“Truth is confirmed by inspection and delay; falsehood by haste and uncertainty.” - Tacitus

There are few better ways to learn about industries than by combing periodicals, filings, and other random sources. You will inevitably find weird businesses. Occasionally, you may even stumble upon something notable—an asset markedly mispriced relative to the gobs of cash it can spew out or capable of becoming one. For me, this type of sleuthing has resulted in several painfully long watchlists full of obscure names, a number of small tracking positions across accounts, and the occasional writeup covering some of the more esoteric. United-Guardian (UG) certainly fits into the ‘weird’ category, and my work tracking its evolution is worth reflecting on.

UG is over eighty years old. It’s been publicly traded for a very long time, but being public serves it no discernible present benefit. When I first published on the company in 2022, it had a $57.3 million market cap. There was no analyst coverage, and the illiquid name had just a few hundred shareholders. This company held gross, operating, and net margins steadily above 60%, 35%, and 25%, respectively. It produced high returns from its assets, and minimal reinvestment opportunities led to significant free cash conversion, nearly all of which was distributed to shareholders as dividends. I held no position but noted:

As an illiquid microcap, a mix of unique catalysts could present an exceptional opportunity to buy into this highly cash-generative business.

What kind of catalysts could have presented themselves?

Earlier in 2022, UG explored partnerships, joint ventures, and even the outright sale of the company, but nothing came about. Then-CEO Kenneth Globus, nephew of the company’s founder, Alfred R. Globus, had been with the company for 39 years and planned to retire by the end of the year. There was no visibility into who would steer the ship, and steering was much needed.

The company’s profits were primarily driven by LUBRAJEL, a cosmetic ingredient and medical lubricant line, and Renacidin, a niche pharmaceutical. The production of Renacidin was contracted out, which simplified operations but presented execution risk courtesy of the contract manufacturer—an issue with a previous CM resulted in a Renacidin shortage from 2010 to 2013. The company outsourced its LUBRAJEL sales and distribution to partners, simplifying internal operations while sacrificing control and visibility. This also presented a concentration risk as there were only a few partners, and most end sales were made to a few Asian cosmetic manufacturers. At the same time, Asian competitors were beginning to undercut UG with similar cosmetic ingredient products.

Preliminary rough maths suggested that shares were potentially worth more than the $12.48 they traded at when I first published on UG in September of 2022. However, uncertainties and pressures were already pushing down earnings and the multiples the company’s shares traded at. As the company’s reporting has always been rather bare-bones, the principal tool at my disposal was to rely on price to offset any information gaps. It was half a year later, at the tail end of Q1’23, that I initiated a small tracking position at around $9:

At the risk of sounding excessively repetitive, I’m compelled to stress that while I believe the range of outcomes skews far to the upside, there are quite a few unique sensitivities that could materially impact forward returns. Additionally, United-Guardian’s equity is extremely illiquid and often carries a bid/ask spread of 5-10% during normal trading hours and regularly balloons to 20-40% during AH. I consider this to be both a blessing and a curse. It is terribly difficult to acquire shares, and due to the company’s size, building a meaningfully-sized position can take weeks or months. It also means that if any existing shareholder holding a sizable position was motivated to sell, the associated pressure on the stock could quickly drive it down 10-20-30%.

I have established a small position near the $9.00 level and have been less than welcoming toward the short-term bounce. Any significant selloff will increase my consideration in building a non-trivial stake in this business.

With a speck of skin in the game, I was in a privileged position to watch things go from rough to rougher.

LUBRAJEL sales weakened further—partners had built excessive inventories to prepare against supply chain disruption during the pandemic, only for demand to wane. The company gained a new CEO, followed eight months later by her abrupt exit, for which no further information was provided. Then, in October 2023, the company warned of an oncoming Renacidin shortage due to required maintenance at the contract manufacturer’s facility. This series of events overshadowed any bright points, such as the company developing new products and signing new distribution agreements. On November 3, 2023, shares hit $5.79.

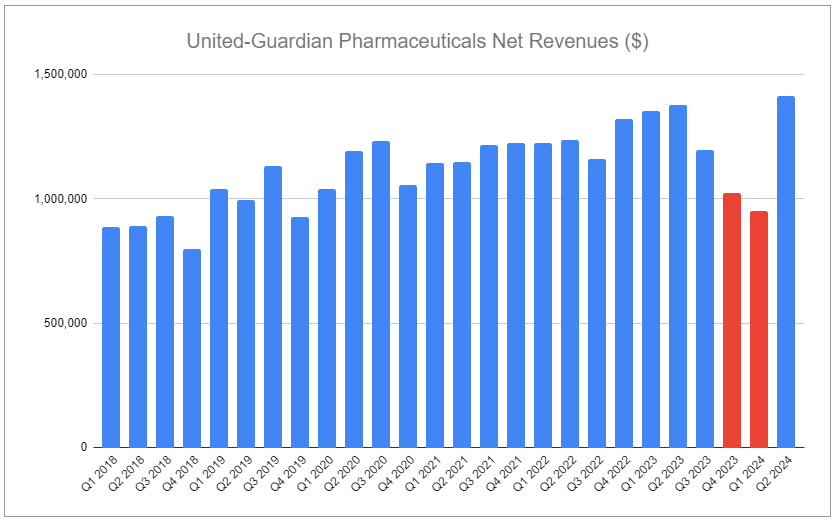

Fast forward, and things appear less bleak. Demand for UG’s cosmetic ingredients picked back up, and excess inventories were worked through, resulting in Q1’24 and H2’24 segment sales growth of 146% and 84%, respectively. Although H1’24 pharmaceutical sales were 13% lower than last year, the Renacidin shortage only lasted two quarters, far more temporary than the previous 4-year stint ending just a decade ago. Q2’24 pharma sales were actually the highest quarterly figure in the company’s history, continuing the longer-term trend.

As someone who generally takes a long-term view of many years or even decades and prioritizes fundamentals over short-term movements in share price, I can’t help but shift my lens and look at what has occurred in short order. On October 4, 2024, UG shares closed at $15.32—a 164% rise in less than a year. That move is rather staggering. However, what interests me most is my actions or lack thereof.

No, I didn’t bottom tick (who does?), and the additions to the tracking position weren’t sizable—if the share price were to zero or double again, there would be minimal differences across my accounts. So the question is: Was this a misstep on my part? Let’s revisit some additional facts.

United-Guardian has not posted an annual loss in over 30 years. The share count has not moved an inch in either direction, remaining at just over 4.5 million outstanding. This company has always been quite conservative and has not used leverage. In fact, alongside distributing a great deal of cash to shareholders over the years, it has built up a considerable trove of cash and marketable securities on its balance sheet. At the 52-week low, the market cap was $26.6 million, and the company had around $8 million in cash and securities, providing an enterprise value of $18.6 million. EBIT for 2018-2023 came in at $5.6m, $5.4m, $3.6m, $5.6m, $4m, and $2.8m. The trough EV/EBIT multiple was 6.5x. EBIT for the first six months of 2024 was $2.1m, and should the company continue marching towards an EBIT near its historical average, Nov 2023 was pricing the enterprise at just over four times. If you believe the pandemic was a rather unusual occurrence, it could be argued that a normalized enterprise multiple would be pushed closer to three times.

You could make the case that we should be strictly talking about the equity and not the enterprise, as management appears more interested in allowing cash and equivalents to build up on the balance sheet rather than pushing out special dividends as they have in years such as 2006, 2012, and 2017. Even so, at under $6/share, the payback period wouldn’t have looked all that stretched when there is a history of annual dividends returning various increments of $0.50, $0.75, $0.90, and $1.20. Considering the company has shifted most of its marketable securities over to instruments that take advantage of higher interest rates, you could further make the case that returns would get a boost and smooth out a bit.

So, what was the source of my hesitation? A good deal stemmed from the lack of visibility. Along with the company’s reporting, which has always been bare-bones, there has been a distinct lack of disclosures as to what their actual strategy is, instead opting to write that they ‘hope’ future sales increase—not exactly what bestows confidence. And so, it had always seemed prudent to wait and size up as the equity contracted significantly more. The market cap was reaching a size where someone could have sneezed and accidentally built an activist position. Even without an additional catalyst, at a certain point, clarity and confidence in the long term can become dwarfed by short-term capital returns.

Finding where the scale tilts in your favor is the hard part—it’s considerably easier when relying on the lens of hindsight. I must concede that I was likely overly concerned with the information gaps I was facing. This company has always had few eyeballs watching it and just a few hundred shareholders. With limited reporting, the odds are that the information I cobbled together provided me with a knowledge gap smaller than most. With that in mind, when I pulled the trigger, it would seem to have made sense to use a caliber larger than a BB. However, there were major points of consideration that weighed starkly against the prospective thesis of rapid capital returns.

Although CI and pharma segments appeared more likely than not to rebound, the development of new product categories and new distribution agreements led to the company stating that they would begin to reinvest more capital. While this would generally be welcomed, considering the company’s history of generating a 30-40% ROIC, very little new investment has occurred over the last decade, bringing into question what incremental returns could be generated. There is still the lingering possibility that not only does the company restrict capital returns but that it dips into its cash equivalents to further reinvest and produces little with it. This consideration becomes even more pronounced when acknowledging that there is no distinctly articulated strategy because the company does not have a CEO. The role has sat vacant after the abrupt departure of the company’s latest CEO. Not inspiring.

It would be too effortless to conclude that an error was made when looking at the significant move in share price. Yes, the company’s current position is less stressed, but I can not explain the extent of the rally other than pointing to the influence of animal spirits. Markets are wild and move to suit, ensuring no shortage of future opportunities. When opportunities present themselves, I believe in taking decisive action to size without hesitation. But eclipsing that is the imperative interest in capital preservation. Patience takes the front seat to find opportunities that are apparent long before the aid of hindsight and can be acted upon boldly.

Thanks for reading. Enjoy this piece? Hit “♡ like” on the site and share it.

Ownership Disclaimer

At the time of publishing this piece, I hold positions in United-Guardian.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: UG 0.00%↑ ASH 0.00%↑

I've looked at this name in the long ago past. I'm pretty sure the reason for passing was its small size and its dependence on a few product lines that could potentially face competition from better funded companies.

You just mentioned a third risk which may not have existed when I looked at it (or I just didn't think about it), and that is the risk of them wasting money trying to develop new products. If they now have a large pile of money and a recent bias towards giving less capital back to shareholders, then I think the risk of management trying to pull a rabbit out of the hat should maybe be front and center to a shareholder.

Again, I don't know too much, just wanted to add my two cents.

I also follow this one closely, but had a different take on what you call "information gaps". In my view they contribute to lumpy earnings, which I consider to be an advantage, rather than a disadvantage. That buy low, sell high thing.

Yes, we often don't know exactly why UG yoyos around it's mean, but what we do know from its very long track record is that its mean is to be a remarkably profitable company. I also wasn't able to nail the low, but I did accumulate steadily during its down phase such that on the rebound it now constitutes the second largest position in my portfolio.

You made a very thorough and accurate assessment of this company, I think your only gap was being able to frame what you learned within a contrarian investing mindset.

Just my two cents.