“I didn’t have a computer until I was 19 - but I did have an abacus.” - Jan Koum, co-founder and former CEO of WhatsApp

WhatsApp is one of the largest platforms in the world and is quite possibly Meta’s most underappreciated asset.

But the crazy thing?

It nearly failed.

The backdrop

WhatsApp was created in early 2009 by two former Yahoo! employees, Brian Acton and Jan Koum, who saw a massive opportunity in the fledgling mobile market after the launch of the iPhone. Their idea was to create an app where you could attach status updates for your address book to see, including if you were on a call on your device, busy in a meeting, etc. But in the early months, continual technical troubles and a lack of overall appeal led to only a handful of downloads.

That changed when Apple launched push notifications; allowing users to see status updates from others even when not actively using the app. People began to use WhatsApp as an instant messenger. That’s when Brian and Jan saw the opportunity to pivot. In August 2009, focused entirely on messaging, the duo launched a new version of the app, and active users quickly jumped to over 250,000.

WhatsApp’s user base continued to grow as it climbed the ranks of the App Store; catching the eye of the rest of Silicon Valley. In 2010, Google met with the founders, and upon seeing the potential, they quickly made a $10 million offer for WhatsApp. The founders just as quickly said no. Several months passed, and Google increased its offer to $100 million. Brian and Jan passed a second time.

But as the app grew, so did costs, and the company needed money. WhatsApp was converted from a free service to a paid one, in which users would pay a one-time fee of $.99. Not only would this generate essential revenue but it would help slow down growth to a more manageable level.

It wasn’t enough.

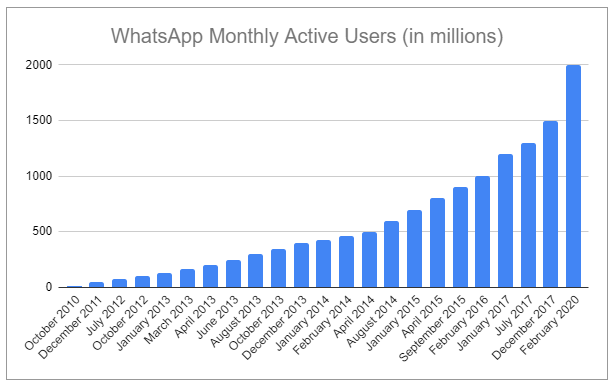

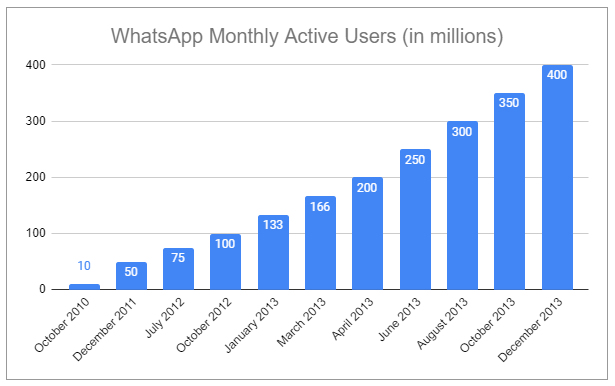

In early 2011, after months of negotiation, Sequoia Capital invested ~$8 million for ~15% of the company. Within two years, monthly active users had crossed 200 million, and Sequoia invested another $50 million, valuing WhatsApp at $1.5 billion. The company also changed its model from a one-time fee to free upfront with a $.99/year subscription thereafter. But that didn’t slow the company down, and by the end of 2013, monthly active users had doubled to 400 million.

It was only natural for this to alarm Facebook, which for the past several years had been navigating its own shift to mobile. However, seeing an opportunity, Facebook decided to open its war chest rather than go to war. On February 19th, 2014, Facebook (now Meta) acquired WhatsApp.

The purchase price?

A jaw-dropping $4 billion in cash, ~$12 billion in Facebook shares, and ~$3 billion in restricted stock grants set to vest over a 4-year period. In total, due to share price appreciation, the company paid well over the initial price tag. It would be the largest venture-backed acquisition ever done and completely dwarfed Facebook’s $1 billion acquisition of Instagram two years prior.

But the deal was easy to criticize. For the full year of 2013, WhatsApp generated a mere $10 million in revenue and recognized a net loss of $138 million. Paying >$22 billion for a loss-generating business doesn’t sound great. However, justification lies in the fact that in one single move Facebook was able to acquire a huge number of users and their personal information, and all but guaranteed it retaining its spot on the top of the mobile mountain. After all, the company had spent the last few years shifting its focus to mobile, and losing future growth to a would-be competitor would be much more costly. This was affirmed during the Q3 2014 call (half a year after the deal announcement), as per Mark Zuckerberg’s comments (emphasis added):

Part of what we've seen is that the use cases for products like Instagram and WhatsApp are actually more different and nuanced from -- than the products that the people compare them to, that Facebook had already built. So for example on the WhatsApp and Messenger side, Messenger's primarily used today for people to chat with their Facebook friends, within this context of, maybe it's not like a real-time text, like you would send an SMS on your phone, but it's something that you're sending to one of your Facebook friends, then if they happen to be there, and then you can text back and forth, or maybe they respond later. SMS and WhatsApp are more for kind of real-time activity. People have contacts on WhatsApp who they wouldn't want to make friends on Facebook, the graphs there are somewhat different. So one of the things that we found, interestingly, to us as well, was that Messenger and WhatsApp were actually growing quickly in a lot of the same countries.

To further appreciate the risk Facebook faced requires looking at what led to WhatsApp’s rise in the first place.

WhatsApp’s growth engine

WhatsApp was created with privacy in mind, with all of its services utilizing end-to-end encryption. Its team also vowed to provide a seamless user experience that would never be cluttered with ads. But the real success of WhatsApp can be attributed to one driver:

Accessibility.

WhatsApp was developed to be platform-agnostic and with a mobile focus, making it compatible with nearly all smartphones. It has also always been free to send and receive messages through WhatsApp, which is critical in countries where consumers can’t afford plans where they are charged for messaging. And instead of signing up and creating a username and then asking people for their username to connect, you simply used your mobile number. These factors made WhatsApp not only easy to use but also outrageously affordable, especially for those in developing countries who began to see it as the way to communicate. But there was still one barrier to entry: payment. However, in January 2016, WhatsApp scrapped the annual subscription fee, making the app completely free for users. Since then, the achieved network effect has been awing:

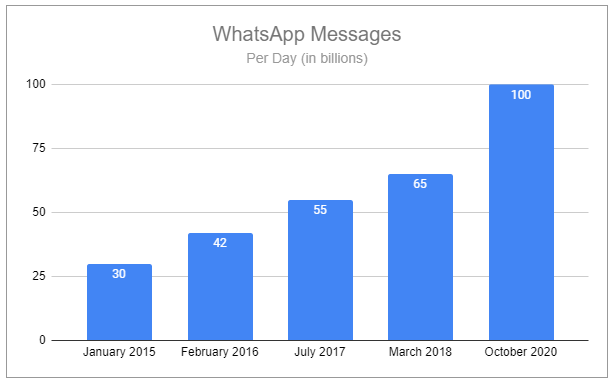

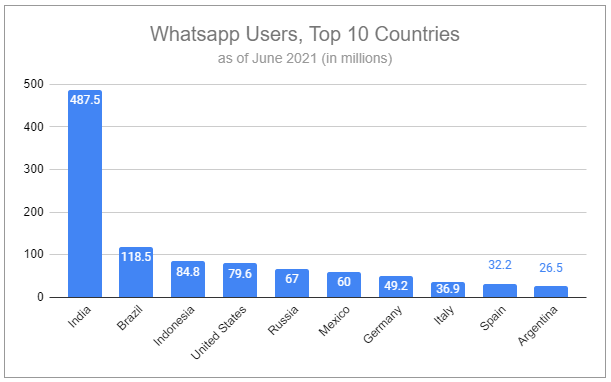

WhatsApp's monthly active users are still widely cited to be ~2 billion. However, that number was reached in early 2020. Similar growth has likely occurred with the number of messages sent per day on the platform, growing from ~100 million/day in October 2020. In fact, the present number of daily active users is greater than the monthly active users from just two years ago, as Mark Zuckerberg on the Q3 2022 call stated:

WhatsApp has more than 2 billion daily actives, also with the exciting trend that North America is now our fastest-growing region. Across the family, some apps may be saturated in some countries or some demographics, but overall, our apps continue to grow from a large base.

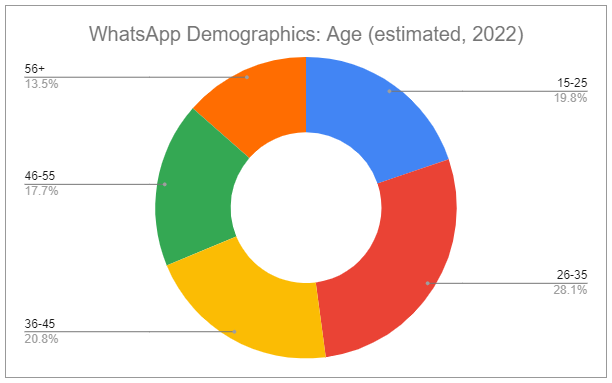

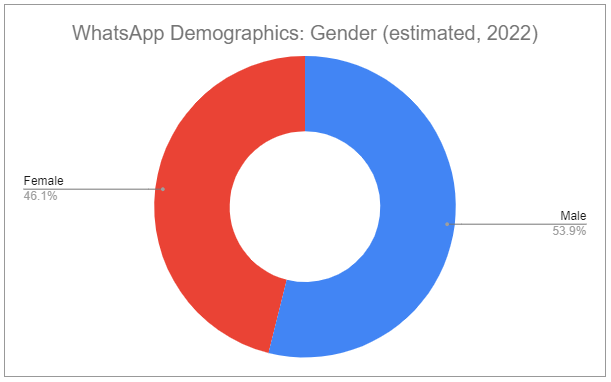

Meta does not break out WhatsApp from the rest of FoA but the above comment should catch your attention. At over 2 billion, WhatsApp DAUs are larger than that of any other social media platform, including Facebook’s 1.984 billion as of Q3 2022. Additionally, the platform sports strong demographic mixes, including nearly half of the users estimated to be between ages 15-35:

The rise of the super-app

Mark Zuckerberg said during the Q1 2014 call:

But over the long term, we also expect WhatsApp to play an important part in connecting everyone by offering a simple, fast and reliable messaging system that can be as ubiquitous as Facebook one day.

WhatsApp’s meteoric rise as a near-frictionless messaging app has been supercharged by its ever-expanding functionality:

Aug 2009 - WhatsApp 2.0 launches on the App Store for iPhone.

Dec 2009 - WhatsApp update introduces the ability to send photos.

Aug 2010 - Android OS support added.

Jan 2011 - Chinese competitor WeChat is created.

Aug 2013 - A new competitor, Telegram, launches.

Aug 2013 - WhatsApp introduces voice messaging.

Jan 2015 - WhatsApp launches its web browser client.

Mar 2015 - WhatsApp introduces voice calls between two accounts.

Jan 2016 - WhatsApp removes its subscription fee.

March 2016 - WhatsApp introduces document-sharing.

May 2016 - WhatsApp launches for both Windows and Mac OS.

Nov 2016 - WhatsApp introduces video calls between two accounts.

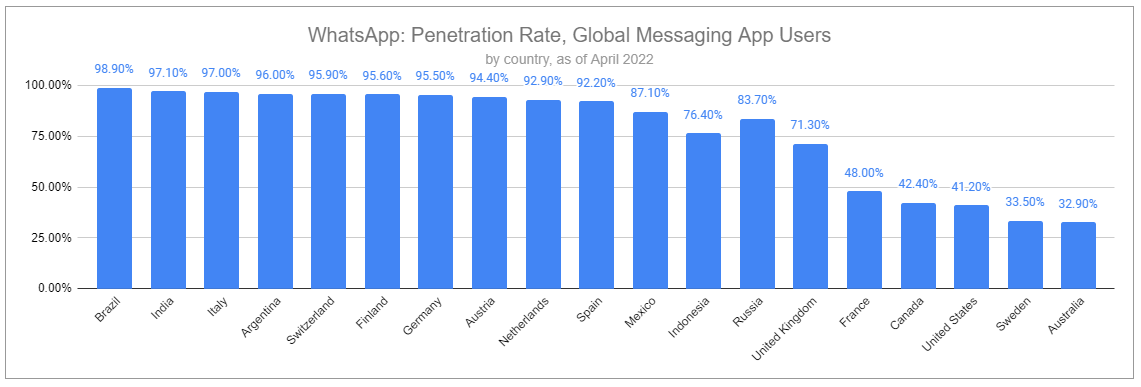

This increase in functionality has led to remarkable penetration:

In many countries, Meta has far exceeded its goal of making WhatsApp ubiquitous, and the app has become entrenched in users’ lives.

In India, the country with the greatest number of WhatsApp users, for example, people rely on WhatsApp to communicate with friends, family, and colleagues, buy and sell items, send money, read news, and even access personal medical information. In other countries, like Brazil and Indonesia, total usage and use cases indicate the app may be more important than any other; including Facebook, Instagram, TikTok. Even in Russia, when Facebook and Instagram were banned following Russia’s invasion of Ukraine earlier in the year, WhatsApp was untouched. Popular throughout the country, it is clear that the Kremlin worried that blocking WhatsApp could generate significant blowback and loss of public support.

Despite all of this, the investing community has been critical of the WhatsApp acquisition. The deal was quite dilutive for Facebook shareholders, and continued growth in users has always meant growing costs, all while the company seemingly had no clear plan on how to monetize the platform. In 2018, WhatsApp cofounders Brian Acton and Jan Koum abandoned their remaining $1.3 billion in stock options by departing early from the company, cited to be caused by monetization disputes, including Facebook’s insistence on porting over similar advertising as seen on Facebook and Instagram.

To many, WhatsApp has continually looked like an overpriced acquisition that would never be successfully monetized.

That is, until recently.

Flipping the money switch

It might seem bizarre that despite WhatsApp’s super-app status and delivering massive value to users, its financial impact has been quite negative for its owner. Even setting aside acquisition costs, the operational costs and costs associated with growth have undoubtedly been massive, which have depressed margins in Meta’s core business, FoA, and have somewhat hidden the true profitability of Facebook and Instagram. This is not unlike the company’s current consolidated results as of late, which have faced additional pressure from Reality Lab’s continually expanding losses.

But Meta’s WhatsApp strategy hasn’t been crazy.

How many companies can afford to offer an exceptionally useful, simple, reliable, and scalable product on a global level for so long with it practically free to users while costing billions? Of those that would be able, how many would be willing to forgo millions or even billions in potential monetization efforts?

As I highlighted in Meta: Pain and Patience, Zuckerberg’s entire history is filled with choices that are long-term oriented. Deferring monetization and focusing solely on end-user functionality is exactly what led WhatsApp to become the #1 messaging app in the world. Yet, when Facebook began to prepare to monetize the platform and clashed with the founders of WhatsApp in 2018, which was also followed up with a scrapped ad strategy, a different seed was already beginning to sprout:

WhatsApp Business

In January 2018, WhatsApp Business was launched, allowing the creation of business profiles and providing a suite of tools to help businesses better connect with and serve their clients.

Below chronicles comments made by Meta executives regarding this continued endeavor that I find particularly relevant:

Q3 2018 call, Mark Zuckerberg (emphasis added):

Our road map focuses on continuing to make WhatsApp and Messenger even simpler, faster and adding basic utility features like payments. We found that every time we make our services faster and simpler, people communicate more.

We'll also keep pushing our messaging services to be more private and secure, and we believe this will continue to be a competitive advantage for us.

On the business side of messaging, our first step has been to enable people to connect with businesses organically in ways they find useful, and then the second step is to give businesses additional paid tools to increase those interactions. We're well into step 1 at this point with more than 3 million accounts on WhatsApp business.

Q1 2019 call, Mark Zuckerberg (emphasis added):

So it (WhatsApp) feels like a more natural space to be interacting with a business in a private way, for doing transactions. So I think what we're going to end up seeing is building out Payments, which is going to end up being something that we do country-by-country. We have a test that is running in India for WhatsApp now. We're hoping to launch in several other countries at some point, but I don't want to put a time frame on that here. But it's something that we're actively working on.

Q2 2019 call, Mark Zuckerberg (emphasis added):

These are pretty big technical projects. We want to make it so that the infrastructure that these services are built on is the most secure and most reliable and fastest and most widely available of any of the major messaging platforms out there. We think that, that's the foundation to build a successful private platform on. And then we need to do things like what we're doing with WhatsApp Business now which is building up the business ecosystem. And that's just something that -- our playbook on this is that this is a multiyear journey where, first, we deliver the consumer product experience, then we create organic business experiences and then only at the last step are we really able to ramp up having businesses pay for things that are meaningful to them within that.

So it's not that you're not going to see progress on that along the way. You'll certainly see milestones every 6 months or 12 months. But before this is really the biggest driver of our business, I do think that that's going to be a number of years.

Q1 2020 call, Mark Zuckerberg (emphasis added):

I think that there's a huge opportunity on WhatsApp, if for no other reason than that it has 2 billion people using it, and we haven't done significant work on building out the business yet. I mean we have some tools there, but we're still early in the phase of -- we've built out WhatsApp business. There's tens of millions of businesses that are signed up and that are using that.

Q2 2020 call, Mark Zuckerberg (emphasis added):

We're going to have more to share there soon. WhatsApp Business now has 50 million people using it and is growing quickly. We've also granted -- we've also created grant programs to help small businesses during this period, including a $100 million program to support small businesses globally and another $100 million program specifically to support Black-owned businesses, Black creators and nonprofits that serve the Black community here in the U.S.

Q2 2020 call, Mark Zuckerberg (emphasis added):

The other area that I'm quite excited about is messaging commerce. And what we're seeing there is it's particularly important especially in developing countries. But we're seeing a lot of small businesses just conduct a significant portion of their business over Messenger or over WhatsApp. And in the medium term, I think the way that we're probably going to build a business around that, we already offer the business API, and that will be meaningful.

But there are also these clicks-to-messaging ads, which have been more successful than I think we'd even hoped, that basically allow people to get customers' attention in especially Facebook and Instagram and direct them to a thread where they can do commerce and messaging. Messenger to start, and we're really working on ramping that up in WhatsApp as well. But as payments grow across Messenger and WhatsApp and as we're able to roll that out in more places, I think that, that will only grow as a trend. So those are the 2 areas that we're really focused on in commerce. It's worth noting, like I said in my opening remarks, this really is primarily focused on small businesses, individual entrepreneurs.

Q3 2020 call, Mark Zuckerberg (emphasis added):

In WhatsApp, we just announced how we're going to make it easier for people to buy products directly within a chat and integrating WhatsApp Business features with Facebook Shops, so that way, when a small business sets up a shop, they can now establish or will be able to establish a commercial presence across Facebook, Instagram and WhatsApp all at the same time. We continue to see how personalized advertising is helping small businesses find customers, grow their businesses and create jobs. I continue to believe that we need new regulation that allows for personalized and relevant ads while protecting people's data and privacy. And I worry that some proposals, especially in the EU and actions planned by platform companies like Apple, could have a meaningful negative effect on small businesses and economic recovery in 2021 and beyond.

Q3 2020 call, Mark Zuckerberg (emphasis added):

One of the early monetization products that is working quite well are those click-to-messaging ads, so that way, someone can get -- a business can run ads in Facebook or Instagram and in the destination for that ad, can take the person to a thread, a chat thread either in Messenger or WhatsApp, to kind of further build out the relationship with the consumer or complete a transaction.

Q1 2021 call, Mark Zuckerberg (emphasis added):

We are also focused on building more native commerce tools across our apps. We recently updated WhatsApp catalog, so businesses can keep them updated from their computers and to include what's in stock. We launched carts on WhatsApp last year, and people have used them to send orders more than 5 million times.

We're also building a broader infrastructure to support commerce, everything from payments to customer service and support. And WhatsApp Payments is now live in India, and we have gotten approval in Brazil to launch shortly, too.

Q1 2021 call, Mark Zuckerberg (emphasis added):

Businesses using the WhatsApp business API are already sending more than 100 million messages per day. Over the last year, during the height of COVID, total daily conversations between people and businesses on Messenger and Instagram grew by more than 40%. More than 3 million advertisers are already using click-to-message ads to direct people to Messenger. And since we introduced click-to-WhatsApp ads, nearly 1 million advertisers have already started using them, too. And now the next step here is we're going to make it possible to create those click-to-WhatsApp ads from -- directly within the WhatsApp business app.

Q2 2021 call, Mark Zuckerberg (emphasis added):

But I think the strategy is the right one. It's creating a better product experience for people. When you click on an ad or when you engage with a business, it's just going to be much better to do that natively, whether you're in Instagram or Facebook or WhatsApp or whatever you're using, than go to a website that doesn't have your payment information and it isn't personalized. So I think we're on the right path here, and we're focused on compounding this as quickly as we can.

Q4 2021 call, Sheryl Sandberg (emphasis added):

We're continuing to invest in new tools to make it easier for people to help and make purchases right from a chat. More than 150 million users globally now view a business catalog in WhatsApp each month. And new features like collections on WhatsApp help businesses organize their products and make it straightforward for people to find things to buy. As we enter 2022, our focus is where it has always been: building products that help people connect and businesses grow. We're making long-term investments to evolve our business and continue to drive real value for our partners.

Mark Zuckerberg on the Q3 2022 call (emphasis added):

Beyond Reels, messaging is another major monetization opportunity. Billions of people and millions of businesses use WhatsApp and Messenger every day, and we're confident that we can connect them in ways that create valuable experiences. We started with click-to-messaging ads, which lets businesses run ads on Facebook and Instagram that start a thread on Messenger, WhatsApp or Instagram Direct, so they can communicate with customers directly. And this is one of our fastest-growing ads products with a $9 billion annual run rate. And this revenue is mostly on click to Messenger today since we started there first.

But click to WhatsApp just passed a $1.5 billion run rate and growing more than 80% year-over-year.

Paid messaging is another opportunity that we're starting to tap into. And it continues to grow quickly but from a smaller base. We're putting the foundation in place now to scale this with key partnerships like Salesforce, which lets all businesses on their platform use WhatsApp as the main messaging service to answer customer questions and updates and sell directly in chat. And we also launched JioMart on WhatsApp in India, and it's our first end-to-end shopping experience that shows the potential for chat-based commerce through messaging.

Meta has not been shy in sharing the WhatsApp roadmap and highlighting the long runway ahead. Yet, despite seeing the number of WhatsApp Business users following the same trajectory as the core app, most people seem to lack appreciation for what’s occurring. The source of such apathy likely stems from the fact that WhatsApp Business is still such a small part of the overall sales.

WhatsApp Business’s Business Messaging falls into the category of ‘Family of Apps Other Revenue’, which in Q3 2022 was up 9% y/y to $192 million, though the strength in WhatsApp Business was somewhat offset by weakness in net fees collected from developers using Meta Payments infrastructure in gaming which is also included. Other Revenue for the first 9 months of 2022 increased from $567 million to $624 million. If Other revenue were to remain flat from Q4 2021, that would bring FY 2022 to $779 million. Ballbarking that only half of Other Revenue can be attributed to WhatsApp business and adding it to the Click to WhatsApp run rate of $1.5 billion brings the total to $1.8895 billion which is a mere 1.6% of Meta’s trailing twelve-month revenues. Even ignoring other potential forms of monetization such as Business Subscriptions, and assuming continued headwinds related to gaming payments, Other Revenues can likely grow at an HSD or LDD rate for the foreseeable future. Click to WhatsApp growth is likely to decelerate. But even so, growth in nominal terms off of a $1.5 billion base will, in fact, turn into a rather significant number in short order and can ultimately become a material driver of growth for the company as a whole.

Of course, this is only focusing on the top line. Profitability is a different story.

The majority of the costs associated with WhatsApp are already embedded into what FoA reports. As the adoption of WhatsApp business continues, additional costs related to current monetized offerings should grow at a far lower rate, allowing increased sales to sport a strong incremental return profile that would be margin accretive. However, there is a very good argument to be made that margins may be depressed by Meta’s strategy which all but ensures continued adoption:

WhatsApp Business promotes a Pay As You Grow model, in which the first 1,000 conversations a business has each month are free.

Any WhatsApp Business Conversation that comes directly from a Click to WhatsApp or FaceBook CTA button is free.

WhatsApp continues to create funds and incentive structures to promote adoption.

WhatsApp Business has largely catered to SMBs and we are still very early on the adoption curve. As adoption increases, the above incentives may depress observable financial performance. However, these incentives are brilliant simply because they present a value proposition for businesses at a scale that no other platform can hope to match.

Meta also shows no signs of slowing its goal of catering to a wider set of businesses. In September, it was announced that WhatsApp would be teaming up with Salesforce, the #1 CRM, to integrate even more value-creating capabilities. This case study, highlighting L’Oréal Malaysia, illustrates the opportunities present, which will also undoubtedly grow as WhatsApp expands its API capabilities.

Outside of the clear financial incentives and the special promotions that Meta offers to use WhatsApp business, adoption will be further supported by the fact that consumer preference continues to shift away from phone calls and emails. Consumers - especially younger demographics - much prefer having text conversations and the option to communicate with support asynchronously. Larger businesses are identifying this and are shifting customer service to social media, including WhatsApp.

Beyond all of this is the importance of what WhatsApp Business achieves for Meta’s FoA as a whole. To build context are several excerpts from the past few years below:

Q3 2020 call, Mark Zuckerberg (emphasis added):

But I think it should simplify things and make it so that these 3 different networks that we've had, between Messenger, Instagram and WhatsApp, can start to function a little bit more like one connected interoperable system. And that's the vision. There is more work to happen here. We, of course, want to bring in WhatsApp to that interoperability as well. There are more features we want to add even to the Messenger-Instagram interoperability.

Q1 2022 call, Sheryl Sandberg (emphasis added):

We're also helping businesses connect directly with customers and grow more on-site data conversions through products like click-to-message ads. This is where you click on an ad on your Facebook or Instagram feed and it opens a chat with the business in Messenger, Instagram Direct, or WhatsApp. It's already a multibillion dollar business with healthy double-digit year-over-year growth in Q1. A great example is Deichmann, Europe's largest footwear retailer. They've built a fully automated virtual shoe assistant to give customers personalized footwear recommendations and promoted it through Click-to-Messenger ads on Facebook.

They had an 85% click-through rate and saw 30% more incremental purchases than with their usual link ads. In the medium term, we see an opportunity to grow other on-site conversion products like lead ads, which make it easier for businesses to generate leads and shop ads, which direct you to a brand's digital storefront on Facebook or Instagram. It's still very early for shop ads, but we think driving people to shops can be a compelling objective for commerce advertisers as we continue to improve our on-site commerce tools. Over the longer run, we're also developing privacy-enhancing technologies, which will help us minimize the amount of personal information we process, while still allowing us to show people relevant ads and measure performance for advertisers. And we're collaborating across our industry on these and other standards that will support this next era of personalized advertising.

Q2 2022 call, Sheryl Sandberg (emphasis added):

So that means the click-to-messaging ads become the perfect opportunity. They help us move people from discovery to a direct relationship with a business. In a world where we're trying to do more with less data, they give businesses and consumers a direct connection, so it's much easier to measure ROI. And so we're investing heavily. You can message a business from Facebook and Instagram feed from Facebook, Instagram, Messenger Stories to WhatsApp, Messenger, Instagram Direct.

You can see how many entry points we have to drive real engagement and real demand.

And I'll end with a case study. RoamHowl Creative, they're a small business consultancy. They used click-to-messaging ads for lead generation. And then they compared those to their normal ads, which were driving website conversions. And the Click-to-Messenger ads resulted in 2.3x more qualified leads.

And this is important, a 57% lower cost per lead. And that doesn't even take into account the fact that it was measurable, that even if the return had been the same, they would have been able to measure it and attribute it more directly to our platform. So we are hugely optimistic about this area of our business, and I am very convinced it will work and is already working everywhere in the world.

The digital advertising space faces a permanent headwind in the form of Apple’s App Tracking Transparency and as I mentioned in Meta: Pain and Patience, Meta has been more affected than other platforms, but only because it was able to leverage Apple’s IDFA to such an extreme degree. Following the impact, the company continues to stress its investments to rebuild ad infrastructure, especially around probabilistic modeling to improve both ad targeting and ad attribution - two equally important sides of the same coin. Yet, critically, despite the impact, Meta still offers the highest returns for DR and brand advertising. But the opportunities extend further, as I wrote in the piece:

As Meta continues to make incremental improvements to their infrastructure and core offerings, I expect the output of the value equation to increase meaningfully. This will be especially true as it builds in verticles, growing the number of transactions occurring wholly on-platform and generating substantial first-party data, which circumvents the need for users opting into ATT in order for the company to operate granularly.

Leveraging WhatsApp will further reinforce this.

In February 2021, Eric Seufert, author of Mobile Dev Memo, published The profound, unintended consequence of ATT: content fortresses. Eric defines a Content Fortress as:

any platform or portfolio of products supported by a rich advertising ecosystem serving owned and operated inventory using only first-party data.

There is a straightforward thesis supporting the idea that Meta may become the largest and best-defended content fortress of them all. Simply put, it’s continually more difficult to track across platforms, and along with ATT, there will be countless changes to the privacy landscape in the future, mostly in the form of regulation, which all negatively impacts targeting, attribution, and companies’ ability to fully understand user journeys. This makes keeping more interactions on a single platform, beyond the obvious first-order monetization opportunities, far more important. Meta is already far ahead of the pack in this regard, but as it continues to build vertically and horizontally, a more integrated FoA will continue to capture a larger amount of each journey. The end result is a far richer environment for businesses, advertisers, and consumers alike, as well as a far more robust and entrenched model for Meta.

To once against reiterate the runway ahead, I’ll conclude with part of Mark Zuckerberg’s comments made at the DealBook Summit last week in which he stressed the immense opportunities ahead (emphasis added):

WhatsApp is largely untapped in terms of how to monetize it. And two billion people are using every day, or, you know, on daily basis on average. So that’s really the next platform that we’re focused on; bringing online from a business messaging and monetization perspective, and I think the potential there is going to be pretty big over the next few years.

Questions or thoughts to add? Comment here or message me on Twitter.

Ownership Disclaimer

I own positions in Meta.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: META 5.26%↑ GOOG 2.04%↑ PINS -0.08%↓ SNAP -0.47%↓ TTD 8.74%↑

great write up! I know of a major insurance company that started to communicate via Whatsapp and found out that it reduced costs of handling 'a call' considerable (-50%) and with higher customer satisfaction (NPS), so I see a future here!

We know Wechat works but no serious alternative in the West. Musk wants to do this with Twitter to some degree and I'm sure others will try. For me personally it would be nice if Meta refocused more on these existing projects as they have huge potential as you mentioned.