“All key elements of the business performed at or above expectations, driving strong double-digit organic top and bottom line growth, margin expansion, and a significant acceleration in adjusted diluted earnings per share growth in dollar terms.” - Emmanuel Babeau, PMI CFO, Q3 2024 Call

Philip Morris International’s Q3 2024 results leave no shortage of points to discuss. IQOS is humming along. ZYN is running rampant. The company continues to make meaningful headway to improve the financial contributions from each. Combustibles, which have been strong throughout the year, proved even more so, affirming the company is executing well on all fronts.

Pouch proliferation

When Philip Morris International’s bid for Swedish Match was announced, one of the most readily understood benefits to the deal was that the group’s widespread distribution infrastructure would permit a global rollout much faster than that of a standalone Swedish Match. Q3 figures indicate such. Nicotine pouch volumes grew close to 70% outside of the United States, with Pakistan and South Africa cited amongst the 30 or so markets ZYN is now in. Many countries remain steadfastly opposed to the category, and trial and adoption rates will vary by area. However, the virtuous qualities of the category cannot be ignored, suggesting that we are still in the early days of the globe’s pouch proliferation.

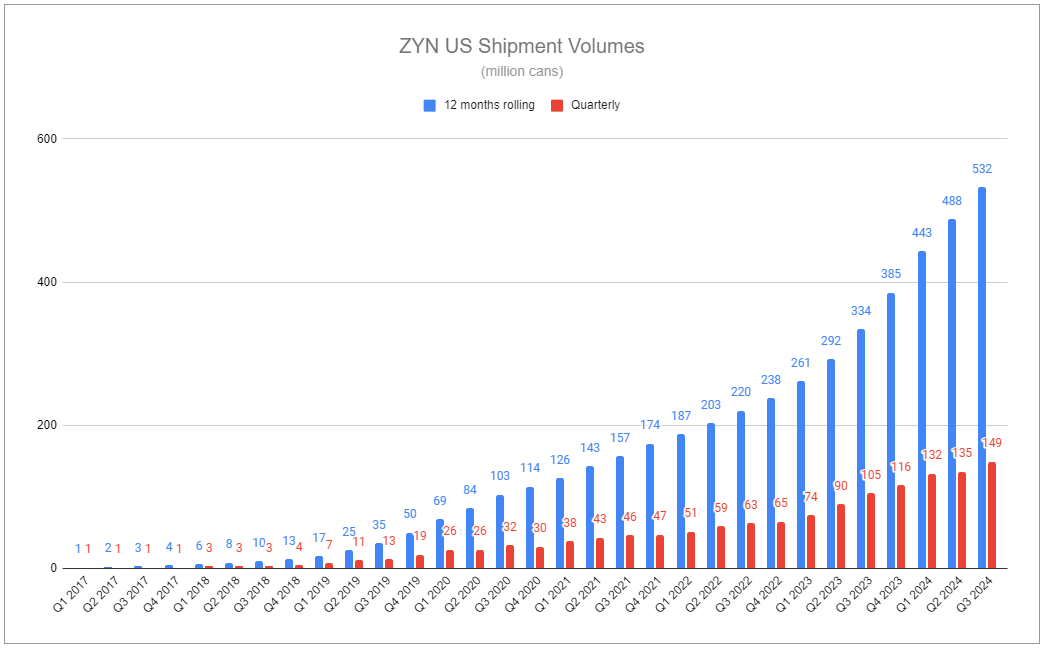

While pouches increase elsewhere, they continue spreading rapidly in the United States as well. US Zyn shipments posted 42% growth in Q3 despite production failing to meet total demand. If you had your head in the sand this year, such constraints could very well have gone unnoticed. For reference, guidance on FY’24 ZYN volumes in the US started at 520m, moved to 560m, and then to 560-580m. Due to capacity improvements, the lower end has been raised, tightening the expected range to 570-580m. The midpoint represents year-over-year growth of just over 49%, a 141% increase from 2022 and 230% from 2021.

As I highlighted in my Q2 note, ZYN’s capacity constraints within the US market force us to reconsider competitive dynamics. During the Q3 call, when asked about restoring supply to match demand, Emmanuel Babeau stated expectations for supply reaching parity sometime in Q4’24, while refilling inventories across channels to normalized levels would only occur gradually throughout 2025. He elaborated with a notable statement:

So what we’ve seen is that -- in fact, when the availability of ZYN went down, we’ve seen the category slowing down because, obviously, it seems that a number of buyers of ZYN are not intending to buy another brand. And therefore, when they don’t find their ZYN, they are maybe probably using or consuming something else. But that probably has been slowing down a bit the category. We will see how we gradually recover. We’ve seen in the second part of the Q3, some improvement sequentially on our market share, which is good news. We believe that we have some positive outlook as we regain availability for the product, but it's difficult to be more specific than that at that stage.

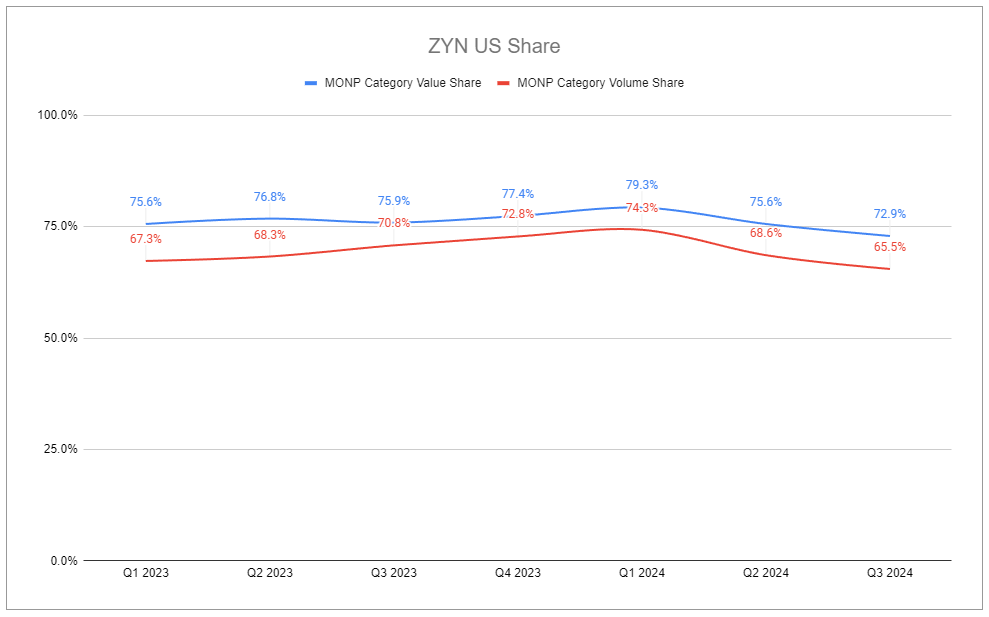

Now, it is true that some consumers are loyal to ZYN and aren’t necessarily looking for other brands within the category. However, it is undeniable that, despite a slowdown, a good number of consumers have branched out in short order. ZYN has ceded market share while retaining a higher degree of value share. But both have declined. Over the last three quarters, volume share measured 74.3%, 68.6%, and *65.5%, respectively, while value share came in at 79.3%, 75.6%, and 72.9%. Better illustrating share evolution is done by including the previous year’s quarters, and in doing so, the recent constraint’s effects over the last two become all the more apparent:

Incremental capacity gains will improve ZYN’s availability, further aided by reinstating certain promotional activities that have been dialed back over the last few quarters. However, looking deeper into competition, recovery is in question. BAT’s recently announced Velo+, which I expect to get my hands on soon to judge packaging and pouch quality, will enter the race shortly. Imperial Brand’s new horse, zone, is already running. Although sales data is more limited in history, zone is a much better product than I believe most are ready to give credit—quality packaging, incredibly soft pouches, long-lasting flavor, and strength and flavor assortments that closely overlap ZYN point to a product capable of winning many over in a blind test.

Despite incremental supply improvements within the broad US market, online channels, such as Haypp’s US sites, have recently shown worse ZYN outages. Sales on PMI’s zyn (dot) com remain turned off. Then there is the question of the many players moving foreign products into the US unlawfully. While PMI specifically stressed its efforts to tackle illicit volumes in the US, I can confirm that many sites still eagerly sell such products to US customers.

The exact rate of change on the US front is unknown, but change it will. PMI will undoubtedly resolve many of the issues faced, one way or another, perhaps to the detriment of others. But recapturing volume share should not be the focus. The inextricable relationship between price and volume, volume share, and value share remains. If you are a company facing production constraints and demand remains so fervent that you have little doubt about being able to sell whatever amount you produce at the moment, what do you do? You may be inclined to take price. The list price of ZYN was raised in early September by $0.15. This follows the previous $0.15 list price increase enacted in March. So long as demand persists, PMI could comfortably cede a degree more of volume share, still scale total volumes in a growing market, and allow incremental pricing to provide its pronounced effect.

The hill

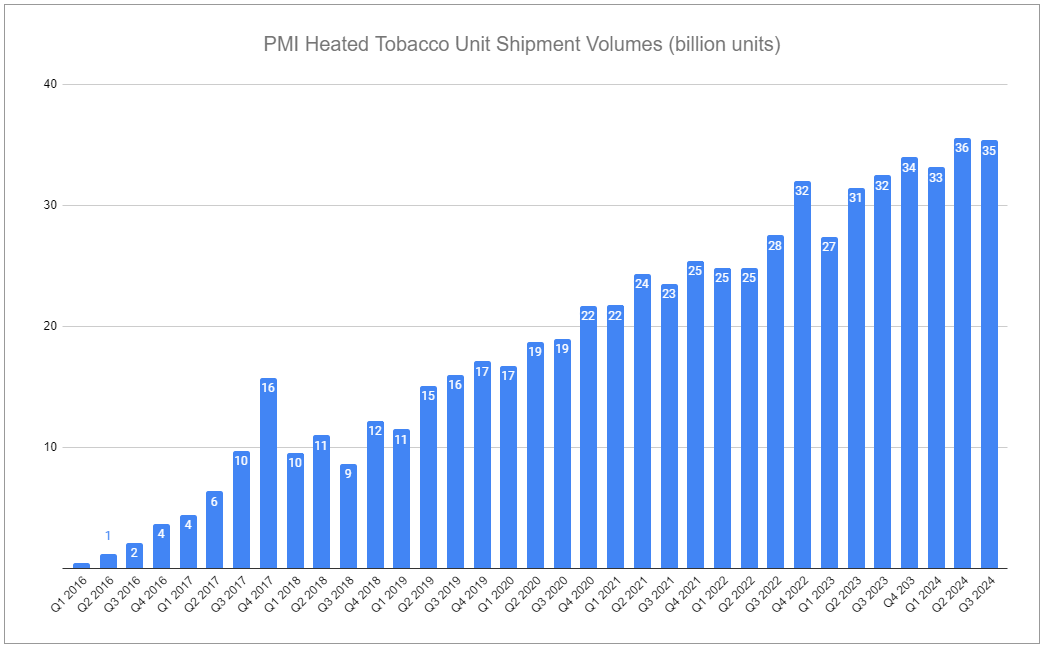

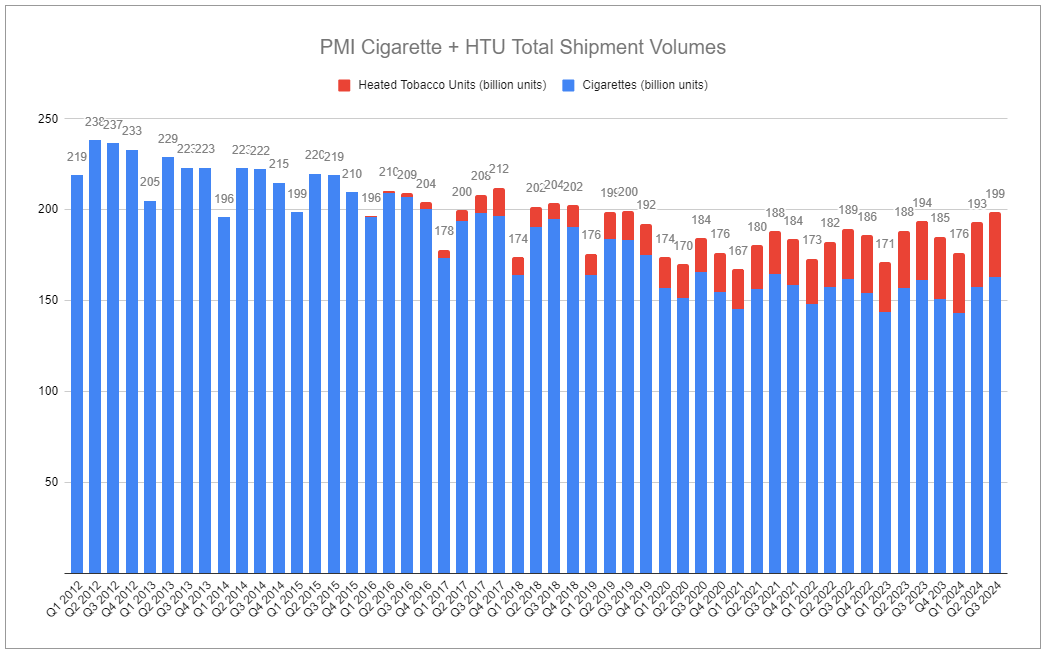

Shortages, shipping disruptions, device transitions, the EU flavor ban, and rollouts of new unit variants—there has always been some mix of factors influencing future sales and concerns that IQOS’s trajectory could falter. Q3 2024 HTU shipments were a mere 8.8% increase over last year, but consumer offtake measured nearly 15%. One more strong step in a long race.

Rather than placing greater emphasis on current unit volumes, I’ve often talked about how the number of IQOS users serves as an incredibly useful forward indicator:

IQOS user growth is followed by sustained associated HTU growth and reflects the cadence of trial, adoption, and shift from poly-usage to exclusive usage.

PMI must not find disclosing that metric as helpful as it once did. The company has not published an exact figure for several quarters. Amongst other factors, this led me to refocus my Q1 note, which was nearly entirely devoted to referencing product qualities and the group’s competitive position:

Beyond the reported number showcasing IQOS’s continued trajectory, there are troves of evidence of consumer responses and reviews highlighting how far apart IQOS’s quality is from other HTPs. Not long ago, others analyzing the company were saying that if IQOS was Coca-Cola, glo was Pepsi, and they’d split the lion’s share of the market, and other offerings would still be left with respectable, small slivers. Now, I am more inclined to say that IQOS Iluma (and Iluma I) are more akin to a cold, crisp glass of Classic Coke on a hot summer day, while all other products are room-temperature dented cans of private-label soft drinks.

Perhaps that conclusion was a tad too punchy, but one doesn’t need to look too far to find confirmation that IQOS is indeed lapping the competition. During British American Tobacco’s Capital Markets Day, the company conceded that its offerings—ones it previously touted as revolutionary and competitive—could not go toe to toe at the premium level. For now, despite BAT promising a new premium variant and other majors working to develop and push heated products, this category remains PMI’s hill to stand on top of.

Sticky sticks

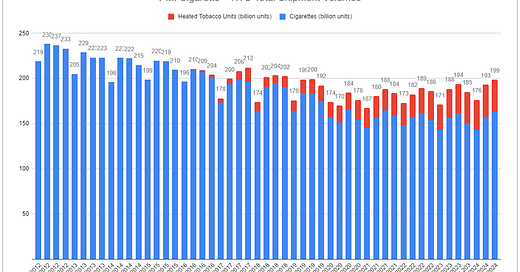

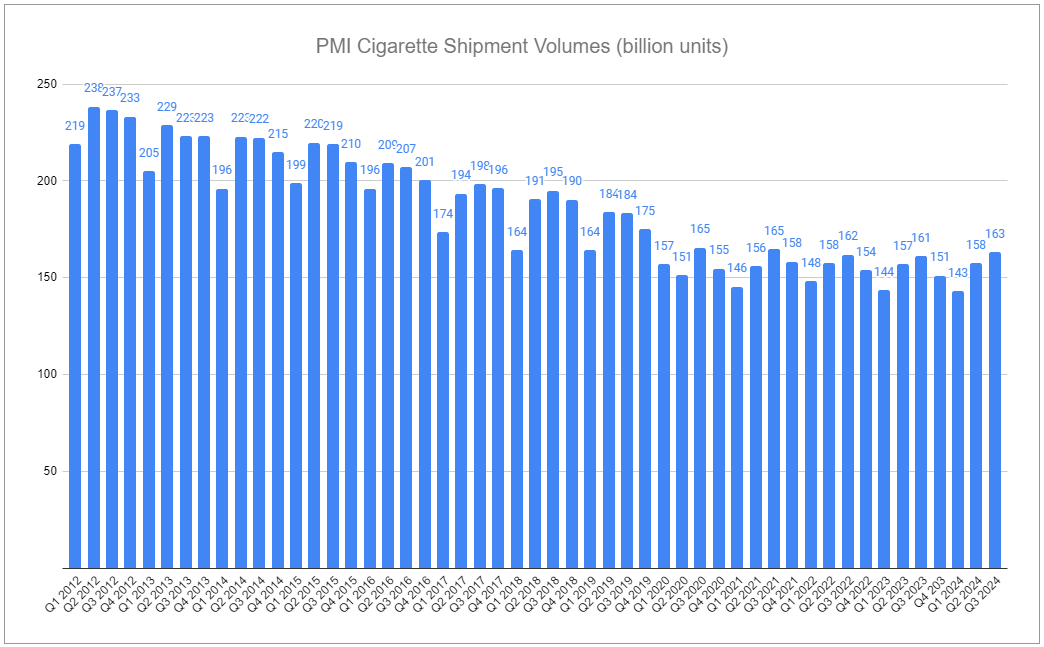

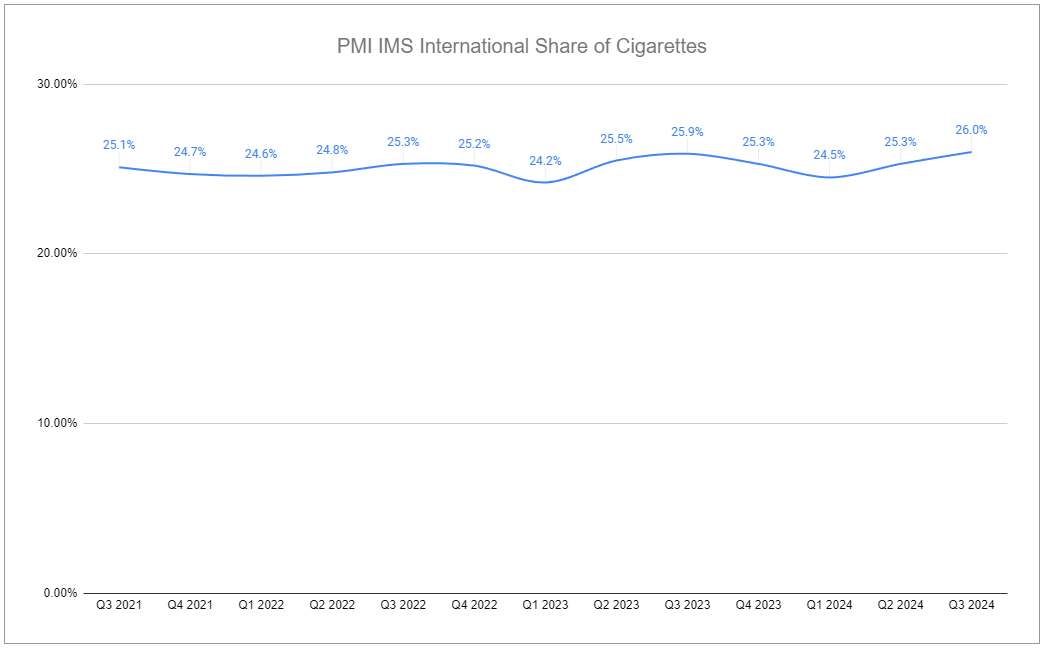

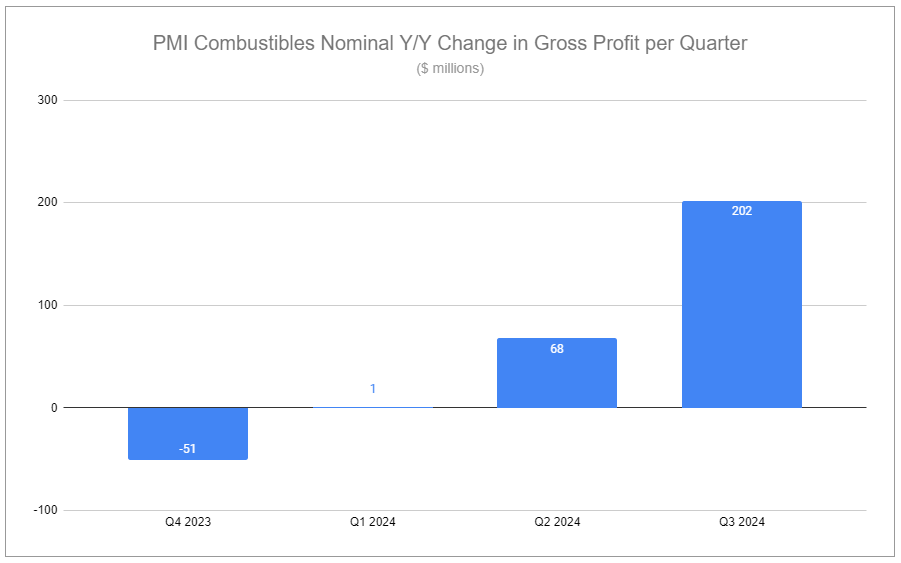

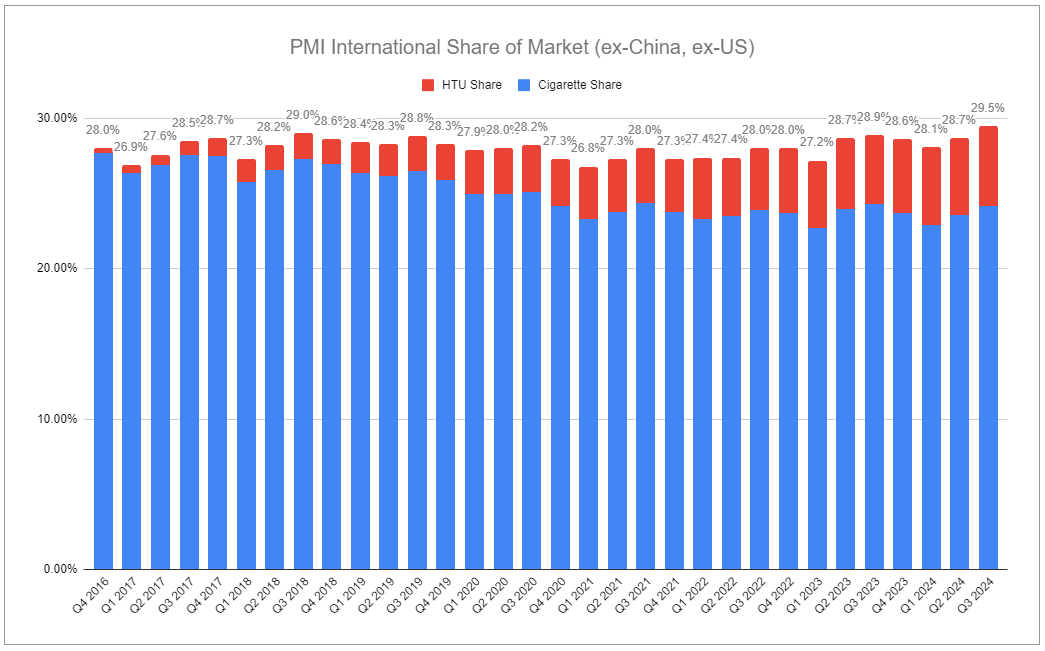

Despite ZYN’s rapid growth and IQOS’s strong position, combustibles can not go unmentioned or unacclaimed. PMI’s Q3 cigarette volumes increased +1.3% from the year prior, taking a fractional point of IMS market share. Volume and share figures will always remain inconsequential in isolation, so what makes this increase stand out are the same reasons that led me to stress the performance of cigarettes in Q1 and Q2. As new nicotine categories spread—PMI’s included—there is an almost implicit expectation that their volume growth comes at the expense of legacy products. There is also an expectation that legacy volumes would be further negatively affected by rich pricing. PMI’s combustible pricing variance in Q1 was +7.9%, Q2 was +8.9%, and Q3 came in at a whopping +9.7%, equating to +8.8% year to date.

If your gut reaction is that Q3 must have been an unusually strong period for combustibles, take comfort in knowing your feeling aligns with exactly what PMI management is telling you:

The unusually resilient industry performance this year reflects growing volume in markets where smoke-free products are not permitted, such as Turkey, India and Brazil, alongside a reduction in illicit volumes in a number of markets driven partly by geopolitical factors. Our growth includes notable contribution from Turkey, India and Italy and reflects good category share performance despite robust pricing.

When asked during the Q&A about favorable trends concerning markets where smoke-free products are absent and illicit continue to be tackled, Emmanuel Babeau quickly dismissed expectations of equally robust future results but conceded there is no reason many of these trends would abruptly end.

Current results are loftier than before, but the combustible portfolio has proven consistently robust over the last few years. Price variance has steadily wrenched upward from +2.7% in 2021 to +5% in 2022, up to +8.9% last year and the +8.8% we’ve seen so far in 2024. Over the last few years, while volumes are down marginally, PMI has gained a total of +0.9% in IMS cigarette share.

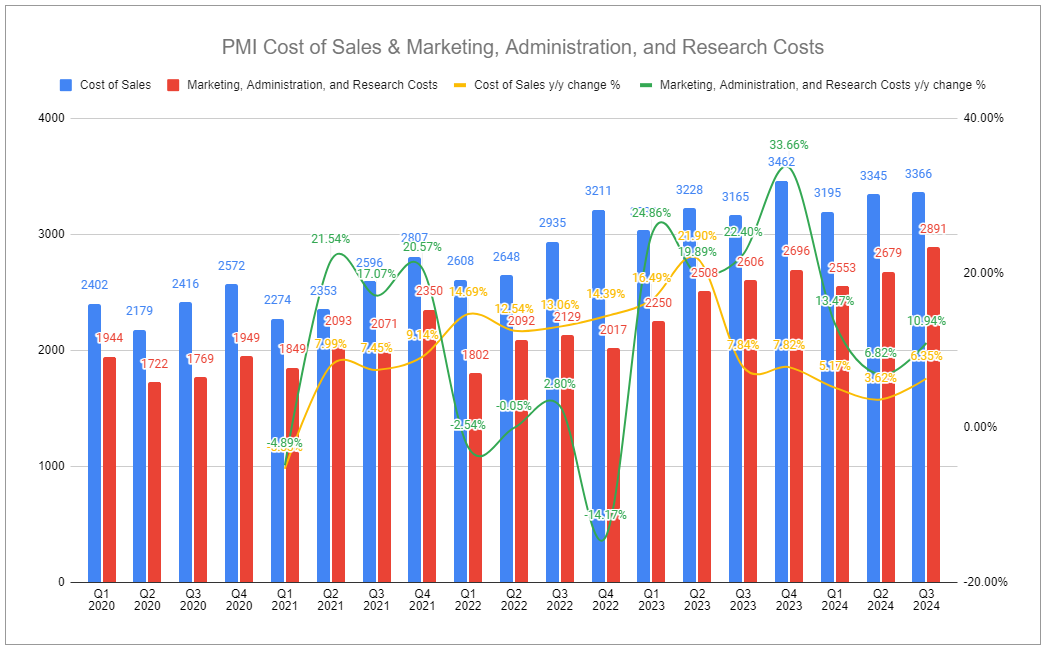

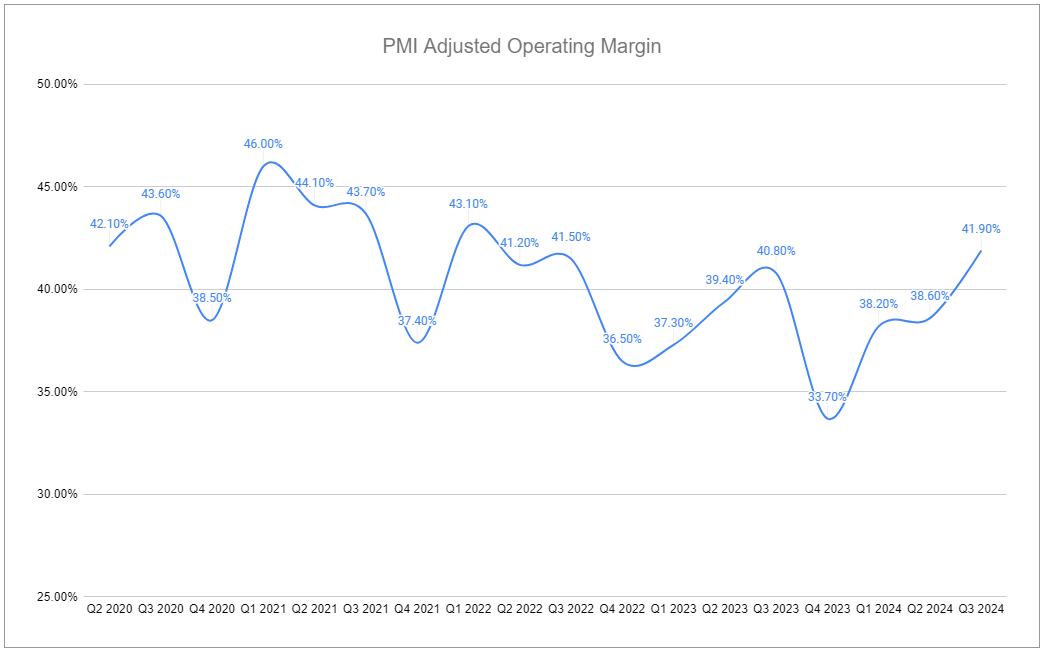

While future volume and price balance may be positive though less robust, more importantly, direct product costs appear positioned to continue to moderate, providing ample room for combustible’s contribution to rise. Although IQOS may be seen as the future, the future assuredly holds a place for cigarettes, too. PMI’s sticky sticks, underpinned by the tremendous brand equity of Marlboro and others within the combustible portfolio, continue to produce an enviable, durable, high-margin cash stream.

Doctor, doctor

PMI’s ailing Wellness and Healthcare segment has needed a doctor for some time:

What is appropriate to say about Wellness & Healthcare? Initially rationalized by PMI’s expertise in clinical testing and navigating complex regulations, it is doing a good job of acting as a black box money pit. This segment is, so far, a clear reminder that management is not infallible, and is hard to be viewed as anything other than the stretching of resources and attention that would be better applied elsewhere—deleveraging and accelerating the path toward share repurchases. Is such a view rooted in impatience? How long is too long if this segment continually struggles to find its footing—especially when nearly all else in operations continues to deliver?

Finally, an operation has been performed. In September, PMI announced the sale of Vectura, leaving the remaining portions of the segment intact and to be renamed. No part of the segment was ever central to the thesis or needed for the equity to perform, so the excision helps prevent the spread of imprudence.

O Canada!

In October, the mediator overseeing the CCAA proceeding of PMI’s Canadian Subsidiary, RBH, suggested a plan to resolve the massive overhang of tobacco product-related claims and litigation in Canada. A hefty price tag of $23.5 billion is to be paid, but how the bill will be split amongst RBH, JTIM, and BAT’s ICAN, amongst many other variables, is still being ironed out. The resolution is bound to result in some impairment, but no matter, as RBH has been deconsolidated since 2019. What remains, when reconsolidated, will prove to be purely incremental.

All Fronts

Last quarter’s note concluded:

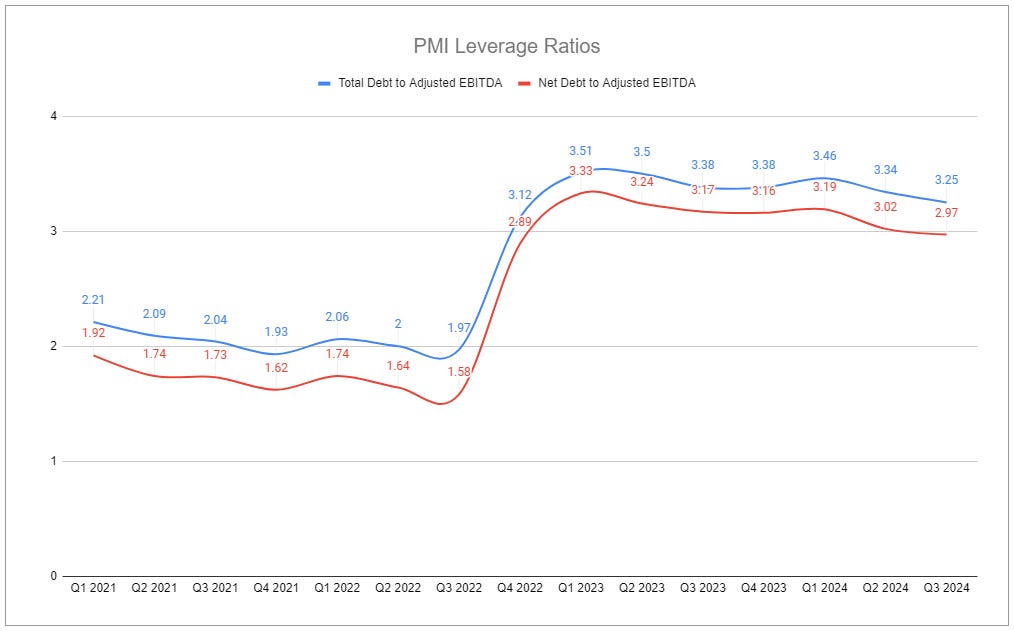

It is difficult to argue against the evidence showing the robust demand for PMI’s product portfolio. While volumes are looked at and focus on pricing remains paramount, the company’s true task at hand is to execute on both fronts while following through on controlling costs; no small feat. Despite the large ask, the company has demonstrated its ability to manage inputs and tighten the operational level, and it is now beginning to deleverage largely by growing the denominator of earnings. With additional measures taken to curb the effects of currency rates, which have been quite nasty in the past, the company is primed to produce earnings growth in the most real sense.

Demand, sales, and pricing are all in place. Costs are at bay. A consecutive revision of full-year estimates reaffirms the strength expected throughout the rest of H2. Take last quarter’s illustration, lick your thumb to smudge net financing and tax downward, and you’re within an inch of the newly provided adjusted earnings range. 20x adjusted 2024 earnings is certainly richer than a year prior, reflecting recent share price movement far outpacing growth for the period. But it remains high margin and sports a compelling growth profile despite low capital intensity, allowing the majority of profits to be returned to shareholders. As we head towards a period when the idea of share repurchases is more entertaining, it becomes hard not to want the market to lose its recent enthusiasm.

Thanks for reading. Enjoy this piece? Hit “♡ like” on the site and share it.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Philip Morris International and other tobacco companies such as Altria, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 0.00%↑ BTI 0.00%↑ MO 0.00%↑