“Year-to-date, in 2024, we have returned more than DKK 1.2 billion, which at the current share price equals close to 14% of STG's market value. This underlines our commitment to deliver on our shareholder return policy.” - Marianne Rørslev Bock, STG CFO, Q2’24 Remarks

The thesis for Scandinavian Tobacco Group has been centered on its portfolio of cigars as long-term global demand remains robust and pricing drives considerable cash flows, deployed to consolidate the market via M&A and return excess aggressively to shareholders. Alongside a substantial stream of dividends, share repurchases are to make up a large part of the return courtesy of what is viewed as a depressed share price, a result of a disconnect between the durability of related cash flows and investors’ lack of appreciation for these unique assets, amplified by ESG mandates, the company’s relatively small size, and Danish listing preventing consideration and access.

When I first published my views on STG, I argued that it could become even more aggressive because its balance sheet was far below its target leverage ratio. Additionally, the company’s foray into next-gen products, namely nicotine pouches, was mentioned but nearly entirely discounted within the thesis. Having executed another large acquisition, increased internal investments, and maintained a significant share repurchase program, STG’s aggression exceeds even my estimates, and while I have been unabashedly bullish on nicotine pouches categorically, I had previously been overly dismissive of Scandinavian Tobacco Group’s related efforts. Now, with several pouch brands owned by the group and increasing distribution leading to rapid sales growth and, at the same time, a new acute headwind is bound to further depress results in the near term, it is time to revisit the core drivers.

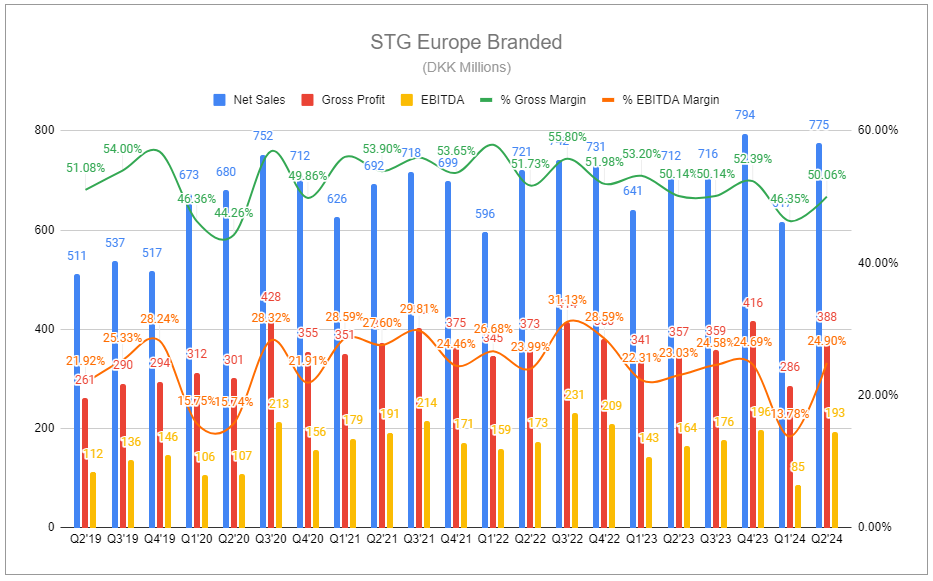

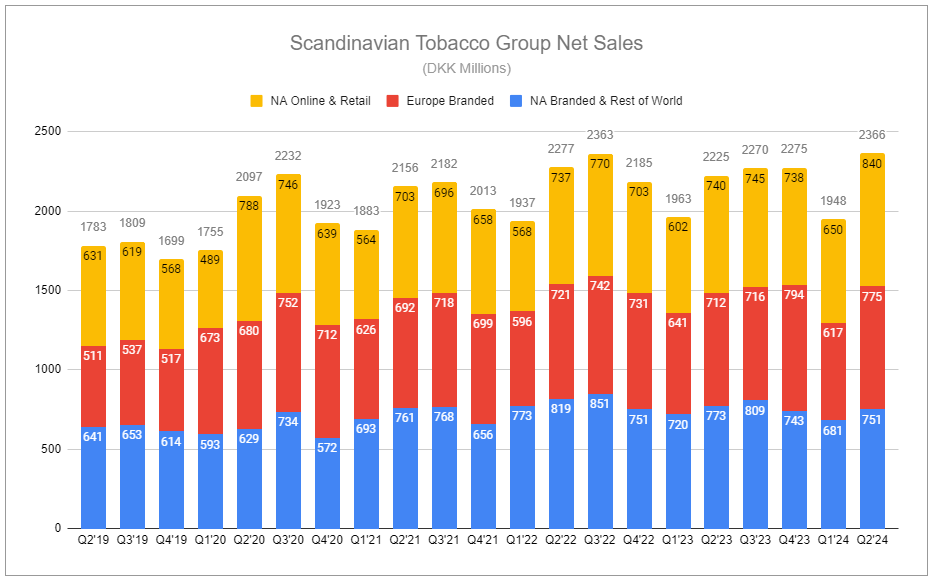

Europe Branded

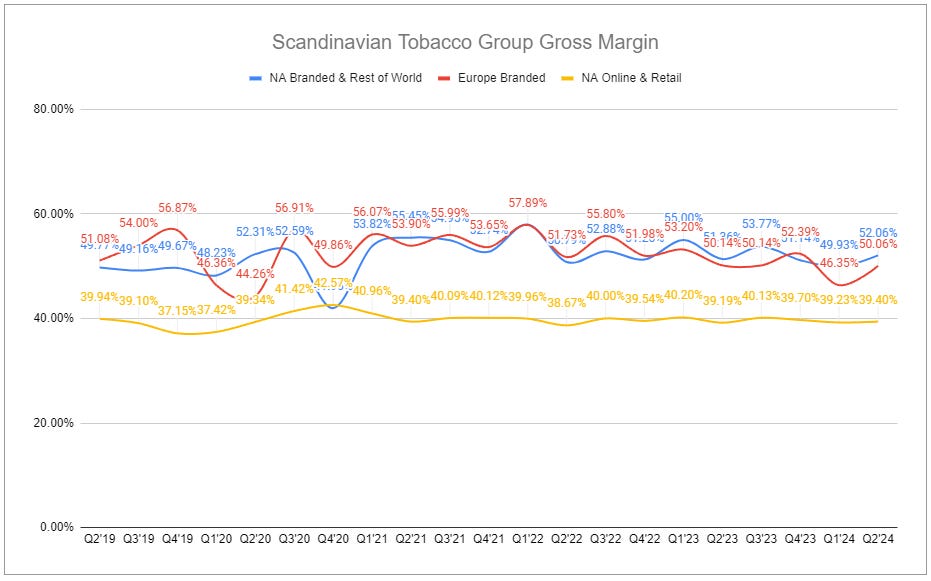

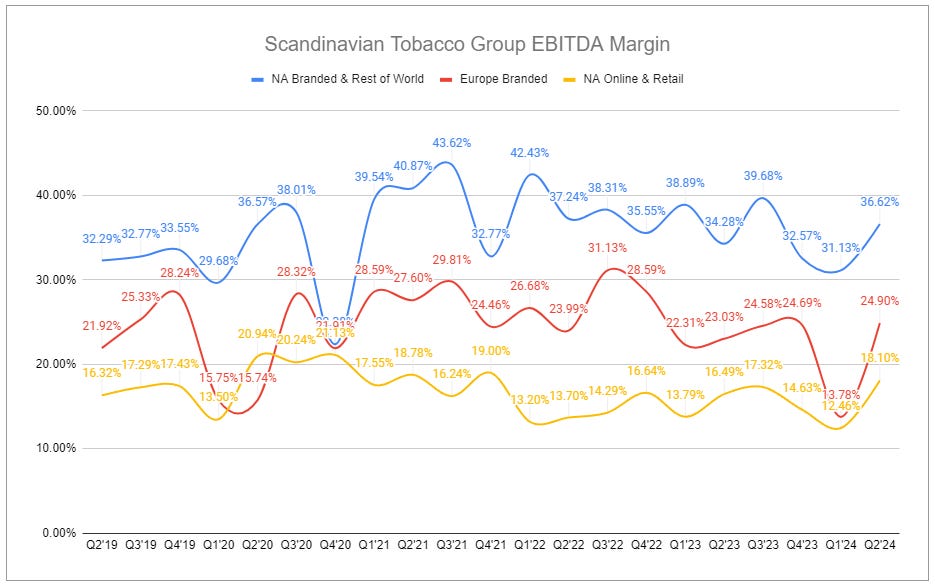

While the group regained a modest 30 bps of share compared to the same period last year, pressures provided by machine-made cigars continued to weigh on the Europe Branded segment in Q2’24, with volume declines of ~5%, remaining above the historical decline rate. Since MMCs are the largest product category within the segment, the resulting financial performance, all else equal, would be notably sour. Fortunately for the group, other categories excelled. Double-digit growth was experienced for handmade cigars, and nicotine pouches continued their rapid ascent, with increasing distribution and launches into new markets lined up throughout the rest of the year. Likewise, pipe and fine-cut tobacco experienced volume growth on top of pricing, leading to aggregate smoking tobacco net sales growth of 6%. So, although MMC volume declines measured nearly 2pp over the rate experienced in FY’23, the segment’s Q2’24 organic net sales increased by 6.1% and by 8.8% on a reported basis. Further, EBITDA margin expanded by 180bps to 24.9%, a function of growing aggregate sales as gross margin was flat. The margin improvement was all the more impressive considering the negative effect of continued investments to support the growth of nicotine pouches—an effect that was especially pronounced in Q1’24.

Hello Mac Baren

On June 27, 2024, Scandinavian Tobacco Group announced the acquisition of Mac Baren Tobacco Company A/S for DKK 535 million. On the day of the announcement, I responded to a reader asking my thoughts on the deal, to which I responded:

My gut is mixed. For one, their leverage ratio, relative to normalized earnings, had previously suggested that either additional M&A or a more aggressive capital return policy was likely. However, the increased reinvestment rate into growth enablers, layered on top of the ERP rollout, will continue to weigh on cash flows. This acquisition seems a tad aggressive, though the brands acquired are quite impressive, and the price tag isn't exactly demanding; especially if there is a good chunk of synergies to recognize. While a smaller % of the acquired, Ace pouches are popular - especially for those gravitating towards very strong varieties.

Having had more time to ruminate over the deal, I now find myself cautiously (always) but definitively optimistic. M&A is in Scandinavian Tobacco Group’s DNA, and the group has a strong track record. While plenty is still unknown about specifics, I point to the facts to rationalize my cautious optimism.

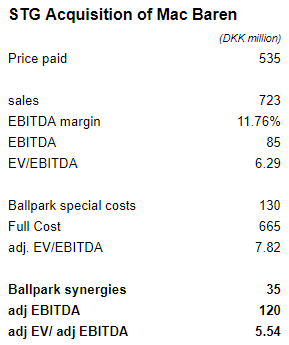

Mac Baren’s trailing annual sales measure DKK 723 million. EBITDA measures DKK 85 million. This provides a purchase price of 0.74x sales and 6.3x EBITDA, but in isolation, that tells us very little, and more context is required.

Mac Baren has operated for nearly two centuries as a family-owned business that predominantly sells pipe and fine-cut tobacco. Its headquarters and primary production facilities are in Denmark, and additional production is in Richmond, Virginia. While the company currently does business in over seventy countries, most of its sales are in the US, Denmark, and Germany. Scandinavian Tobacco Group already has a strong presence in those countries, and its production facilities for its own pipe and fine-cut tobacco brands are also located in Denmark, pointing to the potential of facility rationalization to improve group costs. However, the extent may be less pronounced than previous sizable acquisitions for two reasons. One is that the recent strength of STG’s pipe and fine-cut tobacco business may lead to apprehension toward cutting total capacity due to uncertain future needs. Second, approximately 20% of Mac Baren’s net sales are from its nicotine pouch brands ACE and GRITT. This suggests an opportunity for STG to use the acquired footprint to expand capacity for both brands and its already-owned XQS and STRÖM.

STG’s acquisition playbook, beyond facility rationalization, involves cutting duplicative back-of-house expenses and leveraging its existing distribution and sales infrastructure to bolster or even accelerate acquired brands. Due to the deal's timing, STG has not outlined its expected synergies from the acquisition. Still, they are all to be expected, as are special costs related to their implementation. Let’s plug in some numbers to see how things could look.

~20% of Mac Baren’s sales are nicotine pouches, which the company states have a ‘small negative contribution to EBITDA.’ Call it -1% to -5%, and the roughly DKK 144.6 million in pouch sales represents a DKK -1.5m to DKK -7.2m drag on the EBITDA line. Using the -3% midpoint would give the core tobacco business a current EBITDA margin of 15.45%. Special costs related to integration could very well be higher, but consider that STG can use its distribution to slowly grow acquired NPs to break-even contribution and beyond, alongside pricing/volume/mix benefiting the core, and you have a very conceivable path to well-above DKK 100m EBITDA even before the majority of other synergies. Again, these are very ballpark numbers, and we won’t have better visibility until STG provides its synergy outline in Q3’24. However, the payback period becomes relatively short at these multiples, provided synergies translate to substantial cash conversion. Additionally, there remains considerable upside if the acquired NP brands grow anywhere near the rate of the NP category as a whole. Speaking of the acquired NP brands, let’s talk about ACE.

A word on ACE

Pungent. You can smell the pouches through the can. The can itself is seemingly standard yet high-quality and the labeling is clean and precise—what is expected from Northern Europe. The pouches are distinctly moist but are thicker than most others and may not sit as comfortably tucked under your lip. As for the flavor, in this case, honeydew black pepper, it is sweet and savory with slight spice and is unquestionably distinctive. At 8mg nicotine strength, it is a reasonably standard strength, entirely too much for those with low tolerance and not quite enough for those seeking a harder punch. Overall, it is appealing and unique and complements the unique flavors already owned by Scandinavian Tobacco Group in the XQS brand lineup.

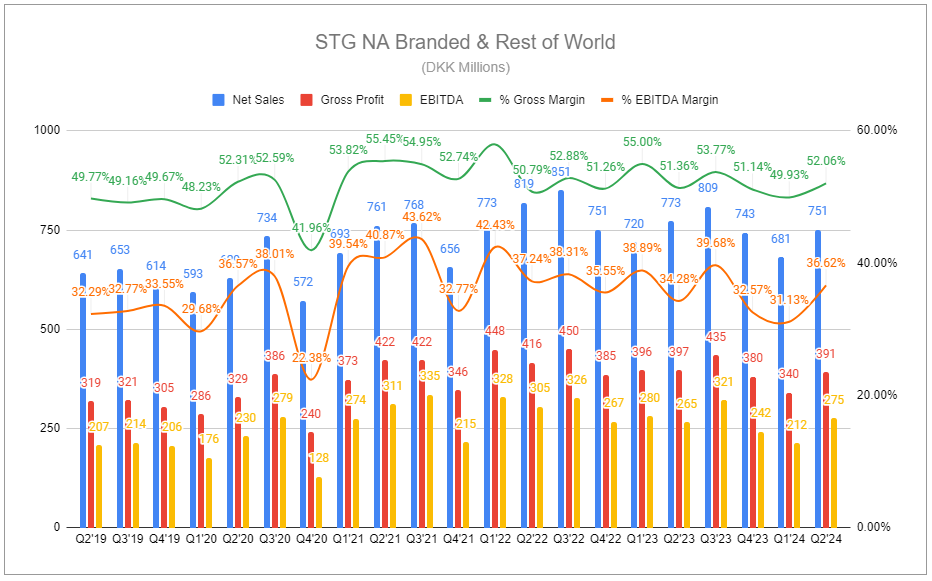

North America Branded & Rest of World

NABROW has not appeared particularly strong, but the long-term thesis remains intact. STG continues to expand its footprint to build brand equity worldwide, much of which is total whitespace for the premium handmade category. While it is essential to separate short-term noise from long-term thinking, it is undeniable that segment performance over the shorter term has been less than impressive. NABROW’s Q2’24 performance was the weakest of STG’s three segments. The impact of the plain packaging laws on MMCs in Canada has lessened, but pressures stemming from RoW still weighed. Net sales down 3.5% on an organic basis and 2.9% reported represents the continued weakness following post-pandemic normalization in consumption patterns, notably in the US. However, price/mix helped offset the continued sluggishness, and a DKK 16 million refund related to import tax payments drove segment EBITDA to DKK 275 million. Subtracting the refund, segment results were just shy of unchanged from Q2’23.

Further supporting the evolution of the US market, I remind you that, in August of last year, the U.S. District Court of the District of Columbia issued a final Memorandum Opinion in Cigar Association of America et al. v. United States Food and Drug Administration et al, providing a distinct benefit to STG, reaffirmed during the Q&A of the Q2 call:

Niklas Ekman, Analyst, Carnegie:

Clear. Can I also ask what's happened with regulation in the U.S. market since the FDA deeming regulations were vacated late 2023. What has happened in the market? Are you now allowed to do significant new product launches again? And is that good or bad for you? Does it mean that competition is increasing? Or have you managed to gain on the back of this?

Regis Broersma, STG Chief Commercial Officer:

Yes. So in principle, on the legislation front in the U.S., since that announcement in principle, nothing really has changed significantly. In principle, when it is classified as a premium cigar then in principle, launches can happen again. I believe when it comes to STG and it is a benefit or not a benefit for us. In principle, we were already complying with the regulations before that announcement was made. So for us, actually, it gives us more freedom to launch new products than previous to the announcement.

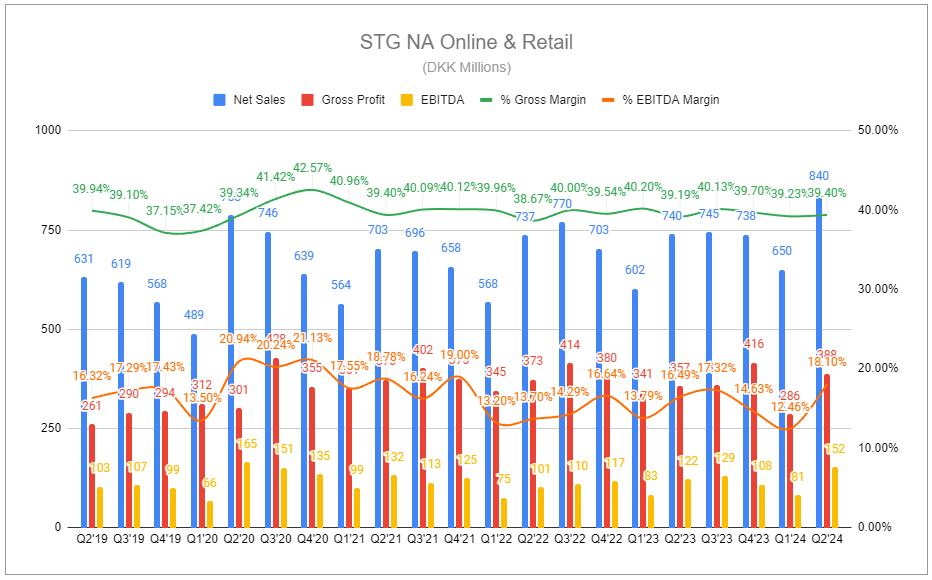

North America Online & Retail

In Q2’24, the NAOR segment again provided a stand-out performance, with 12.1% growth in organic sales and 13.6% growth on a reported basis. Physical retail experienced same-store-sales growth of 5%, and the group is set to open three new super stores in H2’24, following the two new openings in FY’23, underpinning sustained sales alongside price/mix evolution of handmade cigars in the US. Unfortunately, the segment’s strong contribution is set to lessen in the coming periods, as its growth was also a function of handling the online distribution of ZYN through the zyn (dot) com website.

ZYN owner Philip Morris International received a subpoena from the Attorney General of the District of Columbia in mid-June, seeking information on Swedish Match North America’s (the operating subsidiary responsible for ZYN) compliance with the D.C. flavor ban. According to the PMI’s press release, early indications show infringing sales being completed by independent retailers. Still, as an immediate measure, PMI suspended all sales on its standalone website. Due to the percentage of total pouch sales being trivially small relative to PMI’s total volumes, this detail was not included in my latest Philip Morris International note. However, the implications for Scandinavian Tobacco Group are much more pronounced. Total pouch sales represent roughly 6% of the group’s total net sales, with owned brands equating to ~3%, pointing to ZYN distribution making up the other half. This represents roughly 8-9% of NAOR segment online net sales, and there is no clarity on when (or even if) PMI SMNA will decide to resume sales on the standalone site. As long as zyn (dot) com sales remain suspended, the clear beneficiary is channel-leader Haypp Group.

Haypp Group: Further

Aggression Abounds

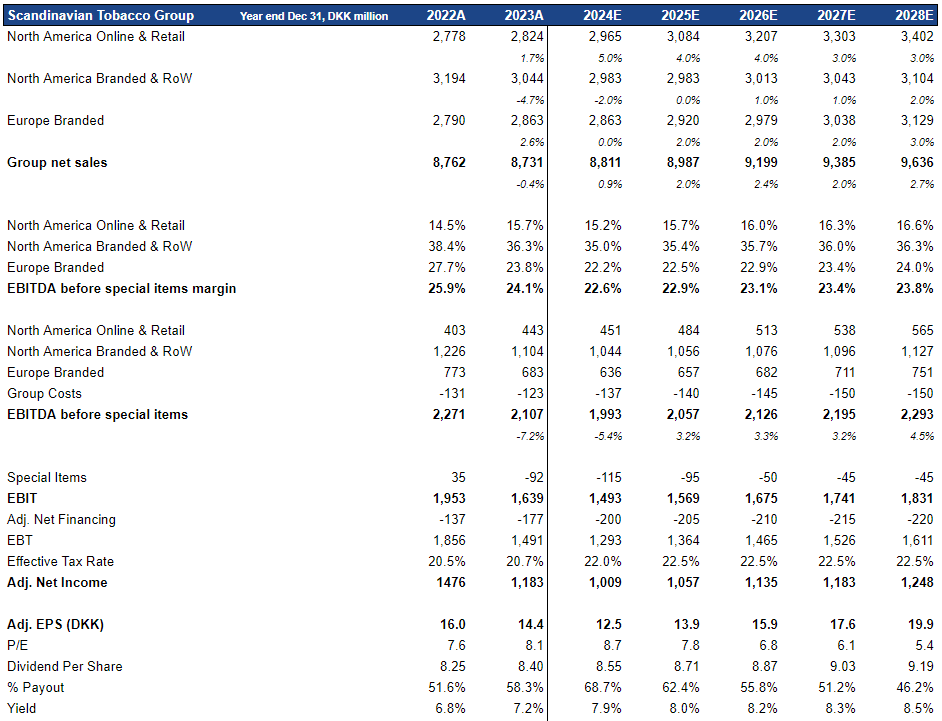

Considering the continuance of the post-pandemic unwind in the US market, the elevated MMC decline rates in Europe, and the undefined pause of online ZYN sales, Scandinavian Tobacco Group’s aggression, reflected in its rapid capital returns despite heightened reinvestment and continued M&A, may appear overly so. Yet, when translated into the numbers, management’s actions continue to be supported. While undeniably facing challenges, core legacy categories can produce stable, even slightly growing net sales growth on the back of price/mix. Growth Enablers, the expansion of handmade cigars, nicotine pouches, and retail, are poised to continue to provide double-digit growth. While Special Item costs will continue to weigh further on profitability, such investments will set the company to recognize further savings only several years out, bringing us closer to a more normalized earnings profile.

Management has once again reaffirmed FY’24 guidance, including:

Net sales: DKK 8.8-9.1bn

EBITDA Margin: 22-24%

Free Cash Flow: DKK 0.8-1bn

Adjusted EPS: DKK 12.5-14.5

This excludes the impact of the Mac Baren acquisition, and I will abstain from including the impact until we receive the outline for integration and synergies in the following quarter. The deal will add roughly 8% to the top line and create a slight bump in net financing. While accretive post-synergies, implementation costs will ultimately weigh on profitability in the interim. For now, I will provide a revised illustration showing modest shifts in STG segment sales, margin evolution, and special items. Below are figures that rest at the low end of net sales and EPS ranges, with the rapid pace of share repurchases acting as a significant driver of returns over the medium term.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Scandinavian Tobacco Group and other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Hello Devin, really enjoying your articles. I am myself an investor of Imb and bats, and I am interested in adding STG for diversification and the possibility of M&A. However, there are a few things I like more with BTI/IMB - I would love to hear something that you like about STG more than in the other two.

1. IMB/BATS valued a bit lower still from P/E / EV/EBIT perspective

2. Ken Dart as a strong owner, do you know anything about strong owners in STG?

3. I can't get out of my head that I think pouches are more natural for IMB/BATS. If you have cigs in all small shops in the world, why not throw in some pouches too? Synergies!

Cigars are not as wide spread and I would believe the synergies would be alot smaller. What do you think? would love to hear your thoughts. Great piece!

Greetings Carl from Sweden

Good article as always.

There are still smaller, profitable tobacco players in Europe. I would know 3 or 4 smaller players in Germany alone that would be lucrative takeovers. The regulation for tobacco becomes more and more costly. Scandinavians Europe strategy seems to be the last man standing and integrating all the small players into STG.