“The FDA’s inaction, lack of enforcement, and slow pace of smoke-free authorizations continues to enable bad actors who are blatantly disregarding regulations.” - William Gifford, Altria CEO, Q2 2024 Call

It is concerning when a company exclaims the results of something so relatively unproven as NJOY. The Q2’24 call opened with a focus on the many efforts to expand the product’s footprint, with improvements to the supply chain, retail store number, and retail positioning all cited. All of these efforts are far from cheap, and related expenses are bound to continue. Rationalizing the spending is the fact that device sales grew by 80% in Q2, an impressive number, albeit off a small base of 1 million the quarter prior. But devices are not where the money is, in the profit sense. Profits would be in scaling the consumables, which grew by 14.6%. Of course, the logical conclusion is that substantially higher growth in pod sales requires a larger installed base of consumers with devices in hand, and so the device sale figure points to things heading in the right direction.

I remain unconvinced, and the company has also been quick to highlight the continued proliferation of illicit disposable vapes in the US market despite recent increases in enforcement actions. While disposables climb, the pod market has continued to shrink. This would be manageable, in the sense of profits, if incremental costs were limited and a substantial installed base to take pricing against already existed, but the current position appears far less rosy than that of legacy products. In addition, NJOY menthol PMTAs receiving Marketing Granted Orders from the FDA may make them the only menthol product with such authorizations, but to steal a line from last week’s piece on British American Tobacco: So What? Receiving a positive determination changes nothing from simply waiting for a determination in the competitive sense, and Altria had to pay an additional $250 million earn-out in conjunction with the acquisition terms for the additional authorizations to boot. Mind you, the most satisfactory outcome for NJOY ACE Menthols receiving MGOs was that, alongside substantially more aggressive enforcement against illicit volumes, the product would be positioned to swallow the void in the market left by a federal-level menthol ban. With the ban appearing largely off the table due to the presidential election, such an aspirational scenario remains merely a dream. Overall, little has changed from the conclusions reached a year and a half ago when evaluating the acquisition's merits.

Get it on!

In October of last year, our friends over at A Peek Behind the Numbers astutely noted:

In December, MO said the $3.9 billion valuation on Skoal’s trademark exceeded it forecasted value based on discounted projections by 12%. However, a 100bp increase in discount rate would shrink that cushion to 2%. We can see that the 10-year bond yield is up 110bp since the last test. Its volume has continued to decay and 3Q was particularly awful.

I was happy to offer my perspective (emphasis added):

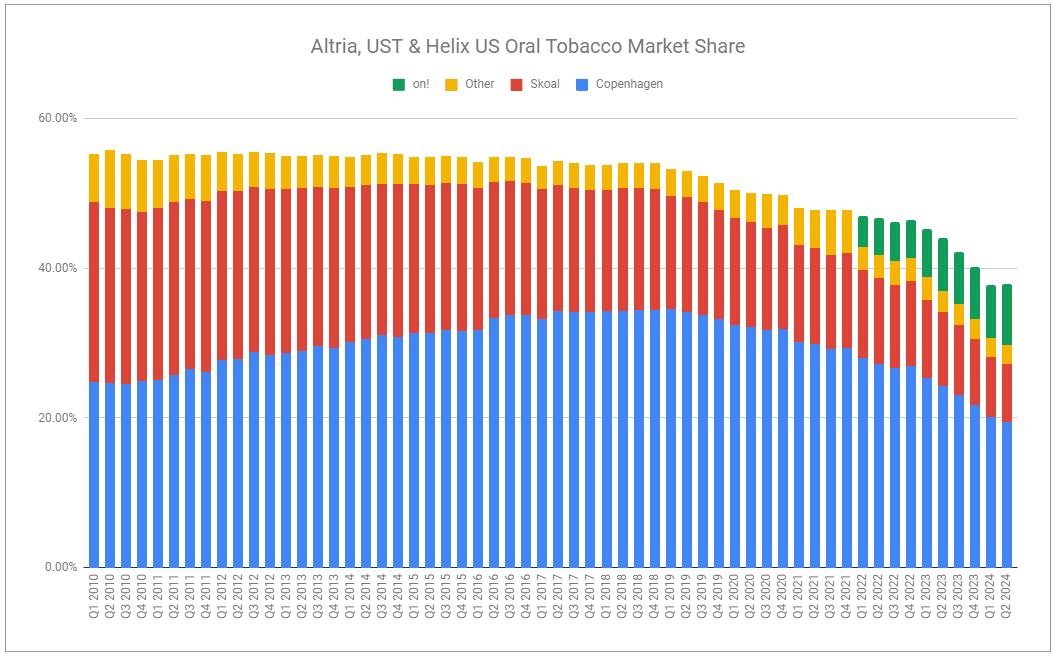

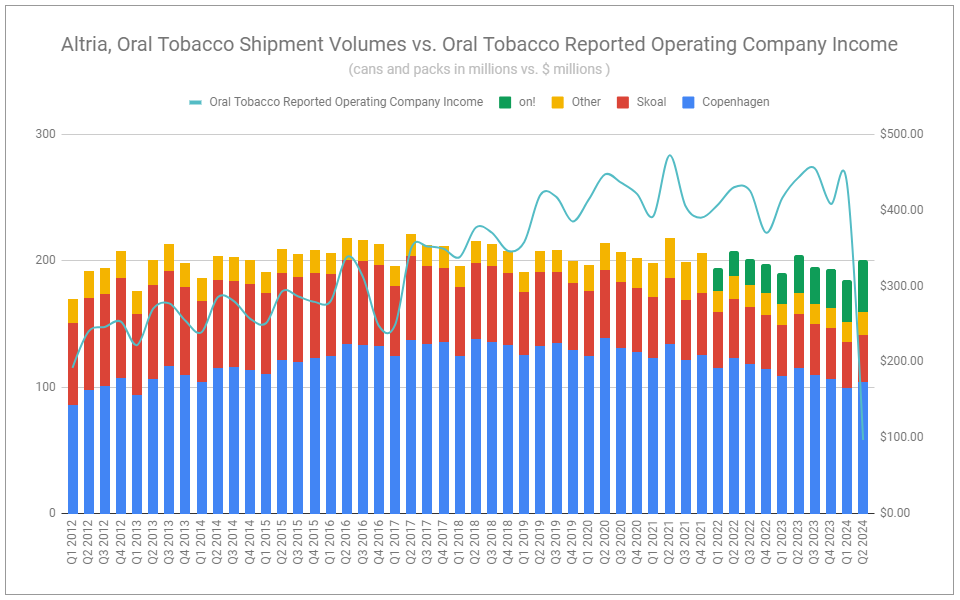

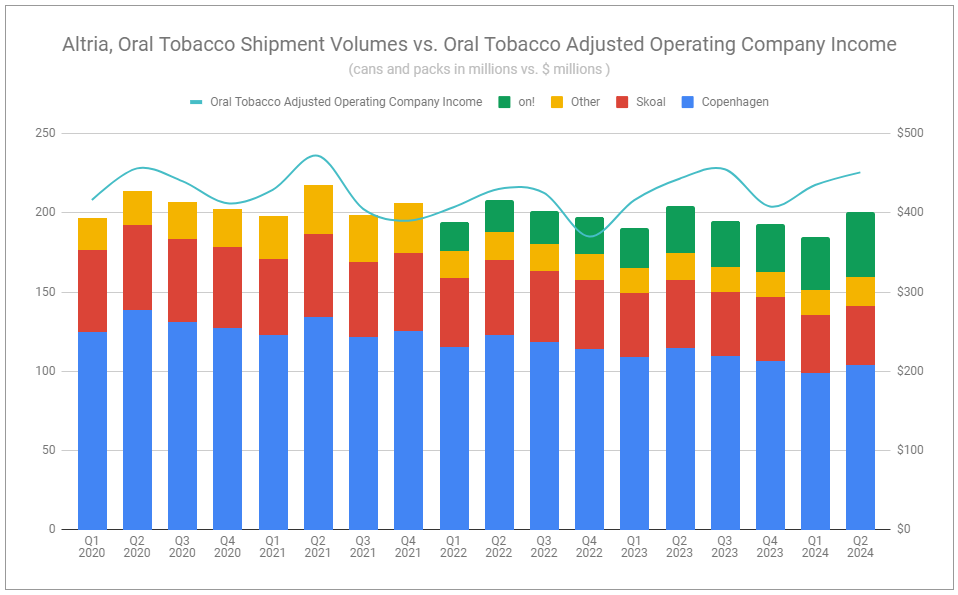

While UST's legacy volumes have continued to fall - largely due to MONPs taking total share, I think it's worth acknowledging that total volumes have actually remained rather stable over the last decade. But focusing on volumes misses that on! has grown mainly on the back of high promo spend, which is now scaling back as they take price. It can be argued that the Oral Tobacco segment has been under-earning the last few years vs. what it would have had it not pursued acquiring Burger Söhne (80% for $372m in 2019 and $250m for remaining 20% in 2021). So value of legacy intangibles decreases - but value has simply shifted to Helix (MONP sub), which positions the company well for the future. Composit oral volumes vs. segment EBIT (image below, from my latest piece) is not exactly alarming. Let's say a writedown of legacy intangibles occurs. In full context, should investors be surprised or concerned?

Indeed, Altria wrote down the value of Skoal intangibles by some $354 million—not quite in the ballpark of BAT’s recent write-down, but a concern to many nonetheless. With the aid of hindsight, the acquisition of UST can be questioned only modestly more, though placed nowhere near the same camp of investments as JUUL and Cronos. At the same time, the performance of modern oral shows that the acquisition of Burger Söhne sits at the opposite end of the spectrum. At an all-in acquisition cost of $622 million, Altria’s has rapidly grown on!, which now holds 8.1% of the total, wildly profitable, US oral tobacco category.

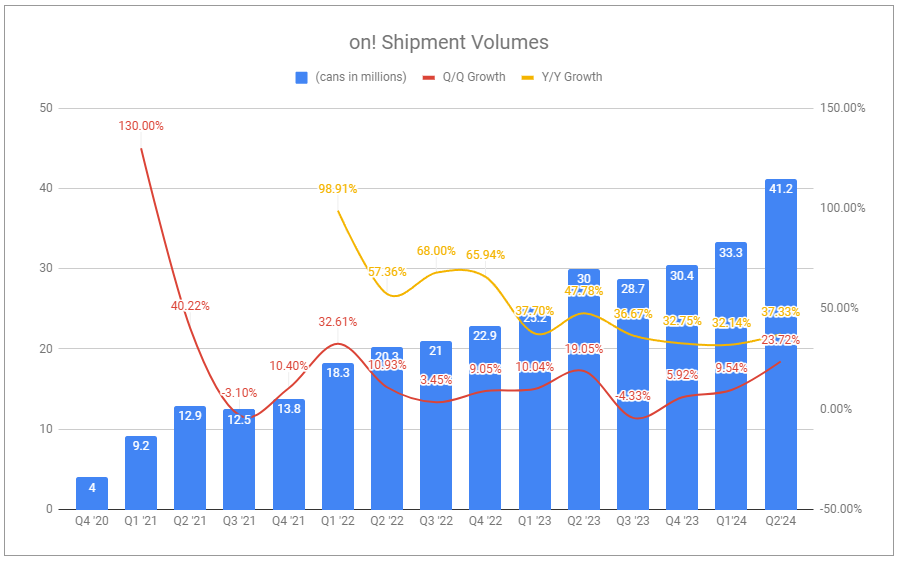

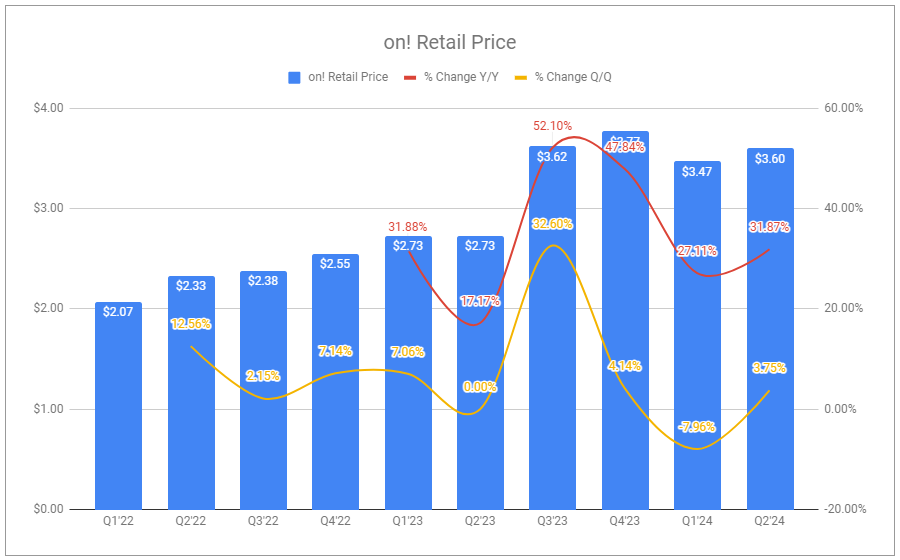

Naturally, the figure of on!’s market share growth would be countered by pointing to two facts. The first is that Altria’s total share of the total US oral market has continued to shrink substantially. Second, the recent re-acceleration of on!’s growth is unquestionably partly due to Philip Morris International facing capacity constraints regarding ZYN production. However, on!’s continued ascent is despite the company continually reducing promotional spending while also significantly taking price. This also entirely ignores the potential future contribution of on! Plus, as retail expansion efforts occur throughout Sweden and the UK, and while the US market could experience a shakeup in competition if and when the FDA finally proceeds to make determinations on MONPs, Altria has submitted PMTAs of its own for on! Plus.

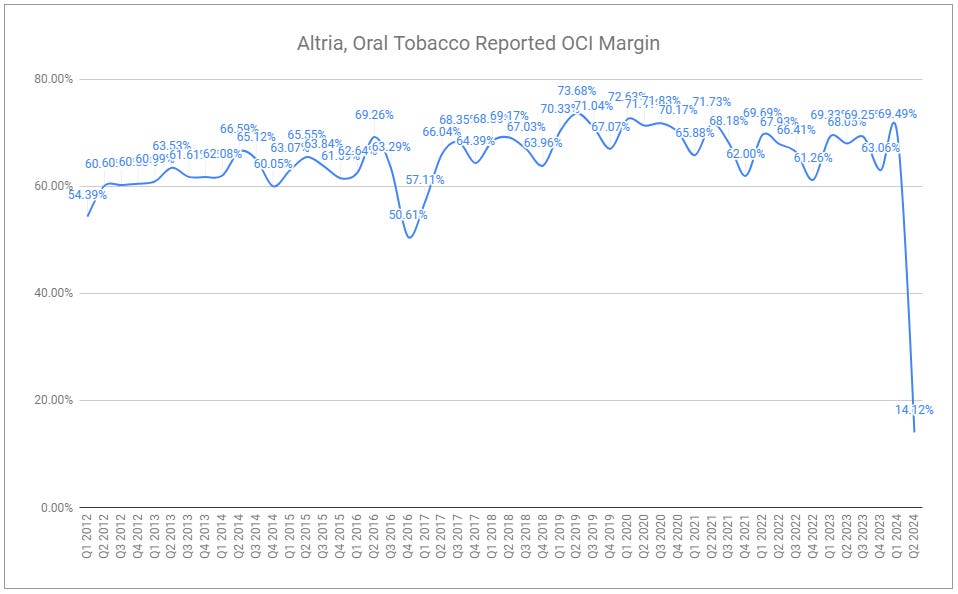

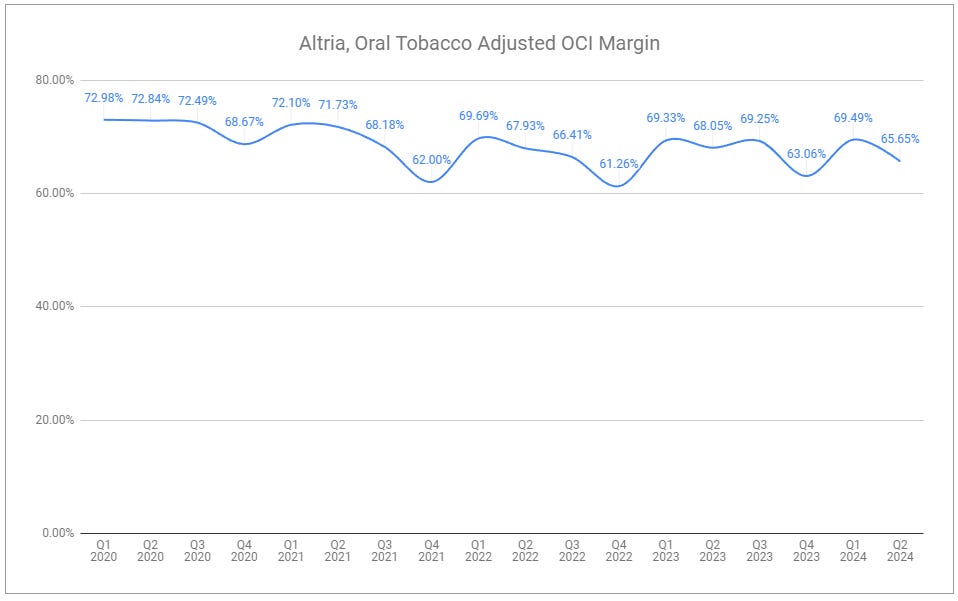

Q2’24 oral tobacco revenues net of excise taxes and adjusted OCI increased by 5.5% and 1.8%, respectively, while aggregate volumes declined by 1.8%. Adjusted OCI margin was pressured as a function of mix/shift toward pouches. Between the continued growth of the total US category and the rapid adoption of modern oral, on! has eclipsed Skoal and, over the next several years, should reach a more substantial scale while promo benefits reduce further, supporting a positive volume growth profile and providing segment profits room to climb. Or, put another way, the non-cash impairment of Skoal is not exactly alarming in the grander scheme.

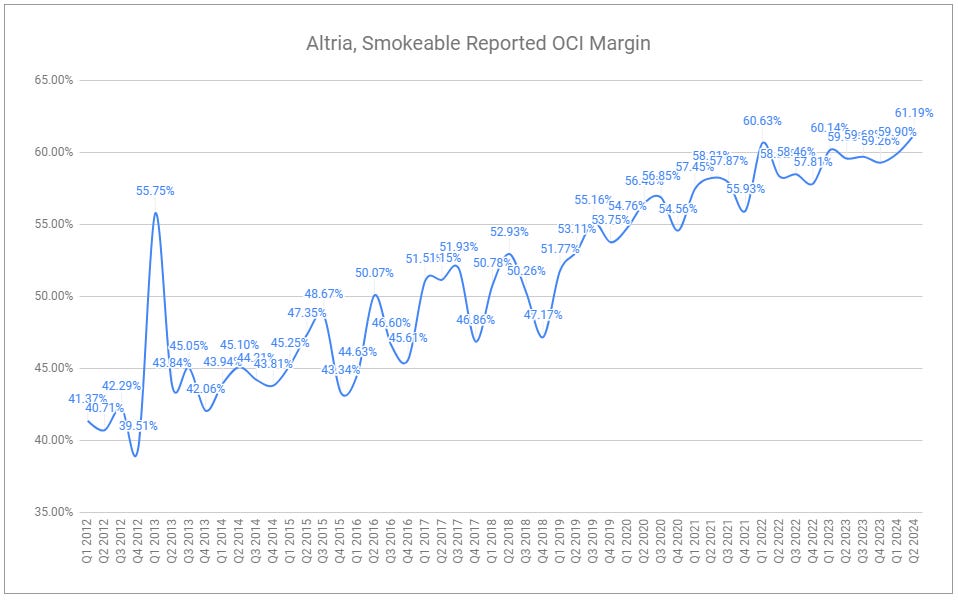

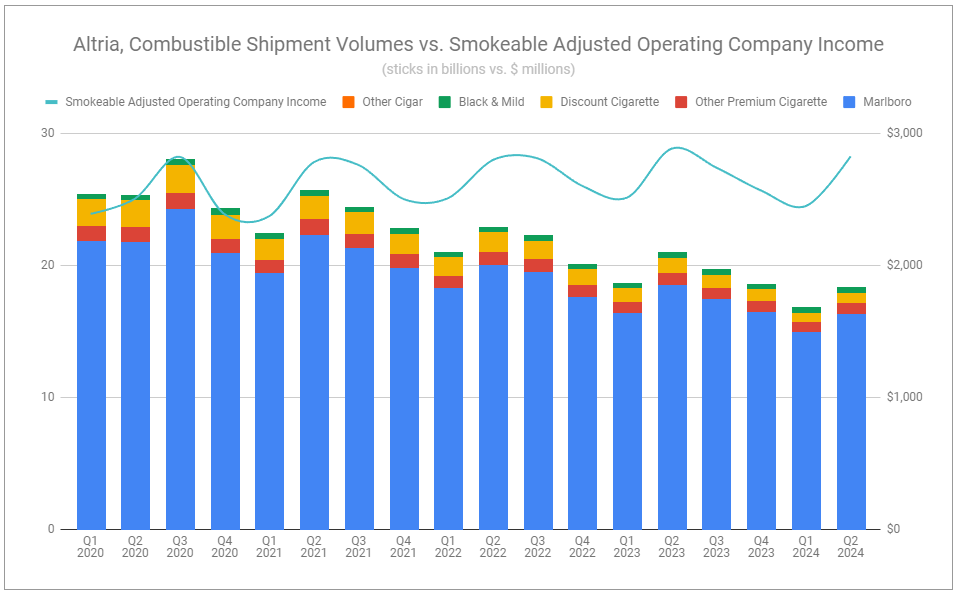

Smokeables

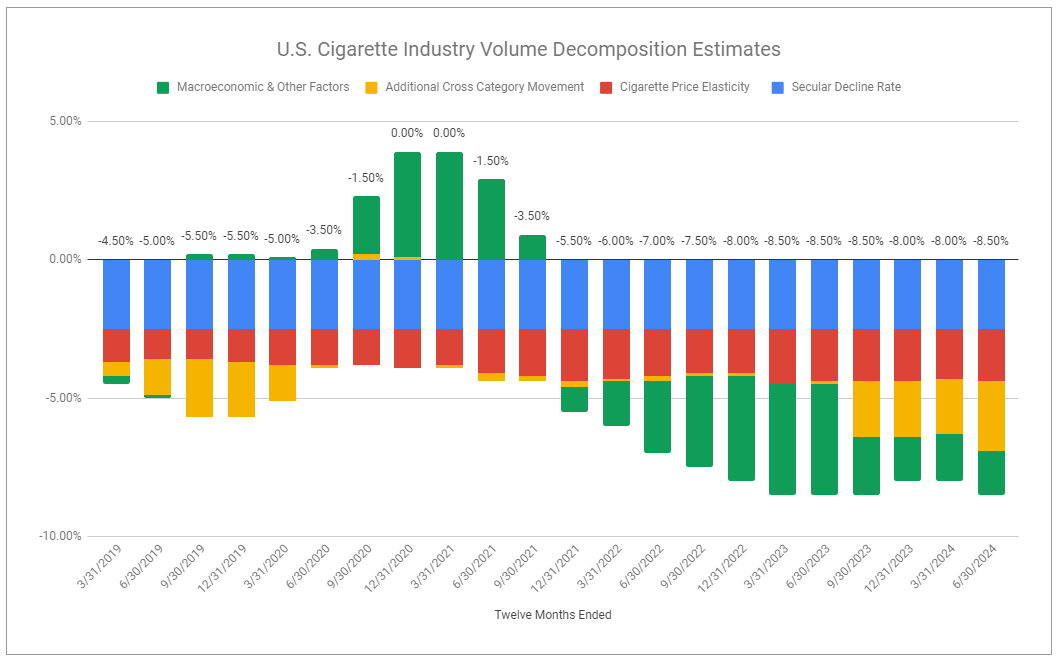

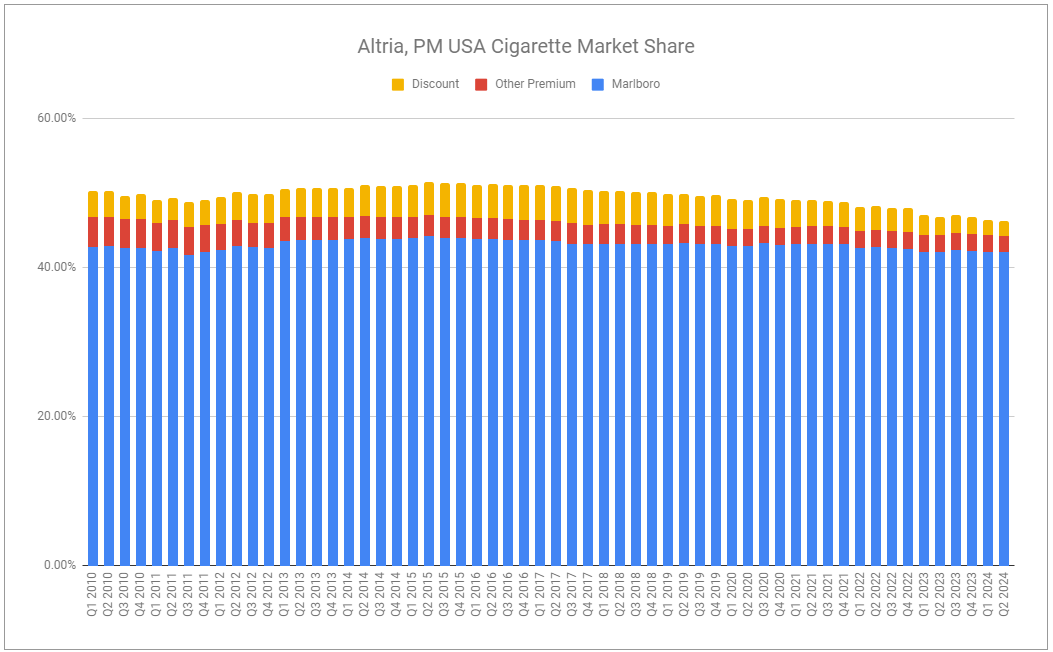

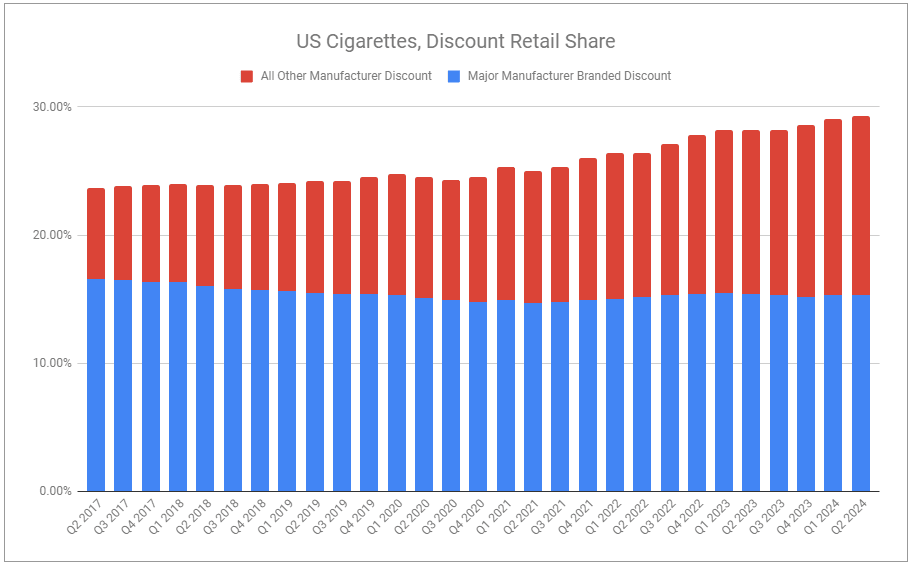

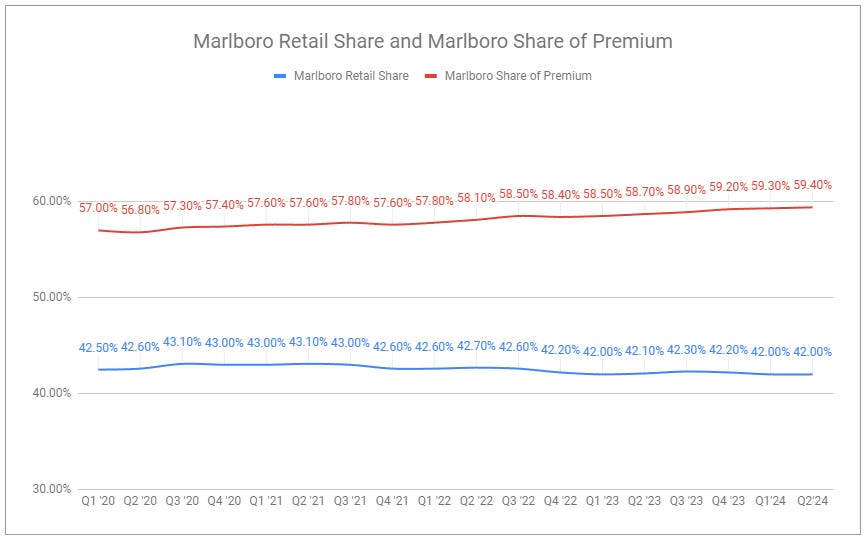

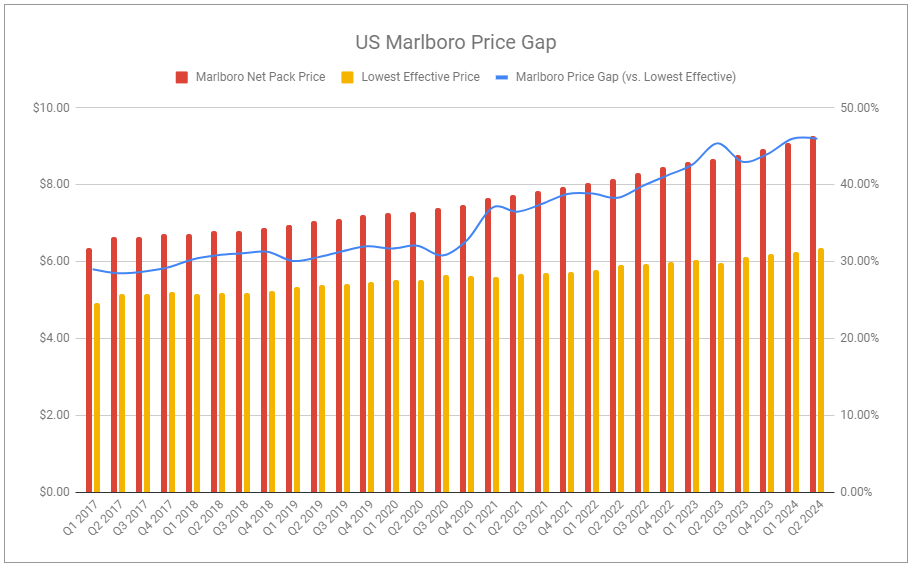

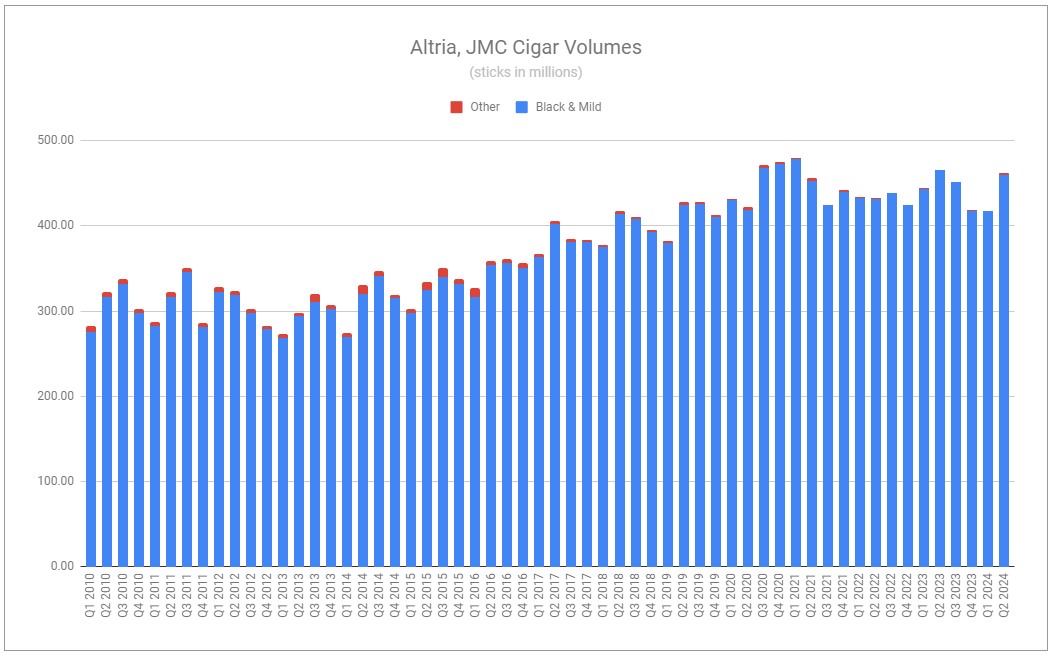

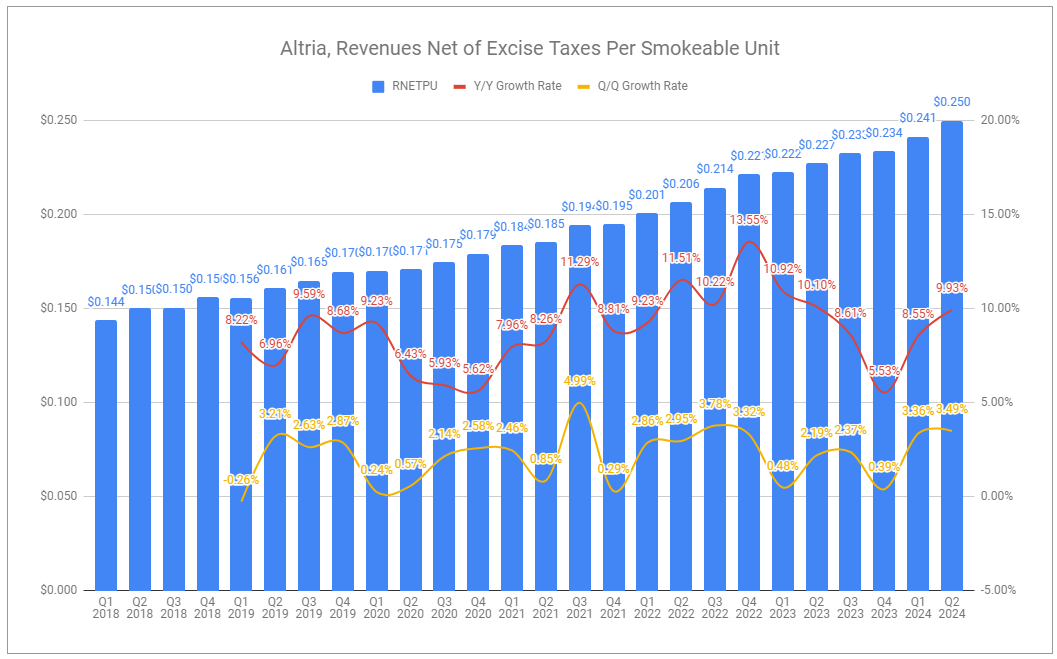

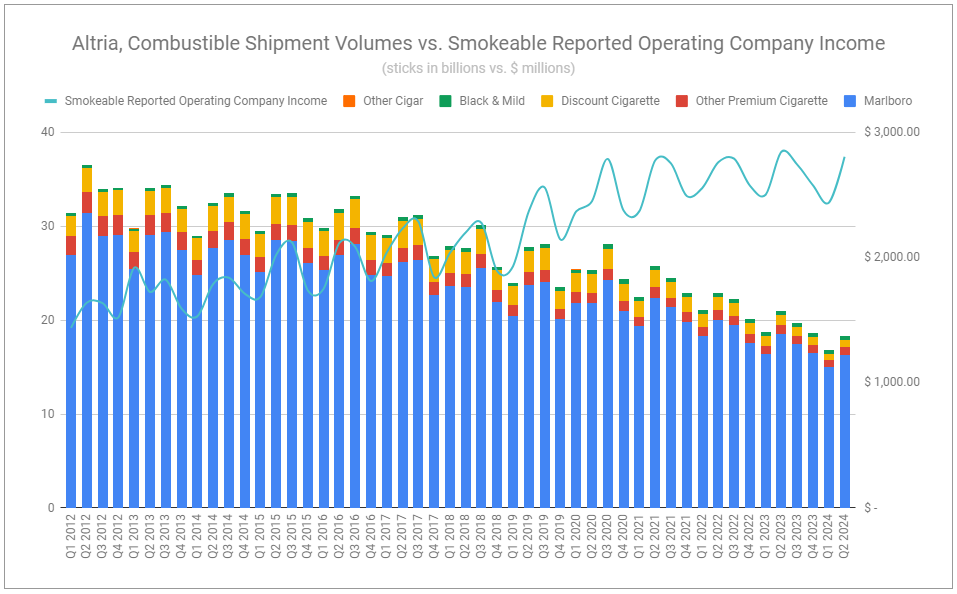

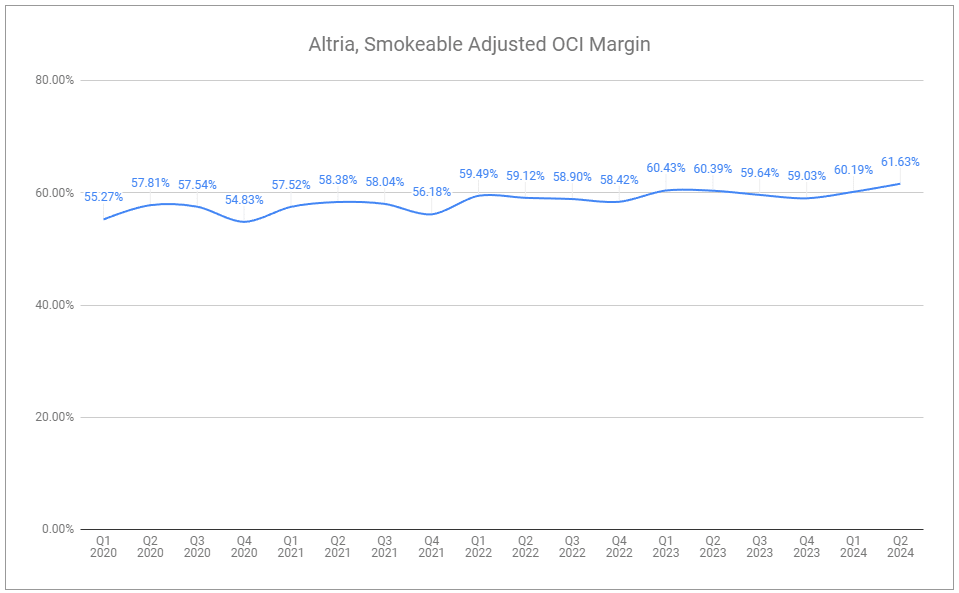

Q2’24 smokeable volumes decreased by nearly 13%; a decline rate elevated far above the historical trend, which many point to as a reason why Altria is simply doomed. A different view would be to acknowledge the company’s focus on continued premiumization, resulting in its own discount brands languishing by some 31.3%, while Marlboro volumes fell by a percent less than the segment total. Competing discount brands continue to take incremental share, but Marlboro still reigns king in the premium space by a lofty stretch, evidenced by its growing share in the premium segment and the price gap remaining at 46%. Added to the segment mix are Black & Mild cigars, far smaller in total contribution, but remain robust and deeply underappreciated.

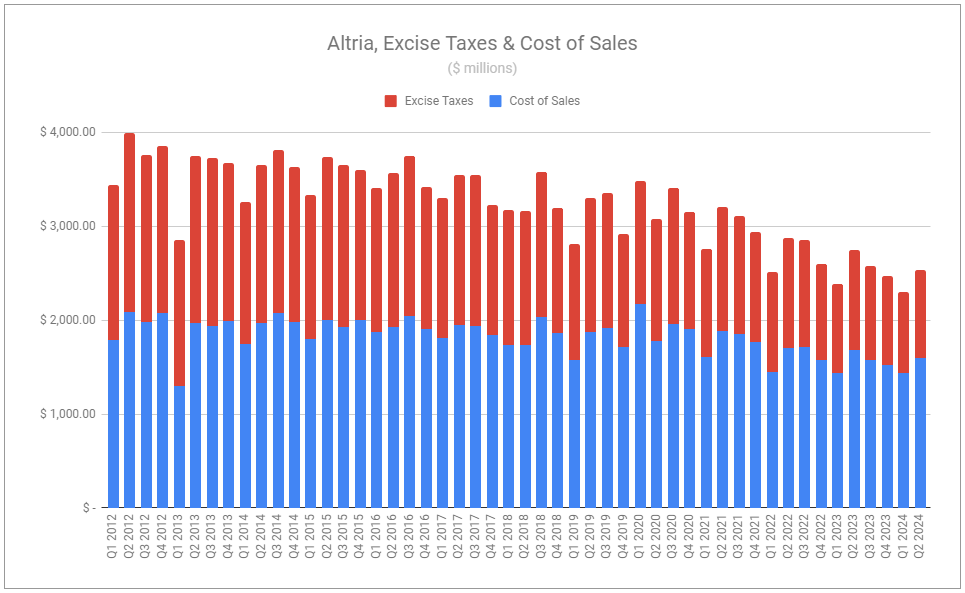

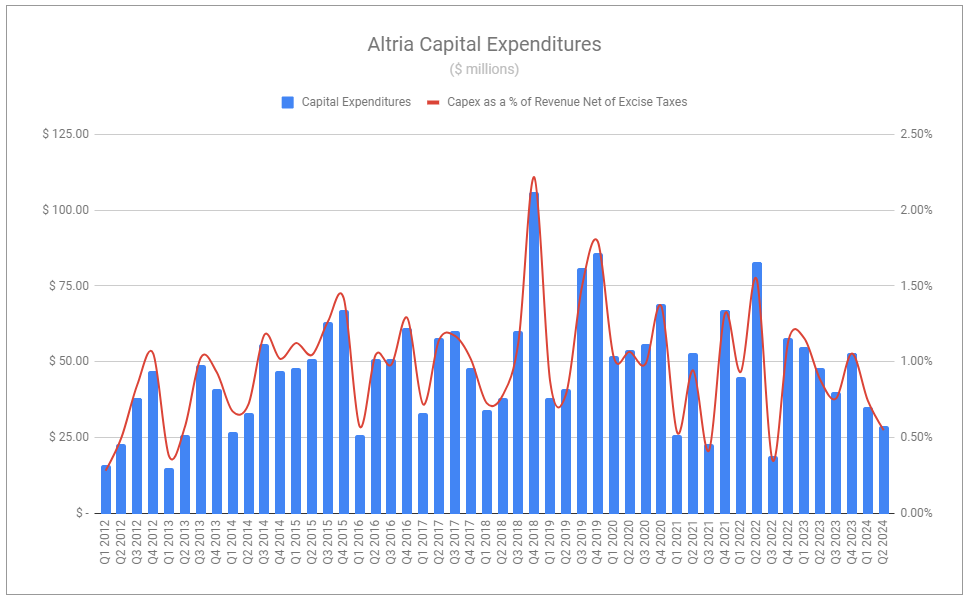

While by far the most important segment in terms of size, little needs to be written on what is a rather tremendous performance considering the pressures faced, both on volumes and costs. Despite revenues net of excise taxes falling by 4%, adjusted OCI fell by 2%, and the margin expanded by 1.2pp. The sustained climb of revenues net of excise tax per smokeable unit bodes well as cost pressures are tackled, and should enforcement against prevalent illicit vapor brands increase, it is clear that PM USA stands to benefit in the most serious way. Even if the current pressures are sustained, declining profits are completely tolerable when acknowledging the rate of decline and the ridiculously large base.

Back to the race

The prevailing narrative is that Altria remains far behind in next-gen products, and its legacy volumes are permanently hindered, so there is no point in investigating a company that is assuredly doomed. The weight of expanding new projects, such as NJOY, has resulted in marketing, administration, and research costs climbing higher despite little to show for them so far. Should material contribution appear out of grasp, we can hope that related expenses will be curbed.

Setting aside the costs and all positive prospects for things like vaping and heated tobacco, one can look at simply the balancing between the group’s two main profit centers, smokeables and oral. Those most pessimistic on the outlook for smokeables must concede that if the segment’s profits continue to degrade, oral, by way of simple mathematical function, will become a larger slice of the overall pie. And so, if fixating on trends, what is the implication over a longer period should the oral segment continue to execute robustly? It is difficult to support the conclusion that “there is no terminal value” and instead suggests the opposite. Yet, this is only part of the story. The tremendous legacy cash flows and the continued ascent of on! present an even more pronounced conclusion when assessing on a per-share basis.

Following the end of 2023, I concluded that the race that should be focused on is not the race in NGPs or the race of legacy volumes but rather the rate at which capital is returned to shareholders. The partial sale of the group’s ABI stake led to an accelerated repurchase program earlier in the year, and now total shares are 3.6% lower than twelve months ago. $1 billion remains to deploy on repurchases throughout the next six months, and should the company execute on its expectations for H2, adjusted EPS is set to hit within a more narrow range, up a respectable 2.5-4% for the year. At the same time, the company will have paid out dividends to shareholders, a total of just shy of $7 billion. The company remains less levered than BAT and PMI, and, critically, there is no pesky hindrance from FX pressures weighing here.

While we never know exactly why the market moves in the short term, it has moved, and Altria’s shares have climbed considerably higher. One would, in simple terms, expect a higher share price to reflect higher investor confidence in the name. Humorously, all else equal, a higher share price will dampen the effect of continued repurchases, thus driving down forward returns. Go figure.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as Philip Morris International, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑ BUD 0.00%↑

Great write up & thanks for the in depth analysis!

Does MO report on! / skoal / Copenhagen / other EBIT in their oral segment or are those your estimates?