“Cigars must be smoked one at a time, peaceably, with all the leisure in the world. Cigarettes are of the instant, Cigars are for eternity.” - Guillermo Cabrera Infante

On August 29, 2023, Scandinavian Tobacco Group released its Q2 results. Total net sales were down -2.3% y/y, group EBITDA margin was down 80bps, and adjusted EPS was down to 3.5DKK from 3.6DKK last year. Additionally, new store openings in the U.S. have been delayed, FX rates negatively impacted results, and full-year guidance has been revised marginally lower. Catastrophic? Not quite. Alongside these less-than-stellar headline results are a number of notable points that further support the long-term thesis laid out in July.

STG remains a relatively small company, listed in an overlooked market, operating in an ignored subsegment of an unpopular industry. Yet it holds an impressive portfolio of assets, is highly cash-generative, and is likely to continue consolidating the field while management remains extremely shareholder-friendly.

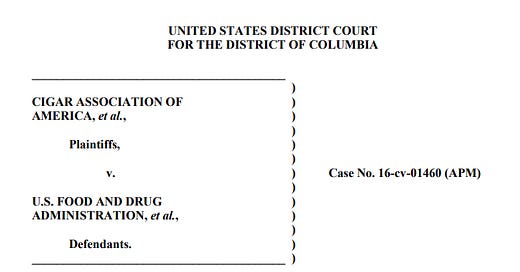

In Q2 2023, Europe Branded net sales, predominantly machine-made cigars, declined by -1%. To add, market volume was down ~3%, above the historical decline rate, with STG’s share down for the quarter to 29.8%, from 30.7% in Q1. Across most countries, pricing more than offset volume declines and—along with portfolio simplification—should support net sales and lead to margin expansion throughout the rest of the year. The loss of share stems from continued strength in flavored products, a challenge to STG, which is the leader in non-flavored variants. A pertinent exchange was shared during the Q&A of the quarterly call:

Peter Grave, Analyst:

“Okay. That's very clear. And on the latter topic here, you stated in the report that flavored products are gaining grounds in key markets in Europe. And as such, I mean, to me, it sounds like these market share issues could be more sticky in nature. Do you share that perception? And maybe could you give some insights as to how do you work on improving this market situation? Is it simply a question of pricing? Or are you thinking about adding flavored products to the shelves as well? Or could you give some insight here?”

Niels Frederiksen, STG CEO:

“So let me say, first of all, even though the traditional non-flavored products are losing ground to flavor, we are also looking forward to a potential flavor regulation in the future. So we are actually quite pleased with our strong position in the non-flavored segment, and we need to continue to strengthen that, but we also need to build market share momentum in the flavored segment. And we are trying to focus that both by introducing new products and by strengthening distribution and rotation of our existing flavored products in the market. So we do want to improve our position in the flavored segment, but we also want to maintain that stronghold we've got in the non-flavored.”

Additionally, the group’s next-gen products—including STRÖM and !act—are included in this segment. These products are still experimental, being tried in various small markets, and evaluated for further development and introduction. With this in mind, core product performance in the segment has been more resilient than it first appears.

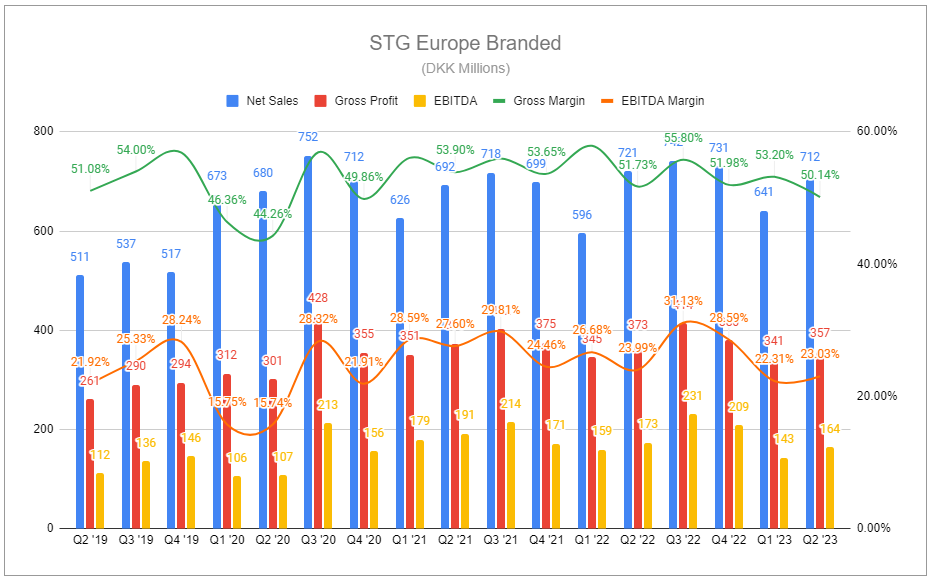

Like Europe Branded, NA Branded & Rest of World faced considerable challenges in Q2. Sales declined by -6%, largely the result of declining volumes of handmade cigars on the back of restocking patterns in the U.S., which was partly offset by the acquisition of Alec Bradley. Further weakness in EBITDA came from lower contract manufacturing sales, as well as persistent cost inflation. To compound, while the acquisition of Alec Bradley helped bolster net sales to a degree, STG has been forced to reinvest in the brand at a higher rate, as CEO Niels Frederiksen humbly conceded during the call:

There's no doubt that Alec Bradley is also impacted by the inventory readjustment. And there's also -- when we took over Alec Bradley, we took over a brand that was performing well but also one that, to be honest, during the acquisition had not been maintaining an innovation pipeline. So we have had to invest more resources in, let's say, reestablishing an assortment of innovation required to compete in the market. So we're not super nervous about this, although it's always not what you would optimally want to find. What we do and what we have been encouraged by is when you look at our Alec Bradley's performance in our online channel what we have, then we are delivering growth year-on-year on Alec Bradley.

There is little concern about a longer timeline as STG is executing the exact playbook that has worked exceptionally for past deals. The growth of Alec Bradley in the online channel is also least surprising, as STG-owned websites, such as CIGAR.com, have continually run targetted promotions since finalizing the acquisition, as well as limited-time email promotions to their verified customer emails:

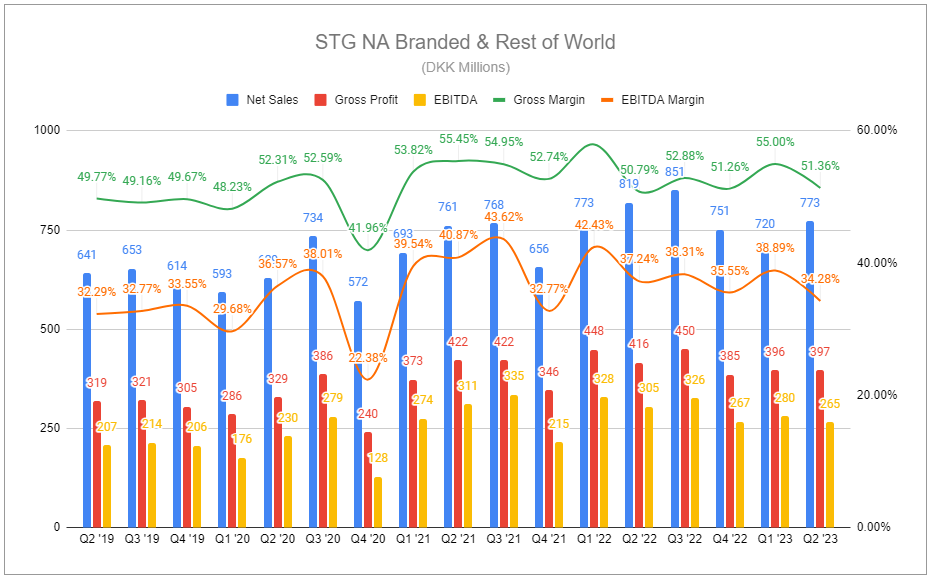

Alec Bradley is far from the only bright spot in STG’s Online & Retail presence. In fact, while Europe Branded and NA Branded & Rest of World declined in Q2, NA Online & Retail saw growth across both e-commerce and brick-and-mortar, with organic net sales increasing 3% y/y. As noted previously, Covid lockdowns led to a massive uptick in Online sales, which was followed by an unsurprising reversal as the U.S. reopened. Now, strength across the category shows that the number of active online customers stabilizing, as well as the continued success of Retail stores, which now make up 9% of net sales.

In Q2, STG opened its 9th cigar superstore, located in Katy, Texas, following its 8th in February of this year. Future openings have been delayed until 2024. Nonetheless, Retail store sales grew double-digits in Q2, and with an initial capital outlay of $8-10 million/store—comprised largely of initial lease obligation and inventory—and a target of >20% ROIC in 3-5 years, I view them as a compelling long-term driver for the business as a whole. As covered previously, these stores are built in states with zero or near-zero state-level excise taxes on premium handmade cigars, making contribution margins higher than cigarettes. These states, broadly, also have higher usage rates, allowing stores to support a large consumer base for decades to come. Most interestingly, when new stores are opened, online sales shipped to surrounding areas fall during the following year, which is then historically followed by strong double-digit growth in related online sales.

But the most promising development during the quarter was not from within the company itself, but rather, a shift in the regulatory landscape of the United States. On August 9th, 2023, the U.S. District Court of the District of Columbia issued a final Memorandum Opinion in Cigar Association of America et al. v. United States Food and Drug Administration et al, which includes:

The court (at long last) returns to this long-running dispute over the U.S. Food and Drug Administration's (“FDA”) decision to regulate, or “deem,” premium cigars under the Family Smoking Prevention and Tobacco Control Act of 2009 (“TCA”). In July of 2022, the court held that the FDA's decision to deem premium cigars was arbitrary and capricious insofar as the agency failed to consider data before it concerning the use of premium cigars and the health effects of such use. Cigar Ass'n of Am. et al. v. U.S. Food & Drug Admin. (Cigar IV), 2022 WL 2438512 (D.D.C. July 5, 2022). Because the issue of remedy had not been briefed, the court reserved on that question and invited further briefing from the parties. Since then, Plaintiffs have asked the court to vacate the FDA's decision to deem premium cigars. The FDA, on the other hand, has urged the court to remand without vacatur.

And concludes with (emphasis added):

For the foregoing reasons, the FDA's Final Deeming Rule is vacated insofar as it applies to premium cigars.

For purposes of this ruling, premium cigars are those cigars that: (1) are wrapped in whole tobacco leaf; (2) contain a 100 percent leaf tobacco binder; (3) contain at least 50 percent (of the filler by weight) long filler tobacco; (4) are handmade or hand rolled; (5) have no filter, nontobacco tip, or nontobacco mouthpiece; (6) do not have a characterizing flavor other than tobacco; (7) contain only tobacco, water, and vegetable gum with no other ingredients or additives; and (8) weigh more than 6 pounds per 1,000 units. See Cigar Ass'n III, 480 F.Supp.3d at 281.

This final opinion is a momentous victory for the cigar industry, liberating it—including STG—from the grip of the FDA, which gained authority over the product class in 2016. Granted, the ruling can be appealed by the FDA until October 9th, but if the FDA does not pursue that route, or if that route concludes with the final opinion upheld, the long-term effects will be pronounced. New premium handmade cigar products will no longer be bound by requirements such as the Substantial Equivalent pathway, promoting faster and greater breadth of variety. While S.E., PMTA, and other pathways have acted as additional barriers against new competition, scaled vertically-integrated infrastructure, including superior distribution, alongside significant brand recognition still remains a considerable advantage. More importantly, being freed from the FDA will spare the industry from what could have been future potential arbitrary and capricious actions, greatly reducing regulatory tail risks.

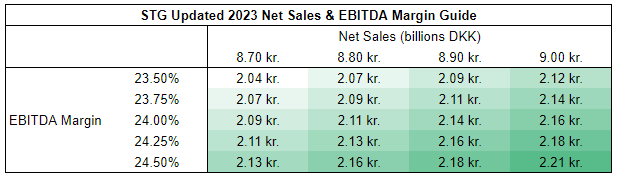

With this fresh in mind, how concerning is it that STG revised down full-year guidance?

Net sales: FY DKK 9.0-9.3 billion revised down to DKK 8.7-9.0 billion

EBITDA Margin: FY 24-25% revised down to 23.5-24.5%

Free Cash Flow: FY DKK 1.2-1.4 billion revised down to DKK 1.1-1.3 billion

Adjusted EPS: FY DKK 14.5-16.5 revised down to DKK 14.0-16.0

Even if we take the low end of the FCF guide, always H2-weighted, the resulting yield appears compelling—near 12%. As captivating as such a cash yield may be, it does not fully capture the potential of the business, as I wrote in July:

Mind you, the last several years have also included higher reinvestment related to improving the company’s supply chain and digital infrastructure (SAP + ERP), which understates FCF potential. This heightened reinvestment will continue, with the total anticipated cost being DKK600-700 million once fully implemented in 2025, providing expected annual benefits of DKK150-250 million. But let’s set further benefits aside. Presently, on an annual basis, there are financing costs of ~DKK100 million and maintenance capex of ~DKK150 million. If EBITDA remains stable and an effective tax rate of 23% is applied, FCF would be approximately DKK1.5 billion annually; a conversion rate several percent over the historical average of 64.8%. For reference, the model’s implied nominal FCF - of which 100% is returned to shareholders - begins just shy of DKK1 billion in 2023.

If we take the low point to the midpoint of EBITDA guidance, ignoring the top half of the range, and increase financing costs and maintenance capex requirements to varying degrees, the potential FCF yield still rests substantially higher:

While a portion of produced free cash flow will be redeployed into various M&A activities in the coming years and decades, a large portion will be returned to shareholders via dividends and share repurchases (management prefers repurchases). Even if future M&A were to be extremely lackluster—running counter to the firm’s track record—the majority of STG’s current market capitalization could still conceivably be returned to shareholders over the next decade. At its heart, this is a capital-light business holding a huge share of an overlooked but lucrative market. The core products are sought for their flavor, sophistication, culture, social experiences, and even status. There is considerably lower underage use relative to other tobacco products, which is likely to permanently free the industry from the FDA’s control. Additionally, unlike other legacy products like cigarettes and traditional oral tobacco, premium cigars face no true competition from next-generation products because they cater to consumers for completely different reasons. Considerable pricing power, with the equity trading at x6.6-7.6 FY’23 net earnings and x7.1-8.4 FY’23 FCF, further supports what I view as a considerable margin of safety.

If you enjoyed this piece, hit “♡ like” and give it a share.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Scandinavian Tobacco Group and other tobacco companies such as Altria, Philip Morris International, and British American Tobacco.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Great coverage! Thanks for sharing.

Thank you. Very interesting company. How would you rate the potential for revenue growth and margins in 2024-2026?