“We continue to work on implementing the synergies identified in each of the different acquisitions, whether it's route combinations or warehouse consolidations, looking to extract the maximum value of the transactions already executed. Furthermore, we continue to seek new transactions, which allow us to secure Logista's growth outside tobacco.” - Pedro Agustín Losada Hernández, Logista CEO, H1’24 Results

Logista, the publicly traded Spanish distribution business, majorly held by Imperial Brands, continues its trajectory as a premier operator. Diversification efforts driven by M&A have resulted in more than half of the group’s economic sales being unrelated to tobacco, and with tailwinds at its back, the strategy is poised to continue delivering respectable financial contributions. Even though these efforts routinely take resources and focus away from the group’s core business, the tobacco distribution component continues to produce strong results and further hints towards the industry’s evolution. The only readily apparent struggle is finding points to criticize, as this remains a story of steady as she goes.

Group sales have continued to march higher, with Q2’24 revenues up 3.08%, H1’24 up 4.57%, and the trailing twelve months up 6.31%. Economic sales (gross) increased by 1.26%, 4.02%, and 16.73% for the same periods. This modest performance begins to look more impressive when considering certain events disrupting supply chains, such as cargo ships being attacked in the Red Sea, forcing rerouting and tacking on additional costs.

Following H1’24 results, Logista acquired the remaining 30% of Speedlink, with the May 13, 2024 announcement stating (emphasis added):

Speedlink, based in Hoofddorp, near Schiphol Airport, serves growth sectors and has developed a unique business model, based on an asset-light structure, and specialised in time critical transport services for healthcare, high-tech, automotive and e-commerce sectors. The acquisition of Speedlink led to the international expansion of Nacex's services in The Netherlands, which was subsequently complemented by the acquisition of Belgium Parcel Services in December 2023, strengthening Logista's position in medical/healthcare distribution by expanding its catalogue of services outside the Iberian Peninsula.

This acquisition is not at all surprising and follows Logista’s initial purchase of its 70% stake in February 2022, further signaling Logista’s intent to build a larger, more comprehensive offering for pharmaceutical distribution throughout Europe, as highlighted last quarter:

Pharmaceutical distribution requires numerous special licenses and certifications. It also includes products that are ultra-sensitive, requiring precision temperature-controlled environments and resources to ensure proper chain of custody. There remains a long list of private targets, and by rolling up smaller specialty operators, Logista will be able to attract larger mission-critical contracts with major healthcare facilities while rationalizing back-of-house expenses. Despite carrying a lower economic sales margin relative to transport and other operations within Iberia, these dynamics can support EBIT margin recovery over time, following constant sales growth despite a post-COVID unwind.

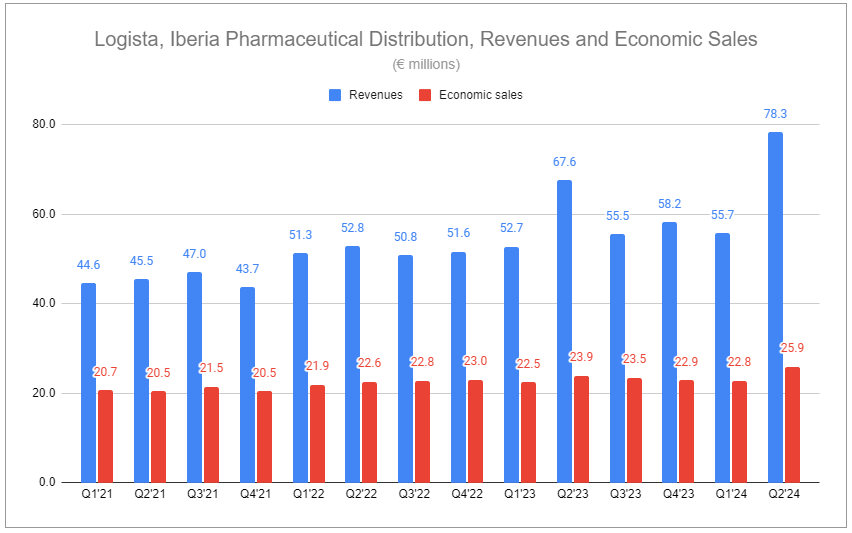

Even with the context provided above, it’s worth acknowledging that the financial contributions from pharmaceutical distribution are still small on a group level, comprising only 2.16% of group revenues in H1’24 and 5.62% of economic sales for the period. Nonetheless, as illustrated below, related revenues and economic sales have been steadily increasing. Critically, these figures underplay the evolution of the segment, as the post-COVID unwind included a significant dropoff in business associated with supplying PPE and other critical supplies to medical facilities in the last two years. With this in mind, it is clear that the economic performance of the core pharmaceutical business has been more robust, making the trailing twelve-month economic sales increase of 14.3% over the course of the period illustrated more impressive. Additionally, the nature of the bolt-on acquisition strategy provides two distinct benefits. One is the low-risk stakes of any particular acquisition, de-risking the segment’s long-term trajectory. Second is that focusing on targeting bolt-ons provides Logista extreme discretion on exactly how, when, and where it expands throughout Europe. Enhancing geographic coverage and capabilities should further improve the group’s ability to win larger contracts, provide additional value-added services to existing customers, and enhance retention rates.

While the merits of the diversification efforts could continue to be expounded on, it is only fitting to shine the light on the core business, tobacco distribution, which continues to excel. Iberia, Italy, and France all possess contrasting qualities but contribute meaningfully as a whole.

France remains challenged, with volume declines at significantly elevated rates weighing on the industry. An increase in excise duties has exacerbated this. However, price increases by manufacturers, passed through by Logista, have allowed the company to protect its trade margins, resulting in stable output.

Iberia and Italy continue to show notable contrast from France. H1’24 showcases volumes of Iberia and Italy of -0.9% and +1.6%, respectively. Iberia’s revenues increased by 7.1%, and economic sales rose by 1.2%, with next-gen products bolstering performance. It would be easy to try to explain Italy’s revenues increasing by 4.6% and economic sales growth of 7.5% as a function of the market’s volume growth. While it is true that, all else equal, positive volumes would lead to positive performance, it is certain that not everything else was equal. The distinct driver remains heated tobacco, with the growing popularity of HEETs specifically cited. This should be flagged as a signal for the evolution of economic performance in other countries as the industry evolves. As disclosed by Philip Morris International, Italy is an epicenter of heated tobacco adoption in Europe, reflected by the company’s HTP share of the overall market within the country relative to others. With HTUs having better unit economics relative to legacy products, there is a significant opportunity for Logista to protect loftier trade margins as the category grows.

Alongside the tailwind of next-gen products, Logista’s tobacco distribution business continues to benefit from Profit on Inventory recognitions. In H1’24, the push and pull of excise increase versus manufacturer-led pricing resulted in Italy showing a €1.5m loss on inventory, down from a €2.6m loss in H1’23. However, this small loss was more than offset by the profit on inventories recorded for Iberia and France of €19m and €7.6m, respectively. While there is choppiness in these recorded profits and losses in various periods, over the long term and in the aggregate, they are sure to skew in Logista’s favor as the structural dynamics for legacy product volumes and pricing remain in place. Logista CFO Pedro Agustín Losada Hernández also provided further visibility for these effects in 2024 during the H1’24 call):

On your second question related to the tax increases in the second quarter or the first quarter on Italy. We have received all this, so to say, the negative impact from tax increases in Italy. In this first half, we have received also the positive impact from some of the price increases from one of the manufacturers, particularly. So we are expecting still to receive more -- a little bit more positive impact on POI in the third quarter of 2024.

Despite Logista’s management rationalizing their diversification efforts by citing uncertainty around the tobacco industry, it appears inevitable that these operations will continue to be respectably profitable well into the future.

Steady as she goes

A modest downward adjustment to Iberia transport economic sales and an upward revision of pharmaceuticals have been made. Beyond the operating segments, there are a host of additional considerations, namely the reciprocal credit agreement between Logista and its majority shareholder, Imperial Brands. The revised terms provide a tranching of lines to partially hedge movements in interest rates. Having no crystal ball on rates, the illustrated model continues to include a modest decrease in financial income despite the narrowing of future potential contribution. This, paired with a continuance of elevated restructuring costs and a step up in the ETR, leaves little change when looking at long-term growth, profitability, and the amount set to be returned to shareholders.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own no direct position in Logista (Compañía de Distribución Integral Logista Holdings, S.A). I own an indirect stake in Logista via positions in Imperial Brands. I own positions in other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑PM 0.00%↑ BTI 0.00%↑

Hi Devin, I'd be interested to hear your thoughts on the IMB interim results. Will that be an upcoming post?