“Now is a time where, of course, we are reaching critical mass on smoke-free products; there are a number of things that we are doing that we can do more efficiently; a number of things that we’ve been learning and that we’re going to implement in the continuation of our journey so all that, we believe, is also giving us some very good ammunition and capacity to generate efficiency at a very high level in the future.” - Emmanuel Babeau, PMI CFO

Many have criticized Philip Morris International’s evolution, saying that its transformation is merely mutating and adding to the complexities of the business, multiplying opportunities to misstep. Currency pressures have been unshakable, weighing on the company for the majority of the years it has been publicly listed. Recently, added cost pressures bogged down progress even further. I have been firmly on the other side, with notes from the last few quarters notably upbeat:

Philip Morris International: Outstanding Momentum

Philip Morris International: Only Scratching the Surface

Philip Morris International: More More More

Q1’24 results were simply robust. Even with the presented headwinds, it must be appreciated that the muting of earnings experienced for more than a decade has also been a function of the firm’s reinvestment rate. Over twelve billion dollars have been invested in new products, now alongside the purchase of Swedish Match. Can Philip Morris International’s margins and overall quality of earnings evolve favorably over the foreseeable future? Will more dollars be pushed closer toward the pockets of shareholders? The company’s next-gen products absolutely carry favorable margin profiles versus legacy products. With SG&A and Capex rationalized and solid visibility into net financing, answering begins with assessing how well-positioned its products are within their respective markets.

IQOS and combustibles

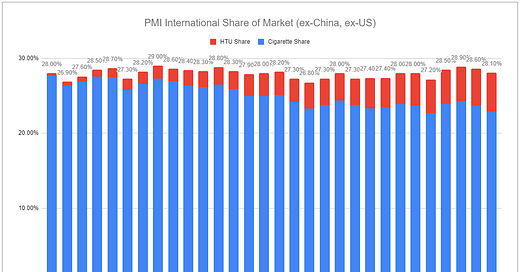

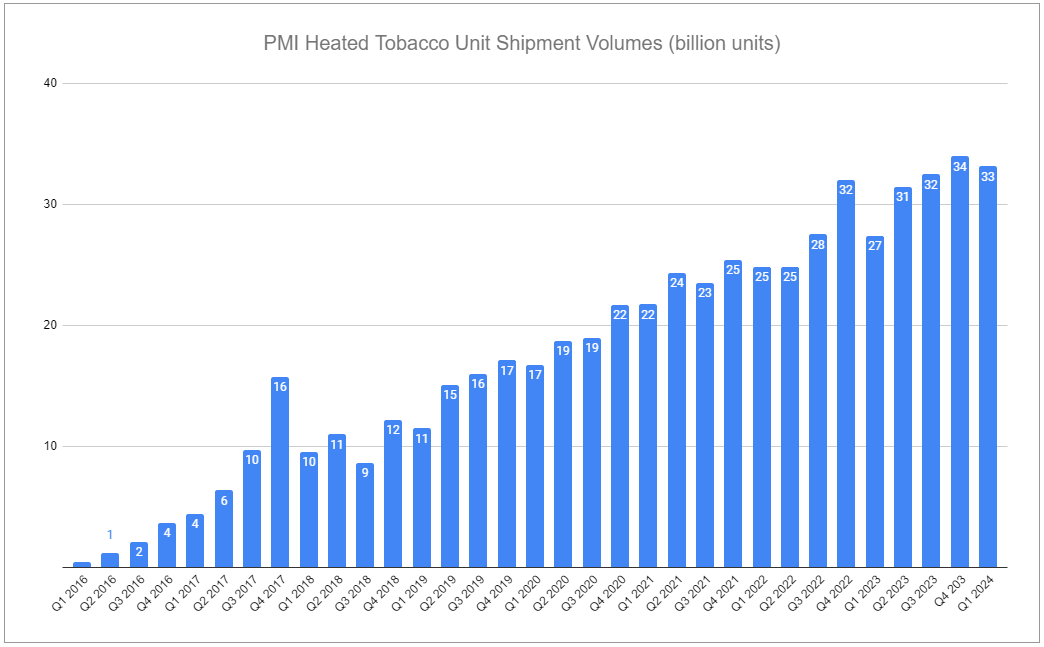

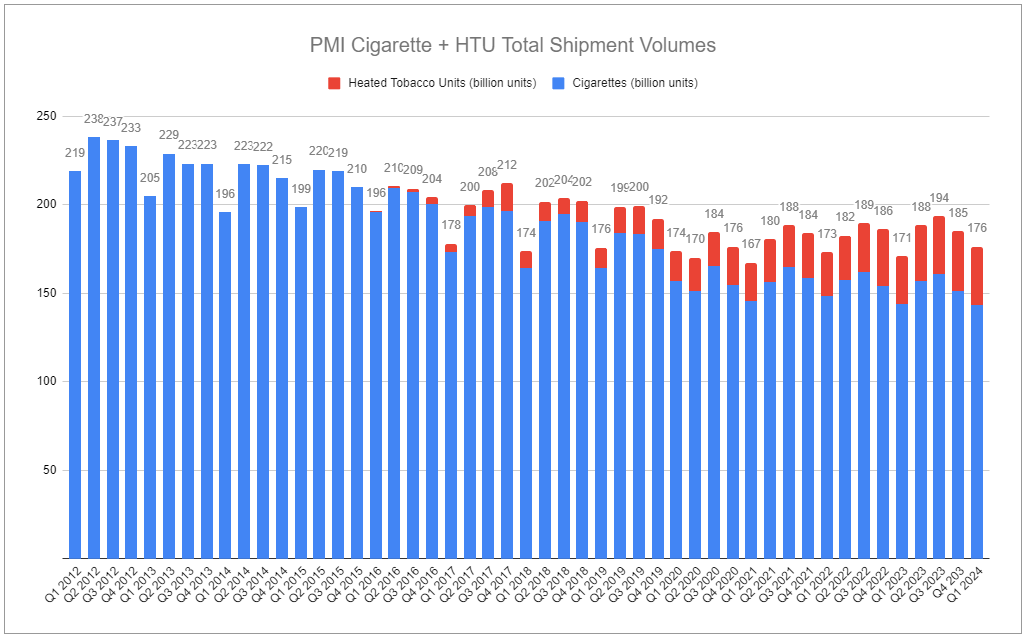

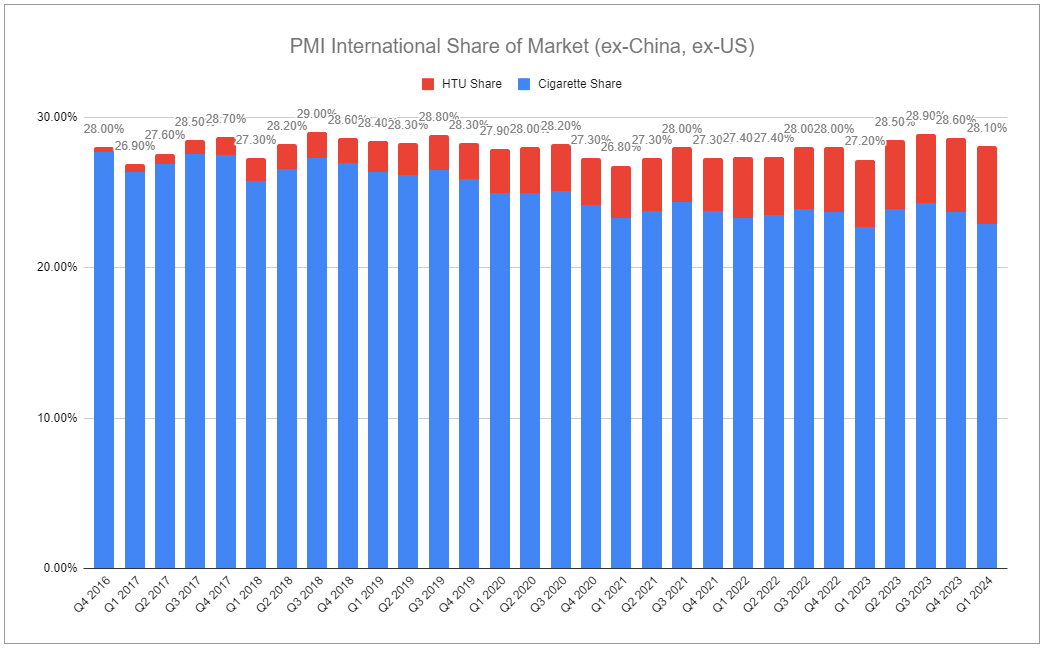

In Q1’24, IQOS HTU shipment volumes increased by +20.94%. There was some push and pull, with adjusted in-mark sales volume growth of ~12.5%, encompassing the reverberating effects of the flavor ban in Europe and an added timing benefit of from ~1 billion units to Japan. It’s worth stepping back from the quarter-by-quarter and looking at more normalized figures. 2023 HTU volumes grew by 14.74%. Management now expects 2024 growth of 14-16%, in-line with the year prior. The midpoint of 15% HTU growth would equate to 144 billion units for the year. Cigarette volumes declined by a mere 0.36% in Q1. It would take a combustible volume decline of 3% for FY to equate to flat aggregate volumes, and a 2% decline in combustibles would still result in aggregate growth of 0.88%. In other words, it is quite likely that 2024 marks the fourth consecutive year of aggregate volume growth.

As I’ve frequently harped on, volumes are merely one part of the equation. But there is certainly a captivating scenario when several further considerations are taken into account. One is the significant pricing being exercised on PMI’s combustible volumes. Full-year 2021, 2022, and 2023 saw price variances of +2.7%, +5%, and +8.9%, respectively. PMI’s minuscule drop in combustible volumes in Q1’24 was despite pricing of +7.9%. This type of strength is absolutely astounding and is deserving of much greater respect—by itself, PMI’s legacy business is still superb, even when the majority of firm resources have been directed toward facilitating the growth of RRPs. Second, the minimal decline in combustible volumes is all the more shocking when acknowledging that the IQOS HTU growth rate would have us expect a greater rate of cannibalization. With this in mind, two things are clear to be happening to different extents. In Q3 2023, I stated:

It only makes sense that IQOS’s trajectory was first aided by PMI converting users of its own products, which it could more easily connect to. But now, with scale and momentum, cannibalization has shifted to converting adult users from other sources at an elevated rate. There is no denying this is happening—there is no other explanation when the core product, cigarettes, faces secular decline, and yet, PMI continues to sport aggregate volume growth. In Q3, the company’s cigarette volumes declined by -0.51% y/y, netting aggregate growth of 2.18%.

With certainty, IQOS is eating the legacy combustible pool and is now likely taking more from the competition than itself. However, the above quote is too reductionist and misses a critical consideration. A framing that converting users equates to a 1:1 mix/shift in volumes is far too simple. Along with converting and retaining smokers at highly effective rates, there is a likelihood that many users are increasing their consumption rates. This shouldn’t be a surprise for a product that is more affordable, usable in more areas, and presents less stigma. With HTUs carrying a markedly higher contribution margin than legacy, this has compounding implications on future product velocities, margins, and profit.

The literal multi-billion-dollar question of how this trajectory can get derailed ultimately boils down to competition and regulation, and it makes sense to focus on two points.

Heated Tobacco Products are by far the most complex of the current three next-gen categories. It takes a ridiculous amount of money to make a minimally viable product, but minimal viability and competitiveness are two entirely different things. Last quarter, I touched on how advantaged IQOS appears relative to competition. Beyond the reported number showcasing IQOS’s continued trajectory, there are troves of evidence of consumer responses and reviews highlighting how far apart IQOS’s quality is from other HTPs. Not long ago, others analyzing the company were saying that if IQOS was Coca-Cola, glo was Pepsi, and they’d split the lion’s share of the market, and other offerings would still be left with respectable, small slivers. Now, I am more inclined to say that IQOS Iluma (and Iluma I) are more akin to a cold, crisp glass of Classic Coke on a hot summer day, while all other products are room-temperature dented cans of private-label soft drinks.

So, if you can’t beat them, copy them? Easier said than done. PMI has been provided substantial IP protections for its devices, and while the vapor category continues to feel the encroaching darkness of illicit, knock-off brands, and certain markets, such as the US, have failed to enforce upon illicit activity, it is exceedingly unlikely the same occurs for heated tobacco. A greater percentage of legacy combustible volumes have shifted towards illicit markets, both in cases of illegal transporting to skirt excise taxes as well as counterfeited volumes, but IQOS stick detection and authentication helps prevent the issue of illicit volumes, helping ensure that as the product grows across markets, PMI will be rightly capturing the value generated from associated consumable volumes.

With competition lagging far behind and an inherent shield from illicit activity, surely regulators will find a way to stunt IQOS? The most straightforward argument is that HTUs are taking market share from combustibles, and since governments recognize significant tax proceeds from combustibles, they will either want to stop that switch or tax the new products at comparable rates so that their purses remain nice and fat. There is the reduced-risk aspect of the product, which, if governments further recognize and incorporate into Tobacco Harm Reduction policies, would result in lower excise rates to incentivize consumer switching. But even setting that aside entirely, along with the fact that IQOS has the potential to create a massive long-tail stream of profits from the results of users living longer and thus consuming longer, there are other angles to consider. It is true that, on paper, even excluding the cost of the devices, HTUs priced above legacy combustibles would present a relative affordability differential that reduces switching and consumption rates. However, it may not be the crippling blow that is theorized.

As touched on in The Nicotine Arc, beyond monetary costs, health costs are a primary driver influencing consumption. Many consumers may very well pay up for IQOS HTUs under the pretense that the health costs they are paying are far lower.

As noted earlier, the hurdle for developing a truly competitive product is immensely high. However, there is still the issue of convincing legacy users or IQOS users to try your product. Raising excise tax rates will have a nasty effect on the limited pool of entrants trying to break into the category and take share from IQOS because it makes it far more difficult to play the pricing game to incentivize trial. Either excise is passed on to the consumer, effectively raising the minimum retail price, or manufacturers must subsidize their product to an even greater extent, altering their path from sub-scale.

Setting aside the product margin profile far favorable relative to cigarettes, there has been a lingering question of how much pricing power PMI would even be able to exercise if it wanted, with many questioning the degree of brand loyalty IQOS holds relative to esteemed legacy brands like Marlboro. This is not an entirely unfair question, though competition appears far behind, which suggests some degree of pricing power via exclusivity, as demonstrated by the ~3% HTU pricing in Q1’24. However, the question about pricing power misses the fact that excise taxes have played an important, integral role in the pricing power bestowed on legacy products. Excise-led pricing and manufacturer price take are two separate variables of a larger equation. When the retail price is composed more greatly of excise, the relative effect of incremental manufacturer price take becomes less felt by the consumer. While increased excise on HTUs is not inherently positive in the absolute, this dynamic is bound to become an easier lever for PMI to pull on in the future—and especially so if competition remains several laps behind in the race.

In almost all potential futures, it is likely that countries' actions to regulate HTP will vary across a wide spectrum. However, the majority will take more favorable, progressive stances toward RRPs. While aggregate excise taxes are bound to increase, the extent is likely to be less extreme, and most of the timing of those changes will be incremental and not done in a sweeping fashion, providing PMI ample room to navigate.

Wildfire was an understatement

With the continued excellent performance of oral nicotine products, it is hard not to sympathize with prior Swedish Match shareholders who complained that PMI’s purchase of the company robbed them. In Q1’24, shipment volumes for oral nicotine product cans increased by 40%, and by 35.8% when equivalised with pouches. In Europe, where nicotine pouches are cannibalizing legacy oral in certain submarkets, PMI grew Snus volumes by 11.6%, and notably, ZYN volumes, despite being an inferior product to the version of Velo available in submarkets, by 55.9%. The product was also introduced into 11 new markets, with many more planned ahead. And, despite all of those figures being terribly impressive, there is the growth of ZYN in the United States, which is on an entirely different level.

In Q4’23, I described ZYN’s US growth as ‘like wildfire’, but perhaps, even, that is an understatement. Sequential growth in the 12-month rolling shipments accelerated further in Q1’24 to 70%, with shipment volumes for the quarter up an alarming 79.7%. Management expectations include 560 million US ZYN shipments, equating to 45.19% y/y growth. As noted on the call, it appears that demand is so fervent, the company is actually struggling to keep up:

Bonnie Herzog, Goldman Sachs:

I just had a quick question, if I may, on ZYN. We're actually hearing about some out-of-stocks in the U.S. from our industry trade contacts. So, maybe hoping for a little more color on this and how much it might have impacted volumes in the quarter? Also, curious if these issues are related to, maybe, specific production issues or more related to the strong demand and, ultimately, when you expect them to be resolved?

Emmanuel Babeau, PMI CFO:

Thank you, Bonnie, this is very much the latter. I mean you can imagine when the business is growing 80%, and we are growing 80%. That is indeed creating some tensions on the supply chain without any doubt. I'm not sure that out of stock is still the proper word given where we are today. I think that maybe some time a reference is not going to be available.

Not everything is going to be fully available in the range at a certain point in time, but look at what the Nielsen are telling us on Q1 and our volume, I mean, we seem to be growing fast, and it's difficult to see any kind of impact coming from restriction on availability. As we said, we are working very hard to maximize our capacity in this fast-growing environment for ZYN. We are comfortable, of course, with our capacity to deliver around our 560 million can. That is not the limit that we are putting, of course, in terms of production capacity. But we are in this phase of adaptation to this strong growth and fast raising demand.

I think so far, maybe with some tension but with limited impact on volumes.

ZYN’s US growth was despite a notable price increase in March. All the more impressive as the product still increased its share of category volume and value for the period while already priced higher than competing products. Further, industry data shows the total oral category growing at an accelerated rate in the US. While modern oral pouches are cannibalizing legacy oral tobacco and converting smokers, it is apparent that many non-users are beginning to explore the product. However, I believe this is still in the early stages of its potential, with the majority of adult consumers still entirely unaware the product category exists. The product, categorically, is relatively affordable and is completely discrete, providing countless usage occasions throughout the day, every day. With US per-user consumption rates far under that of comparative Scandinavian figures, there is an added runway to compound upon rising adult consumer awareness.

(While not apples-to-apples, ZYN’s US figures provide a compelling signal for Haypp Group’s Growth Markets results)

So, again, with a trajectory shooting far up and to the right, the question is: How does this change? Based on what’s in front of us today, the future of the US market is a key determiner, and I touched on potential futures in both last quarter’s note and my report on Haypp Group. As noted, no modern oral pouch product has received a Marketing Granted Order via the PMTA process in the United States. Not ZYN. Not on!. Not Velo. No Fre. Not Juice Head. Not Rogue. Not Lucy. Not Sesh. Statements provided by the FDA give reason to believe that the remaining PMTA backlog will be processed by the end of the year. Determinations for related products will provide distinctly new visibility into how the category is shaped to evolve in the United States. For ZYN specifically, we can go further and place potential outcomes into a few buckets:

The backlog is further delayed.

MDO > legally contested > temp stayed > permanently stayed.

MDO > legally contested > temp stayed > MDO upheld.

MGO > FDA recognizes reduced-risk qualities of nicotine pouches on a category level, providing MGOs for the majority of applications.

MGO > FDA maintains its nearly impossible hurdle, preventing the majority of products from receiving authorization.

Although these appear as distinctly different outcomes, there are some considerable overlaps in how they affect ZYN’s place in the market. The FDA has had prior delays in tackling the PMTA backlog, and further delays benefit ZYN. Allowed to remain on the market under enforcement discretion while its PMTA is pending, delays equate to business as usual, and with currently competing products far behind in quality, business will be rosy.

Both subsequent paths following a Marketing Denial Order lead to PMI challenging the results. As noted previously, since Swedish Match’s General Snus, an oral tobacco product that has already received Modified Risk Orders via the MRTP process, which is an additional, nearly impossible hurdle to clear, there is good reason to suspect an MDO to be unlikely. In the unlikely event MDOs are issued, there is no better company to be placed in such a position since PMI has such extensive legal resources and experience. Further, as has occurred for other next-gen products, in the vaping category, it is likely that the company will receive temporary stays for ZYN while it challenges the FDA’s determination, drawing out a conclusion for potentially years—years that the product will retain its leading place in the market should the FDA roadblock new entrants.

The potential futures that contrast most heavily relate to the product receiving Marketing Granted Orders. The FDA has largely appeared disinterested in authorizing novel products but may concede to the evidence substantiating ZYN. On paper, this would be looked at as a simple win for the product. However, the greatest risk lies in the FDA being overwhelmed by the evidence on a categorical level, potentially leading to MGOs for competing products. The other products currently competing in the US market are not the concern—it is the hoard of novel, incrementally improved products originating in Northern Europe. Beyond the ‘Velo 2.0’, which dominates those markets, and the future potential of on! Plus, a moist variant of the 2nd largest US product, exists in numerous smaller brands that have differentiated products with properties that compete favorably with ZYN. Pouch form factor, feel, moisture content, flavorings, speed, duration, consistency, and packing all lead to a key question: Has ZYN truly built enduring brand equity in the US and will it be able to defend its position if fully challenged?

There are also strong arguments supporting the idea that ZYN performs well even in a scenario in which it faces a new array of competition. Despite the regulatory bar for the category potentially being easier in the future, new PMTAs will still take time to process, review, and determine. While certain products hold qualities superior to ZYN, quality is only part of the equation. As the category continues its rapid trajectory, production and distribution stand out as equally critical considerations, if not more so. On both fronts, PMI’s footprint is poised to reinforce its leadership position, even when challenged. This will ring true beyond the borders of the US and will also support efforts as the product is rolled out into more untapped markets throughout the world.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Philip Morris International and other tobacco companies such as Altria, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 0.00%↑ BTI 0.00%↑ MO 0.00%↑

Additional Resources:

Philip Morris International - Reports and filings. Source

I was one of those aggrieved Swedish Match shareholders, so I appreciate your empathy Devin! I agree with you, Zyn’s growth in the US has been astounding.

You’ve written a lot recently about nicotine prohibitionists would like nicotine to simply go away, instead of embracing harm reduction. I think they had the advantage the past few decades because (a) well educated and high income Americans now smoke at much, much lower rates than poor or less educated Americans and (b) well educated citizens have an outsized influence on political outcomes. For instance, if banning vaping flavors makes cigarette smokers less likely to switch, it’s not the well educated who suffer the consequences.

Nicotine pouches are a different ballgame. They appeal to professionals working in the finance, tech, and media industries, for the reasons you describe. Figures like Peter Thiel, Peter Attia and Andrew Huberman have discussed their risks and benefits.

Here are the first two paragraphs of a recent Bloomberg News article on Zyn. Try to imagine someone saying the same thing about cigarettes:

> Whenever Mark Moran, chief executive officer of the investor relations firm Equity Animal, is about to perform a boring task, he has a ritual. He pops a Zyn nicotine pouch into his mouth. Then his concentration sharpens, at least for a while. “Am I addicted to it? Absolutely,” he said. “But it’s something I very much enjoy.”

https://www.bloomberg.com/news/articles/2024-01-31/zyn-lucy-nicotine-pouches-gain-traction-with-office-workers

If a critical mass of high powered professionals start using pouches, I don’t think politically the FDA or Congress will be able to ban them. We may already have reached that point, based on the the pushback that Senator Schumer got after his remarks last January, which you also covered.

PM forward P/E 14

Bat forward P/E 6

Sorry but never ever is PM 2.33x better then Bats…

Still IMB/BAT > PM.

PM better business but worse stock then Bat/Imb.

I hope you also do a update on altria. Because after the earnings report for me MO is the worst tobacco stock now. Revenue decline + -10% volume decline again + market share lost in several categories. Would be interested if you are still invested in altria.

I think you dont talk about portfolio positions but I would bet altria is your smallest position …