“Looking more broadly at the e-vapor category, we continue to believe that the current state of the market is intolerable for both legitimate manufacturers and consumers.” - William Gifford, Altria CEO, Q4 2023 Call

When a CEO boldly describes market conditions as intolerable, one would expect it to be harshly reflected in both broad sentiment as well as reported financials. Altria continues to face a mix of unsavory headwinds led by the rapid proliferation of illicit disposable vaping devices, and to many, the company’s efforts to develop and market its own next-gen products appear underwhelming. The loudest critics continue their narrow fixation on unit volumes, namely of the company’s primary product, cigarettes. This preoccupation avoids addressing fundamentally important considerations, such as the costs to produce and sell products, as well as the prices that can be fetched. Likewise, there remains too little attention provided to the company’s non-cigarette operations. While smaller, they are not trivial, and, as a whole, the company continues to show supernormal profitability.

Smokeable Products

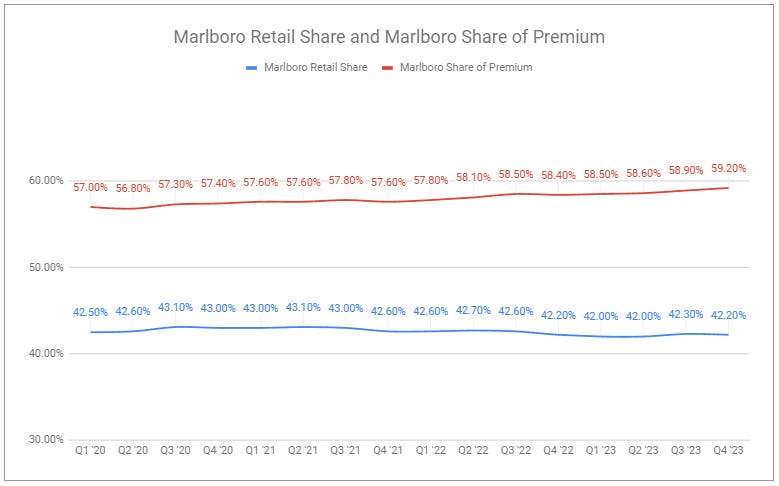

Altria’s reported cigarette shipment volumes decreased by -7.6% in Q4 and, when adjusted for trade inventory movements, fell by -9%. For the full year, reported volumes declined by -9.85% and by -10% when adjusted in kind. While decline rates remain far above historical trends and are even above the adjusted estimates for the industry decline rate of -8% for the year, it should be noted that the company’s discount brands were a disproportionate contributor, and the overall Marlboro-centric strategy continues to evolve favorably—a focus on maximizing long-term value creation via continued premiumization rather than chasing lower-margin market share. Altria’s total share of the US cigarette market declined by 1pp to 46.9% for the year and measured 46.8% in Q4.

Marlboro’s share of the market measured 42.2% for Q4. While this is under the high of 44% set during quarters in 2014 and 2015, it remains within a fairly tight historical range and equal to the same share dating back to 2011.

Share continues to be ceded to discount brands produced by non-major manufacturers, previously labeled “Deep Discount.”

While total share continues to be lost, Marlboro’s share of the premium cigarette subsegment continues to grow, reaching 59.2% in Q4.

This premiumization continues to be reflected in a historically wide gap between Marlboro’s net pack price vs. the lowest effective price—44% in Q4.

Dwarfed by cigarettes and tucked into the smokeable segment are John Middleton’s cigar volumes, which, while down -1.4% in Q4, saw a +2.8% increase for the full year, continuing a trend of slow and steady volume growth on top of equally steady pricing.

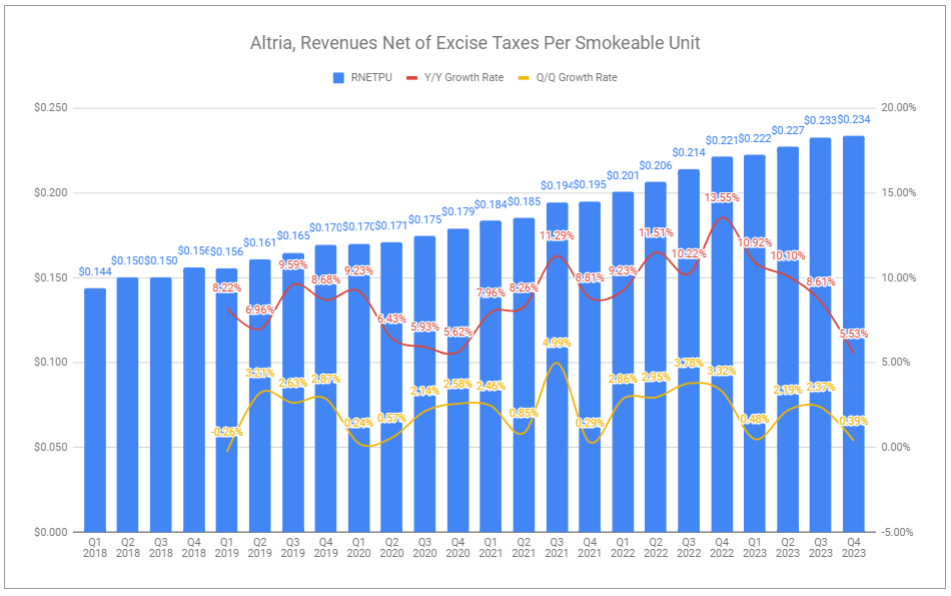

Net price realization for the smokeable segment decelerated in Q4 to +5.53% but measured a remarkably strong +8.8% for the full year. A key contributor to the deceleration was downtrading to Marlboro Black, and specifically, Black Gold, which I highlighted as an oddity in Q1. Priced cheaper than other Marlboro offerings, it will weigh on further net price realization if downtrading continues—running counter to the premiumization focus. Conversely, the rationalization for introducing such a product is that it is far more efficient to keep consumers within the Marlboro family of products when an eventual reversal occurs.

Despite net revenues being down for the year -3.2%, net price realization on top of lower volumes led to related excise taxes decreasing -9.79% and revenue net of excise taxes decreasing by -1.6%. With tight cost controls, margins widened 90bps.

Reported smokeable segment operating company income for Q4 was up +0.08% and down -1.34% when adjusted for NPM and ligation items. For the full year, reported operating company income decreased by -0.17% and was down by -0.15% when adjusted. It is inevitable that many will point to these results and assert that the pricing algorithm for the segment is now broken. Using the less favorable reported figures, I point to the drop in nominal terms—the segment generated $10,670,000,000 in operating income, merely $18,000,000 shy of the year prior. Certainly not bad for a dying business, and by all means, if this is what broken looks like, I would prefer no one meddle in trying to fix it.

Oral Tobacco Products

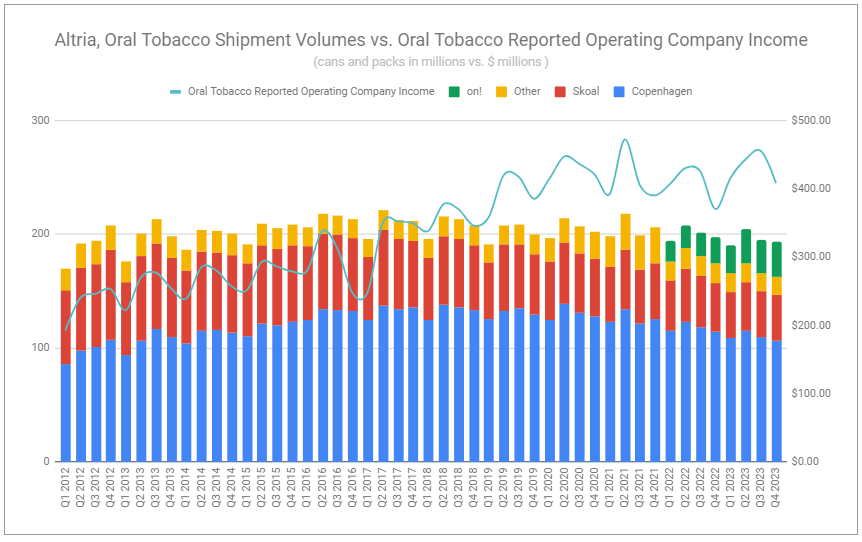

Altria’s total retail share of the US oral market declined in Q4 by a staggering -5.8% to 40.1% and decreased by -3.7%, from 46.5% to 42.8%, for the full year. Without question, loss of share continues to be led by the rocketing growth of PMI’s ZYN. Altria’s own modern oral nicotine pouch, on! continues to cannibalize legacy volumes, and while its reported shipment volumes were up an impressive +32.75% y/y in Q4 and +38.55% for the year, it did not make up for the drop in volumes of the company’s legacy oral tobacco products. Altria’s quarterly and full-year reported total oral shipment volumes declined by -2.03% and -2.21%, respectively. It would be easy to look at these metrics and conclude that prospects are dismal. However, further context shows that such a view is all too narrow.

Unappreciated by many is the fact that oral tobacco remains a growth category in the US market. Therefor, to focus specifically on the rate of change of market share is bound to misrepresent the rate of change of volumes. Yes, Altria’s total oral volumes were down for the year—but they could have very well been flat or even positive if the company was in the business of maximizing volumes. It is not. Altria is very much in the business of maximizing the value it creates over the long term. The most impressive feat in the oral tobacco segment this quarter was not the growth rate of on! but the fact that the growth rate was achieved while continuing to make substantial efforts to both reduce promotional spending and increase the retail price of the product. In Q4 2023, the retail price of on! increased +4.14% quarter-over-quarter, +47.84% year-over-year, and is now up a staggering 82.13% since the start of 2022.

There is little question as to whether these significant price increases have tamed the growth rate of shipment volumes. They have. Nonetheless, the US remaining a growth market for oral products and the category remaining relatively affordable suggests that the long-term formula remains robust. Alongside on! is the declining volumes of legacy tobacco products, offset by continued price take, providing net results that should be the envy of most companies. In Q4, net revenues and revenues net of excise taxes increased by +6.65% and 7.12%, respectively, and operating company income increased by +10.27%. Full-year revenues net of excise taxes increased +3.82%, operating company income rose +5.51%, and margins increased a whopping 108bps to 67.4%.

The intolerable environment and regulation

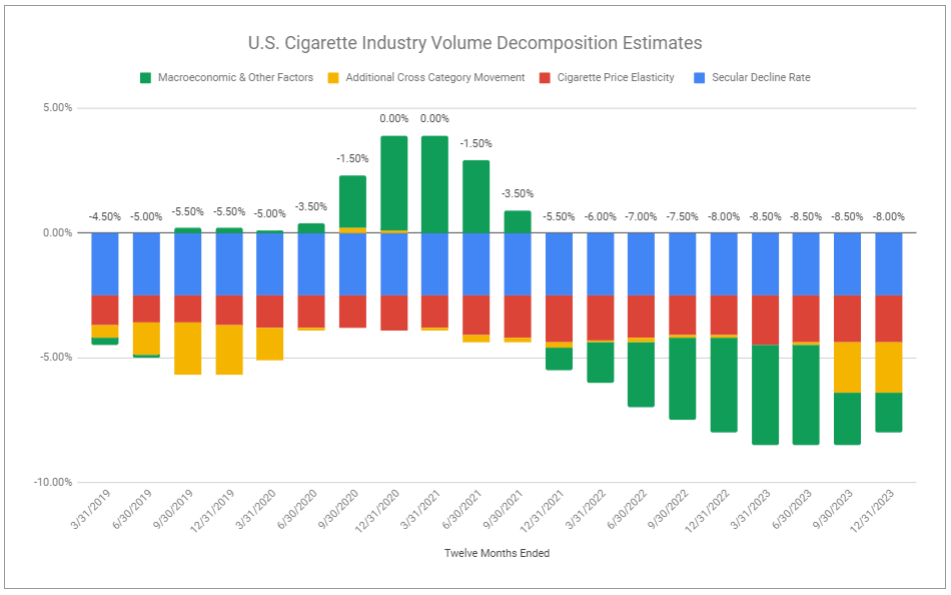

Investors were alarmed following Altria’s previous Q3 announcement in which it revised its US cigarette industry volume decomposition estimates. I questioned the response, as the revision was predicated on drivers that had continually been highlighted prior. Now, while Macroeconomic & Other Factors—namely gas prices—have eased, we see continued pressure stemming from Additional Cross Category Movement—specifically due to the proliferation of disposable vaping devices.

I have repeatedly expressed my view that the US cigarette industry decline rate is unlikely to revert to historical levels. Without question, the rise of disposable vaping devices and next-gen products broadly has led many current smokers to switch. Likewise, with vaping prevalence more prominent across younger legal-aged (21+) cohorts, it is evident this has been even more pronounced in terms of reducing the number of new smokers. However, I would also like to highlight that I think it is improper to over-extrapolate a continued compounding of additional cross category movement.

A common, and I believe incorrect, train of thought is that vapes are accessible, come in wider ranges of flavor, do not produce lingering smoke or smell, and categorically carry a lower risk profile, and therefore, there is no reason for anyone to not ditch cigarettes. But for all of their virtuous qualities, vapes simply do not perfectly replicate the experience of smoking a cigarette. It stands to reason that among smokers previously, many of those most inclined to try and adopt vaping have done so. Of those that have adopted it, there remains the consideration of poly-usage, in which users both vape and smoke. Still, some tens of millions of smokers remain in the United States. There are those who have tried next-gen products and yet still revert and far prefer their beloved brand of cigarette, and in that same vein, there are millions who have no interest in replacing cigarettes with anything else. Ultimately, there are many noisy variables, and while there are uncertainties, it appears that rather than a rapid and widespread switch to next-gen products, reflected as industry cigarette volumes falling off a cliff, it is far more likely we will witness a steadier, albeit elevated rate of change. Conversely, pointing to another variable, affordability, perhaps gas prices and discretionary income improve, resulting in a moderate counter to cross-category movement or even uptrading to premium Altria-owned brands. Alas, we lack a crystal ball to predict macro.

Further supporting the idea of a more moderate decline rate, and one that requires no crystal ball, are the movements of the regulatory beast in the United States. Over the last year, we have seen an increasing number of enforcement actions, namely against illicit vapor products, as the FDA prepares its strategic pivot:

Despite actions and words suggesting the FDA will act substantively, ample evidence also shows the contrary, highlighted by the administration’s total failure to educate the public on the nature of nicotine and the continuum of risk:

We have seen a continuance of enforcement measures, even as recently as last week, when on January 30th, 2024, the FDA issued maximum Civil Money Penalties to a number of retailers selling illicit products. This follows the steady sending of warning letters for similar infractions. However, these still remain too small in the aggregate to meaningfully impact the market. Alongside a potentially substantial increase in similar measures, there are several critical drivers that are poised to materially impact market evolution.

The FDA has set a new deadline for when it expects to complete the review of previously pending PMTAs: June 30th, 2024. This remains suspect, as the administration has pushed back similar deadlines previously. To date, only a small list of novel products have received Marketing Granted Orders through the process. Numerous MDOs received through the PMTA process have led manufacturers to challenge them, and we are seeing a continued stream of rulings criticizing the FDA for its handling of applications. Such a continuance suggests that significant escalations against the FDA are not out of the question, including scenarios in which such concerns find themselves in front of the Supreme Court. In the interim, should the FDA continue to deny the vast majority (99.9%) of applications as it has, Altria would find itself in a distinct position, as reiterated during the Q4 call between an analyst from Thomson Reuters and CEO Billy Gifford:

My first one is around the successful challenges to the FDA's marketing denial orders for some vapes, which have started to put some pressure on the agency and also increased the likelihood of a case going to the Supreme Court. I wondered whether Altria would want to participate in any Supreme Court case. And if so, how it's preparing for that possibility?

William Gifford:

Yes. I think you certainly highlight that the circuit courts have taken different positions on the approach by the FDA in the e-vapor market when we certainly are closely monitoring these cases. But I think when you step back from it, we're in a unique position. We're the only pod-based product that has received authorization from the FDA. So if you think about other major competitors in the pod segment, they have not received authorization.

Our authorization was in the tobacco-flavored pods and our application from the menthol version of the same product is pending with the FDA. And we really feel like looking at those court cases in both instances where the courts have taken different positions, we believe that we should get a marketing order for this menthol product, whether you look at the holdings on either of those instances in the circuit court. So we'll monitor those, but we're in a unique position.

Such a unique position is wholly irrelevant if the rampant proliferation of illicit vaping volumes is not addressed. If the federal administration does not act, states will take matters into their own hands. The beginnings of such efforts were highlighted on the call:

Callum Elliott, Bernstein Analyst:

Can you talk about some of the recent regulatory changes in Louisiana, where I think they've been taking it upon themselves to clamp down on the illegal sales that you spoke about the disposable vaping products given the action that we've seen from the FDA? I think some of those changes took place in November. So that should have a couple of months' worth of data now. What impact have you seen in Louisiana? And do you expect that other states might follow that path that Louisiana have taken?

William Gifford:

Yes, that is a lot based on efforts by ourselves and working with the legislatures in the state. And what you're referring to is Louisiana requires manufacturers to certify the individuals within the company to certify that they either have followed FDA guidance and they have a legitimate application on file and it's pending or that they have actually received authorization. It is early right now, Callum, in Louisiana. I would say the early signs are encouraging that we are seeing illicit-based being removed from the marketplace. I hope that that trend continues. And we are -- there have been a number of states that have passed similar legislation as well as a number of states that are considering it. But it's a bit early, but yes, the early signs are encouraging.

While not yet enacted, more than 20% of states have similar bills working through their legislatures, including:

New Hampshire - HB 1591

Iowa - SB 3101

Nebraska - LB 1296

Arizona - SB 1212

South Dakota - SB 116

South Carolina - SB 994

Indiana - SB 227

Washington - SB 6118

Virginia - SB 550

Florida - HB 1007

Should federal actions increase alongside any of these states enacting and enforcing the above bills, Altria would find itself doubly benefitting. The market position of NJOY would materially improve as the company continues to invest in getting it into more stores and improving visibility. The greater beneficiary is its legacy business, which would undoubtedly see cigarette volumes bolstered.

Naturally, the evolution of the US space does not end there—competition is set to further increase. In several months’ time, PMI will be launching IQOS into the US market. However, as noted in October, the rollout will likely be much slower than widely forecast as the rollout will strictly involve the previous blade version, with IQOS ILUMA likely 12-18 months behind. Likewise, while Altria has launched its superior (moist) on! Plus in Sweden, a PMTA will likely only be submitted in H1 of this year, potentially allowing PMI’s moist ZYN variant to enter the market well ahead, provided an MGO is attained. Further uncertainty is provided by the fact that no modern oral nicotine pouch has received an MGO through the PMTA process, and now, various figures are sounding the alarm on the product category as a whole, as highlighted last week:

The great race

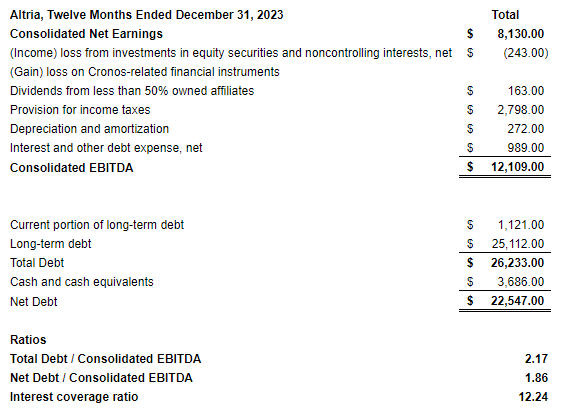

Altria continues to sport healthy leverage ratios, with a total debt/consolidated EBITDA of 2.17 and a net debt/consolidated EBITDA of 1.86—under the ratios of the frequently compared PMI and BAT.

With equally healthy coverage ratios and a well-termed maturity profile, the company continues to face little issues regarding servicing its debt obligations.

Highly cash-generative, Altria currently trades at 7.9x EV/consolidated EBITDA. Even with heightened reinvestment related to next-gen products, it is set to produce some $8b in free cash flow, returning nearly $7 billion via dividends and $1 billion through share repurchases—the company completed its previous $1b share repurchase authorization, reducing shares outstanding by 1.3%, and has now authorized an additional $1 billion program. With a current market cap of $73 billion, this represents an ~11% cash return to shareholders.

The investing community continues to fixate on the race for next-gen products while simultaneously overlooking the exceptional profitability of legacy operations. The great race that Altria should be partaking in is seeing how fast it can continually return capital to shareholders. One must wonder what relative multiples it would take for management to consider selling down the BUD stake to accelerate share repurchases. A $1 billion deployed to share repurchases retires ~24.1 million shares at the current price—1.37% of share capital. Along with increasing EPS, this incremental $1 billion repurchase would also cut the total annual dividend paid by $94.8 million.

Even with operations facing heightened challenges, 2023 adjusted diluted EPS grew +2.3%. Continued pressures will weigh on the business, but the sheer enormity of cash flows from its capital-light legacy operations are likely to be far larger than the market has impliedly expressed, and a continuance of regular repurchases is likely to support minimal EPS growth. I find these dynamics unlikely to change, and so long as they stay the same, I continue to view Altria as a highly complimentary piece within the nicotine basket.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as Philip Morris International, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑ BUD 0.00%↑

Devin, thank you for the sober analysis and the great graphs!

Where I think company’s critics have a point is the deceleration of adj EPS growth. By my calculations, from 2009 to 2022, Altria grew adj EPS by 7-8% annually. That has slowed down to 2% in 2023 and, according to their guidance, also 2% in 2024. If these trends don’t reverse, we are looking at a very different company than the one from the 2010’s.

I’d be curious to hear your thoughts on the BAT - PMI global patent dispute settlement.

Another solid write-up, Devin. Thank you, as always!