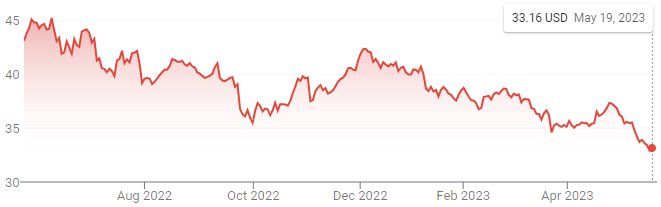

“Maximum dismay is often met with minimum price. When no one else wants to own something, you can generally purchase it for a ridiculous price far under intrinsic value. But the concern is that there is no clear way to measure maximum dismay precisely. Awkwardly, and by definition, maximum dismay shouldn’t be reached until your own expectations collapse. Even when you’re right, it can look like you’re heading into a black hole.” - Gravitational Collapse

Something silly that you should never do is commit bank fraud and violate sanctions that benefit you and, say, North Korea. You would look extra silly if you were a big company that had also been including a bunch of ESG sections in your reporting to score points with institutional investors that had been growing more apprehensive towards your industry. Apparently, British American Tobacco never got that memo, because that’s exactly what they did. In late April, the United States Department of Justice (DOJ) and Office of Foreign Assets Control (OFAC) issued BAT penalties totaling $635 million dollars and forced the company into a deferred prosecution agreement (DPA). This wasn’t much of a surprise, as the investigation had been previously noted and BAT accounted for a related provision on its balance sheet. The financial impact beyond what was already accounted for won’t be all that great, but the ordeal brings into question management’s judgment.

Was that why Jack Bowles was ousted from his position as CEO on May 15th? He was head of the company’s Asia-Pacific division for a period while the sanctions violations were taking place, so that’d make sense. Or maybe it was for other inappropriate behavior. Or maybe it was the bidding of large shareholders like Kenneth Dart, or Capital Group, which as of a recent filing has accumulated a 12.98% stake. Or for personal reasons. We don’t know for sure because the company has provided few details aside from the fact that Bowles is out of the picture and the CEO position has been filled by Tadeu Marroco, the Finance Director, whose previous position is now filled by Interim Finance Director Javed Iqbal.

Tadeu Marroco worked his way up the ladder since joining the company in 1992. With a strong background in finance, this could be an opportunity for him to capitalize on - improving communications, further refining the company’s strategy, and perhaps reassessing BAT’s capital allocation framework. In February, concerning BAT’s announcement that they would be pausing share repurchases to focus on further paying down debt, I wrote:

I am not disappointed in this change in events. First, I have to commend management for being responsible stewards of capital and acting prudently to ensure future flexibility - so long as the broad market continues to remain sour on the sector, there will be plenty of opportunities to engage in buybacks in the future.

Sour indeed.

I stand by my initial assessment and do not believe management misstepped with this move, however, buybacks begin to look better and better as the stock price grinds lower and lower.

While no one can pinpoint exactly why a stock moves in the short term, whatever market voting is going on is likely influenced by far more than the above. Some have hypothesized a longer-term headwind from capital avoiding London post-Brexit, which is the home of BAT’s primary listing. There is pointing to FX dynamics, but looking at the recent performance of GBP and USD relative to each other and other currencies suggests that falls short. I lean towards a variety of factors, though they each vary in validity. At the same time, there appear to be several positive aspects that continue to be neglected.

Menthol bans

With BAT holding the largest share of the menthol market, concerns about menthol bans in the United States are completely fair. Following Massachusetts several years prior, California banned menthol cigarettes at the end of 2022. BAT and other manufacturers looked to challenge the ban via the Supreme Court, which refused the request. Then, BAT (and others) introduced new cigarette variants containing synthetic cooling agents, which provide a similar sensation to menthol, much to the dismay of California Attorney General, Rob Bonta, who in April sent warning letters stating that these new products violated the state’s flavored tobacco prohibition laws. It was no surprise to see Reynolds (BAT) file a lawsuit a few weeks ago in California to protect the new products. From Reynolds's press release (emphasis added):

Reynolds American Inc. (Reynolds) announced today that its subsidiary, R.J. Reynolds Tobacco Company (RJRT), has filed a lawsuit against California state officials, including Attorney General Robert Bonta, in response to the Attorney General's issuance of several Notices of Determination ("Notices") that allege certain Camel and Newport cigarettes styles are "presumptively" flavored based on their promotional materials. The lawsuit, filed in California state court, seeks declaratory and injunctive relief, including that the Notices be rescinded.

RJRT stands by its new products and believes that they comply with California state law and therefore can continue to be sold. Before introducing the products for sale, RJRT followed all applicable pre-market regulatory requirements.

The new Camel and Newport styles do not impart a distinguishable taste or aroma other than tobacco and are marketed to clearly indicate that they are non-menthol. The California Attorney General's Notices do not acknowledge the fact that RJRT's new product introductions are prominently labeled and marketed as non-menthol.

Along with state-level conflicts remains the lingering potential of a federal-level ban on menthol as a characterizing flavor in cigarettes as well as non-tobacco characterizing flavors in cigars, of which a finalized proposed rule from the FDA is expected by the fall of this year. The timeline of the finalized proposed rule includes a 1-year delay to go into effect and will undoubtedly be heavily challenged, potentially delaying further. An extra dose of skepticism should be applied when evaluating the merits of such policies, as I’ve highlighted before:

While many groups support such measures, there is also notable resistance. 85% of menthol smokers are black, and organizations such as the American Civil Liberties Union (ACLU) have opposed a menthol ban, stating it would ultimately result in increasing negative interactions between communities of color and local law enforcement. The proposed legislation would exempt menthol e-cigarettes as the FDA evaluates separate rulings for related devices.

We also have precedents to look at. When Massachusetts enacted its menthol ban, the counties of bordering states saw a large influx in related product purchases. No surprise. Some data shows similar happening in California, with distinct volume changes in bordering Nevada. A federal-level ban would curb such dynamics, though could spur smuggling and black market activity. But when similar actions were taken in places such as Canada and Turkey, retention rates were over 95% - some over 100% - indicating that such bans are dreadfully ineffective. Anticipating timelines and estimating the quantified impacts of such actions remains difficult, and these concerns overlap pressures on adult consumers who are downtrading, as well as BAT’s substantial volume drops in 2022, exacerbated by SKU rationalization and the rollout of the TaO system.

Next-gen products

Paired with concerns about cigarettes is uncertainty relating to next-generation products and the company’s 3-category strategy.

HTP

In heated tobacco, BAT’s new devices, namely glo HYPER X2, and heat sticks have received positive responses from consumers, but still trail the success of PMI’s IQOS ILUMA, and now face additional competition of new HTP variants from JT and others, potentially weighing on the company’s ability to take incremental share and exercise positive pricing.

Modern oral

While the European version of BAT’s modern oral pouch, Velo, continues to dominate, it’s nearly safe to call its U.S. version a failure, as I warned of last year:

The U.S. version has struggled to grow in volumes and market share relative to well-received competing products such as Altria’s on! and Swedish Match’s Zyn tobacco-free nicotine pouches. Velo comes in four strengths in the U.S., including 4mg, 6mg, 10mg, and 11mg pouches. Non-U.S. Velo comes in a wider range of strengths, including stronger versions, which consumers find preferable. Consumer anecdotes regarding U.S. Velo include criticisms:

Flimsy plastic packaging with poorly placed labeling

Lower-quality pouch form factor

Weaker flavors and aftertaste

Excess powder within the container

The company aims to move through the PMTA process to introduce the European version to the states, but there is no definitive timeline of when that will happen, or even if it will gain authorization at all.

E-vapor

Despite fervent competition, BAT’s Vuse line of vaping devices continues to grow, with recent alternate data showing Vuse Alto continuing to take share in the U.S. vs. other pod-based systems. To date, only Vibe and Ciro from the Vuse line have received authorization through the PMTA pathway. BAT remains confident that Alto PMTAs will succeed in receiving authorization since the applications are predicated on science closely mirroring that of the successful Vibe and Ciro. However, it is less likely to see the authorization of menthol varients, as the FDA has continued to deny any e-vapor PMTAs with the characterizing flavor, though courts have issued full stays pending resolution, including for certain Reynolds products:

The FDA inexplicably switched its position on menthol-flavored e-cigarettes in at least two crucial ways. First, before the application deadline, the FDA represented that long-term studies were likely unnecessary and that applicants had discretion to use “products that consumers are most likely to consider[] interchangeable” when submitting “comparative health risk data.” PMTA Guidance at 13. The FDA then notified RJRV directly that for its “flavored products (other than menthol),” it should submit evidence that those products “increase[d] the likelihood of complete switching among adult smokers relative to tobacco or mentholflavored products.” (emphasis added) The FDA never told RJRV that similar evidence would be required for its menthol Vuse Vibe PMTA. RJRV relied upon these representations when crafting its PMTAs and supplemental filings.

There is a non-zero chance all Alto PMTAs will receive Marketing Denial Orders. There also remains a limbo in which the FDA issued MDOs for approximately 6,500 products manufactured and marketed by 10 companies. 8 of the 10 companies have been listed, with the remaining 2 remaining undisclosed to protect potential confidential commercial information (CCI). While BAT would surely contest MDOs through all available legal pathways, upheld MDOs on the Vuse Alto line could stunt the company if legacy volumes continue to degrade at an accelerated rate. Additionally, BAT faces pressures in the form of royalties, after Vuse versions were found to infringe upon patents held by not only Altria but also PMI in the United States.

The one potential saving grace is the recent action in which the FDA ordered imports of Elf Bar and Esco Bar to be detained, with the alert’s guidance stating:

Divisions may detain, without physical examination, the tobacco products identified on the Red List of this Import Alert. If the division is not sure whether a tobacco product is the same product as one identified on the Red List, the division should consult with the Center for Tobacco Products (CTP). CTP concurrence is required to add a product to the Red List.

The alert’s charge includes:

This article is subject to refusal of admission pursuant to section 801(a)(3) of the FD&C Act because it is a tobacco product that FDA has found to be adulterated under section 902(6)(A) of the FD&C Act in that it does not have an FDA marketing order in effect under section 910(c)(1)(A)(i) of the FD&C Act. [Adulteration, Section 902(6)(A)]

OASIS charge code - TP NO PMTA

Future enforcement was anticipated in March in Changing Gears:

And specific actions against disposables were highlighted in rationalizing Altria’s NJOY acquisition:

But there is one glaring issue. Elf Bar, one of the most prolific disposable vapes, having taken the market by storm by selling a variety of flavors against guidance provided by the FDA, is technically no more illegal than Vuse Alto. While I find it improbable that MGOs would be granted to products offering such a wide variety of characterizing flavors, especially when those same products currently hold the highest underage usage rate, Elf Bar products have PMTAs pending, and this is the first enforcement action taken targeting products on the market awaiting marketing determinations, suggesting that this is a dramatic overreach by the FDA. If the FDA is willing to take this action, perhaps it is willing to use other measures against Vuse Alto or any other PMTA pending products. The clear winners of this behavior are ENDS with Marketing Granted Orders and legacy cigarette volumes.

Outlook

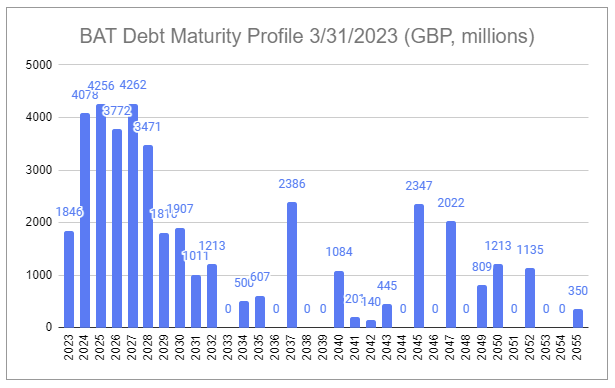

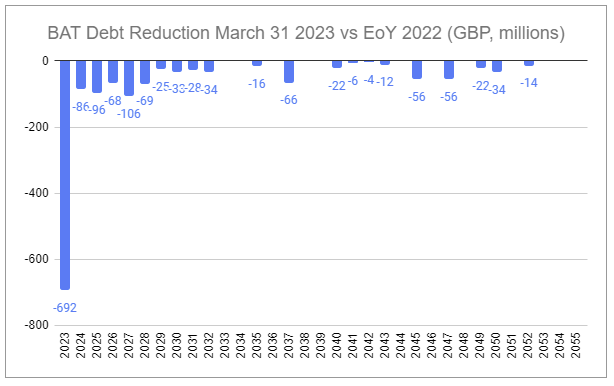

British American Tobacco does not report quarterly. That lack of granularity on Q1 2023 has amplified the recent concerns above. However, last month, on April 19th, the company reaffirmed its guidance and outlook during the 2023 AGM Chair’s address, including maintaining progress towards its 2024 New Category profitability target and reaching the mid-point of the 2-3x net debt / EBITDA target range by the end of the year.

As covered in February, British American Tobacco looks to remain ahead of schedule. It’s worth revisiting a particular exchange held during the FY2022 earnings call:

Gaurav Jain (Analyst, Barclays):

I have three questions. So first, Tadeu for you on the restructuring charge in the comment you said. So last year, BAT had restructuring of GBP 770 million. And over the last 12 years, it is GBP 400 million on average. And now you are saying, going forward, it will be 0.

So if I had assumed a GBP 400 million restructuring charge for next year your adjusted EPS growth will be high single digit. Is that the right way to think about that?

Tadeu Marroco (then Finance Director, now CEO):

First of all, just to some color on the GBP 700 million that you are referring to. We -- as we highlighted in the announcement, we -- within that, we have a factory closure in very costly locations, that's there. We have pulled out of -- we are closing operations in some markets, as you saw, and a place like Egypt, Yemen and they come also with some tax liabilities that need to be settled this is in there as well. And we have, like Jack said, with all the archetypes of markets and the closure of factories, we have almost 2,000 employees leaving in the next coming years and most of it in '23. So it's also provide there.

So what we are referring you absolutely right in the sense that we believe that with the conclusion of Quantum now, we are not incurring in the restructuring, adjusted items anymore. This will be a positive for the cash, to be honest, because when you see adjusted numbers, we are taking this out. But on the cash, there still cash outflow, some of that. There are some other elements that are noncash items. But this will be helping us more, I would say, in '24 because a lot of this provision will result in some cash outflow happening in '23.

But from '24, is where we expect the major benefits coming from the cash side.

Within the valuation model I provided in February a number of assumptions were made that aimed to lean conservative, including the assumption that share repurchases would resume in 2027 at a rate of 2% per annum. At the current rate of deleveraging, driven by both debt reduction and increasing earnings (a mix of top-line growth and margin expansion from sales mix, price take, and disciplined cost rationalization), it is likely that repurchases resume much earlier, contingent on reinvestment needs in New Categories, perhaps as early as H1 2024.

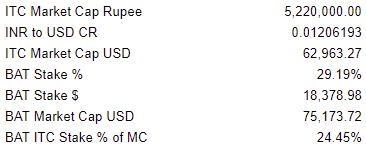

Additionally, the model purposefully excluded any value or contribution from the group’s stake in ITC - a factor deserving of focus.

ITC

ITC, a company with a dominant share of the Indian tobacco market, estimated to hold a 70% share of the country’s cigarette sales, has continued to see its share price climb higher over the last year; a stark contrast to British American Tobacco’s performance. However, BAT actually holds a substantial stake in ITC, as covered previously, which is currently at 29.19%.

By all conventional measures, the ITC stake makes up a staggering portion of BAT. But is this actually the right way to think about this? I don’t think so.

Unlike, for example, western markets, in which smaller equity stakes could be sold without too great of a burden, BAT’s ITC stake, which carries a market value of $18.3 billion, is quite different. India’s government indirectly owns a massive stake in ITC as well, and by all observable policy decisions looks to be only interested in preserving the status quo in order to enjoy a steadily growing stream of profits and excise taxes. The Indian government and ITC have had a rather contentious history with BAT, and any proposed sale would encounter an equally contentious process, taking considerable resources and time, as well as creating steep tax implications. Furthermore, while BAT has attempted to increase its stake in the past it has been prevented from doing so, while at the same time, its stake has been slowly diluted due to ITC’s Employee Share Option Scheme (stock-based compensation). BAT’s ITC stake in 2020 ended at 29.46%, in 2021 finished at 29.38%, and in 2022 ended at 29.19%.

None of this is to say that BAT’s stake isn’t valuable - far from it. Rather, for better or worse, the company will likely be keeping it for some time.

Critics have pointed to ITC’s ‘diworsification’ over recent years, aiming to move away from its core tobacco business. It now has a rather bizarre list of operations, including hotels, paperboard and packaging, agribusiness, IT, and a swath of consumer goods. Despite these efforts, its core tobacco business continues to make up the majority of its operating income. Along with ITC recently increasing the price of its cigarettes for the first time in 2 years, India has softened tax increases on cigarettes to maximize its revenue while avoiding further promoting illicit sales, and now, with the country overtaking China as the most populated, along with a fast-growing middle class, ITC looks incredibly well positioned. Even without selling its stake, BAT will benefit long-term due to the stream of dividends it receives. In 2020, 2021, and 2022, BAT received £351m, £353m, and £394m, respectively. At a ~80% payout ratio, ITC will continue to reinvest, and while returns on incremental invested capital will assuredly be lower, the stream of associated dividends is likely to substantially increase over time.

Rooting toward zero

Some analysts and shareholders have suggested that British American Tobacco move its primary listing from London to New York, citing it as a way to help close the relative valuation gap with its peers. I dissent. Not only is such a move less likely following the revelation of the sanction violations, but closing a perceived relative valuation gap has little to do with the intrinsic valuation of the business. Oddly, many who call for this also call for the resumption and increase in share repurchases. Engaging in activities to pump up a stock price so you can then buy back shares at said higher price is a fundamentally unsound plan. I would like nothing more than to see shares grind even lower - and with mounting uncertainties and anticipated FDA announcements, that remains plausible.

Rather than allowing shorter-term price movements to dictate my level of conviction, I continue to remain focused on operations, cash flows, and the deployment of those cash flows, including the resumption of buybacks to enhance equity returns and ownership over the long term. British American Tobacco will provide its Pre-Close Trading Update on June 6th and its Half-Year Report on July 26th. I look forward to hearing more from the company, and in the meantime, I’ll continue rooting toward zero.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in British American Tobacco and other tobacco companies such as Altria and Philip Morris International.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: BTI 0.00%↑ MO 0.00%↑ PM 0.00%↑

Nice to see some rationality, all I read about is ‘moving the listing’ and ‘itc stake is worth 25% of the company’

Interesting analysis. I purchased some $MO last year, on a dip after some bad news came out. So far very happy with it and could potentially add some $BTI due to the decreasing price, I will take a look at its dividend. Although currently I am focused on building up my South American oil company ( $EC and $PBR ) positions.