“Nobody should be able to operate a cigar business at higher margins than we can. Nobody should be better at buying and integrating companies than us, and nobody should be better at working capital and cash flow generation than we are.” - Niels Frederiksen, STG CEO, Capital Markets Day 2023

Scandinavian Tobacco Group’s Capital Markets Day on November 21st was set to be eye-opening—it had been two years since the company hosted such an event, in which all executives took turns walking through their individual operational focuses. This year’s was far less engaging, with the group’s CFO, Marianne Rørslev Bock, unable to attend due to pneumonia, plus the less lively pre-recorded remarks by Sarah Santos, Senior VP of the North America Online & Retail division, for which no explanation for pre-recording was given. Nonetheless, alongside STG’s Q3 results, published November 8th, the event provided a good degree of additional detail into the group’s evolution, and there was one word that stood out above all the rest:

Pockets.

Management expertly highlighted the strong points of the business and pointed to pockets of opportunity to drive further growth and profitability. At the same time, in a rare, refreshingly candid way, they also took time to explicitly detail pockets of the business that are struggling. Each is worth exploring.

To get up to speed, read my initial report on Scandinavian Tobacco Group, first published in July.

Europe Branded

Europe Branded organic net sales, comprised predominantly of machine-made cigars and pipe tobacco, declined by -5% y/y. This exceeded the decline in the broad market of -3%, compounded by a 50bps loss of market share over the period. The segment’s reported net sales, gross profit, and EBITDA were down -3.5%, -13.29%, and -23.81%, respectively. While not explicitly stated during the Q3 call or CMD, STG has faced competitive pressures from flavored machine-made cigars, a subsegment it lacks offerings. Additionally, the loss of market share was likely driven by relatively aggressive pricing, in which the group took MMCs up 7% y/y to combat volume declines on top of previous supply chain issues and excise tax increases—alongside a sizable and growing black market for smoking tobacco. Offsetting pricing, the significant drop in margins additionally stemmed from a loss of scale advantage from declining volumes. Jesper Madsen, STG’s Chief Supply Chain Officer, offered a comment related to the group’s total production footprint during the Capital Markets Day:

We constantly work with evaluating our footprint. And you can say for our side, there are areas where we're actually looking at whether we need to add capacity because we can see that we are growing in some of the areas for our manufacturing footprint. And there are also areas that we're looking carefully at as to whether or not at some point in time, we would need to take a decision on our manufacturing footprint. But so far, not anything that is on the table for now. We're also looking at some of the new categories, where we can see from the competitors that we have is that at some point in time, when we grow that category to a certain level, then it becomes attractive, actually, to start do the manufacturing yourself instead of having it done by a third party. So all of these are the combinations that we're making. And you would always see that our manufacturing footprint does not remain static. As Niels said, we are in a position where if we do not find mergers and acquisitions, do not find these pockets of growth, we will need to look at also doing changes within the area of our manufacturing footprint. But so far, nothing on the table.

It should be noted that while loss of scale benefits affected the segment, not all markets are experiencing the same trajectory, and volume decline rates across Europe have varied widely, with the UK and France seeing declines of ~10% in the last year, while Germany, the Netherlands, and Italy were all nearly flat. Germany, specifically, is a notable pocket of growth for the business, further illustrated during Capital Markets Day, in which the group’s brand Break took market share, and grew absolute volumes, net sales, and gross profit significantly year to date, despite STG being only the 5th largest manufacturing operator in the country (and much smaller in total footprint).

Additionally, the massive differential in relative net sales to gross and EBITDA declines was largely due to the growth and subsequent reinvestment into next-gen products, which are included in the EUB reporting segment. Along with MONP STRÖM, launched in Sweden in September 2022, and !act, a non-tobacco, non-nicotine pouch launched in Denmark in May of this year, the newly-acquired XQS (acquired in June, ~DKK 150mn) is now a top-five brand in Sweden, with growth accelerating, aided by STG’s distribution infrastructure. Following Q2, I stated I expected net sales and margins to recover over the remainder of the year. This was predicated on improving the relative strength of legacy products and discounted all respect to the potential of XQS, and now can safely be marked as incorrect. Q4 net sales may improve moderately, but margins will continue to be weighed down as the group reinvests more heavily in NGPs, rationalized by the accelerating growth rate, in addition to bolstering its MMC position. The group aims for XQS to reach ten markets in 2024.

A few of the pouch users I’ve spoken with who have trialed XQS have had the following to say:

The packaging is high-quality. The pouches are soft and feel great.

The flavors are unique. Cactus Sour was a total surprise.

XQS is really interesting. I'm not sure how I'd feel about it as an everyday pouch, but it has a distinct flavor. XQS seems to me to be a reasonably differentiated product... I've tried Velo, Lucy, Juice Heads, Fre and they all kind of seem the same.

North America Branded & Rest of World

In Q3 2023, NABROW's EBITDA before special items decreased from DKK 326mn to DKK 321mn y/y, with the EBITDA margin expanding from 38.3% to 39.7% over the period. Margin expansion was a function of organic net sales decreasing by -2.6% and reported net sales decreasing by -4.9%, largely offset by positive pricing and product mix against continued volume declines above the historical decline rate—a clear continuation of normalization following the COVID-related bump, highlighted previously.

The integration of Alec Bradley has gone well, and the company completed an additional small acquisition, targeting La Perla Habana. But the most impressive execution has been the growth of international sales of handmade cigars. For international sales, STG rebranded Cohiba to Silencio, as outside of the U.S. the Cohiba trademark is owned by Habanos SA (the same trademark dynamic is true for many of the group’s portfolio brands.) In total, Cohiba products have experienced a 5-year net sales CAGR of +13% and a gross profit CAGR of +11%. Total international volumes have compounded at +15% over the last five years, with a net sales CAGR of +16% and a gross profit CAGR of +18% for the period. This has continued strongly throughout 2023 so far, largely aided by the evolution of competing Cuban products. In July, I noted:

Although Cuban cigars are still renowned, Cuba is no longer the premier origin it once was, with new world cigars having equal quality and often higher consistency.

Cuban producers have faced a myriad of challenges, exacerbated by the pandemic, which shocked supply chains and further weakened their ability to maintain necessary skilled labor. Following Imperial Brands’ sale of its cigar assets, including the 50% stake in Habanos SA to Allied Cigar Corporation S.L., Habanos has been aggressively raising pricing for its Cuban cigar offerings—some increasing by 20-100% each year. Now, with both the quality and price differentials firmly in STG’s favor, continued international expansion will be a priority objective—and rightfully so. In response to a question posed during the Capital Markets Day 2023 event, comments made by Niels Frederiksen, STG CEO, provided clarity on the immense opportunity ahead (emphasis added):

You say you aim to be the undisputed global leader in cigars. Who is the current global leader, and how significant is the gap to you?

Niels Frederiksen, CEO:

I think it's a good and fair question. I think we may already be the global leader in cigars. There's probably no other company in the cigar industry that has our unique focus on this category, and also the width and breadth of our portfolio and our geographic coverage. But when we talk about being undisputed global and sustainable leaders in cigars, it is because we have pockets of our business where we are not strong in cigars. So we want--and we'll talk more about it today. We want to be a much bigger player in handmade cigars outside the U.S. We also want to build our machine rolled cigar business so that it has a bigger and more global platform. What people often forget is that maybe only 85% to 90% of cigars is consumed, that 85% to 90% is consumed in North America, Europe and Australia and New Zealand. So the Rest of the World don't yet have, let's say, a strong tradition for smoking cigars. And we think especially for handmade cigars, that's a big potential. So we want to be so much bigger than #2, that nobody really questions that we are the leading player in the industry. That's what we are aiming to do.

With momentum benefiting STG, one must ask what further potential international sales have as the largely Western tradition branches elsewhere at the same time that more countries continue to mature economically and discretionary income grows. Much like in the West, it will not be merely about sales volumes, but rather capturing the interest and hearts of consumers and moving them up the premiumization ladder.

North America Online & Retail

Q3 NAOR organic net sales increased by 4.4% y/y, yet an FX headwind of nearly 8% resulted in reported net sales declining by -3.2% for the period. The strength in organic sales continued the trend seen throughout the start of the year, further aided by the group’s small but growing distribution of third-party product, PMI’s ZYN. For the same period, the segment’s EBITDA margin before special items increased from 14.3% to 17.4%—a significant jump reflective of further scale advantage, and efficiency improvements, including a massive revamp of automated warehouse processes.

Since retail represents approximately half of the total value for the cigar category, continued improvement to segment operations represents a material opportunity. Both online sales and physical retail grew in Q3, with retail now representing ~9% of net sales after growing double-digits for the period. STG now has nine superstores operating, all having hit or progressing toward a 3-year target ROIC of 20%. Interestingly, during prior year discussions, management stated an $8-10mn capital outlay for new stores and a target of reaching 20% ROIC in 3-5 years. This acceleration in returns, along with strong execution, is a function of the capital outlay is now estimated to be $5-7mn per store. While the group’s rate of new store opens has been slower than expected, the resulting efficiency from taking a measured approach in assessing optimal locations is hard to argue against. Even if only opening, say, two new stores per year going forward, maintaining optimal placement would lead to a material impact on the segment’s growth rate, along with further driving margin improvements through continued scaling. This holds especially true as the company prioritizes store placement in states with zero or near-zero excise tax rates on large handmade cigars, though management has stated a future interest in trialing opens in states with higher excise taxes if forecasted traffic and volumes are attractive enough.

Although the segment has continued to experience a notable readjustment period across channels following post-COVID normalization, online performance has also been strong. The number of active online consumer profiles, while still lower than last year, has shown signs of stabilizing quarter-over-quarter, with the total remaining >1mn. In 2023, STG implemented new real-time pricing adjustment software to improve value capture and customer retention. Disclosed KPIs also show a drastic improvement over the first half of 2022, with total impressions increasing 25%, site sessions up 53%, total engagement across social media up 46%, and both click-through rate and new email acquisitions up modestly. Below are updated figures showing the growing online value as consumers are retained.

The company also continues to improve its use of targeted email promotions.

Following Q2, I noted the significantly positive development of the U.S. District Court of the District of Columbia issuing a final Memorandum Opinion in which the FDA’s deeming rule would no longer apply to premium cigars. While the FDA has appealed the decision, the ruling allows manufacturers to operate without additional burdensome regulation. This is especially beneficial to small operators, which likely reduces the total potential pool of future acquisition targets for STG that are predominantly focused in the United States. However, it seems most likely that STG will be more interested in targeting acquisitions to bolster volumes of MMCs in Europe, in which operators would be more inclined to sell while facing elevated pressures—further helping STG regain its scale advantage. At the same time, the ruling in the U.S. will allow STG to more easily collaborate with other groups to release limited-edition blends, which can then be offered exclusively either through its online channels or in its retail stores, further reinforcing the group’s position.

Stitching it all together

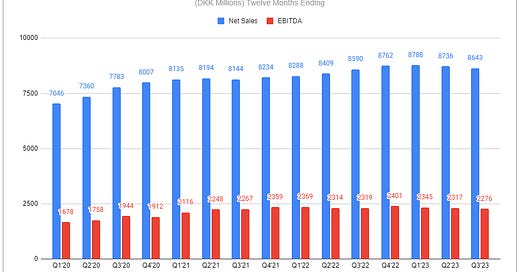

Pockets of growth. Pockets of struggle. When stitched all together, group performance has remained strong.

Scandinavian Tobacco Group has maintained the updated full-year guidance it issued following Q2, including:

Net sales: DKK 8.7-9.0bn

EBITDA Margin: 23.5-24.5%

Free Cash Flow: DKK 1.1-1.3bn

Adjusted EPS: DKK 14.0-16.0

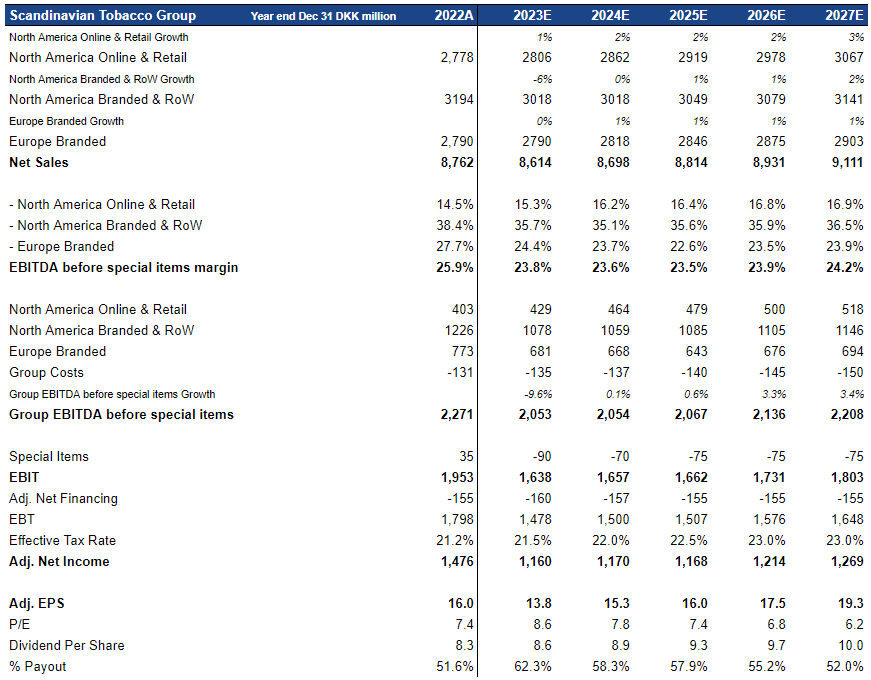

This would require a notably stronger Q4, which I am not inclined to assume. Yet, looking beyond, even assuming weak growth in NAOR offset by margin strength via warehouse automation, zero NABROW growth in 2024 as a proxy for continued weakness following post-COVID adjustment offset by price/mix, and a close-to stabilization in EUB with increased related investment pressuring segment margins, the next few years could conceivably appear as the following:

With an (ideally) conservative hand, the above largely discounts the trajectory of growth enablers, now defined by the company as NGP products, international sales of handmade cigars, and its physical retail footprint, which in total accounted for ~5% of group net sales in 2022 and now represent 8%. Additionally, Future outcomes are certain to look quite different from the above due to future M&A, which is fair to expect, though exact size is not. Further, on a per-share basis, results look more compelling, as the company recently announced a new DKK 850mn share repurchase program to run through February 2025 at the latest, which currently represents 8.26% of total share capital.

Further providing conservatism, the above still excludes the future impact of the group’s ERP rollout, in which DKK 150-250mn of annualized cost savings are anticipated. Associated costs of this program have been included in the company’s reporting, yet little benefit will occur until it is finalized on a global scale, ensuring the majority of savings and enhanced profitability will not be visible until 2025 and beyond. Should this occur, free cash will be materially higher than what would otherwise be implied, providing ample room to continue retiring considerable share capital. Management remains steadfastly focused on increasing per-share ownership of these uniquely enduring operations.

If you enjoyed this piece, hit “♡ like” and give it a share.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Scandinavian Tobacco Group and other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Imperial Brands.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

There Ström products were very good. I had a few. I shifted from rolling tobacco to pouches.

I don' t know if Ström is dicontinued, they are not longer listen at the online store i normaly buy. You can not buy pouches in Germany in normal stores. But you can order them online legally because Denmark and Sweden are EU members.

Thank you Devin! I appreciate reading XQS user testimonials. This kind of “boots on the ground” information makes your piece unique.

I find it interesting that Asia, Latam and Middle East represent such a small percentage of cigar sales and that STG wants to expand sales there. That’s a pretty big “pocket” and is definitely worth watching.

> further aided by the group’s small but growing distribution of third-party product, PMI’s ZYN

Somehow I always assumed that SM was distributing ZYN itself in the US and that a big rationale for PMI’s acquisition of SM was to get its distribution network to help with IQOS distribution.