“A ship in port is safe, but that's not what ships are built for.” - Grace Hopper

The smaller the vessel, the more quick and nimble. The smaller the company, the higher the upside as it captures niches and rides the tides of good fortune. However, it’s also true that when storms form and waves turn violent, tiny ships find themselves fully at the mercy of the elements. United-Guardian is a prime example, and the company finds itself precariously positioned. Part of it appears battered and torn—struggling to regain momentum. Inversely, another piece benefits from gusting tailwinds, and while the horizon shows no end of the storm’s end, the company continues to showcase its buoyancy.

The following will fully catch you up on the voyage:

A tear in the sail - LUBRAJEL

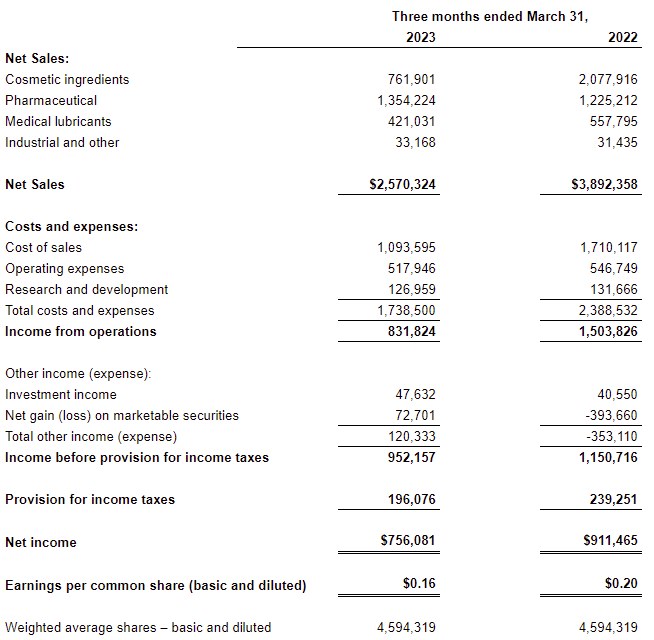

United-Guardian’s operating categories continue to post remarkably different results. In Q1 2023:

Cosmetic Ingredients net sales fell by 63.3% y/y.

Medical Lubricants net sales fell by 24.5% y/y.

Industrial Chemicals net sales grew by 5.5% y/y but is an inconsequential contributor to overall sales and will be discontinued next quarter.

The company has attributed the massive drop in Cosmetic Ingredients and Medical Lubricants sales to decreased demand in Asian countries due to extended COVID-19 policies throughout 2022 and customer inventory destocking. Unfortunately, we are provided little granularity, as UG relies on partners to sell and distribute the majority of its LUBRAJEL line. One is tempted to ask how long destocking can go on before it must be called a complete lack of demand as customers switch to competing products. However, weighing against that concern, Ashland Speciality Ingredients, UG’s largest partner, has stated that they are unaware of any significant loss of major customers. If that truly is the case, then volumes are likely to pick up, albeit later than anticipated.

Along with a potential reversal in current LUBRAJEL sales, a potential change in course may be found in the company’s recent announcement of its Natrajel™ line—a line of both classic and nature-derived products for sexual wellness. This is not entirely new for United-Guardian and is not unexpected, as I previously highlighted unannounced changes to the company’s website:

Under ‘Products’, renamed ‘Our Markets’, the discontinued industrial segment has been removed and has been replaced with ‘Oral Care’ and ‘Sexual Wellness’. Neither of these categories is entirely new, as the company’s line of LUBRAJEL lubricants has uses in oral care products as well as condoms. Unfortunately, the updates on the website are incomplete, and neither navigation link provides a page with greater details. It is not unreasonable to expect the company to focus on expanding LUBRAJEL applications in these two markets, especially for its recently-growing natural variants. Just as the company currently faces customer concentration risk, these markets are extremely large, especially relative to UG’s size. A new CEO focusing on these products, which the company also continues to sink significant R&D dollars into, could make for a very different picture.

Uncertainty remains regarding what specific uses these products would have, as well as if they were developed specifically for established customers. To avoid inappropriate speculation, I’d curb expectations toward Natrajels’ short-term contribution. However, it is worth noting that the required capex to facilitate production and greater capacity would likely be minimal, and due to the company’s size, even a single customer of these lines could be a material impact on the company’s segment results.

The tailwind - Pharmaceuticals

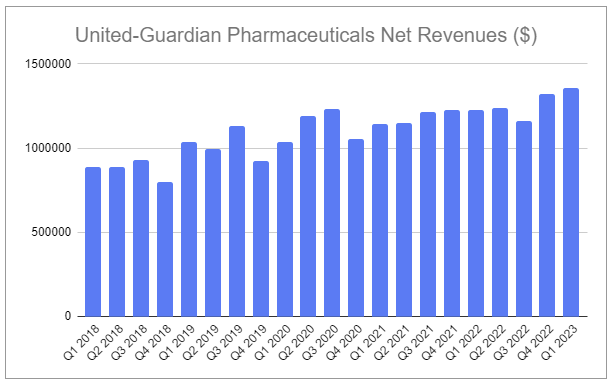

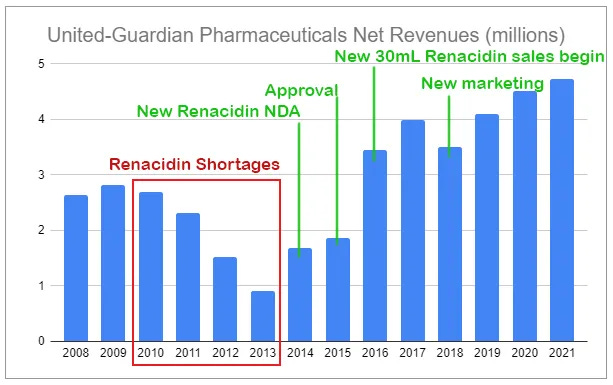

United-Guardian’s Pharmaceutical segment continues to impress. Unlike the volatile and recently struggling LUBRAJEL lines, Pharmaceuticals continue to grow steadily and in Q1 2023 increased 10.5% y/y.

Also unlike Cosmetic Ingredients, in which the majority of sales are overseas (though sales to partners such as ASI are accounted for as domestic sales), the majority of Pharmaceutical sales are in the United States. This segment is comprised of two drugs, Ranacidin and Clorpactin WCS-90. Renacidin is an off-patent prescription drug with zero generic competition due to a variety of factors, as covered in Mini Monopoly. Clorpactin is a broad-spectrum chlorine-based topical antimicrobial. According to FDA reporting, Clorpactin is classified into the Marketing Category of “Unapproved drug other”, though has been marketed for nearly 3/4 of a century, per its product information:

It has been in use since 1955 in a quantity equivalent to many millions of liters of solution, yet no indications of a toxic nature have appeared in the medical literature, despite the varied nature of the conditions treated and the variations in the methods of application.

Due to the unique nature of these drugs and their niche existences, it is understandable why United-Guardian provides little granularity into the specifics of group contribution results. We don’t know the exact contribution margins of these products, nor what portion of sales growth comes from volumes vs. price. Nonetheless, historical comps highlight that:

The company has routinely exercised moderate pricing power of these drugs in the past.

Growth of segment net sales over the last half-decade correlate to new Renacidin-specific marketing efforts over the same period.

It is not unreasonable to think the company has sufficient capacity to cover sustained growth in related volumes for the foreseeable future. If additional capex is required, it will likely be inconsequential based on total historical requisite spending. With any degree of pricing power, growth in sales should comfortably outpace related operational expenses, leading to improved segment and group margins.

In addition to the growth of core sales, the company has more recently announced new growth initiatives for this segment.

The company is exploring the geographic expansion of Renacidin, and during the annual shareholder meeting specified Europe. Regulatory complexities shroud any clear parallels between the unique dynamics that insulate Renacidin from competition in the United States.

United-Guardian is working with SIGN Fracture Care, who is testing Clorpactin as a surgical disinfectant with ‘very promising results’.

I have no appropriate way of anticipating the potential financial contributions of either of these initiatives other than to say they would be non-zero and likely skew heavily positive for United-Guardian.

Buoyancy, profitability, and the model

UG shares have continually ground lower over the year as the outlook of its (previously) largest segment, Cosmetic Ingredients, has become more questionable. However, there are several things to note.

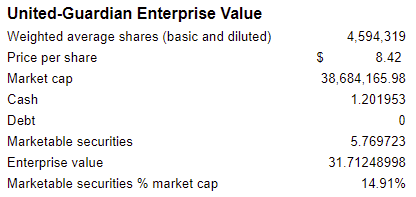

United-Guardian still holds 0 (zero!) debt on its balance sheet.

The company continues to hold a sizable portion of marketable securities on its balance sheet, currently totaling $5.76 million, or 14.91% of the current market cap.

Despite clear headwinds, the company’s operations are still quite profitable.

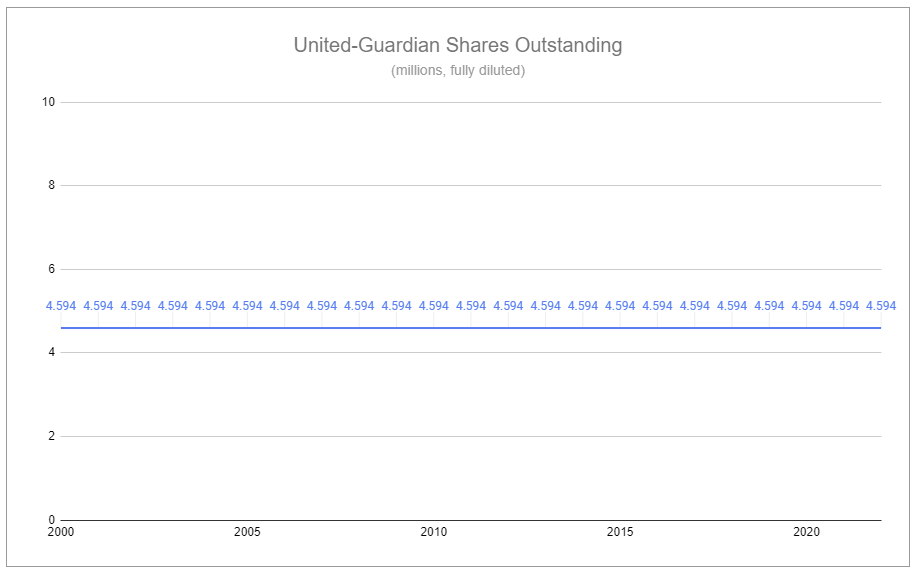

This company has no SBC to account for and future dilution is exceedingly unlikely, as illustrated by the comical chart below.

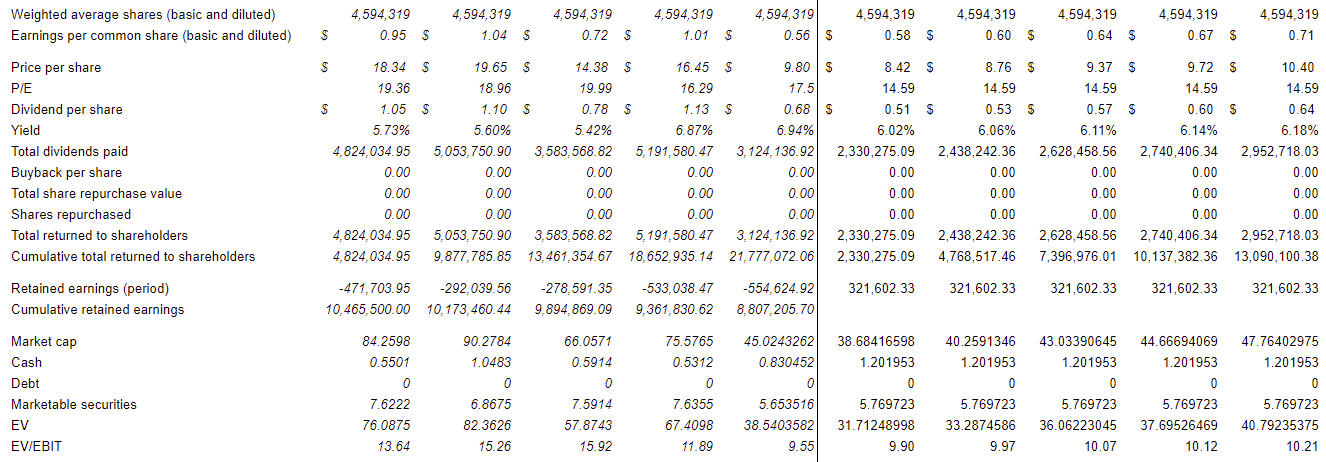

Despite the outrageously low capital intensity of this business, previous assumptions regarding the rate at which (or even if) LUBRAJEL sales recover appear simply wrong. At the same time, previous assumptions will be terribly off the mark if Pharmaceuticals maintain its current trajectory.

What would things look like if Cosmetic Ingredients not only do not recover but fall far under the LTM run rate experienced in 2020 during COVID?

It’d conceivably look something like this:

As previously, there are pertinent further considerations:

Cost of sales will likely soften.

Requisite retained earnings will likely be less.

While CI sales may soften more short term, there is a far greater chance the segment recovers in the medium term.

If CI never grows again, Pharmaceuticals will remain the dominant segment, likely making the company’s earnings as a whole more stable and less sensitive to global macro factors.

The assumed effective tax rate moving forward is ~100bps above the historical norm.

Not specifically reflected in the simplified income-oriented model above is the additional buildup of ~$800,000 in inventory on the balance sheet.

The company has stated its intention to shift its marketable securities (mostly fixed income) into USTs, which may increase investment income as well as provide a tax shield via recognition of unrealized losses.

Pushback regarding the illustration above is that capital returned to shareholders in the form of dividends may be muted, not because of a lack of earnings, but because of the shareholder equity threshold to satisfy NASDAQ listing requirements. The company received a letter on April 20th regarding its non-compliance, and as of its Q1 2023 10-Q has since been found in compliance once again. Despite the board voting to declare a mid-year dividend in July, the payout may be a fraction of what is illustrated to keep shareholder equity above $10 million.

While difficult to estimate, it’s not impossible to think that Cosmetic Ingredients could perform as poorly as illustrated above and shares continue their grind lower. With a further selloff, shares could present an owner’s earnings yield near double-digit territory. Taking an extreme approach and assuming that 60% of the cost of sales and 50% of operating expenses are related to Pharmaceuticals, the present value of estimated associated future cash flows exceeds $20 million. Subtracting cash and marketable securities, further weakness in the equity would result in an enterprise value ascribing effectively zero value to the other operating segments. If LUBRAJEL sales recover and/or if any growth opportunities materialize, owner’s earnings could find themselves seriously higher. I patiently await any radical disconnect.

Ownership Disclaimer

At the time of publishing this piece, I hold positions in United-Guardian.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: UG 0.00%↑ ASH 0.00%↑

An enjoyable read as always! Great writing style and once again charts support the narrative — yes the shares outstanding chart is comical and yells “management doesn’t dilute shareholders!”

I also end up asking myself questions after reading your posts. Last week, based on one of your comments, I asked myself how would I go about valuing Meta’s metaverse business. And the answer is — I have no clue. Zero idea.

I like mocking venture capitalists because they invest so much money in silly endeavors (FTX is a prime example). But at the same time some VCs can actually put valuations on businesses such as the metaverse, and they bring value by doing so.

Reading about this nanocap, my thought is how does one manage to research in detail a company for which little information is available, and yet avoid the sunken cost fallacy of “now that I’ve spent so much time looking into this company, might as well invest in it to avoid wasting all that work.” (Obviously such thoughts are not conscious.) Maybe by studying many such companies and therefore not focusing on a single one?