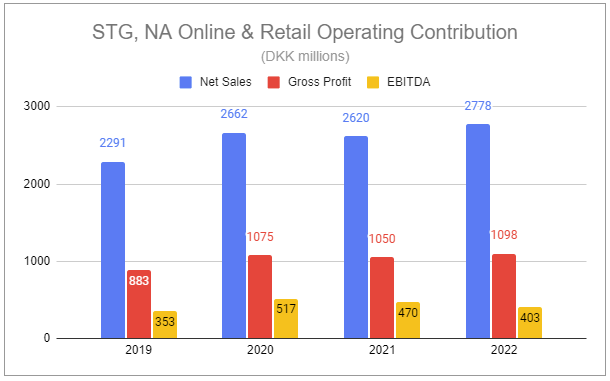

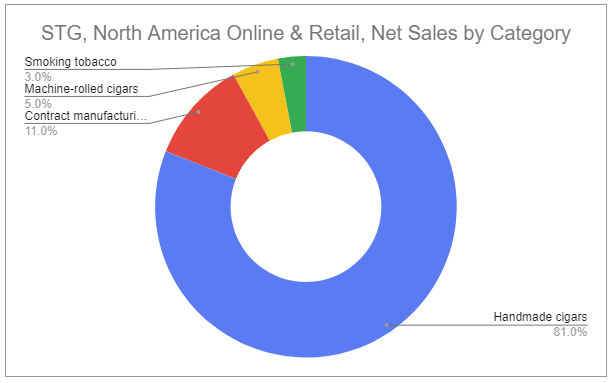

North America Online & Retail

Since most forms of advertising are prohibited for tobacco products in the U.S., catalogs marketed directly to consumers, which are legal, are a major driver of cigar sales. For STG, transactions occur via phone, brick-and-mortar retail, and e-commerce platforms. This division not only sells STG products but also those of other leading brands, at an approximate 65/35 split, in order to remain competitive and satisfy trends. While consumers often have preferred product types and brands, there is a great deal of exploration across each, with great interest in keeping up with new blends and offerings of well-known producers.

Online and B&M retail are complimentary. Generally speaking, consumers are first introduced to cigars via brick-and-mortar retail. They want the physical experience of exploring walk-in humidors, talking to knowledgeable experts, and socializing with others who enjoy cigars. As individuals become more knowledgeable, purchasing habits move online. There have also been unique channel shifts in recent years, with Covid pushing sales online, and reopening leading to a reversal.

STG owns and operates 9 cigar superstores, located in:

Bethlehem, PA (2008)

Hamburg, PA (2012)

The Colony, TX (2018)

Fort Worth, TX (2020)

Tampa, FL (2020)

Lutz, FL (2020)

San Antonio, TX (2022)

Conroe, TX (Feb 2023)

Katy, TX (June 2023)

The states that these stores are located in have either zero or near-zero state-level excise taxes on large cigars and higher cigar smoking prevalence amongst local demographics. As more public smoking bans are enacted, the number of places available to smoke decreases, which actually drives traffic and sales to these superstores. In 2022, the 7 stores that were open made up 8% of division net sales, up from 6 contributing 6% in 2021. In Q12023, superstores made up 9% of division net sales, despite the Conroe store opening halfway through the quarter. STG plans to open one additional superstore in 2023 and 2-4 stores per year moving forward, focusing on suburban locations that can easily be serviced by the company’s existing infrastructure, with an expected ROIC per store of >20% within 3-5 years.

STG’s portfolio of websites includes:

cigar.com

cigarsinernational.com

cigarbid.com

pipesandcigars.com

thompsoncigar.com

cigora.com

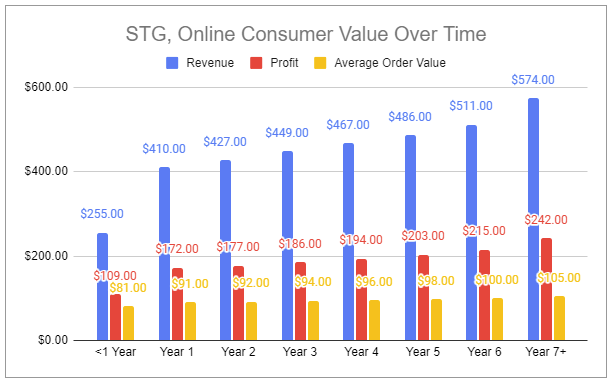

These properties are unique. They experience a tremendous volume of organic traffic via search and direct and were responsible for 92% of segment net sales in 2022 and make up an estimated 45% of the U.S. online market, with cigarsinternational.com being the largest cigar-based online platform in the United States. To comply with U.S. regulations, users must age-verify, and the company has nearly 1 million active consumers across platforms, which the company can also engage with directly via email campaigns. There are daily deals, auctions, promotions, membership tiers with points and rewards, a cigar of the month club, samplers, guides, ratings, and everything else that a cigar enthusiast would want. Nurturing customer relationships is integral since spending habits increase over time.

Europe Branded

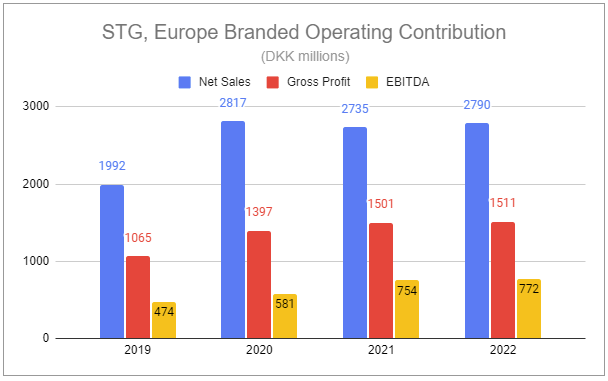

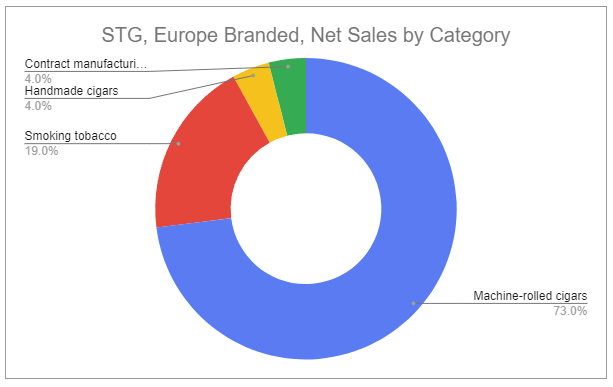

STG’s Europe Branded division sells products to wholesalers, distributors, and directly via retail. Top brands include La Paz, Panter, Mehari’s, and Signature, with Signature Finds being the most popular product. The segment focuses on precision pricing strategies and on country/region-specific trends in consumer demand to drive growth. Machine-rolled cigars in Europe are generally smoked by mature consumers, leading to volumes slowly declining while value continues to grow. STG’s European product portfolio spans value-for-money and premium segments, allowing the company historically to maintain its total market share regardless of cycles. Smoking tobacco volumes have also been strong, with the company exercising price to steadily drive value.

The M&A Engine

It is my clear belief that we are the strongest cigar -- the strongest company in the cigar industry, and we are better positioned than any other company to further consolidate the industry. We have the financial strength, the expertise and the intention to consolidate the industry further. - Niels Frederiksen, CEO, 2021

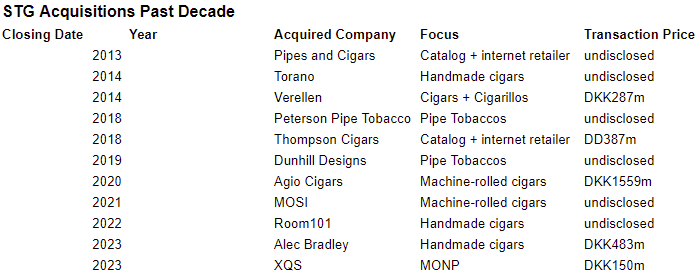

Scandinavian Tobacco Group has a long track record of acquisitions, both before and after becoming publicly traded. Recent transactions include:

Undisclosed price transactions represent small targets. Due to the challenging nature of this industry, many small players struggle to navigate the ever-changing global regulatory landscape, manage complex supply chains, and establish and retain relationships with suppliers, distributors, and various trade groups. By leveraging its lower cost of capital and existing vertically integrated infrastructure, Scandinavian Tobacco Group is able to recognize significant synergies through dealmaking by reducing overhead costs. Even larger targets, like Agio, perfectly illustrate the group’s ability to execute.

First, to ask: Why was Agio selling? Niels Frederiksen, STG CEO, shed light during the 2021 STG Capital Markets Day presentation:

For Agio, it was really a combination of the risk profile of the industry versus the alternative use of money inside their own company. They had, over the years, built a secondary investment vehicle into industrial products, and they wanted to take some more money from the tobacco business and move it into the industrial part, and they were feeling increasingly uncomfortable with the risk profile of tobacco and this was especially related to a few big markets where they had a big exposure.

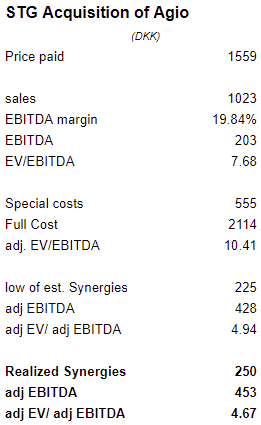

STG completed its acquisition of Agio in 2020 for a price of DKK1.559 billion. When you factor in additional special transaction and integration costs of DKK555 million, the total price stood at DKK2.114 billion. However, STG was able to combine production into existing facilities, reduce personnel needs, and cut redundant back-of-office expenses. When you factor in these resulting synergies, the price multiple paid is incredible:

STG ended up effectively paying x4.67 EV/EBITDA for growing operations that also substantially expanded its market share of machine-rolled cigars in multiple key areas. In the Netherlands, share grew from ~25% to ~60%, France went from ~30% to ~50%, and Spain more than doubled to greater than 20%. In Belgium, where STG was already dominant, share grew to over 90%. In just three years, the ROIC for the acquisition reached nearly 20%. These types of results are not exclusive to the Agio deal. Since 2016, STG has been able to drive net sales continually higher while reducing its production footprint by 30%.

In March 2023, STG acquired Alec Bradley, a leading handmade cigar brand in the United States, with its Churchill Prensado being named Cigar Aficionado’s Cigar of the Year in 2011. Integration has entered the planning period, and I fully expect STG to recognize material synergies by combining production lines in Nicaragua and Honduras, cutting back-of-office, and growing the line through the company’s retail channels.

Moving forward, it’s worth acknowledging that STG will likely face a variety of regulatory, geopolitical, macroeconomic, and other challenges. However, as a dominant and well-scaled operator, it is likely to navigate such challenges far better than most. With smaller players more greatly impacted by unfavorable events, STG will likely be provided a number of cycles to selectively target future acquisitions at highly accretive prices.

Experimentation with NGPs and alternatives

While STG remains steadfastly focused on its leading portfolio of cigar products, the company has remained open to exploring and experimenting with next-generation products (NGPs). In 2022, it launched STRÖM, a tobacco-free nicotine pouch in Sweden and the UK. In April 2023, the company also acquired XQS, a Swedish producer of tobacco-free nicotine pouches and nicotine-free pouches. Additionally in April, the company, as a joint venture with REKOM, launched !act, a caffeine pouch, in Danish markets.

STG is collecting preliminary data on consumer response as it further researches alternative product opportunities. I expect the company to do so conservatively and presently ascribe zero value to its NGP experimentation.

Leadership

Niels Frederiksen, CEO. Joined STG in 1999.

Marianne Rørslev Bock, Executive VP, CFO. Joined STG in 2018.

Jurjan Klep, President, Senior VP, Europe Branded Division. Joined STG in 1997.

Régis Broersma, President, Senior VP, North America Branded and Rest of World Division. Joined STG in 2002.

Sarah Santos, President, Senior VP, North America Online & Retail Division. Began at Cigars International in 2003 and joined STG in 2008.

Jesper Madsen, Chief Supply Chain Officer. Joined STG in 2023.

Yulia Lyusina, Senior VP, Strategy and Transformation. Joined STG in 2019.

Hanne Berg, Senior VP, Chief HR Officer. Joined STG in 2017.

The majority of Scandinavian Tobacco Group’s executive management has long tenures. Most compelling is how management discusses and discloses operations. The company’s reporting is sensible, and it doesn’t dance around. Everything strictly focuses on factors that move the needle; artfully quantifying qualities that would otherwise be hard to understand to outsiders.

To simplify, the team has three very straightforward ambitions:

Grow the size of the company

Expand EBITDA margin

Produce tons of cash

The compensation structure incentivizes management’s focus on both short-term and long-term priorities to achieve the above goals, with a mix of fixed and variable pay for the CEO and CFO of 68/32 and 73/27, respectively. Each is also awarded PSUs subject to meeting key performance metrics including organic EBITDA growth, ROIC growth, and adjusted EPS growth, and both own shares representing 437% and 114% of their annual base salary, respectively.

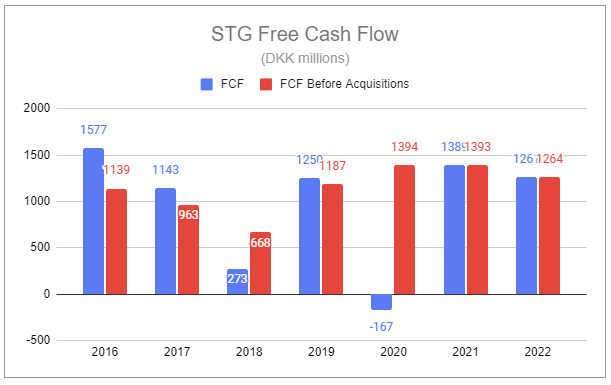

Management’s success is illustrated by having grown the company both organically and inorganically while managing margins well and generating an undeniably large amount of free cash flow—so much that the company has aggressively returned it to shareholders, totaling DKK6.149 billion since the 2016 IPO when the company had a market capitalization of DKK10 billion.

Major shareholders

STG has 4 major shareholders each holding >5% of share capital and voting rights:

Chr. Augustinus Fabrikker Aktieselskab >25%

C.W.Obel A/S >10%

Capital Group Companies Inc >10%

Parvus Asset Management Europe >5%

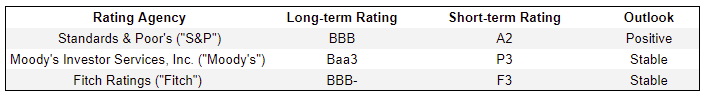

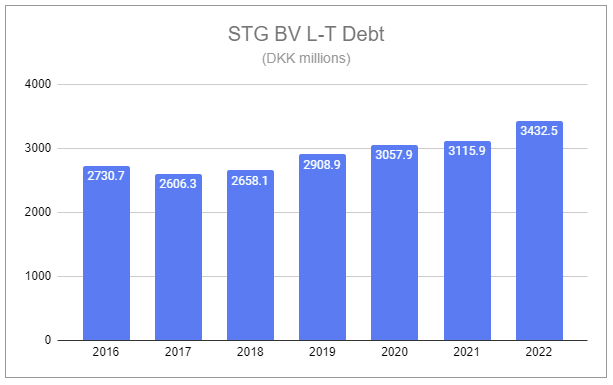

Debt and leverage

Scandinavian Tobacco Group holds the following credit ratings:

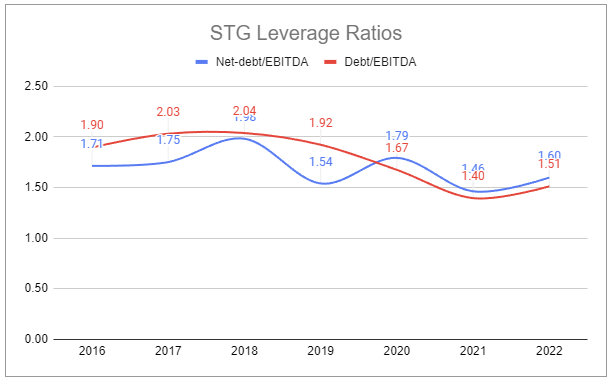

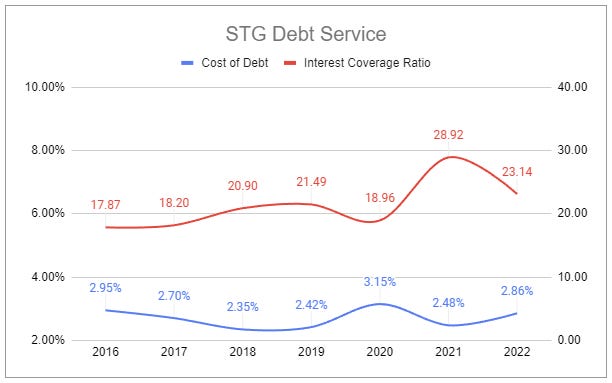

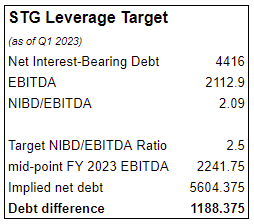

STG has not been shy about using debt to drive growth and returns. However, its leverage is not concerning and is considerably smaller relative to other publicly traded tobacco companies. As of Q1 2023, the company holds:

a net-debt/EBITDA ratio of x2.09

an interest coverage ratio of x16.19

a cost of debt on its book of ~3%

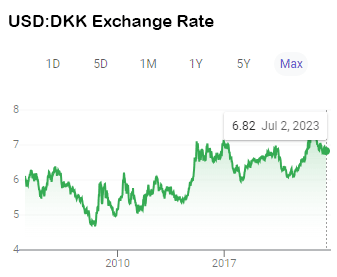

STG’s debt is a mix of bank loans and a revolving credit facility at a floating rate, and bonds denominated in EUR at a fixed rate. The company has historically used swaps and other derivatives to offset movements in interest rates and FX rates. It is estimated that a 10% change in the USD/DKK FX rate would impact company sales by ~5% with EBITDA margins only slightly impacted. At the time of publishing this piece, 1 USD is equivalent to 6.824450231 DKK (1 DKK = 0.14653195 USD).

Despite tough comps, including the 2021-2022 spike in handmade cigars, the company has reaffirmed its 2023 full-year guidance, as per the Q1 call:

Niklas Ekman, Analyst:

Just a couple of questions from my end. Firstly, on the top line target here of growing sales to DKK 9 billion to DKK 9.3 billion, if I'm not mistaken, this would require an organic growth in the range of 3% to 6%. And these are growth rates that you only ever achieved really during COVID. And you started now with minus 1% in Q1. So that sets the bar even higher for the coming quarters.

Can you elaborate a little bit on why you expect sales growth to accelerate strongly here in the coming quarters? Or if you see a risk that you will come in at least near the lower end of the guidance given the weaker start here to '23?

Marianne Bock, STG CFO:

Thank you, Niklas. Yes, we maintain our top line guidance of the DKK 9 billion to DKK 9.3 billion. And you are correct, that will imply that we will have organic growth for the remaining year. The organic growth is coming from various prices across the divisions and the handmade cigar market will drive part of this growth.

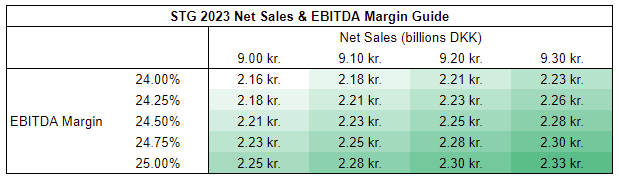

Full-year guidance includes:

Net sales of DKK9-9.3 billion

Group EBITDA margin of 24-25%

FCF before acquisitions in a range of DKK1.2-1.4 billion

Adjusted EPS of DKK14.5-16.5

Implied full-year EBITDA sensitivity:

Management has expressed a goal of reaching a net interest-bearing debt/EBITDA ratio of x2.5, approximately half a turn above current levels. Using the midpoint of both assumptions implies FY2023 EBITDA of DKK2.24175 billion. This suggests that there is room to add more than DKK1 billion in debt to the balance sheet.

Valuation

Valuing Scandinavian Tobacco Group should start with several core questions:

Are industry dynamics favorable?

Does the company have clear competitive advantages?

Is management capable of creating substantially more value over time?

Are all of these factors properly reflected in the current price of the equity?

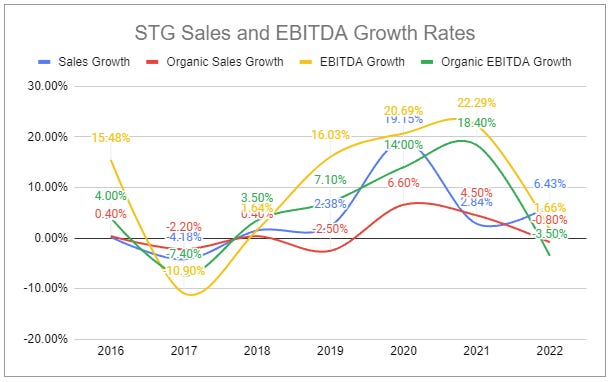

One could argue that the industry segments STG operates in are very unfavorable, pointing to estimated secular volume declines, increasing regulatory challenges, and supply chain complexities. But as illustrated throughout this piece, these factors have allowed the company to flourish, not flounder. The company’s top-tier portfolio, scale, pricing power, ability to engage in accretive M&A, and continued focus on efficiency have allowed it to overall grow both organically and inorganically.

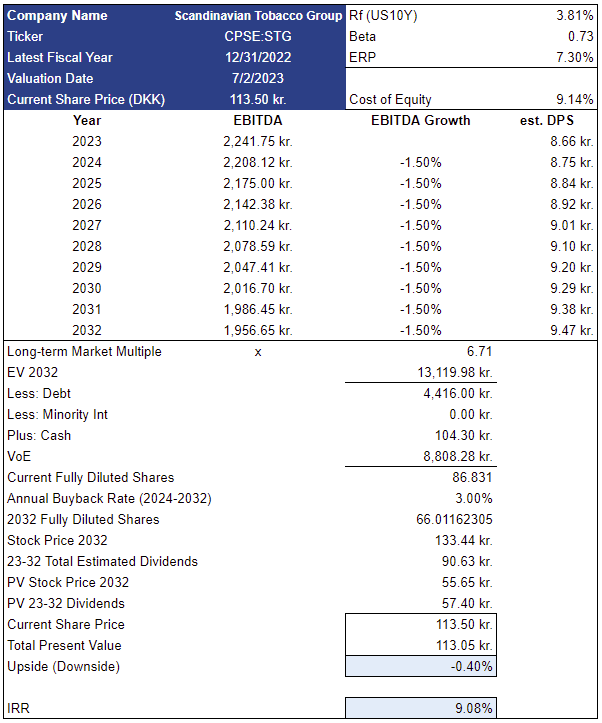

But what if one is overestimating what this company is capable of? What if consumption patterns of handmade cigars in the U.S. did peak in 2022 and are going to decline at a faster rate? What if the company continues its string of acquisitions but fails to recognize synergies as it has in the past? What if the company ends its track record of efficiency gains? What if pricing power begins to have a less pronounced impact? What if? What if? What if? I created a rough 10-year exit model based on backing out equity from an EV/EBITDA multiple and factoring in forecasted dividends and share repurchases to answer.

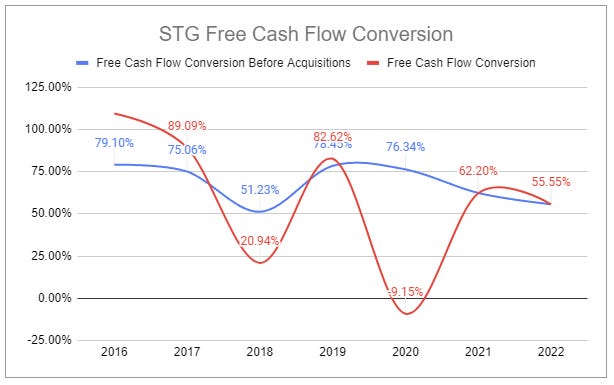

This rough model suggests that the equity is near fair value. But what are the actual implications of inputs? Such performance likely requires - along with weakening price/mix - a stalling of efficiency gains, including logistics improvements, analytics, automation, and advances in manufacturing technology. This notion runs completely counter to the firm’s track record. More critically, it’s assumed that dividends and share repurchases will be done with free cash flow produced by the firm over the next decade. But the model is based on free cash flow after acquisitions, using a conversion rate of 42.43%, the average of the last 5 years. If the company continues M&A, is it reasonable to expect the targets to provide zero increase to EBITDA, even post-integration? Assuredly no. Likewise, if the company does not engage in M&A moving forward (which is not a safe assumption, but is one that is easier to approximate), FCF conversion would be materially higher, as evidenced by historical performance.

Mind you, the last several years have also included higher reinvestment related to improving the company’s supply chain and digital infrastructure (SAP + ERP), which understates FCF potential. This heightened reinvestment will continue, with the total anticipated cost being DKK600-700 million once fully implemented in 2025, providing expected annual benefits of DKK150-250 million. But let’s set further benefits aside. Presently, on an annual basis, there are financing costs of ~DKK100 million and maintenance capex of ~DKK150 million. If EBITDA remains stable and an effective tax rate of 23% is applied, FCF would be approximately DKK1.5 billion annually; a conversion rate several percent over the historical average of 64.8%. For reference, the model’s implied nominal FCF - of which 100% is returned to shareholders - begins just shy of DKK1 billion in 2023.

The industry may very well face mounting challenges, but STG, as a cost-efficient operator, will likely navigate well, just as it has through previous cycles, and could even more easily hunt for discounted acquisition targets in an intensely negative environment. All of this further excludes the consideration that the company is half a turn under its target leverage ratio. If management resumes share repurchases following the assessment of the Alec Bradley acquisition, closing the gap in that ratio may mean an even more aggressive return of capital to shareholders.

The above considerations suggest a significant margin of safety, as normalized FCF at the current share price would provide a low to mid-teens owner yield. For a durable business with an exceptional track record, that alone is attractive. With all that said, it won’t surprise me if the market continues to overlook this name for many years into the future.

If you enjoyed reading, hit “♡ like” and share this artisanal article.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Scandinavian Tobacco Group and other tobacco companies such as Altria, Philip Morris International, and British American Tobacco.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Scandinavian Tobacco Group - Financial Reports. Source

Scandinavian Tobacco Group - Debt Information. Source

Scandinavian Tobacco Group Remuneration Report 2022. Source

Swedish Match - Financial Reports and Presentations. Source

Imperial Brands - Results, Reports and Presentations. Source

Altria - SEC filings. Source

Premium Cigars: Patterns of Use, Marketing, and Health Effects. Source

Cigar History 1762-1862 U.S. Cigar Industry Begins. Source

Cigar History 1878-1915 Golden Age. Source

FTC Report to Congress, Cigar Sales and Advertising and Promotional Expenditures for Calendar Years 1996 and 1997. Source

Industry Circulars. Alcohol and Tobacco Tax and Trade Bureau, United States Department of the Treasury. Source

Code of Federal Regulations. Title 27. Chapter I. Subchapter B. Part 40—MANUFACTURE OF TOBACCO PRODUCTS, CIGARETTE PAPERS AND TUBES, AND PROCESSED TOBACCO. Source

Code of Federal Regulations. Title 27. Chapter I. Subchapter B. Part 41—IMPORTATION OF TOBACCO PRODUCTS, CIGARETTE PAPERS AND TUBES, AND PROCESSED TOBACCO. Source

Iain Gately. “Tobacco: A Cultural History of How an Exotic Plant Seduced Civilization.” Dec. 2007. p. 172

Incredible, best analysis in a long time

Stellar piece. While tobacco companies are outside our competence (we're instead focused on a similar setup in coal companies), we've fully enjoyed following your work in the sector. Keep up the great work!