Altria: Ins and Outs

“Our core tobacco businesses delivered solid financial performance again this year in a dynamic external environment. The smokeable products segment delivered over $11 billion in adjusted OCI for the full year and expanded adjusted OCI margins by 1.8 percentage points to 63.4%. This performance was supported by robust net price realization of 8.4%.” - Salvatore Mancuso, Altria CFO, Q4’25 remarks

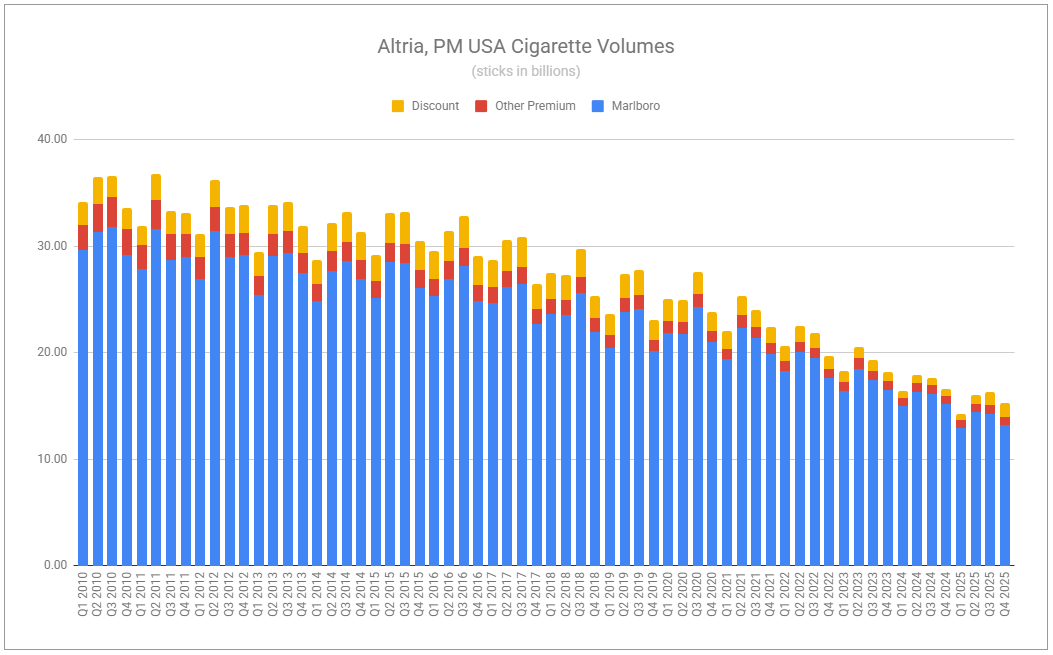

The headlines write themselves. Volumes down. Eroding market share. Plot the trends on a chart, and the company will appear headed toward oblivion.

We both know it is not that simple.

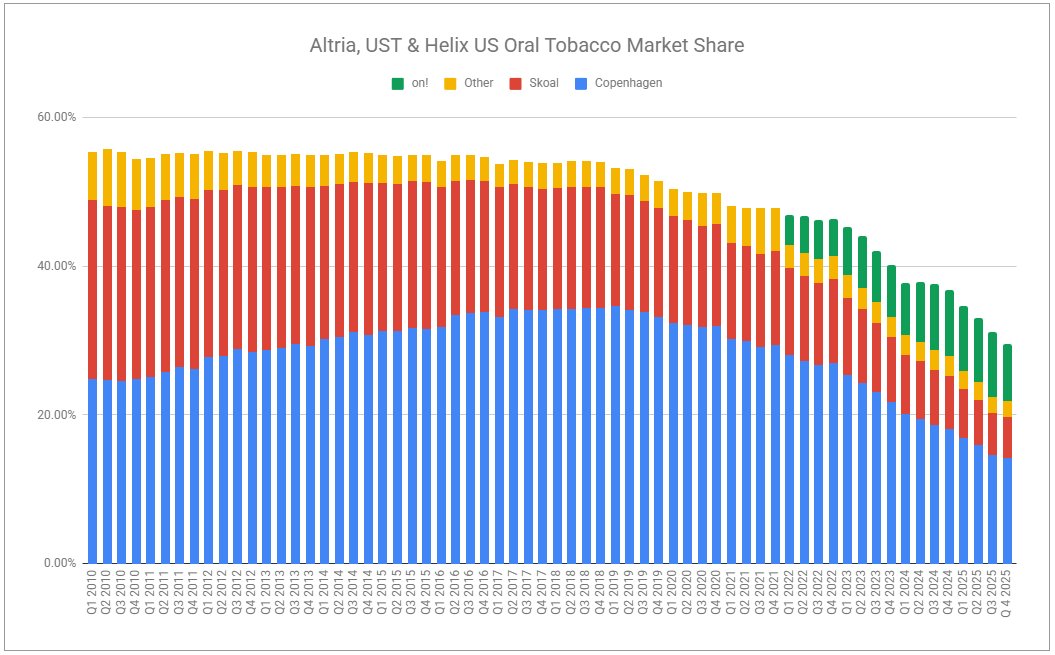

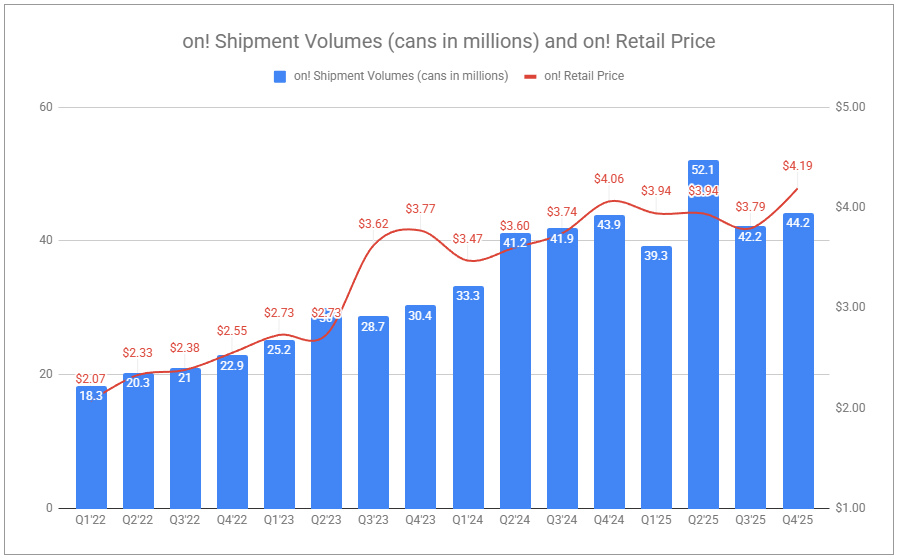

I’ve often cited the importance of zooming out to shed short-term noise. But what period is right? If we look at FY’25, Altria’s oral segment grew adjusted OCI by 1.3%. But there is truth in the idea that zooming in helps you identify the potential formation of new trends, or at least things deemed worthy of keeping a pulse on. Q4 showed revenues net of excise up 2.9%, while adjusted OCI was down 4.6%, partly reflecting reinvestment, and partly confirming the pressures participants in the nicotine pouch category are under, while pouches themselves continue to cannibalize legacy volumes swiftly. on! volumes were up 10.9% for the year, while only up a mere 0.7% in Q4. Against a backdrop of competitors cutting prices and engaging in far higher degrees of promotion, the trade-off is not all too painful considering on!’s average retail price climbed $0.11 year-over-year.

Yes, more volume declines within the segment are to come. Legacy volumes will not be spared; however, rest assured that plenty of pricing will occur, as users switch to pouches. The trajectory of on! may not be as rosy as it once was, given new competition and increased promotion. However, Altria will surely apply pressure of its own with the recent authorization of on! Plus, which was fast-tracked following last quarter’s note, which stated:

on! Plus’s advanced launch was in defiance of the FDA, indicating a more aggressive approach by Altria to capitalize on the category’s growth. Whether the FDA takes action against this launch is as uncertain as whether Altria will roll the product out nationally in the near term. While Altria had initially stated that the product would be launched in a few select states, the product became readily available online on on!’s standalone website, with shipping available to the majority of states. It appears on its standalone website for on!, Altria has stopped selling on! Plus in the United States, indicating potential apprehension. Avoiding FDA hostility may be for the best in this instance, as one of the most significant recent developments is the FDA’s announced pilot program to expedite PMTA reviews concerning pouches, which on! Plus is included. With the prospect of determinations being made by year-end, the US market could be shaken up significantly with on! Plus, European Velo Mini, and ZYN Ultra

Keep reading with a 7-day free trial

Subscribe to Invariant to keep reading this post and get 7 days of free access to the full post archives.