“I don't do drugs. I am drugs.” - Salvador Dali

United-Guardian is a very small, very profitable company. There are no adjustments in how it presents its financials - just clean reported numbers. It also has 0 debt on its balance sheet, and alongside cash, the company holds a sizable portfolio of marketable securities.

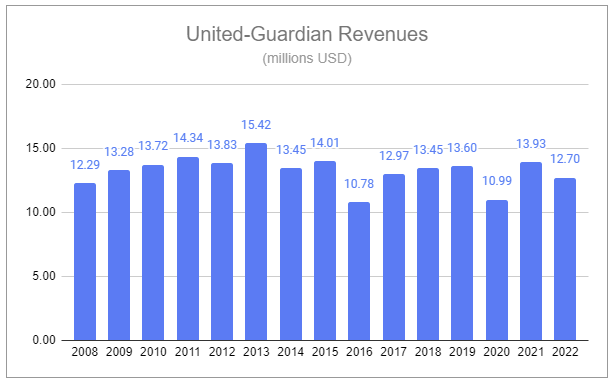

The core of this business has existed for over 3/4 of a century and it has not had an unprofitable year in over 2 decades. However, it’s so tiny that most funds can’t own it and most screens and trackers miss it. When people do discover it, it is likely quickly discarded, as the headline numbers hide the dynamics that make this company so compelling. The only detailed analysis of it has been my own, which I published last year.

Since then, I’ve closely tracked the company but had previously refrained from building a position, and wrote:

Markets have a tendency to get weird, and I can think of plenty of scenarios where I decide I need to pull the trigger:

a steeper selloff without degrading fundamentals

improving fundamentals with a stagnating share price

an activist investor or new management that I think could usher in a new wave of catalysts

Such a scenario is playing out.

Shares of the company have continued to grind lower while detaching from the fundamentals of the business. The company also has a new CEO. Paired with these points are several nuanced aspects of operations that illustrate a compelling opportunity.

Let’s dive in.

Ownership Disclaimer

At the time of publishing this piece, I hold positions in United-Guardian.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

The rundown

United-Guardian’s operations are easy to understand.

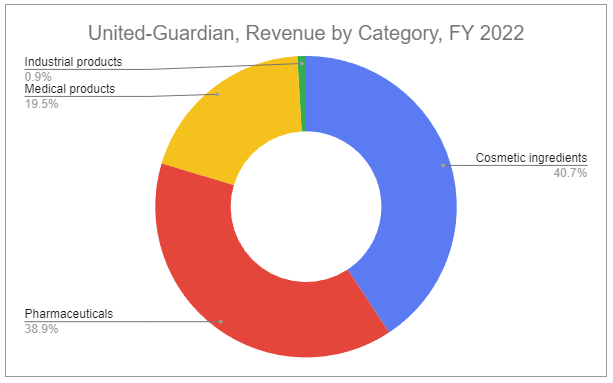

The company sells a line of lubricants under the LUBRAJEL brand, which are used as cosmetic ingredients and in medical applications.

The company sells two pharmaceuticals; Renacidin and Clorpactin.

The company also produces a small quantity of niche industrial chemicals (<1% of revenues), which will be discontinued in the second quarter of 2023.

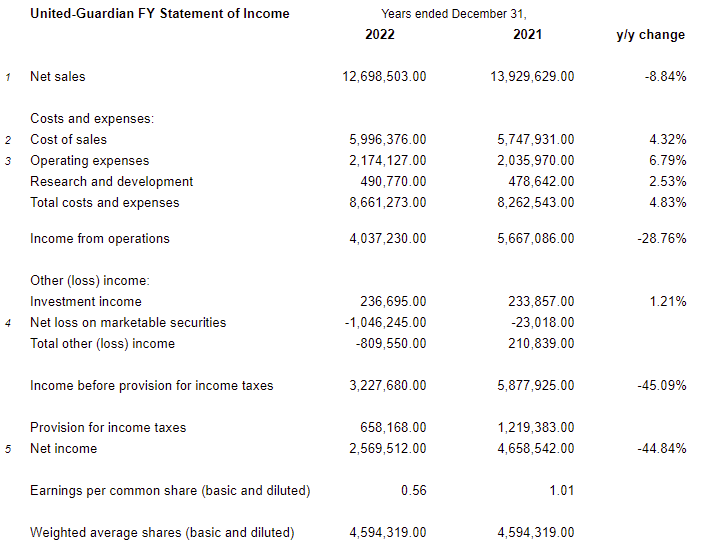

United-Guardian’s reported net income for 2022 fell by nearly 45%.

Ugly.

Catastrophic? Perhaps not.

The drop in net sales (1) can almost wholly be attributed to Cosmetic Ingredients, the company’s largest segment. UG does not sell these ingredients directly to manufacturers and instead relies on partners. I previously noted:

This is a double-edged sword.

United-Guardian substantially reduces its own costs and leverages the expertise of large players (such as Ashland). However, this limits UG’s tactical control and also introduces substantial variance in reported sales due to partner order/inventory patterns. Additionally, this approach offers a way for UG to grow its international sales, though obviously exposes the company to greater global macro factors.

Ashland Specialty Ingredients (ASI) is UG’s largest partner, which drives over 1/3 of UG cosmetic ingredient sales, largely fed by Chinese demand. Contract manufacturers stockpiled significant volumes in 2021 to avoid the same supply-chain issues they experienced in 2020. This, paired with extended lockdowns in China due to its zero-COVID mandate led to a weak 2022 performance. There appears no loss of any large manufacturer end-clients, and while UG has cited pressures from low-cost competitors, the company believes it is well-positioned due to its extensive variety of products and commitment to quality.

UG’s increasing cost of sales (2) and operating expenses (3) were driven by inflation in materials, shipping, and wages. These pressures appear to be softening, with both shipping costs and transit times falling back to pre-covid levels.

Beyond operations, UG’s reported net income included a net loss on its portfolio of marketable securities. Of the -$1.04 million loss, only $364,074 was realized, with the rest being an unrealized loss on the portfolio based on a change in fair value. This is a function of GAAP, and no impairment is present for the portfolio, which is a mix of equity and fixed-income mutual funds not granularly disclosed by UG.

Hidden gems

Topline down. Costs up. Bottom line down significantly. Zoom out, topline choppy and down. For the few people who stumble across United-Guardian, most of them will immediately pass on it after seeing these numbers. This is exactly what interests me. If you dig deeper, there are some hidden gems.

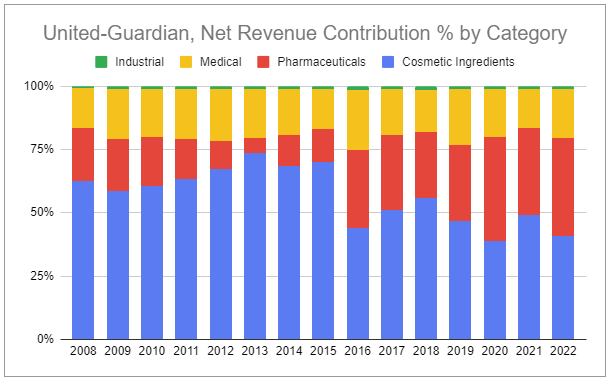

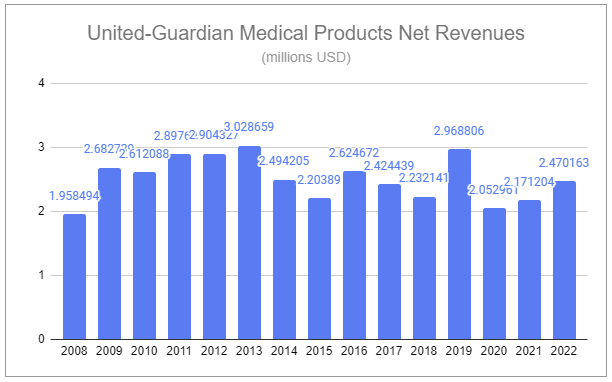

While the Cosmetic Ingredients segment has faced numerous challenges, other segments have faired better.

And over time, Cosmetic Ingredients have become a lower % of total net revenues.

Pharmaceuticals

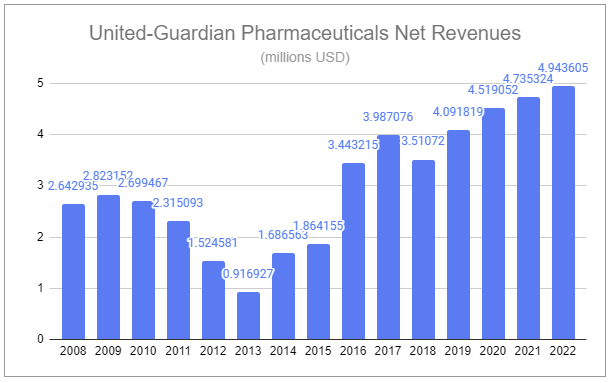

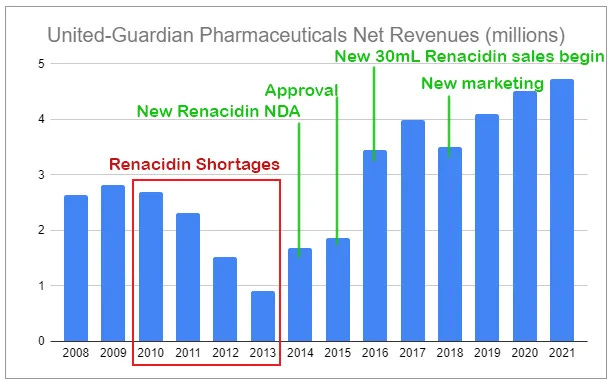

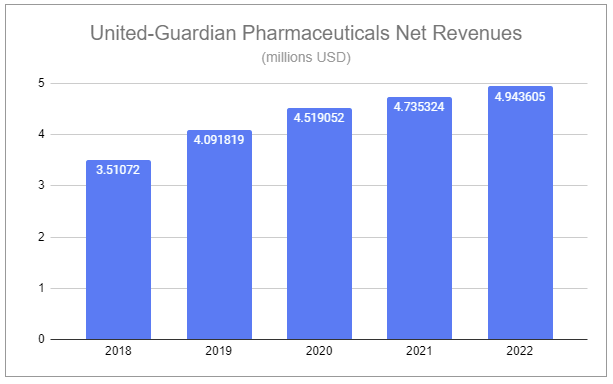

Pharmaceutical revenues were up 4.40% in 2022. This perpetuates the recent trend. It is also core to my interest and thesis.

United-Guardian’s key pharmaceutical, Renacidin, has a colorful past. There was a 4-year period of shortages caused by a contract manufacturer being forced to stop production due to issues stemming from a separate, unrelated product. Then a new single-use version of Renacidin was approved, paired with new manufacturing and eventually newly focused marketing. This is a niche off-patent drug that has such a small market that it is uneconomic for generic competitors, the full dynamics of which I covered in Mini Monopoly.

Accompanying Renacidin is UG’s pharmaceutical Clorpactin, which saw gross sales increase by 6% from $706,784 in 2021 to $748,026 in 2022. Both of these products were originally developed in the 1950s. Like Renacidin, there is no lower-cost generic for Clorpactin, and generic competition would be cost-prohibitive.

Several dynamics further stand out. While net revenues increased by 4.40% y/y, gross sales increased by just 3.1%. This is due to the company exiting specific government programs and the effect of fewer related rebates and allowances. And while the company no longer provides such granularity, reports have historically illustrated low single-digit pricing affecting the category mix. The chart below illustrates the effect of these dynamics following the company’s new Renacidin-specific marketing efforts, even steadily growing throughout the pandemic.

It should be noted that while I don’t see any current specific impact, recent changes in healthcare may be just the beginning. Don’t fully discount the possibility of material impacts on how UG is able to sell its pharmaceutical products in the future.

Medical Lubricants

Medical Lubricants, also produced under the LUBRAJEL brand, saw sales increase by 13.77% in 2022. This jump was primarily driven by higher demand from a larger contract manufacturer customer located in China, whose sales doubled in 2022 compared to 2021. It should be noted that while revenues are recognized in USD, domestic sales for the segment made up only 3% of the total in 2022. Moving forward, the Medical Lubricants segment’s growth should be less stable, as the dynamics surrounding it are less clear than Pharmaceuticals and sales are concentrated with a small number of customers. With that said, it has grown each year following the large hit taken due to the pandemic in 2020.

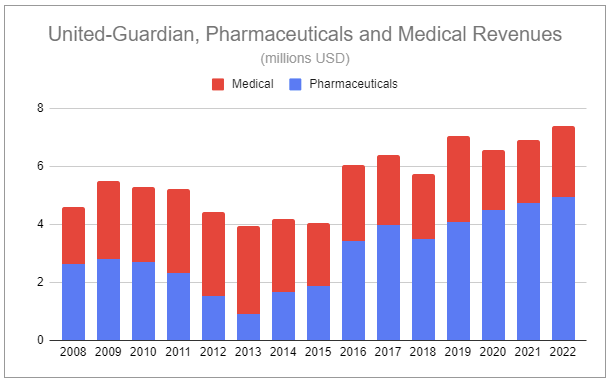

Stacking Medical revenues with Pharmaceuticals illustrates a more impressive longer-term trend.

Normalization and Valuation

What can this company do moving forward?

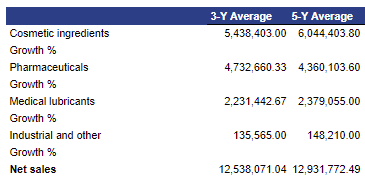

It’s unwise to assume Cosmetic Ingredients will fully bounce back or grow to an all-time high. It’s equally unwise to extrapolate recent growth in Medical Lubricants far into the future. Fortunately, I don’t think you need to in order to illustrate something compelling.

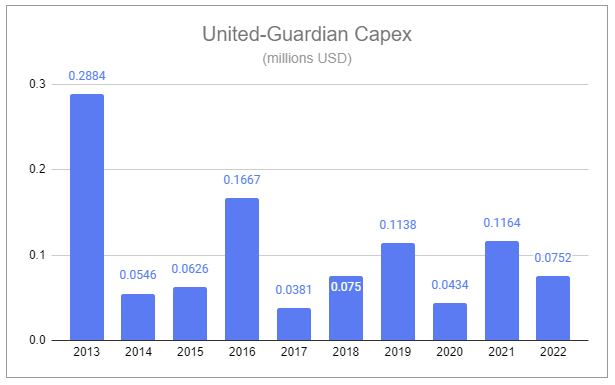

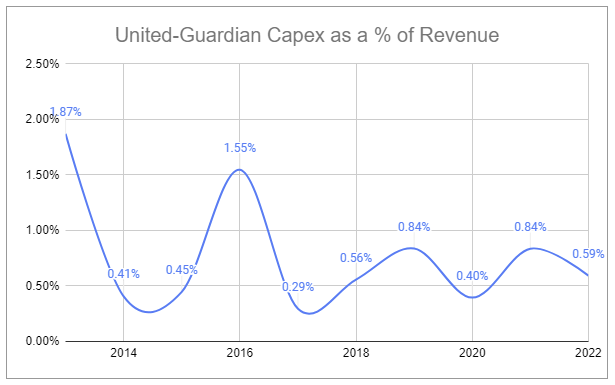

This is a company that operates in a single depreciated building sitting on top of land that it owns outright. There is no leverage, and the company currently generates a ROCE of 48.63%. While the business hasn’t materially grown, it requires almost 0 capital reinvested back into the business to maintain current operations.

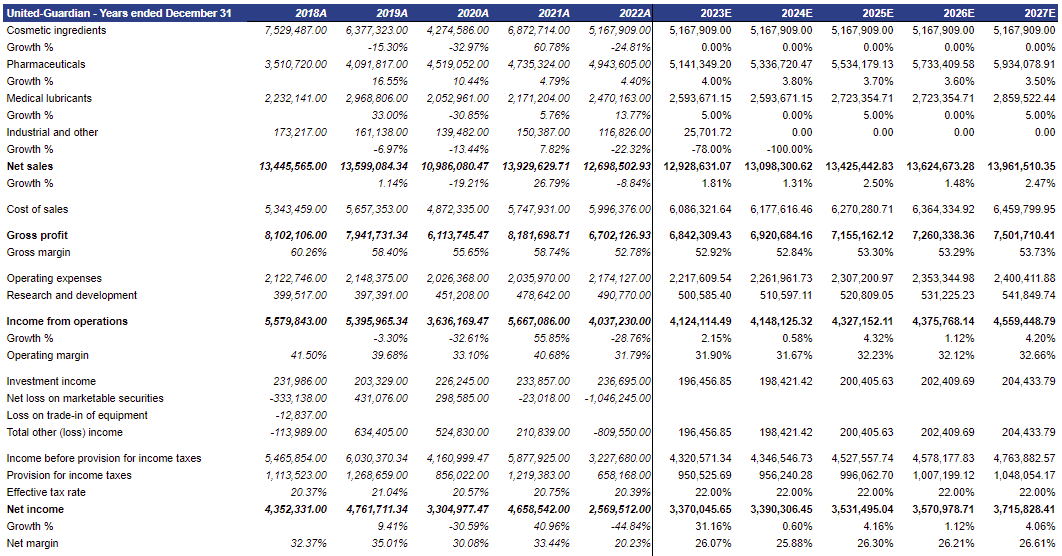

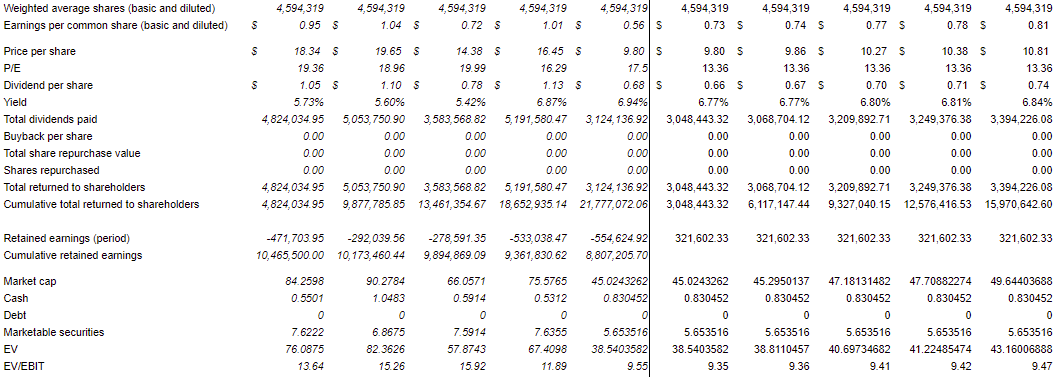

Below are the earnings for the last 5 years, as well as estimates for the next 5.

The 5-year forecast includes the following assumptions:

Cosmetic Ingredients will remain permanently stagnant at 2022 levels.

Pharmaceuticals will experience decelerating growth compared to the past 2 years, far under the medium-term average.

Medical Lubricants will fluctuate between 0-5% growth.

Industrial products are discontinued, as per management guidance, and contribute 2023 revenues of 22% of what was generated in 2022.

COGS will grow by 1.5% per year.

Operating expenses will grow by 2% per year, driven by a reduction in certain associated costs more than offset by increasing wages.

R&D will grow by 2% per year.

Investment income from the portfolio of marketable securities will fall 17% in 2023 and will grow by 1% per year thereafter.

The company’s effective tax rate will sit at 22%, approximately 1pp above the medium-term average.

The company will retain $0.07 per share in earnings each year, totaling $321,602.33, to cover Capex ($38,100-$288,400 per year historically), etc.

The company will distribute the remaining excess earnings to shareholders in the form of dividends.

The projections above estimating years 2023-2027 are not meant to predict the future. Quite the opposite. It illustrates a firm with sustained earnings power despite any type of recovery. You could push back and argue that Cosmetic Ingredients could face additional near-term pressures causing the assumption of stagnant associated sales to be inappropriate. However, it’s worth highlighting the fact that the assumed value is less than both the 3-year and 5-year averages for the segment, which capture the significant impact of COVID and extended Chinese lockdowns.

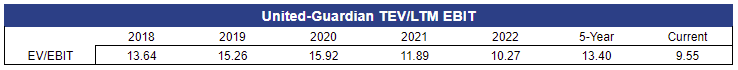

In addition to the conservative Cosmetic Ingredients assumption are an ever-growing expense base and a level of retained earnings markedly above what has been historically required by the business, and a slightly increased ETR to boot. What we are left with is an enterprise capable of generating a sustained 6-7% equity dividend as of last Thursday’s closing price of $9.80 with room to grow.

Additionally:

Cost of sales will likely soften.

Requisite retained earnings will likely be less.

While CI sales may soften more short term, there is a far greater chance the segment reaches $5.5-6 million in the medium term.

Pricing is likely to generate sustained growth in Pharmaceuticals above what is illustrated, which will also slowly widen margins. If CI never grows again, Pharmaceuticals will grow to be the dominant segment, making the company’s earnings as a whole more stable and less sensitive to global macro factors.

Furthermore, the high cash returns stemming from low capital intensity are completely unlevered. At the current market cap of $45 million, the company’s cash position represents 1.83% and its portfolio of marketable securities makes up 12.5%. That portfolio also makes up a mere 4.5% of normalized pre-tax income. Historically, management has been outrageously conservative, and while we should not expect them to wield debt, there becomes an expectation that they will (and should) take advantage of continued share price weakness.

Within the last few weeks, shares have traded as low as $9.03. At that price, cash and marketable securities make up 15.6% of the market cap, and give the firm an EV/EBIT multiple of x8.6, down from the current x9.5. If shares were to hit $8.50, cash and marketable securities would make up 16.6% of the market cap, leading to an enterprise value of $32.56 million and an EV/EBIT multiple of x8. Such weakness would push the implied dividend yield to 7.35-7.8%. This excludes any recovery in Cosmetic Ingredients or any of the other positive considerations above. Management would have an opportunity to sell a chunk of the marketable securities portfolio and retire a significant amount of the equity. Additionally, the company would be able to recognize a portion of its unrealized losses to offset part of the company’s tax burden in the next year or two.

All of the considerations above can lead to a swath of scenarios in which the equity generates 8-9% annualized cash returns. And while there is no certainty, any clear stabilization or clarity on outlook could cause the firm to re-rate toward the historical average, producing an IRR anywhere from the mid-teens to potentially much higher, depending on the rate at which a re-rating occurs.

The most uncertain variables

Ken Globus retired after acting as United-Guardian’s President and CEO for nearly 40 years and has been replaced by Beatriz Blanco. As I wrote last quarter:

Beatriz Blanco looks to be an exceptional choice to head United-Guardian. While her academic credentials are impressive, including a bachelor’s degree in chemistry and pharmacy, an MBA with a marketing focus, and a master’s in chemical engineering from Carnegie Mellon University, her track record truly shines. Ms. Blanco holds over 21 years of experience specifically focused on specialty cosmetic ingredients and personal and home care products, including nearly 5.5 years at ISP (now Ashland Specialty Chemicals, one of UG’s largest partners). Along with enhancing profitability, her skillset is ideal to both foster growth and navigate an extremely challenging macro environment; especially for UG’s cosmetic ingredients - its most sensitive segment.

While no further announcements have been made, I expect Ms. Blanco to make a more comprehensive statement regarding her vision in the annual shareholder letter, if not earlier.

We never received a shareholder letter from Ms. Blanco, leaving us a bit in the dark. However, we still have a few considerations to work off of.

Ken Globus is still the Chairman of the Board of Directors and still owns over 28% of outstanding shares, so it’s reasonable to curb any expectations that radical change will occur. With that said, I continue to believe that, despite so far providing little direction, Ms. Blanco appears exceptionally positioned to run this company. While I try to avoid hard speculation, there is one kernel of interest, though currently immaterial. United-Guardian’s website, u-g.com, has historically been rather stagnant. However, on March 2nd, 2023, the site began to display several subtle changes.

Old website navigation:

Updated nivation:

Under ‘Products’, renamed ‘Our Markets’, the discontinued industrial segment has been removed and has been replaced with ‘Oral Care’ and ‘Sexual Wellness’. Neither of these categories is entirely new, as the company’s line of LUBRAJEL lubricants has uses in oral care products as well as condoms. Unfortunately, the updates on the website are incomplete, and neither navigation link provides a page with greater details. It is not unreasonable to expect the company to focus on expanding LUBRAJEL applications in these two markets, especially for its recently-growing natural variants. Just as the company currently faces customer concentration risk, these markets are extremely large, especially relative to UG’s size. A new CEO focusing on these products, which the company also continues to sink significant R&D dollars into, could make for a very different picture.

Posing an even greater uncertainty is geopolitical tensions and the West’s relationship with China. If issues arise leading to another trade war or permanent impairment of UG’s partners’ ability to sell its Cosmetic Ingredients in China, I would expend a violent, negative re-rating. There is a non-zero chance that shares would overshoot the impact, further mispricing both the Pharmaceutical business and the portfolio of marketable securities.

Onward

At the risk of sounding excessively repetitive, I’m compelled to stress that while I believe the range of outcomes skews far to the upside, there are quite a few unique sensitivities that could materially impact forward returns. Additionally, United-Guardian’s equity is extremely illiquid and often carries a bid/ask spread of 5-10% during normal trading hours and regularly balloons to 20-40% during AH. I consider this to be both a blessing and a curse. It is terribly difficult to acquire shares, and due to the company’s size, building a meaningfully-sized position can take weeks or months. It also means that if any existing shareholder holding a sizable position was motivated to sell, the associated pressure on the stock could quickly drive it down 10-20-30%.

I have established a small position near the $9.00 level and have been less than welcoming toward the short-term bounce. Any significant selloff will increase my consideration in building a non-trivial stake in this business.

Ownership Disclaimer

At the time of publishing this piece, I hold positions in United-Guardian.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: UG 0.00%↑ ASH 0.00%↑

Nice to see you open a position. Forbes just did a video on Don Levin that you might like https://www.youtube.com/watch?v=55UEAYuAI9o