“Wild rumors abound, wherever there is any adequate reality for them to cling to.” - Herman Melville, Moby-Dick

There’s never been a shortage of worry or rumor. Endless questions about emerging markets, management, and new investments. New products ridiculed. Covid. Component shortages. Supply chain shocks. War. Now, here we are, and Philip Morris International’s Investor Day, held September 28th, and Q3 Results, released October 19th, have given investors even more to chew on. The company is unlikely to hit its goal of 50% of net revenues derived from smoke-free products in 2025, looming flavor bans in the EU are impacting HTU inventories, and now it is clear the company intends a much slower U.S. rollout of IQOS in 2024. All stacked up, it may begin to feel that these points are only scratching the surface of the company’s problems.

However, concerning a slower U.S. rollout of IQOS, there should be no surprise, as I noted in April:

I remain guarded towards IQOS’s reentry into the U.S. and feel that the company is actually in a more awkward position than most want to admit. Yes, there is the allure that HTUs would take share from cigarette volumes, of which PMI has no share in the United States, thus capturing purely incremental volumes. But HTP, as a category, is not established in the United States and only the IQOS 3 version has PMTA authorization. Rushing to push IQOS 3 into the United States may be a serious risk to the brand. While a good product, it’s notably inferior to ILUMA, and with a lower conversion rate, the company may turn off would-be ILUMA adopters and struggle to gain momentum. But does PMI really want to take a slower, conservative approach? A PMTA for ILUMA will likely be submitted sometime in H2 2023. But there is no guarantee it gains authorization, and if it does, there is no clear timeline of how long that will take. Conversely, if IQOS 3 does gain momentum and the company then introduces ILUMA, the costs from the upgrade cycle may weigh heavily on margins in the future just as it is currently doing in more established HTP markets. And mind you, this will all be occurring as major competitors that have larger U.S. sales and distribution infrastructure relative to PMI will be working to introduce their own HTPs to the U.S. market.

PMI’s CEO, Jacek Olczak, affirmed this during the 2023 Investor Day last month, and now we can expect a guarded rollout of the previous IQOS blade variety in the spring of 2024 across several select cities and a soon-to-be finalized PMTA for IQOS ILUMA which the company expects determination on in 2025. Although this undoubtedly reduces maximum potential momentum, it is likely the correct approach—both curbing excess investment and the odds that the older variant alienates would-be ILUMA users. The company maintains its belief it can take ~10% of the cigarette + HTU market share in the U.S. by 2030. I have my doubts.

Along with the slower U.S. rollout of IQOS, HTU inventories in Europe are being affected by the soon-to-be-ennacted flavor ban. Again, not too surprising, though the company has adjusted its full-year guidance for shipped HTU volumes to the lower half, from 125-130 billion to 125-127.5 billion. I share with management the view that these short-term effects are unlikely to translate into long-term structural challenges. Nonetheless, management now finds it less likely the company will reach 50% of net revenues derived from smoke-free products in 2025. The goalposts have been moved to an aspirational 75% of net revenues derived from smoke-free in 2030.

Zoom out

The above are popular talking points, but they are more distraction than substance. The specific percentages on specific dates are, to a degree, arbitrary. It’s not that these ambitions are irrelevant, rather, they fail to fully capture the value-creation engine of this company. One could just as easily throw endless money at a revenue goal—promising margins collapse. Or one could allow other parts of operations to atrophy, assuring the part obsessed over becomes a larger of the whole. Zoom out.

In Q3, Heated Tobacco Unit volumes grew 18% y/y, and volumes are up 18.3% year to date. These volumes are for shipments and do not capture consumer offtake, which maintains strong momentum. Looking at the number of IQOS users—a metric I continue to place the utmost importance on for the category—200,000 were added in the quarter, compared to flat for Q3 2022 (historically, Q3 is seasonally the weakest quarter).

From just a year ago, total users are up 15.6%. A growing number of users continues to bolster the brand’s social proof, driving awareness, interest, trial, and adoption—all at a lower cost. Higher HTU volumes also follow user growth, as usage shifts from marginal polyusage to exclusive. But it’s also key to acknowledge where these users are coming from. For this, let’s first revisit a slide from Jacek Olczak’s presentation during Investor Day.

The above slide is, to be clear, a chart crime. While the precipitous growth of IQOS has been awing, comparing its trajectory, occurring under the hood of an established giant, to the founding dates of then-nascent and now well-known behemoths is far from apples-to-apples. This slide, however, does illustrate one of PMI’s greatest strengths: A colossal distribution network and direct relationships with millions of adult consumers around the globe, along with expertise built up over decades on how to best navigate an evolving and tightly regulated market.

It only makes sense that IQOS’s trajectory was first aided by PMI converting users of its own products, which it could more easily connect to. But now, with scale and momentum, cannibalization has shifted to converting adult users from other sources at an elevated rate. There is no denying this is happening—there is no other explanation when the core product, cigarettes, faces secular decline, and yet, PMI continues to sport aggregate volume growth. In Q3, the company’s cigarette volumes declined by -0.51% y/y, netting aggregate growth of 2.18%.

This dynamic is also expressed by the company’s evolution of market share.

Aggregate volume growth is a captivating story—but an insufficient one. It is also certain that, at some point, PMI will drift back toward declining aggregate volumes. However, investors continue to place too much importance on volumes. PMI’s cigarette share increased 40bps y/y from 23.9% to 24.3% in the quarter. But that by itself is an equally incomplete story. The increase of either, in isolation, makes no guarantee of increasing value. What is terribly impressive is the performance of these metrics alongside two critical factors:

Aggressive pricing. Q3 combustible pricing variance measured 8.6%, following a similar elevated rate in Q2. For context, the full years 2020-2022 each came in between 2.7-5%, and the years 2008-2018 averaged 6.5%.

Minimal resources. The majority of commercial resources, now over 75%, have been directed away from legacy products and towards smoke-free.

The displacement of legacy products as a percent of total net revenues has slowed precisely because of the strength of those products. Yet aggregate net revenue per unit still grows, and there remains a number of new, even untapped, markets, for IQOS. While pricing on HTUs has intentionally been far less aggressive than combustibles, the ability to raise future prices remains intact. This is on top of current contribution margin, in which HTUs are substantially higher at ~2.5x the net revenue per unit of cigarettes thanks to favorable taxation dynamics. Surely, some markets will face less favorable evolution in tax treatments on these products, and while the differential may shrink in some markets it is unlikely to collapse—especially when taking a global view.

The greatest counterweight to the impressive engine of pricing and mix shifting towards higher-contribution products is FX rates. The nature of reporting in USD while deriving essentially zero revenues in USD has been a thorn in the side of the business’s realized earnings for nearly every year—a significant headwind impossible to ignore. Few people possess the ability to anticipate future movements with any type of precision—I surely cannot. It does seem clear, however, that even if only with slight success, the U.S. rollout of IQOS will soften this sharp edge. This is especially true when it has been laid out that U.S. HTU net revenue contribution would be x2 of international HTUs; an astounding x5 of international cigarette contribution on a per unit basis. Of course, presently, something less speculative that assists in this regard is the exceptional contribution of Swedish Match.

Match is on fire

Swedish Match saw total oral shipment volumes up 20.5% y/y in Q3, with ZYN in the U.S. experiencing a staggering 65.7% increase in the period. The U.S. performance is continuing well above expectations, and growth has considerable room left with further expanding distribution and points of sale—and especially considering consumption rates per legal-age nicotine user in the U.S. are far under Scandinavian countries. Along with alarming growth, ZYN has also continued to strengthen in U.S. category share, despite being priced, on average, ~70% higher than the second largest (on!). This is a product that faces no MSA/SFMSA fee and broadly favorable taxation treatment, netting a gross margin profile of more than 80%.

Naturally, it’s not all sunshine and rainbows for this operating segment. Its machine-made cigar segment saw volumes fall by 21.3% in the quarter—though this was largely a result of continued outrageous pricing. Snus volumes fell by 11.6% in Q3, largely due to strong comps and the trend toward modern oral pouches. The real concern rests with the star product, ZYN. It’s worth noting that no modern oral pouch has received MGO authorization via the FDA’s PMTA process. Additionally, for the company, nicotine pouch growth in Scandinavia came in at a mere 2.8% in Q3. Scandinavia, with a strong history of oral use and modern oral adoption, is a meaningful reference point. There are far more brands, more innovation, and more competition compared to the legally-bogged-down United States. As impressive as U.S. performance has been, and as seemingly successful as the company has been at building brand equity for ZYN, there remains a considerable degree of uncertainty regarding how this segment fairs should meaningful regulatory overhaul occur—though holding your breath while waiting for the FDA to get its act together may leave you blue in the face. It should also be noted that, while the growth of ZYN in the remaining parts of the world appears early stages and nearly entirely untapped, its trajectory will reflect a race between PMI leveraging its infrastructure against the innovation stemming from Europe.

Wellness & Healthcare needs a doctor

What is appropriate to say about Wellness & Healthcare? Initially rationalized by PMI’s expertise in clinical testing and navigating complex regulations, it is doing a good job of acting as a black box money pit. This segment is, so far, a clear reminder that management is not infallible, and is hard to be viewed as anything other than the stretching of resources and attention that would be better applied elsewhere—deleveraging and accelerating the path toward share repurchases. Is such a view rooted in impatience? How long is too long if this segment continually struggles to find its footing—especially when nearly all else in operations continues to deliver?

Refocusing on value

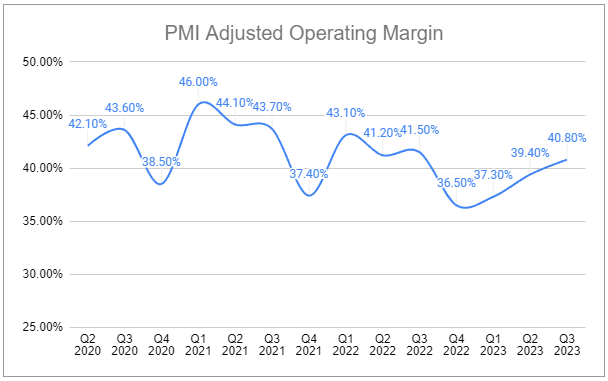

Despite all new developments, and as much as it may be preferred that I don’t sound like a broken record, nothing has materially diverged from my last published model. While the company has added Russia back into its reporting, I find it most appropriate to keep it excluded. Still, pro forma, PMI’s consolidated net revenues have a clear path for continued high single-digit growth while the company reinvests to meet demand, in addition to returning substantial sums of capital to shareholders via dividends. Margins are likely to face pressures as reinvestment remains elevated. Share repurchases get pushed back a year further as it becomes apparent that leverage ratios will improve mainly from growth in denominator rather than a reduction in numerator. The future will assuredly surprise us with negative events and true problems to worry about. For now, it appears rather than merely scratching the surface of problems, we are only scratching the surface of this firm’s ability to generate value over the long term.

If you enjoyed reading, hit “♡ like” and give this piece a share.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Philip Morris International and other tobacco companies such as Altria, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 0.00%↑ BTI 0.00%↑ MO 0.00%↑

Additional Resources:

Philip Morris International - Reports and filings. Source

Devin- Do you have any issues with PM's quality of earnings? Tobacco Insider wrote an interesting piece a few weeks ago addressing their EPS vs. Adjusted EPS. They said EPS has been flat for the past decade and that is the main reason the stock price of PM has gone nowhere. I'd be curious to your thoughts.

https://tobaccoinsider.com/pmi-not-all-roses/

Thanks.

Another great Write up Devin. Thanks!🙏