“From a small seed a mighty trunk may grow.” - Aeschylus

During a previous podcast appearance, I was asked which of the three next-gen nicotine product categories was most promising. I answered:

That’s a tough question. I think that, overall, this industry and how it unfolds will not be a winner-takes-all situation, and I think that’s going to be true for both categories, as well as, really, companies. I think there’s multiple players that can do exceedingly well, and I think that when you look at how diverse the world is—you factor in consumer preference, affordability, societal norms, and different regulatory frameworks around the world—there is going to be certain products that do exceedingly well in some areas while falling flat in others. I think that all three (vaping, nicotine pouches, and heated tobacco) are likely to do well. With that said, I'm a big proponent of the modern oral segment. I think the tobacco-free nicotine pouches represent something very very interesting.

Fast-forward two years to the present day, and the growth of the nicotine pouch category has remained fervent. Such growth has captured far greater attention from investors. However, the rapid growth of nicotine pouches—especially in the United States—has also captured the attention of special interest groups and politicians, leading to verbal crusades against the category. Opponents underpin their alarms with concerns that part of the rapid growth has been underage usage. In The ZYNpocalypse, I argued that such claims were unfounded and not supported by readily available data:

If you squint hard enough, you can see usage prevalence amongst 8th, 10th, and 12th graders of 0.6%, 1.9%, and 2.9%, respectively.2 Some would argue that with only one year’s data, historical context is missing, and thus, the (supposedly current) rise in usage is not reflected in this chart above. However, tucked within the results of the same survey is data indicating the exact opposite. For the same period, LIFETIME PREVALENCE amongst 8th, 10th, and 12 graders measured 1.2%, 2,6%, and 3.6%, respectively, but the prevalence of usage in the LAST THIRTY DAYS (also referred to as current use) measured a mere 0.4%, 1.1%, and 1.4%. Simply, prevalence amongst these groups is extremely low.

Further countering the alarmist claims is the recently published Notes from the Field: E-Cigarette and Nicotine Pouch Use Among Middle and High School Students, which analyzed data from the 2024 National Youth Tobacco Survey. The preliminary report shows that a mere 1.8% of middle and high school students reported current nicotine pouch use in 2024. Unfortunately, regardless of the data, certain groups will remain staunchly opposed to nicotine pouches. Even though the science and data suggest an eventual end state of regulatory policies embracing Tobacco Harm Reduction, the road to that point is not necessarily short or well-paved.

Current nicotine pouch adoption trends are partly a function of accessibility, underpinned by a government regulatory framework that permits the product category to be marketed within the United States. To date, zero nicotine pouch brands in the United States have received authorization through the FDA’s PMTA process. Instead, the existing market comprises products for which their manufacturers submitted PMTAs before designated deadlines, with an understanding that the FDA would not take enforcement actions against them so long as they remained under review. The only appearance of new entrances has been due to the first deadline targetting products containing tobacco-derived nicotine and a lag for synthetic nicotine products.

The FDA is likely to soon reach determinations on the first few PMTAs for products with tobacco-derived nicotine, as it has asserted that it is nearing the end of its backlog of millions of applications. Due to several factors, it is more likely than not that we see several Marketing Granted Orders:

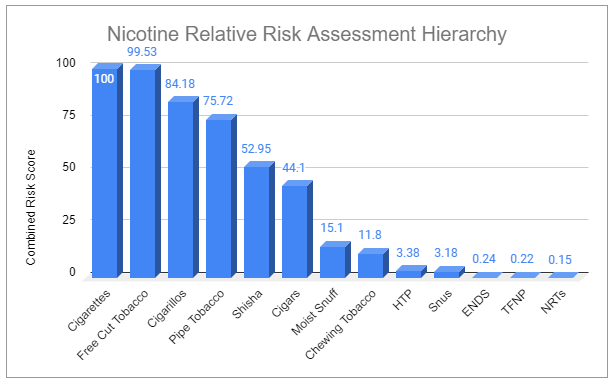

General Snus and Copenhagen Classic Snuff have received MRTPs, a separate and more difficult pathway that allows the proclamation of specifically defined reduced-risk claims. Numerous risk assessment studies show nicotine pouches carry lower risk profiles beyond these products.

While the risk to users is a significant consideration for whether or not a product receives authorization through the PMTA pathway, such considerations must be weighed against the potential of underage usage if the product remains on the market. Underage usage of nicotine pouches remains incredibly low.

In addition to considering potential impacts on underage usage, the FDA considers the product’s impact on society at large. There is a stated interest in avoiding authorization of products that can cause widespread harm from adult non-users of current products becoming users of newly authorized products. While a majority of pouch users are converted from other product categories, there is a growing interest from non-users, which will undoubtedly weigh heavily into the equation. However, due to the radically lower risk profiles sported by the category, the category’s potential to move combustible tobacco users toward lower-risk products, and the lack of evidence showing a gateway effect for pouch usage to lead to usage of more harmful categories, this is less concerning—of course, with the caveat that it requires the FDA to act in good faith and performance honest calculation, which may be foolish to assume.

Even with FDA authorizations, nicotine pouches face a litany of pressures. There is not currently a federal-level excise tax on the category, and while one may not materialize, a growing number of states are keen to institute and raise them. Further, several states have placed regulations prohibiting certain characterizing flavors and sales channels. While different levels of regulation act as roadblocks for nicotine pouches, other factors have done the opposite. Even though the number of brands in the United States is limited, competition remains fervent, with many competing heavily to raise brand awareness and gain market share. These actions involve expanding physical retail coverage, utilizing online sales channels, and increasing investments in production to ensure availability. Additionally, certain brand owners continue discounting to spur trials, improving affordability. Affordability improves further as the brands within the category compete not just with one another but also with legacy categories. So long as manufacturers continue to take pricing up on cigarettes and other legacy products more aggressively, affordability differentials versus pouches will continue to widen.

Equally crucial to accessibility and affordability, yet discussed less, is precisely what qualities within nicotine pouches appeal to adult consumers. After all, governing bodies can permit a product, and manufacturers can produce a product, but at the end of the day, adult consumers have to desire the product.

So what do they want?

Direct appeal

Most nicotine pouch users are previous users of cigarettes or legacy oral. Pouches represent a displacement of a habit. For smokers specifically, displacement of that habit presents unique hurdles because of exactly how the products are used. Lighting a cigarette, taking drags, and exhaling are all seemingly small acts but make for an ingrained ritual. For a new product to usurp that ritual within users’ lives requires meeting specific considerations.

One of the clearest appeals of nicotine pouches is the markedly lower risk profile compared to other products—especially cigarettes. This alone provides a major driving force. The most helpful reference is Sweden, as total nicotine consumption in the country is similar to most of Europe but has shifted dramatically to oral products. So, while the country has a high total nicotine usage prevalence, the shift away from combustible products and toward lower-risk snus has resulted in a significant reduction in lung cancer and heart disease. Now, as nicotine pouches cannibalize snus volumes, Sweden has an opportunity to reduce tobacco-related harm even further.

Although snus is low on the continuum of risk, nicotine pouches represent an even lower risk profile, leading to increasing appeal. Additionally, the transition from legacy oral and snus to nicotine pouches comes with less friction because their physical rituals are strikingly similar, and nicotine pouches provide additional benefits. They do not stain teeth or cause bad breath, and no spitting is involved. For these reasons, while legacy oral tobacco products are disproportionally used by males (~95%), nicotine pouches also generate substantial appeal amongst females.

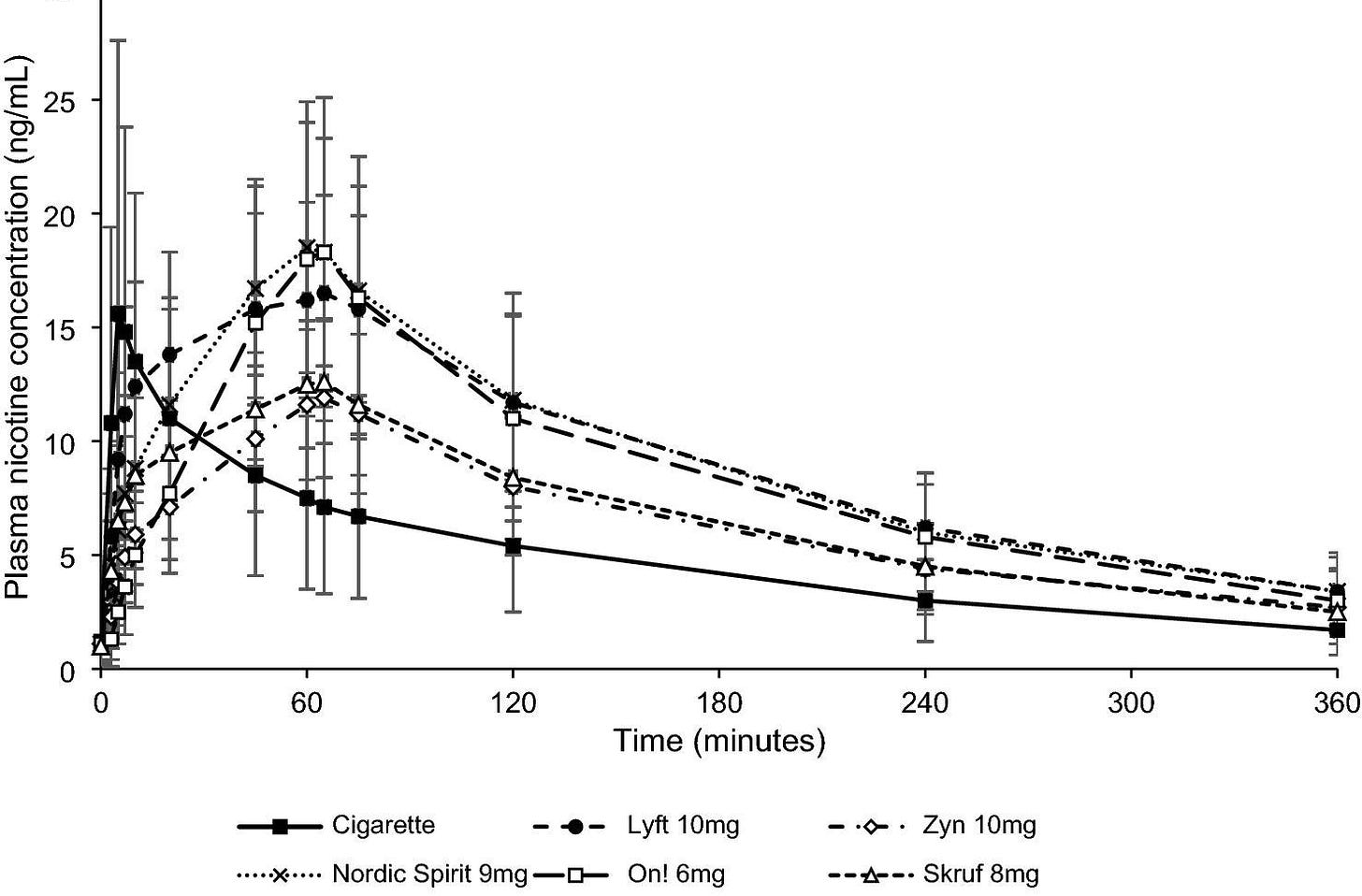

While there may be interest in switching away from legacy products, there is one hurdle when considering adoption beyond trial: speed of delivery. Cigarettes work more quickly to deliver nicotine, making it difficult for alternatives to satisfy in precisely the same way. As this is a function of the delivery route, it is not as easy as simply significantly increasing the nicotine content in pouches—while the initial uptake speed is slower, pouches can ramp into a higher peak and decline more gradually. Far higher nicotine content would make for an unexpected and undesired trajectory for most users. The fact that nicotine pouches originated in Sweden helps explain prevalence usage, but the rate of innovation on this front has also led to their sustained success. Products offer a more comprehensive range of strengths and—along with other improvements, such as narrowing pH ranges—they also contain higher levels of moisture, which aids in delivery, consistency, and flavor and improves the comfort of use.

The difference in nicotine delivery trajectories can help explain polyusage—users who use both cigarettes and nicotine pouches. For users, part of their ingrained ritual may be to start their day with a cigarette, and even polyusers may intend to continue to do so as it is the quicker delivery method. There is also the social aspect of smoking, leading to more usage occasions in specific settings. However, nicotine pouches have an evident ability to displace other usage occasions throughout the day by providing an adequate level of delivery and sustained delivery. They are also far more convenient in countless other settings because of their discrete nature, leading to a natural shift in usage behavior over time and eventual exclusive use of the product.

Another critical factor influencing appeal and sustained use is the role of flavors. Across markets, mint varieties are most popular, followed by fruit offerings. Tobacco-flavored and non-flavored pouches rank far lower in the aggregate. A strong argument is made that most users switching prefer flavors that don’t attempt to mirror the products they are switching from. However, an additional consideration is that many users prefer mint and fruits because those flavor profiles appear more consistent, and tobacco flavors are described to resemble some mix of flavoring agents that essentially make them weaker and misaligned versions of dessert, chocolate, coffee, and caramel.

Nicotine pouch anecdata

European variants lead on delivery, consistency, and flavor fronts because the barriers to innovation remain much lower. This allows a much wider assortment and flavor pairings, helping increase appeal amongst more expansive sets of would-be users. Below is a list of short notes on nicotine pouches, including familiar US brands and some brands with varying degrees of popularity in Europe. While most of the information is anecdotal, you may find it helpful, as it illustrates the vast difference in product qualities across the category.

US Variants

Zyn

First to market and largest by share, Zyn is the current market leader in the US, and for good reason. The product is dry but remarkably consistent. Strengths come in 3 and 6mg. Flavors include citrus, cinnamon, and coffee, but all pale to the popularity of its multiple mint variants. The product does not stand out as well once compared directly against some European offerings, but its familiarity and dependability explain its success.

on!

The only brand whose cans come in a rectangle form factor rather than the circular design that is widely popular, on! is an odd man out—though some users report preferring the unconventional shape. Setting on! further apart from other brands is the smaller size of its pouches, which a subset of users find easier to use. Most of its flavor offerings overlap with ZYN, although none stand out. Historically, the product has had consistency issues, reflected by excess powder in cans—though it appears the company has improved its QA, and that issue has lessened. One aspect that stands out for On! is its wider strength range compared to ZYN, providing higher appeal to specific groups.

Velo

Despite a recent ‘brand refresh,’ there is little to add about the US version of Velo that has not already been said. From my latest British American Tobacco note:

What is inside the cans is still the same: dry pouches, weak flavors that barely pass for what they claim to be, and, of course, excess loose powder. The delivery and enjoyability of the product are no better than before. I have previously highlighted and often repeated the inferiority of US Velo to its non-US counterpart. Allow me to take it a step further: US Velo isn't just inferior to its non-US version; it’s inferior to every other pouch I have analyzed.

Rogue

The embossed branding and sheen of Rogue’s cans do not make up for their cheap construction. The pouches are wider than necessary and ungodly dry. While the brand sports a broad variety of flavors, they are reminiscent of TUMS antacids, are chalky in their own right, and provide a concerning aftertaste.

Juice Head

The packaging is standard and of decent enough quality. The pouches themselves are odd—longer than most, and the pouch material itself almost feels more like paper. They simply don’t sit as comfortably as most other pouches when tucked in. The flavors are also a mixed basket. All flavors are iterations of fruit + mint. Watermelon Strawberry Mint and Peach Pineapple Mint fall short. Mango Strawberry Mint somehow gets the balance right. Blueberry Lemon Mint is like drinking a cold glass of lemonade on a hot summer day—after brushing your teeth.

Sesh

Sesh stands out. The packaging is standard and high-quality, but the can is marginally thinner than most others, making it easier to carry in your pocket. When opened, the pouches are faintly moist—sometimes sticking together. Flavors are limited, but all are pleasant—especially mango. Strengths are a reasonably standard 4/6/8mg.

Lucy

Lucy is doing a lot of things right. The packing labels are sometimes a bit misaligned, but the can’s form factor is identical to Sesh—standard, solid, and marginally thinner. The pouches are dry, but the flavors deliver—mango is perhaps a bit milder than Sesh’s mango variant, but Lucy’s espresso hits it out of the park. Highlighting a unique innovation is Lucy’s Breakers, which are pouches with a small plastic bead within each pouch. The beads contain additional flavoring liquid, broken by biting, enhancing the flavor profile temporarily.

Fre

There is no question that Fre’s cans are durable—so rigid that it’s sometimes a task to get the cap off. The flavors are potent—the scent will smack you in the face when you open the can. With strengths of 9/12/15mg, the brand clearly caters to a subset of users looking for something beyond what the more popular brands offer.

Zone

Newer on the national front, Zone provides a pleasant surprise. From my most recent Imperial Brands note:

The packaging is high-quality, and cans include a second compartment to place used pouches. When you open the main container, the aroma of the pouches is notably pungent. The pouches themselves are distinctly soft—gentle even—providing an extremely comfortable user experience. The initial release is, perhaps, a tad slow, but the consistency and duration of both nicotine delivery and flavor are outstanding. With strengths of only 6mg and 9mg, these are unlikely to appeal to new users, but anyone experienced with the category will likely find themselves impressed.

European variants

Velo

Are there words to properly articulate how much better this is than the US version? We can try. The cans are high quality but pale in comparison to the pouches themselves. Well-sized and moist, few pouches are more comfortable to tuck in than this—there are even mini variants for those looking for something even more relaxed and discrete. There is an undeniable consistency in the speed and duration of delivery and flavor. With a broad strength range and a massive variety of flavors, it isn’t hard to understand why the brand is so popular—it appeals to most user subsets.

XQS

XQS is a bit slow on delivery, and its duration feels shorter than most—at least for the 4mg variant. 8 and 10mg variants are available if you want more punch. The flavors stand out and are genuinely unique. Orange Apple and Citrus Cooling are better than most, but Cactus Sour steals the show.

Klint

The packaging is adequate, and the labeling is fine. The pouches themselves are slim and relatively moist, ensuring comfort. Flavors are muted relative to other brands.

NOIS

Despite being labeled Slim Nicotine Pouches, NOIS is slightly bulkier than expected. Flavor varieties include many mint-like flavors, fruit + mint pairings, and Blackcurrant. The flavors are somewhat muted, but the brand makes up for it elsewhere. Notable attributes of NOIS are that its cans come with more pouches than many other brands, depending on the version, and their nicotine strength ranges from 4 to 17.5mg.

Lundgrens

The container and labeling instill an immediate sense that this is a more elegant product. The flavor Fjällskog, translating to Mountain Forest, is marketed to capture the taste of the earthy mountain wilderness. It’s funky, salty, and appeals to a consumer subset far apart from those after simple mint or fruit flavors.

Kelly White

Minimalist packaging and labeling. Black type on white. Hot Cherry is undoubtedly better than the cherry variants of other brands that taste more like a cough drop, but it lacks duration and intensity. Pouches are on the drier side as well.

Ace

Scandinavian Tobacco Group recently acquired Ace’s parent, and my recent note sums up the qualities of the product:

Pungent. You can smell the pouches through the can. The can itself is seemingly standard yet high-quality and the labeling is clean and precise—what is expected from Northern Europe. The pouches are distinctly moist but are thicker than most others and may not sit as comfortably tucked under your lip. As for the flavor, in this case, honeydew black pepper, it is sweet and savory with slight spice and is unquestionably distinctive. At 8mg nicotine strength, it is a reasonably standard strength, entirely too much for those with low tolerance and not quite enough for those seeking a harder punch. Overall, it is appealing and unique and complements the unique flavors already owned by Scandinavian Tobacco Group in the XQS brand lineup.

LYFT

Good quality packaging and labeling and the pouches are comfortable. Flavors are less unique, but the variety ensures broad appeal. Overall, there is an appreciation for the consistency in the product's delivery.

Volt

The container and labeling are on point, and the pouches are soft and moist. Strengths span 3 to 11mg for different flavor variants. The standout flavor is Mystic Blue, pairing blueberries, vanilla, and mild peppermint—it’s almost like a cake.

FIX

It has less impressive packaging than most. Labelling looks rushed. FIX has a number of unique flavor combos, including Peach Rhubarb and Green Mango Lemongrass. Fig Raspberry doesn’t taste much like either, and it is one of the few pouches that, even at lower intensities, burns and has a lingering, unwanted aftertaste.

Helwit

It may be listed last, but that’s just by happenstance. Helwit is excellent. While drier than many other popular European variants, the product remains remarkably consistent in delivery and flavor, though it is a bit slow to act. Most interesting is the addition of sucralose to the pouches, enhancing flavors like Mocha to make them almost candy-like.

As it unfolds

Considering that nicotine pouches make up only a fraction of the US market, there is ample opportunity ahead. Current growth trends are well supported by increasing awareness and availability driving new converts and current polyusers shifting usage occasions. With anticipated PMTA determinations ahead, we can expect more visibility into how the US market will unfold. While the US has the potential to remain relatively stagnant, there are significant implications for all product categories should the FDA find favorable conclusions when it eventually reaches applications for European variants and compounded if there is a favorable shift in perspective categorically.

Enjoy this piece? Hit “♡ like” on the site, share it, and consider upgrading to a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in tobacco companies such as Altria, Philip Morris International, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Resources:

McEwan M, Azzopardi D, Gale N, et al. A Randomised Study to Investigate the Nicotine Pharmacokinetics of Oral Nicotine Pouches and a Combustible Cigarette. Eur J Drug Metab Pharmacokinet. 2022;47(2):211-221. doi:10.1007/s13318-021-00742-9

Back S, Masser AE, Rutqvist LE, Lindholm J. Harmful and potentially harmful constituents (HPHCs) in two novel nicotine pouch products in comparison with regular smokeless tobacco products and pharmaceutical nicotine replacement therapy products (NRTs). BMC Chem. 2023;17(1):9. Published 2023 Mar 3. doi:10.1186/s13065-023-00918-1

Mallock-Ohnesorg N, Rabenstein A, Stoll Y, et al. Small pouches, but high nicotine doses-nicotine delivery and acute effects after use of tobacco-free nicotine pouches. Front Pharmacol. 2024;15:1392027. Published 2024 May 22. doi:10.3389/fphar.2024.1392027

Smoking kills; nicotine doesn’t. Pouches save lives (since users are often ex-smokers).

I myself hold close to 500k splitter in BAT PM and MO, I am from Europe and have been to the USA

I know both cultures very well

I thought HnB especially IQOS to be a game changer, I occasionally smoke cigarettes, like 2 or 3 in a month

After trying VELO ZYN and ON! Plus, I can see those are the real game changer, it's not IQOS

ON! plus are different and I somehow le lean into them in having great potential due to the flex technology