“Someone is sitting in the shade today because someone planted a tree a long time ago.” - Warren Buffett

Quaking aspens grow across many of the cooler parts of North America. They are also known as golden aspens due to their leaves turning vibrant shades of yellow during the autumn months. If you see them in this state, their beauty might temporarily capture your attention. But, outside of that narrow window of the year, at an average mature height of 55 ft and with plain light bark, few people would find such trees memorable.

As is the case with most of nature, there is far more than meets the eye. In fact, despite its rather unassuming qualities, the quaking aspen is, without question, one of the most impressive species found on our planet. These trees exist in clonal colonies, propagating through root sprouts, with all trees in a colony genetically identical to one another. Due to their genetically identical nature and the fact that each sprout is connected to the same root structure, systems of quaking aspens appearing to be separate trees are technically all part of the same single organism. This dynamic allows quaking aspens to grow large and old, and there is no larger nor older than Pando.

Pando sits in the Fishlake National Forest in Utah. Estimated to be comprised of stems totaling greater than 47,000, it spans more than 106 acres and is ballparked to weigh a nearly inconceivable 6,000 tonnes—making it the largest single organism on the planet. Equally impressive is its age. Each sprout may only survive for around 100 years, but they collectively support and sustain the organism’s connected structure, which various estimates pin at an age of 8,000, 12,000, or even 80,000 years, making Pando one of the oldest organisms on the planet, perhaps the oldest.

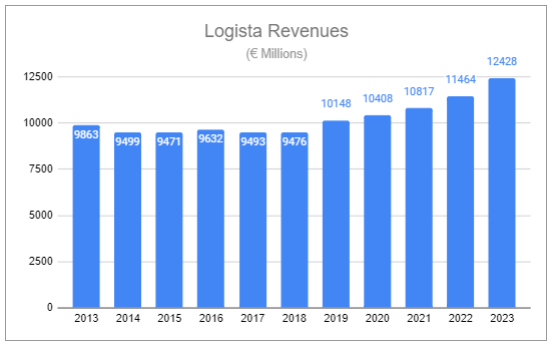

When looking through the annual results of Logista, the Spanish distribution company, my mind could not help but think back to the quaking aspen. Surely, the company is no Pando, but it is still impressively old, with heritage tracing back nearly 400 years. And like the quaking aspen, Logista continues to leverage its root system, massive distribution infrastructure, to become more expansive, more entrenched. Its operations are becoming even more durable, and evaluating them also provides additional insights into the tobacco and nicotine industry throughout select parts of Europe.

In 2020, Logista refocused its priorities, just as its majority stakeholder, Imperial Brands, outlined and successfully executed its strategic overhaul. However, unlike Imperial, which curbed its NGP investment and prioritized its legacy tobacco business, Logista transitioned to a new M&A focus, aiming to diversify away from its reliance on tobacco distribution—marked as having an uncertain trajectory due to continually declining volumes. There are several key developments to take note of:

The rise of next-generation nicotine products has become an underappreciated tailwind for Logista, supporting the growth of its tobacco distribution business despite a lack of higher reinvestment.

With an M&A focus, Logista has meaningfully grown its pharmaceutical distribution and transport services. Non-tobacco-related economic sales have eclipsed tobacco and now represent more than 51% of its total.

Logista CFO, Pedro Agustín Losada Hernández, provided unique insights concerning the first point above with respect to the Italian market during the FY’23 conference call (emphasis added):

Total revenues reached EUR 4.3 billion and economic sales, EUR 370 million, which represents a 6% and 12% increase, respectively, versus last year's figure. During the first quarter of 2023 fiscal year, the government increased taxes on tobacco, which led to price movements for some manufacturers during the rest of the year. These price movements did not offset fully the negative change in inventory recorded during the first quarter of the year, but it has compensated some of it, closing the period with a negative inventory impact of EUR 3.5 million. In terms of total tobacco volumes distributed, they remain stable after a decline of close to 3% in traditional tobacco volume, which was offset by a very good performance of NGP distribution, particularly in HEETS. Looking into the convenience distribution segment, we continue to have a double-digit year-on-year growth, thanks to adding new products into the distribution catalog such as beverages and the increase in sales of NGP products, particularly e-cigarettes, which doubled its distribution versus last year.

Hernández further elaborated on the call that they believe NGPs represent ~20% of tobacco industry volumes within Italy. He stated that they also believe that while NGPs continue to proliferate across Europe, this rate of penetration is unlikely to be achieved in Spain and France, at least in the next 2-3 years. Nonetheless, the company’s legacy business holds incredibly steady despite concerns of being a dying business.

In 2023, transport service sales for the Iberia segment, Logista’s largest contributor, more than doubled following the consolidation of previous acquisitions. Pharmaceuticals also grew minimally for the period, although it can be argued that such performance is impressive in light of a massive unwind in demand for COVID-related distribution, predominantly vaccines and PPE.

Non-tobacco operations carrying lower margins have put downward pressure on group margins. However, zooming out further, both total revenues and aggregated EBIT across all segmented geographies continue to prove durable.

Two critical points:

As non-tobacco operations, specifically transportation, grow, total operations will become more cyclical, and also will be more closely linked to broad GDP.

Growing operations of specially regulated categories, such as pharmaceuticals, allow significant entrenchment and higher customer stickiness and present considerable additional barriers to entry for competition.

Logista CEO, Íñigo Amusco, addressed further growing pharmaceuticals on the FY’23 call (emphasis added):

Isabel Troya, Logista Head of Investor Relations:

How do you plan to grow in Italy after the acquisition of Gramma more inorganic growth or organic growth? Do you think you will be able to replicate the pharma distribution model as in Spain?

Íñigo Amusco, Logista CEO:

Thank you for your question. Regarding the Italian market, that's for sure, that we are looking for more inorganic growth. I think that Gramma is only the first step in our strategy to establish a strong position in the pharma sector in Italy, but we have to do more on an inorganic basis because only with Gramma is not enough. And regarding if we can replicate the pharmaceutical model as is in Spain today, the answer clearly that this is the target. And this is in our strategy. We believe that we can replicate in, we need years, but we can replicate the distribution model that we already have in Spain.

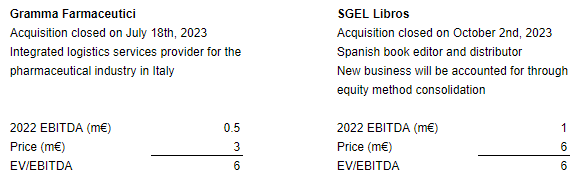

It’s also worth recognizing the small sizes but favorable prices paid for Logista’s two most recent acquisitions, including Gramma:

It is somewhat frustrating that Logista does not provide guidance on synergies it expects to recognize from acquisitions. However, looking at previous executions, there are straightforward opportunities to consolidate routes, rationalize distribution warehouses, cut duplicative back-of-house expenses, and, with scale, acquire services contracts requiring more expansive operations and specialty services. At mid-single-digit EBITDA multiples paid, returns on incremental capital can be significant, even with little synergies recognized. With stable operations, minimal leverage, positive net financial income, and cash on hand, Logista is capable of making a number of future deals, with management open to taking on debt, if opportunities are clear enough, to deploy as much as €1 billion. With that said, there is also a clear preference for small and medium-sized acquisition targets that can be more easily tucked into existing infrastructure. Continued bolt-on acquisitions alongside organic performance can conceivably lead to sustained mid-single-digit growth while maintaining a ~90% payout ratio to shareholders.

While Logista presents its normalized 2023 free cash flow with the figures above, I believe a considerably conservative hand should be used when assessing free cash moving forward. FY’23 included two benefits of unusually significant size relative to previous years:

€30m of POI (profit on inventory) benefit, reflecting changes in tobacco prices and associated tax rates across reporting geographies.

€76m of net financial income, a function of minimal interest expense (€8m), far eclipsed by the proceeds (€84m) generated by the reciprocal credit agreement between it and Imperial Brands, on top of rising interest rates.

The €30m of POI far exceeds the €8m recorded in 2022. While future changes in inventory values are all but certain, it is unlikely that the degree of recognition is to be as pronounced. With interest rates presently reversing, future financial income is also likely to be less significant. However, the company remains open to exploring the use of derivatives to hedge its interest rate exposure, presenting the potential for future net financial income to remain above historical rates. By fully subtracting out the profit on inventory during 2023, assuming 3% growth of core, sustained restructuring costs of €20m, increasing capex to €50m, and reduced net financial income at the midpoint between FY’23 and FY’22 provides a normalized figure of €265.23m. At the most recent share closing price of €25, Logista trades at x7.1 EBITDA, x9 adj. EBIT, and x10.2 FCF (x12.4 fwd, conservatively). Although these multiples may appear compelling, I continue to point to Imperial Brands. Imperial owns 50.01% of Logista, trades at lower multiples, and is committed to retiring its own share capital at an aggressive rate. On a long-term timeline, Imperial is set to return considerable cash to shareholders and substantially increase per-share ownership of this distribution network which continues to grow its roots throughout Europe.

If you enjoyed this piece, hit “♡ like” and give it a share. Already a subscriber? Consider supporting Invariant by pledging a paid subscription.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own no direct position in Logista (Compañía de Distribución Integral Logista Holdings, S.A). I own an indirect stake in Logista via positions in Imperial Brands. I own positions in other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑PM 0.00%↑ BTI 0.00%↑

Thank you for covering a company that operates in Europe only!

It’s interesting how they make very small acquisitions. The latest one (Jan 2nd): a Belgian courier for €8 million.

Note: it seems that “Iberia” includes all countries except France and Italy.