“And there ain’t no day

And there ain’t no day

And there ain’t no night

And there ain’t no night

And there ain’t no day

And there ain’t no night

Into the white

Into the white

Into the white” - “Into the White,” Pixies

It was not all that long ago that British American Tobacco was touting its ESG initiatives when its previous CEO stepped down, coincidently timed close to announcing the company had entered into a deferred prosecution agreement with the US government for violating sanctions by selling cigarettes to North Korea, netting a big fat fine. The once-promising Russian operations have been sold. More recently, the company announced it would be writing down the value of some of its US cigarette brands by around £25 billion. Now, the impairment charge has been declared at £27.3 billion. Willingness to reinvest in next-gen products continues in defiance of mixed results, undeterred by equally persistent economic and competitive pressures. And yet, despite flashy graphics and vibrant colors found throughout presentations, somewhat obfuscating from the dark points, true bits of brightness shine through. The group’s aggregate legacy performance produces enormous cash; new categories flipped to profitable contribution; deleveraging proceeds apace; perspective on the ITC stake received a spotlight. In all, the fundamentals appear fairing far better than the widespread pessimism plaguing the equity would suggest.

A mixed bag

For the full year, BAT’s US combustible volumes decreased by 11.3%, due to a mix of macro pressures, competitive pressures from downtrading and illicit vapor, and the impact of the California flavor ban—a rate at which price/mix was clearly unable to offset. The company sees primary pressures easing and continues to place great emphasis on the macroeconomic impacts, believing the industry decline rate will revert closer to a mid-single-digit range. The perspective offered, as I interpret it, falls short. The company’s optimism appears rooted in an expectation of elevated and effective enforcement against illicit disposables, a potential tailwind I have covered throughout the last year. However, it remains unclear to what extent material actions will occur on a federal level. Running counter, state-level actions are progressing at a clearer pace, such as PMTA registry bills, as covered two weeks ago—a list that can now add Alabama’s HB 65 and Oklahoma’s HB 3971. Even though BAT would clearly stand to benefit, it remains unclear exactly how the company intends to maximally balance volume and value share as it prioritizes a more laddered portfolio of products, with extra emphasis on the value tier with Lucky Strike. While clear parallels exist to Altria, which has introduced Marlboro Black Gold, BAT’s strategy largely runs counter to the sole premiumization focus.

Outside of the US, combustibles continue to be a very different story. AME reported combustible volumes declined 5.7%, with revenues up 0.3% due to strong pricing. However, the period was affected by the sale of operations in Russia and Belarus, adjusting for which shows organic volumes increasing by 1.2% and revenues up by 8% on a constant currency basis. In APMEA, combustible volumes declined by a hefty 10.6%, largely due to Pakistan's substantial excise tax increase. Aggressive pricing more than offset the decline, leading to constant currency revenue growth of 5.2%, however, significantly adverse FX rates led to reported revenues down 4.5% on the year. While reported results are not as impressive in isolation, the stark differential in performance between the US and the rest of the world is further highlighted by the evolution of new categories.

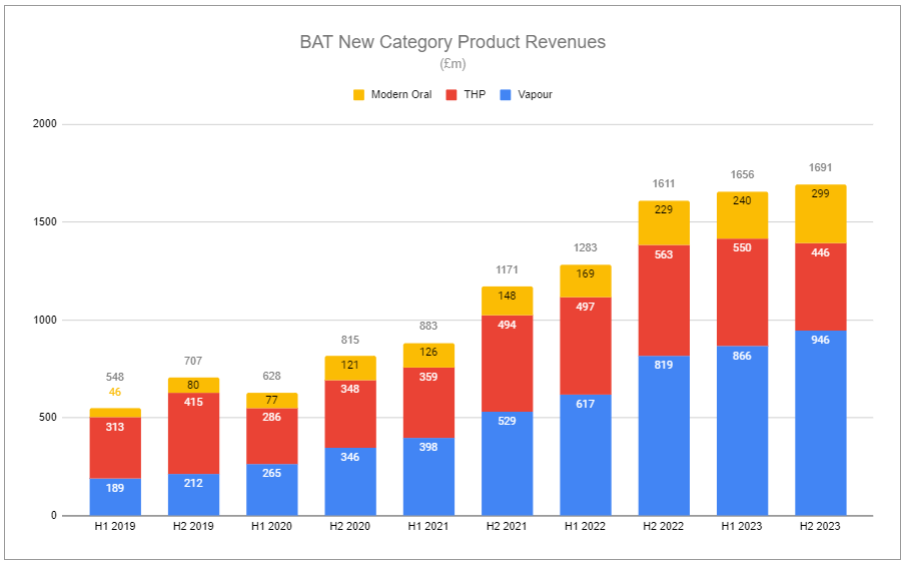

US vapor volumes decreased by 6.6% for 2023. While still dominant in share of pod-based systems across tracked channels, illicit vapors have continued to proliferate. Nonetheless, continued pricing led reported US revenues to increase by 13.1%. AME vapor volumes increased by 19.4%, and revenues grew by 47.6%, and 46.5% when organically adjusted at constant rates. APMEA vapor volumes balooned by 43.1% and increased revenues by 60.5%.

US modern oral volumes continued to erode, reflecting the inferiority of the Velo 1.0 currently in the market, dropping by 10.9% in 2023 and reported revenues experiencing even worse, falling by 32.2% for the year. US oral remains a growth segment led by ZYN and on! while BAT awaits determination on its PMTA for its modern oral variant leading in the rest of the world. Velo’s weak position further adds insult to injury as modern oral cannibalizes legacy oral, reflected in BAT’s traditional oral volumes down 10.9% for the year and reported revenues declining 4%. The other two regions demonstrate polar opposite results. AME modern oral volumes grew 36.5% and 37.5% organically, with reported revenues up 41.5% and 44.6% organically at constant rates. APMEA sported similarly impressive results, albeit off of a much smaller base, with volumes up 36.2% and reported revenues increasing 50.3%.

Heated tobacco continues to offer no contribution to US results and is undoubtedly the most challenged new category of the other two regions. AME heated tobacco volumes decreased by 7.5%, largely due to the timing of the sale of operations in Russia and Belarus. Even so, reported revenues increased by 2.3%. Excluding the two countries, organic volumes increased by 23.4% in the region and organic revenues climbed 23.1% at constant rates. APMEA reflected a more concerning development, with volumes up 4.9% and reported revenues down 13.2%, and at constant rates, revenues were down 7.3%. The lackluster performance reflects glo’s struggles in the Japanese market, which continues to be dominated by PMI’s IQOS. While the recent patent settlement between the two companies is ultimately a benefit, and despite glo Hyper Pro showing notable improvement from previous versions, IQOS ILUMA remains a distinctly superior product that is likely to challenge BAT’s success in the interim, as highlighted in the most recent PMI piece.

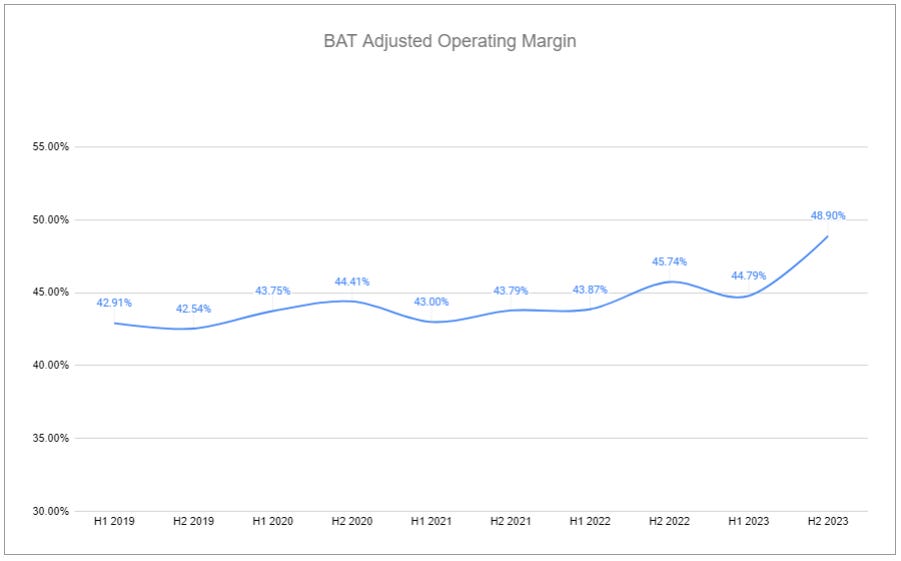

Despite the struggles in heated tobacco, the sustained topline growth of new categories is well visualized in the aggregation of reported revenues, growing by 15.65% year over year and making up 12.3% of total group revenues. Even with elevated reinvestment remaining, aggregate volume growth and pricing have led to new categories inverting to profitability two years ahead of initial targets. Not only are new categories no longer a losing drag on group financial performance, but continued economies of scale should be reflected in positive group margin evolution.

Deleveraging proceeds apace

British American Tobacco’s focus on deleveraging has proven responsible. Even while continuing to reduce debt in both absolute terms and ratios, its net financing expense increased nearly 12% year over year and remains a considerable headwind, with 2024 guidance including another 5.6% jump to ~£1.9 billion. Stripping out the contributions of Russia and Belarus shows a net debt / adjusted organic EBITDA ratio of 2.61x, within a finger’s length of the target point to reevaluate and resume share repurchases. However, Imperial Tobacco Canada (ITCAN) remains protected under the Companies’ Creditors Arrangement Act, leaving approximately £2.35 billion in trapped cash. Adjusting for such moves the leverage ratio up toward 2.79x, suggesting that if BAT’s management continues to act conservatively, further deleveraging will push new authorization of share repurchases back toward 2025. This would be further delayed when considering a change to the leverage ratio denominator when stripping out ITCAN’s financial contribution.

ITC in the spotlight

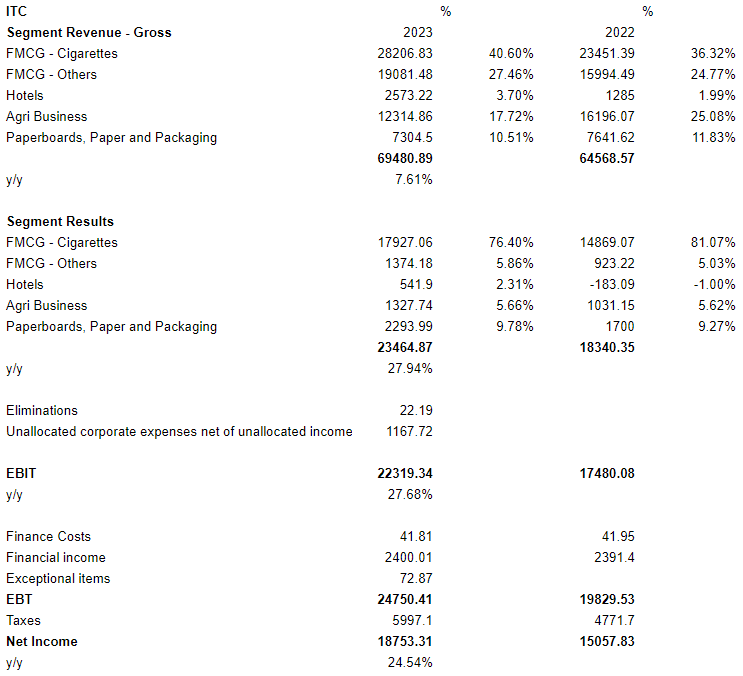

There was already eagerness surrounding ITC’s spinoff of its hotel business, and now everyone has become giddy over British American Tobacco readying a potential partial sale of its full ITC stake.

The stake in ITC is slowly being diluted due to ITC’s stock-based compensation, falling from 29.19% to 29.12% in H1 of 2023, and is bound to slowly fall further. BAT’s management has expressed the intent to maintain a stake greater than 25% to retain its privileged veto rights, meaning that an initial trimming is unlikely to take it right to the line. While a partial sale could accelerate deleveraging and the date at which share repurchases resume, it’s prudent not to expect a sale soon as there is no definitive timeline and approval from the Indian authorities is yet to be granted. Further, as accretive as a partial sale and redeployment of that capital elsewhere may appear, it’s worth revisiting what the Indian market represents in terms of opportunity.

As noted previously, in 2022, during the Deutsche Bank Global Consumer Conference, Tadeu Marroco stated (emphasis added):

…India will be the largest country in terms of population in this decade. So it's not one more country, so start there. ITC is performing well. You see their share price is back to the pre-pandemic levels now. And we believe that in new categories we might have opportunities in India. The oral tobacco size of India is largest than the rest of the world, as big as that. So, if you add all that... So we talk about modern oral in the US, in the Europe, if you add all that across the world, India is still larger than that. So we believe that we might have opportunities there. And that's the strategic reason why being there at this point in time. I don't know if we're going to stay another 15 years or not, but the fact is that you note that there is a ban for foreign direct investment in tobacco in particular. So it's hard to get assets to that market. It's hard to pull out, but we are satisfied with the performance of ITC for the time being. And we are hopeful that these new categories could present towards a strategic opportunity in future.

India has already surpassed China in population. Further contextualizing the tobacco market, despite legal cigarettes making up ~90% of global product volumes, they make up only 8% of volumes in the Indian market. India currently holds 17.76% of the world's population and only consumes ~2% of the world’s cigarettes, signifying incredibly low per capita consumption. Partly explaining this is the exorbitant tax rates on cigarettes in the country, a magnitude higher than many developed countries. Previous substantial increases in cigarette taxes had also fostered a large illicit market, providing a significant headwind for ITC. However, over the last three years, Indian cigarette taxation has become more rational, and government actions to crack down on illicit volumes have largely acted as a positive catalyst for the company. Further fostering a black market, in 2019, the Prohibition of Electronic Cigarettes Act was passed, banning vaping and heated tobacco products. Illicit activity aside, India is by far the largest market for oral tobacco, eclipsing the rest of the world combined, suggesting an opportunity for a product like Velo is immense, especially with FDI regulation barring would-be competition. Materialization of such an opportunity has not occurred and appears less likely as time passes. Nonetheless, even without the entry of BAT’s products, the sole operations of ITC proved robust in 2023.

Rounding down

Although there is far higher rigidity in regulation for legacy tobacco products versus the relatively nascent next-gen categories, significant uncertainties remain for both. With a unique mix of each, across diverse geographies, I have continually suggested that the spectrum of potential futures facing British American Tobacco is the widest for any of the major operators in the industry. In the interest of conservatively rounding down expectations, what would a possible future look like if:

US combustibles sustain weakness and avoid stabilization

Despite the delay of a federal menthol ban, an eventual rule was enacted in 2028, resulting in a significant drop in US combustibles revenue and a compression of operating margin

Even with Vuse Alto permanently staying on the market, illicit vapor continues to weigh on not only US combustibles but also the growth rate of pod-based devices

BAT never enters the US with a heated tobacco product

BAT never receives PMTA authorization for its superior Velo 2.0 product

BAT’s traditional oral is cannibalized by competing MONP brands at an accelerated pace

AME and APMEA combustibles remain relatively stable

AME and APMEA heated tobacco shows sluggishness, reflecting a continued dominance of PMI’s IQOS

BAT’s MONP and Vapor continue to show relative promise

Net financing continues to increase at an elevated rate

Associates & JVs, namely ITC, provide weaker contribution growth

The effective tax rate marches higher

Such a future is possible but is likely improbable. A few caveats on group operations:

Should BAT’s efforts to stabilize US combustibles be met with increasing enforcement against illicit vapor volumes, US combustibles are set to fair far better than reflected.

An eventual menthol ban on the federal level, while disproportionally affecting BAT, is unlikely to have as significant of an impact as shown. Further, no beneficial cross-category movement to vapor is reflected.

Combustible performance in AME and APMEA reflect future revenue growth rates far under what has been achieved on an organic level, implicitly conveying weaker performance courtesy of significantly adverse FX, competitive dynamics, or otherwise—take your pick.

Should glo Hyper Pro prove my skepticism toward the product’s qualities conservative, THP growth ex-US should be materially higher.

Even with such conservatively pessimistic expressions, BAT will produce over £8 billion in net income in each of the next several years. However, further considerations can be taken under the group operating level. The contribution of associates and JVs is marked well under what can likely be achieved and the future effective tax rate is a tad aggressive. Most critically, the net financing expense is likely far too conservative. With British American Tobacco paying just over £5 billion out as dividends per year, assuming upheld reinvestment, some several billion still remain each year to sustain the deleveraging path and eventually transition to returning capital via share repurchases. The above model shows shares outstanding unchanged in all future periods. Considering all of the above, it wouldn’t be unreasonable to see several tweaks leading to group net income proving stable off of the 2023 base and for EPS to grow at a low to mid-single-digit clip from 2025 and beyond.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in British American Tobacco and other tobacco companies such as Altria, Philip Morris International, Scandinavian Tobacco Group, and Imperial Brands.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: BTI 0.00%↑ PM 0.00%↑ MO 0.00%↑

What I like about BAT management is they don't seem to be lazy. Despite massive cash flows, the company remains efficiency oriented. They had quantum initiative, and reported significant savings achieved (I have no idea, and never found any information on how those savings were achieved), and what's more important, but nobody seems to notice, they constantly slash headcount.

2020 - 55,329 employees

2021 - 52,050

2022 - 50,397

2023 - 46,727

I wonder how long they can remain on this trajectory.

A very rational view, without any hype, but neither stock-price-induced fatality. Thank you.