“A fool sees not the same tree that a wise man sees.” - William Blake

Cigarette volumes are down, FX dynamics continue to depress earnings, and there is a long list of margin headwinds. On almost every level, Q1 2023 results show Philip Morris International under pressure. Yet, I don’t think there has been a period in which the company has been better positioned than now.

No surprise

While deserving of our attention, the majority of pressures PMI is facing shouldn’t be a surprise at all! I point to comments made by the company’s management during the Q4 2022 call (emphasis added):

Jacek Olczak, PMI CEO:

Logically, the international expansion of pouches, U.S. IQOS penetration, and the replacement of IQOS 3 with ILUMA entail additional investments this year which combined with inflationary pressure will weigh temporarily on our margins.

Emmanuel Babeau, PMI CFO:

A few words now on 2023 phasing. We expect margin pressures to be weighted to the first half, particularly given the challenging Q1 2022 comparison, a progressive decrease in air freight costs throughout the year. In addition, investments are expected to be front-loaded, and we know that the rollout of ILUMA can lead to a short period of slower user acquisition as consumers wait for the launch. Combined with the timing of shipment and cost savings, we expect our 2023 top and bottom-line delivery to be heavily H2 weighted.

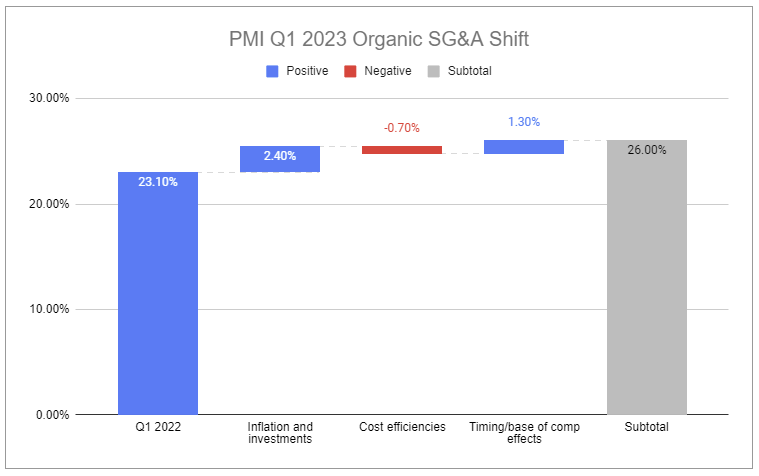

And sure enough:

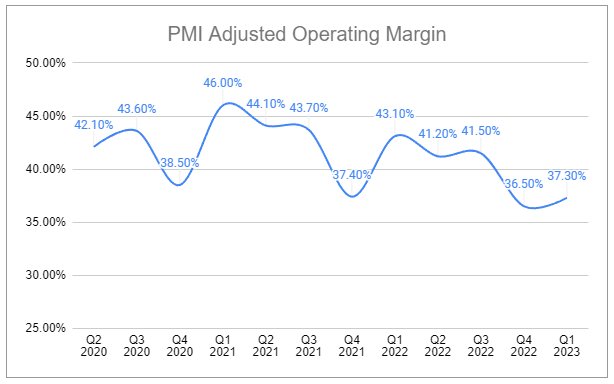

Mind you, while pressures stemming from RRP growth and transition are pronounced, there have been other large contributors, including energy and COGS headwinds affecting cigarettes such as tobacco leaf and acetate tow (the material used in filters, yes really). For context, the last time acetate tow was mentioned during a quarterly call was briefly by an analyst in Q4 2015. Moving forward, there is good reason to expect many of these pressures will lessen. And focusing on heated tobacco becoming a larger group contributor, my perspective on margins remains unchanged from last quarter:

However, this continuation is absolutely welcomed. One of the greatest difficulties for new products in the nicotine space is convincing users to try them. With legacy products carrying tremendous loyalty, it can be painstakingly time intensive and costly to convert. As IQOS ILUMA continues to take share, it will automatically act as social proof, validating the platform for others. It’s important to note that the growing number of IQOS users is a lagging indicator for volumes since there is usually a ramp time between trial, adoption, and fully switching to the device. Today’s margin loss is tomorrow’s gain.

While I am not one to try calling shots with precision, it is far more likely that we are at, or within 1 quarter of, bottom of the trough gross margin. Though mind you, now with Swedish Match under the hood with IQOS, continued investment should not be protested, and operating margin recovery may be muted. Growth must be financed, and if recent performance is any indication, there is a long runway ahead.

Volumes and values

IQOS

In Q1 2023, Heated Tobacco Unit volumes grew by ~10.3%, with volumes of 27.4 billion being comfortably at the higher end of the previously guided 26-28 billion range. Q1s, historically, are a weaker volume quarter than Q4, and this year had a notable impact from wholesaler and distributor inventory movements. Even so, PMI has maintained previous full-year guidance of 125-130 billion HTU volumes, suggesting a notable acceleration in the second half of the year.

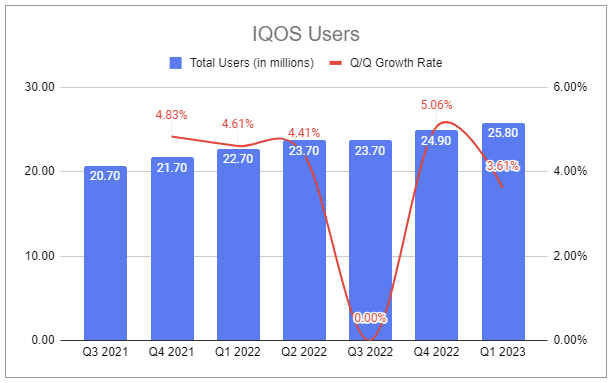

I believe the most intuitive and meaningful metric currently available to gauge IQOS success is simply the number of users.

IQOS user growth is followed by sustained associated HTU growth and reflects the cadence of trial, adoption, and shift from poly-usage to exclusive usage. Investments in ILUMA have been well-deserved, as PMI CFO Emmanuel Babeau illustrated during the call (emphasis added throughout):

IQOS ILUMA has been a positive catalyst for volume and share growth across a broad range of launch markets, both supporting our strong position in the heat-not-burn category with a superior user experience and fostering further category growth.

For existing IQOS users, ILUMA drives an accelerated upgrade cycle. This enhances retention and full conversion for the future with a temporary margin impact from concentrated device sales. Indeed, we are now approaching an estimated 10 million ILUMA users with ILUMA taking over 85% of HTU volume in the first launch market of Japan, Switzerland and Spain. ILUMA is also enabling better acquisition and conversion of legal age smokers with market share acceleration visible in both earlier and more recently launched markets, such as Italy and Korea.

ILUMA’s claimed superior user experience continues to be substantiated by reviews highlighting consistency, intuitive design, and critically, its ability to best replicate the experience and ritual of cigarette usage. As HTP begins to emerge as a premium category, IQOS is best positioned at the top.

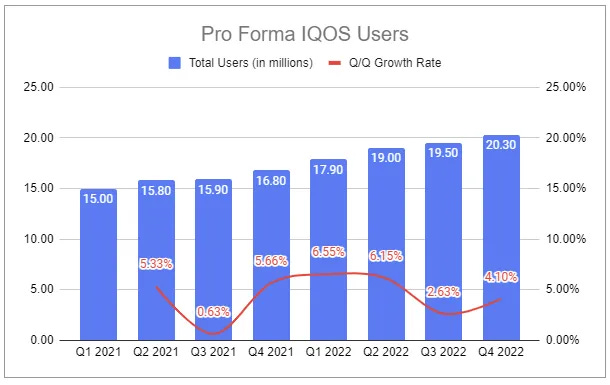

The discerning eye might notice that the IQOS user growth data provided by the company this quarter looks different than the last few reports, such as the aggregated data through FY2022.

PMI has shifted away from segregating operations and presenting data pro forma with the exclusion of Russia and Ukraine. It only makes sense for PMI to continue to abstain from a Russian exit. The current climate guarantees any potential sale price for its related operations would be equivalent to theft. However, I think it is somewhat disappointing to not have greater granularity provided in reporting. The unique challenges facing Russian operations paired with the halting of further major investments in the country only obfuscate the resulting consolidated numbers.

Disappointment aside, hitting the midpoint of guided HTU volumes would result in full-year shipments of 127.5 billion. This would represent a y/y growth rate of 16.8%. With the continued success of ILUMA, a double-digit (teens) growth rate could be maintained on HTU volumes for years even without successfully reintroducing IQOS into the United States, which PMI continues to invest in and plans past 2024.

I remain guarded towards IQOS’s reentry into the U.S. and feel that the company is actually in a more awkward position than most want to admit. Yes, there is the allure that HTUs would take share from cigarette volumes, of which PMI has no share in the United States, thus capturing purely incremental volumes. But HTP, as a category, is not established in the United States and only the IQOS 3 version has PMTA authorization. Rushing to push IQOS 3 into the United States may be a serious risk to the brand. While a good product, it’s notably inferior to ILUMA, and with a lower conversion rate, the company may turn off would-be ILUMA adopters and struggle to gain momentum. But does PMI really want to take a slower, conservative approach? A PMTA for ILUMA will likely be submitted sometime in H2 2023. But there is no guarantee it gains authorization, and if it does, there is no clear timeline of how long that will take. Conversely, if IQOS 3 does gain momentum and the company then introduces ILUMA, the costs from the upgrade cycle may weigh heavily on margins in the future just as it is currently doing in more established HTP markets. And mind you, this will all be occurring as major competitors that have larger U.S. sales and distribution infrastructure relative to PMI will be working to introduce their own HTPs to the U.S. market.

Equally challenging is the company’s rollout of BONDS in test markets around the world. BONDS is a bladeless heated tobacco product that, while still premium, is designed for low and middle-income consumers. While commercial success remains uncertain, PMI has claimed strong progress, as BONDS offers an accessible option that overcomes the difficult category barrier of device cost.

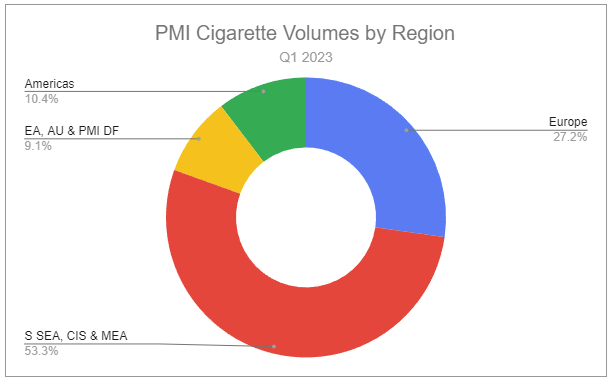

Cigarettes

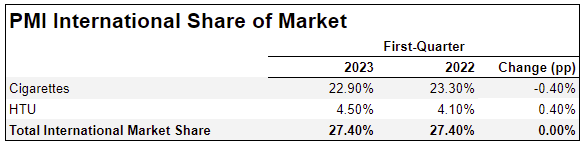

In Q1 2023, cigarette shipment volumes declined by 3.1%. Continued weakness should be evident throughout the year due to several notable excise tax increases in markets such as Japan and Pakistan, as well as heightened pressure on consumer purchasing power in the Philippines. Naturally, part of the cigarette volume declines should be attributed to the continued success of IQOS, and combined total volumes decreased by 1.1% y/y for the quarter. Nonetheless, full-year combined shipment volumes of cigarettes and HTUs are guided to be stable to positive. Full-year cigarette volume declines continuing Q1 performance paired with the midpoint of guided HTU volumes would equate to total combined volumes of 730,129 million for the year, -.13% less than the 731,077 for FY 2022, meaning any easing in cigarette declines will lead to a third year of aggregate volume growth.

With increasing competition, namely from British American Tobacco’s Glo Hyper X2, it is likely that PMI will be unable to hold such a staggering share of the HTP category. However, with HTP taking incremental total share, along with IQOS cannibalizing competitors’ combustible brands at a faster rate than PMI’s own, it is likely that total share remains between stable and low growth.

Positive competitive forces and a potential third consecutive year of volume increases paint a compelling picture. However, more compelling is the quality of those volumes. Cigarette volume declines were met with aggressive pricing of 7.4% in the quarter, above historical trends, and more than double the 3.6% of Q1 2022. Full-year price variance should fall between 6% and 7%, which will be further aided as the company tackles related COGS headwinds. Additionally, the substantially higher gross margin profile and higher net revenue per unit of HTUs will unavoidably help group performance as they take total volume share - which will also become more pronounced through the rest of the ILUMA transition. On an operating level, further relief should be recognized through additional cost-saving efforts as well as the fact that many investments were front-loaded at the start of the year.

Swedish Match

Organic growth highlighted in the sections above exclude the exceptional contribution of Swedish Match. The Swedish Match business, now firmly under the hood of PMI, delivered quarterly y/y FX-neutral net revenue growth of plus 14.3%, of which smoke-free product was 77%. The performance was led by the tobacco-free nicotine pouch ZYN, which saw U.S. volumes increase by 47% y/y, and around 30% when adjusted for inventory movements.

Does continued robust growth suggest that PMI got an absolute steal of a deal on this acquisition? The company has certainly made ZYN the focal point, and perhaps rightfully so. In 2016, ZYN was available in only ~4,000 stores in the western United States. By the end of 2021, the brand’s nationwide footprint was 120,000 stores. Despite competition from Altria’s on! and non-premium products, ZYN has held a lion’s share of the retail market, and as of Q1 2023, ZYN is in over 141,000 stores, representing a 13% increase y/y. And on top of this, volumes per store per week are up 21% y/y. Surely these numbers justify continued investment to grow distribution and consumer awareness in an effort to further build brand equity in this burgeoning category. It certainly sounds like this is a home run. But as beautiful as charts like U.S. ZYN volumes may be, I feel compelled to curb my enthusiasm by highlighting a few contrasting points.

‘Swedish Match’ and ‘ZYN’ are often referenced interchangeably. Even in my own writing, I have been guilty of being ZYN-centric. But Swedish Match’s operations are far more than just ZYN. Within the oral segment, the company also sells Snus and Moist Snuff. Total oral volumes were up by 9.9% y/y in the quarter. But Snus, the company’s second largest oral category, saw volumes decline by 15.7%, nearly entirely driven by excise tax and price increases in Scandinavia. At the same time, Moist Snuff experienced a 3% increase in shipment volumes due to share gain. All of this is to say, the company’s total oral segment is not performing as well as ZYN, which is important to stay mindful of. Additionally, to date, no tobacco-free nicotine pouch has received PMTA authorization in the U.S., including ZYN. At the same time, British American Tobacco has submitted a PMTA for its superior European version of Velo, which has taken an impressive share overseas, and Altria is moving forward with on! Plus, a larger, stronger moist pouch, with plans to file a related PMTA in 2024. We can expect ZYN’s market position to be tested in more than one way. PMI CFO Emmanuel Babeau addressed some of these concerns during the call:

Yes. I believe that with Swedish Match, we have the biggest specialist, super-focused, knowledgeable player of the oral nicotine category. So we've been adding to that amazing skill, Fertin -- you may remember that we bought this company that is specialized in formulation of product some of them, including nicotine, and that can also come with very nice innovation in the form factors. So you should expect us. Of course, don't expect me to come down with detail, but you should certainly expect us to come with nice innovation.

There is certainly the appetite in some area from the consumer to try new things, new reduced risk product to develop this oral nicotine category in other spaces, probably the consumer doesn't know as well what can be done. So it's for us, it's our duty to come and make some proposal. But I guess you can expect us, and I think we demonstrate that PMI and now in the PMI per Swedish Match to be leading innovation in this category as well in the future.

Fertin, referenced, is now part of Vectura Fertin, leading the company’s Wellness and Healthcare segment. During Q1, the segment reported an operating loss of $38 million on net revenues of $86 million, primarily driven by research and development. The operations remain a bit of a black box, and losses may continue to widen, though the net fiscal benefit may ultimately be expressed through the oral segment. Fertin’s standalone website cleanly illustrates potential future routes.

Swedish Match also sells mass-market cigars, which is ironic, as PMI acquired the company to advance its vision of a smoke-free future. However, cigars are a relatively minor part of operations. Though, I find the performance impressive and continue to view the total cigar category as underrated. During Q1 2023, Swedish Match’s cigar volumes experienced a 4.2% volume increase y/y as well as increased pricing.

Many analysts have floated the idea of PMI spinning/selling off its cigar operations. It makes sense, as it is merely an afterthought that does not contribute to the company’s primary goals. But spinning it off as a standalone would likely starve it of necessary distribution influence and legal resources. Sale proceeds would help deleverage to a small degree, but to make a sale, a willing buyer must first be found. There is only a short list of companies where a fit makes sense. There is Altria, but the FTC may have concerns due to the company’s JMC subsidiary already holding a large share of the U.S. market. Altadis is a potential suitor but may want to focus more on handmade variants. The most obvious fit might seem to be Scandinavian Tobacco Group (STG), which was formed in 2010 through a merger that included Swedish Match’s premium cigar, European cigar, and pipe tobacco business. STG already holds a massive mass-market cigar business, but those operations are nearly exclusively focused in Europe. STG has been engaging in continual M&A, but nearly all deals are focused on acquiring premium handmade cigar brands which have more distinct synergy potential. Could PMI still sell to one of these or another interested party? Certainly, if the price is right. But despite the cigar business being nearly inconsequential to PMI, a reasonable future is one in which the company holds onto the cigar operations that continue to kick off a modest amount of cash. The same can be said for Swedish Match’s Lights operations.

As a segment, Swedish Match reported Q1 net revenues of $581 and an adjusted operating income of $261 million. The adjusted operating margin of 44.9% is in-line with the full-year 2021 and above the 41.5% achieved in Q3 2022. Margins may come under pressure depending on how aggressive PMI chases growth, though pricing may offset some of the headwinds. As noted previously, Swedish Match’s U.S. footprint will assist in reintroducing IQOS into the U.S., regardless of PMI’s cadence, and PMI’s global infrastructure will be used to grow Swedish Match’s Oral business. PMI has signaled 10 such launches throughout the rest of 2023. That is likely just the start.

E-vapor

While PMI is the overall leader in the nicotine pouch and heated tobacco categories, it is an undeniable laggard in e-vapor. There were 2 key standouts shining a light on this in the report and during the quarterly call. First was the notable omission of any explicit reference to PMI’s collaboration with KT&G. Second was that PMI recorded a pre-tax asset impairment and exit cost of $109 million due to the initiation of fully outsourcing and restructuring of e-vapor device and consumable manufacturing. PMI CFO Emmanuel Babeau explained the plan during the call (emphasis added):

Look, I think we've already been clear that while we were clearly developing some offering on the vaping category, this was not our priority. We had IQOS. And now I would say we are even more taken by 2 priorities, which are IQOS and ZYN. When you have such a fantastic team and the potential that they have to deliver very strong top line growth, volume growth, revenue growth and in a very nicely profitable fashion, that's really the priority.

I guess you listened to us at CAGNY and we expressed the questioning that we have on the vaping category today, which are around the absence of clear regulation in many countries. The fact that, that is giving way to an appropriate marketing activities, risk of underage consumption. And also the fact that this is a category where so far it's difficult. I'm not saying impossible, but difficult to see a lot of profitable model being developed. And therefore, that is pushing us to look at that and continue to work on this category and the fact that we are coming with this evolution of the range, I think, is just in line with the fact that the technology is evolving.

In this light, PMI’s strategy of prioritizing the other two next-gen categories appears sound. Most interestingly, it runs counter to the vocal many questioning HTP viability in the U.S. while remaining fixated on e-vapor. Who here is wrong? Or can multiple companies succeed with different competencies? Time will tell.

Leverage

Philip Morris International currently has ~$47.1 billion in total debt, ~$2.4 billion in cash, and holds:

an interest coverage ratio of x15.19

a total debt/adjusted EBITDA ratio of x3.51

a net-debt/adjusted EBITDA ratio of x3.33

Except, of course, that isn’t true. Swedish Match only contributed to LTM earnings beginning November 11, 2022. Adjusting for a full contribution would shift the numbers approximately as such:

Government impact

While governments historically have inadvertently lent a helping hand to insulate the profits of big tobacco, from time to time they bite the hand that feeds them. Excise taxes in Germany and Japan hit HTUs. Scandinavian excise taxes hit oral products. A sudden increase in excise tax in Pakistan resulted in an explosion of illicit trade and a 30% decrease in industry cigarette volumes. As a global operator, PMI is too big to fully avoid such occurrences. However, the fact still remains that PMI is best positioned to mitigate and navigate such challenges. It is likely that as governments witness follies (such as Pakistan’s), they will take more measured approaches in their own excise tax management. This, paired with regulatory frameworks continuing to shift to Tobacco Harm Reduction, should work to PMI’s benefit. Additionally, not all impacts are promised to be permanent. The legality of the recent German excise tax surcharge on HTUs is currently being challenged in court. A favorable ruling could ultimately result in full-year net revenues 1% higher and adjusted diluted EPS 3% higher.

Valuation

Truthfully, Q1 shows not much has changed in the grander story. As Philip Morris International continues its impressive trajectory on a much longer arc, there will assuredly be challenges and periods that can only be described as rocky. I am not in the business of attempting to anticipate and accurately map global governmental behaviors, FX dynamics, and other immensely complex factors at play. What I am interested in doing is continuing a conservative approach in viewing the company on a pro forma basis by excluding the contribution of Russia and Ukraine, as well as other measures such as understating pricing variance and aggregate volume growth levels. I have refrained from attaching an updated model to this piece as there is effectively nothing to update. Philip Morris International remains a far-above-average company priced below average. Why make it any more difficult than that?

If you enjoyed this piece, please hit the like (heart) icon and consider sharing it. Your support means a great deal and only helps Invariant improve.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Philip Morris International, British American Tobacco, and other tobacco companies such as Altria.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 0.00%↑ BTI 0.00%↑ MO 0.00%↑

Additional Resources:

Philip Morris International - Reports and filings. Source

Great update Devin!

Excellent analysis as always.