“Our model is that we will generate a bottom line without closing the pricing gaps on any competition. And we quite like the pricing gaps where they are. We believe there are good reason for people to maintain or accelerate the migration from offline to online. So we’re not particularly interested in closing the price gaps bearing in mind how competitive or how rapidly growing the category already is. We’re very keen to continue to take share within it. So we see that we can maintain the price gaps and that what you're getting coming through in the form of increased margin is predominantly falling out from both the economies of scale, both directly within our operations and, of course, with support from our business partners.” – Gavin O’Dowd, Haypp Group CEO, Q1’24 Call

Scale economies shared, applied to one of the fastest-growing consumer product categories of the last half-century, ushering in a new era of widespread nicotine consumption. Haypp Group offers concentrated exposure to the nicotine pouch megatrend and, this past Thursday, published its Q1’24 results, showcasing an impressive trajectory.

Before proceeding, if you aren’t familiar with the name, I recommend reading my comprehensive thesis on the name, published in February of this year:

Haypp Group: Ahead of the Nicotine Pouch Megatrend

Core Markets

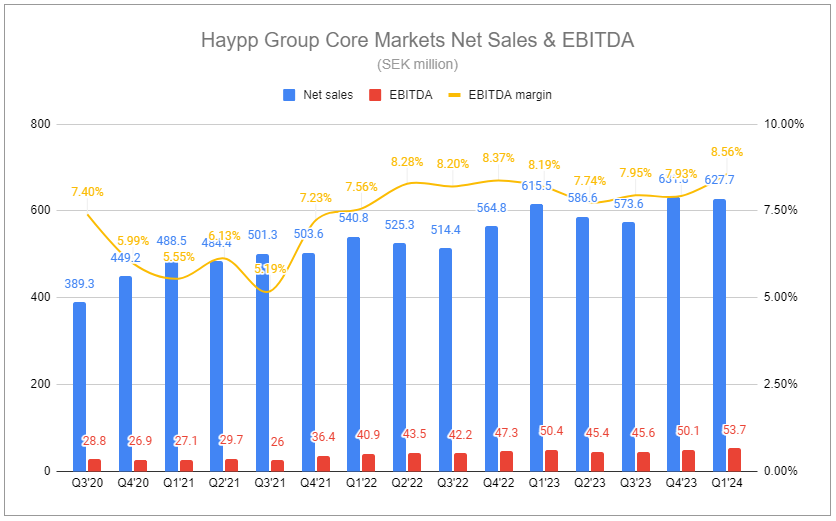

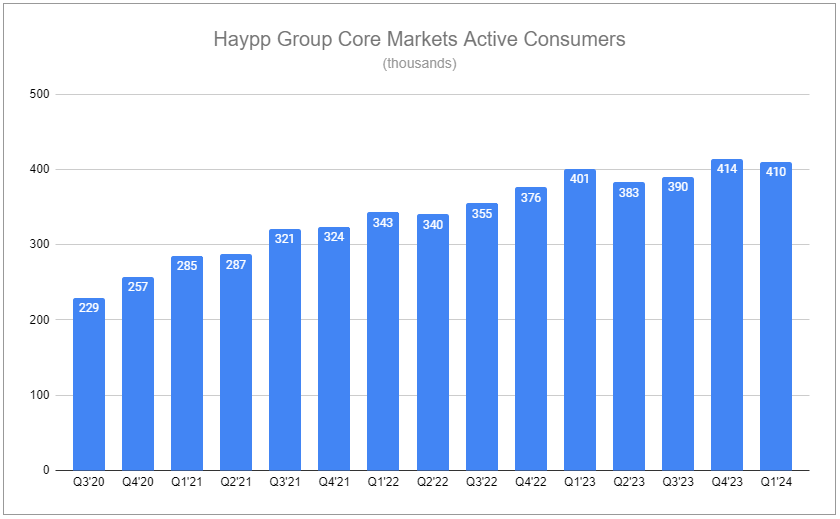

In Q1’24, Core Markets' nicotine pouch volume increased by 32%, which was largely offset by declines in snus, leading to net sales growing by 1.98% year over year. Segment active consumers grew similarly, up 2.24% from Q1’23. Yet, with further scale and a volume mix shifting more toward nicotine pouches, segment-level EBITDA grew by 6.55% year over year.

Despite the impressive incremental profitability, I am sure it is easy for many to paint the lackluster topline growth as a concern, showing that the company is well on its way to missing the aspirational SEK 5 billion target set for 2025. I am not so sure that is the right takeaway. There are the aspects of seasonality and calendar timing that partly explain the relatively weaker Q1 Core Markets topline, but the company’s NP volume growth was observed as outpacing the category, showcasing that Haypp is not only defending its market share but is taking incremental share. Further, we must look beyond the Core Markets and to performance as a whole.

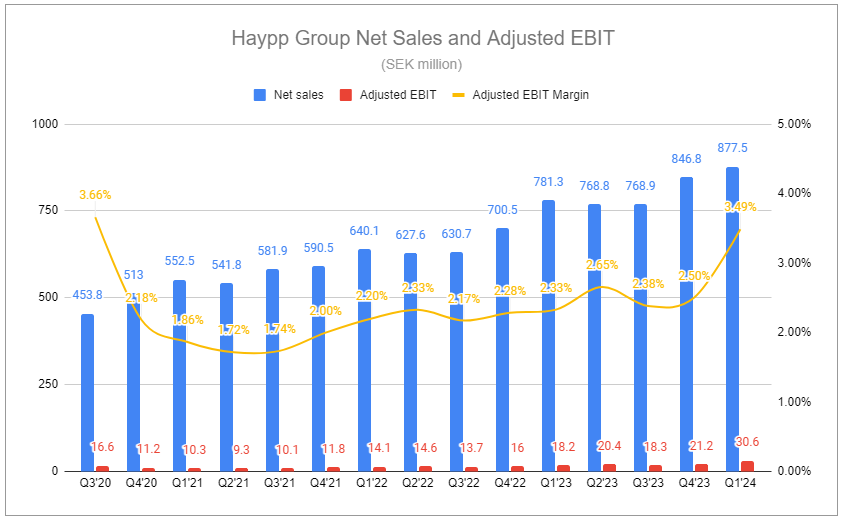

Haypp Group’s Q1’24 net sales increased by 12.31% year over year. This increased several points further in April, helping adjust for seasonality and calendar timings. Undoubtedly, the snus decline in Core Markets will continue to drag on performance, but this was already known. Equally well documented is the simple mathematical function explaining why it will be less material to Haypp over time. In Q1 ’24, Haypp’s nicotine pouch volumes grew by 40% and now account for 60% of sales. Not only is snus rapidly becoming a smaller piece of Haypp’s overall pie, but that rate of change is bound to accelerate as volumes not only shift toward NPs but also total volumes become weighted more heavily toward Growth Markets.

Growth Markets

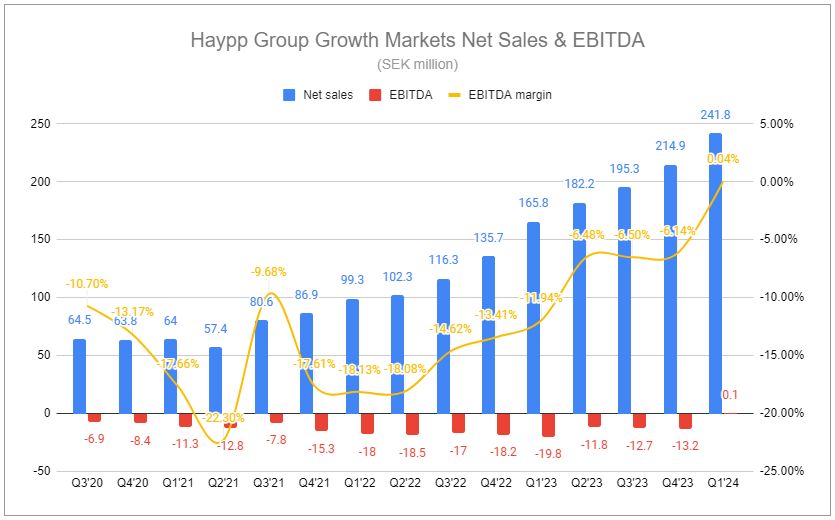

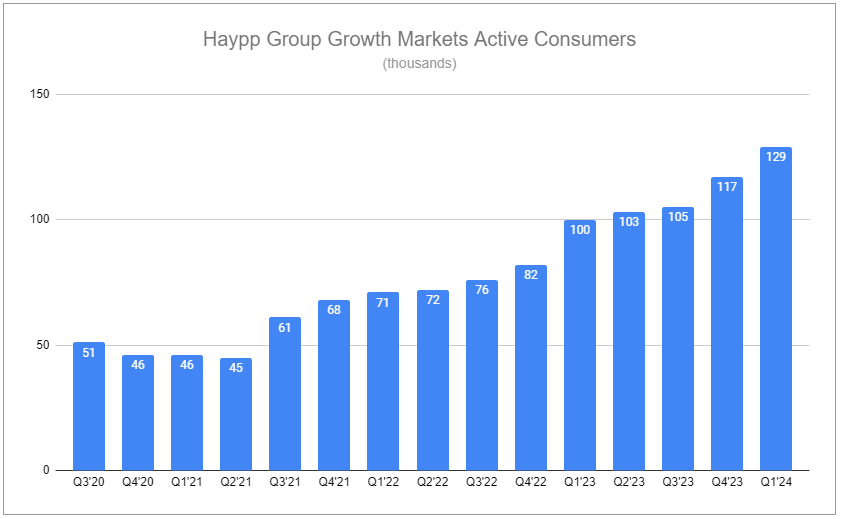

Most impressive was Haypp’s change in Growth Markets EBITDA margin, expanding by 1190 bps year over year and 610 bps sequentially. Explaining this significant step-up was what was highlighted prior:

Frankly, getting from modest gross margin improvement to a substantial adjusted EBIT margin improvement is a function of scale: massive growth in volumes against operating expenses that are set to grow much slower. For Growth Markets, we already saw a similar radical step up in segment EBITDA margin in FY’23.

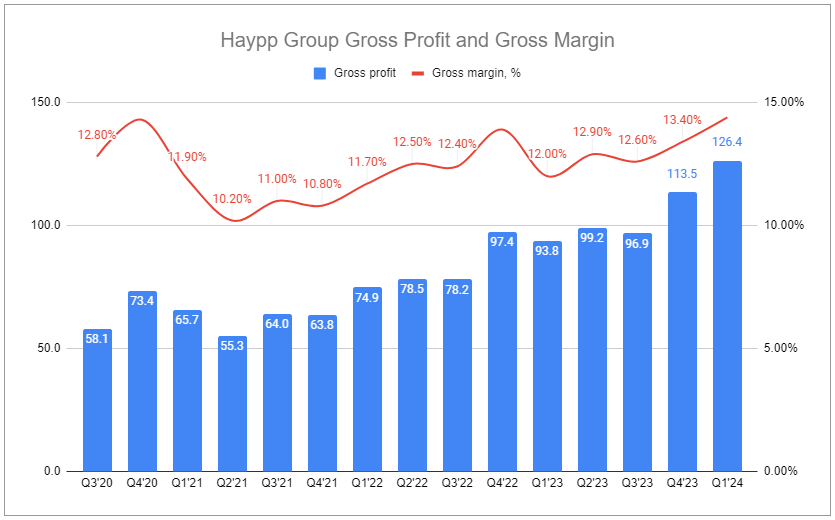

Q1 ’24 Growth Markets' top line grew by 45.84%, driven by 52% nicotine pouch volume growth and better rates with suppliers negotiated based on calendar year volumes. It stands to reason that as Haypp continues to rapidly grow NP volumes, subsequent improvements to margins will be reflected most heavily in the Q1s of coming years. This is also well-captured in the group’s gross margin profile, which has steadily improved following the acquisitions in 2021.

The US, being the largest NP market in the world, will continue to play an outsized role in Haypp’s trajectory, with the company’s NP volumes in Q1’24 growing by 59% in the country. Notably, this growth rate includes lapping the sizable 2023 pull-forward following California’s late 2022 flavor ban, with volumes growing across the rest of the country by ~70% for the period.

Numerous examples highlight the considerable uncertainty surrounding how regulation may inhibit the continuance of such a trajectory. In late April, Sonoma County in California unanimously passed resolutions to restrict flavors and online sales of tobacco products. Likewise, a NY senator has introduced a bill to ban the sale of all flavored nicotine pouch products in the state. Conversely, while certain jurisdictions will undoubtedly enact unfavorable regulations, not all actions will be headwinds for Haypp. The company’s 100% age-verified transactions bode well for regulation specifically built around further limiting underage access, and it is likely that steep restrictions limiting the behaviors of physical retailers can become a tailwind for the company. Likewise, recent actions taken by the FDA are bound to present similar benefits. On April 4th, the FDA issued a block of warning letters and civil money penalties to brick-and-mortar retailers that sold nicotine pouches to underaged individuals. Additional warning letters were sent out to three online retailers that were selling flavored products in the US that are unauthorized variants from overseas. These online retailers include Snuscore, Snussie, and one of the more popular, Snusdaddy. And now, recognizing that such behaviors will be enforced against, other online retailers, such as Snusdirect, are proactively ensuring they don’t face a similar fate:

Although the US market is the largest NP market and is fast growing, it still sports the lowest online penetration amongst the markets Haypp operates in. Enforcement actions against other online retailers will help ensure that Haypp’s growth outpaces the category as the market matures and a greater percentage of adult consumers migrate to online channels to make their purchases. Likewise, as highlighted in last week’s note on Philip Morris International, we are likely to see determinations reached on v1 products currently marketed in the United States by the end of this calendar year and potentially will see determinations reached on v2s in the following year or two. As Haypp continues to take total share and insulate its leading place in the online channel, it is positioned to benefit greatly if the total available SKU pool expands with a greater mix of high-quality products.

Emerging Markets

As guided previously by management, Haypp reported a new third segment in Q1’24: Emerging Markets, consisting of online vaping retail in existing European markets. This will be the reinvestment focus before the company transitions to branching out NP sales in new European markets, followed by expanding new RRP categories into new European markets. Q1’24 net sales for the segment reached 8.1 million SEK, with EBITDA firmly negative at -7.0 million, reflecting investments into commercial capabilities and product capacity. This segment undoubtedly presents a new tier of risk and reward, and reinvestment into it will weigh against the profitability of the core business, just as the Growth Markets had for years prior to inflecting. On one hand, there are looming threats of regulatory actions, such as disposable vaping bans, including within markets such as the UK. However, disposable vaping products within these markets carry substantially higher contribution margins, potentially allowing impressive operational leverage at scale, provided Haypp best utilizes its expertise of understanding the RRP scape and takes advantage of adult users’ propensity to be poly-users.

Distilling the value proposition

Haypp’s reported financials are likely to remain dragged due to reinvestment in Emerging Markets, site infrastructure, and physical distribution capabilities. Likewise, the cannibalization of snus in Core Markets is masking the exceptional performance of nicotine pouches. With Growth Markets having inflected to profitability, the future opportunity can be distilled down into a few points:

Nicotine pouches, as a category, are still in their infancy as a global phenomenon.

As markets mature, a greater percentage of NP sales in Growth Markets will shift to online channels, as has happened in Core Markets.

Haypp Group has multiple defensible competitive advantages, including dominant organic online visibility, the largest assortment of lowest-priced, high-quality products, and the most valuable data insights and capabilities for brand owners.

Haypp is positioned to replicate its advantages in new markets as the NP category spreads worldwide.

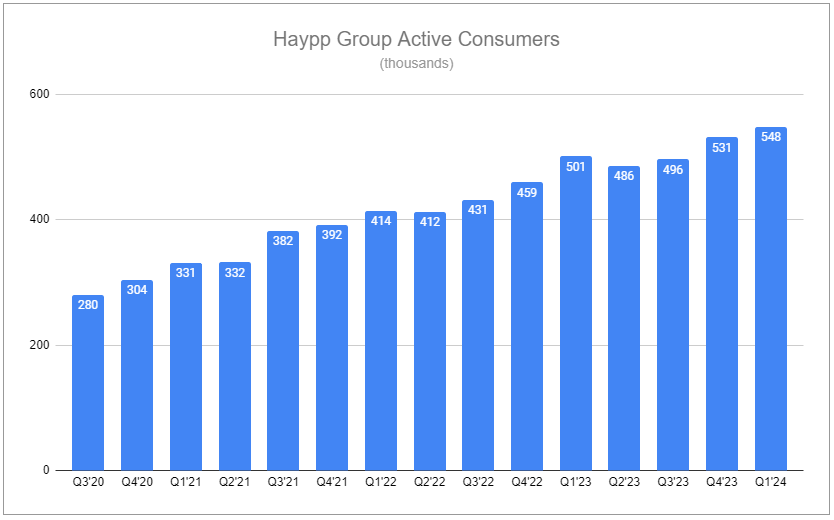

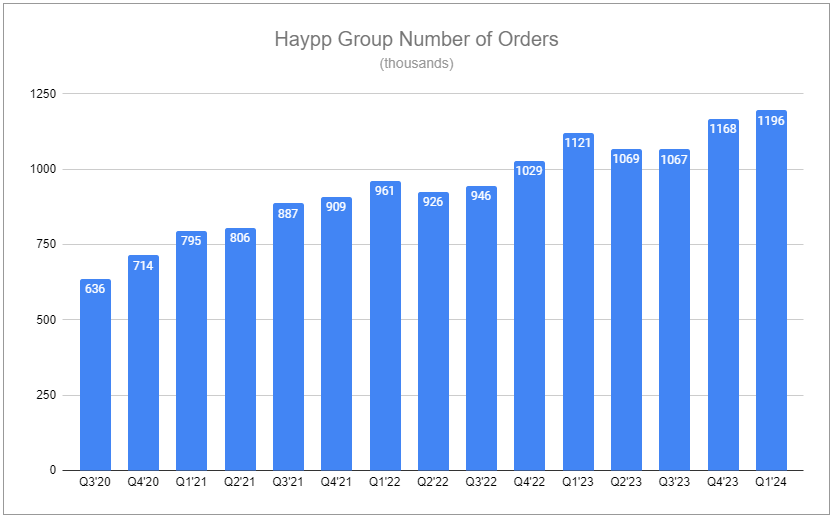

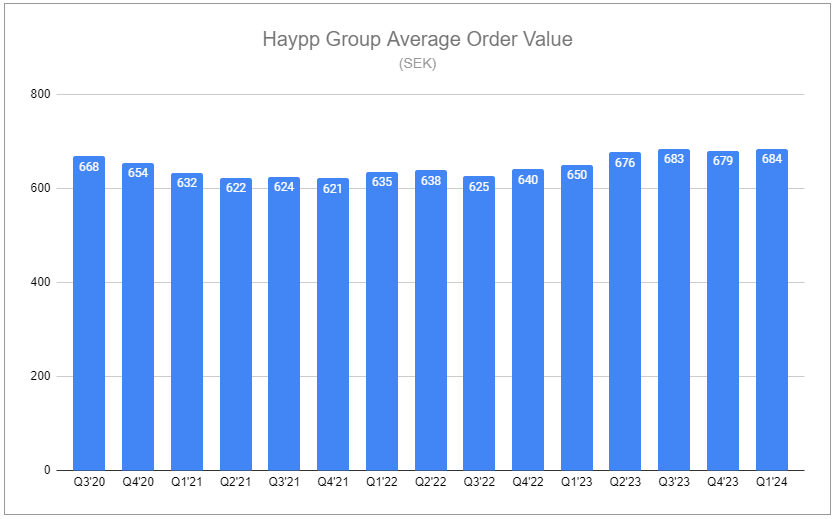

These points make up a virtuous cycle that will allow Haypp to reinforce itself as it outscales the fast-growing market. As Haypp’s CEO Gavin O’Dowd stated during the Q1’24 call, quoted at the opening of this piece, the company quite likes the pricing gaps where they are. Without question, adult consumers do, too, as evidenced by active consumers, number of orders, and average order value are all steadily increasing for the company.

In the valuation section of my comprehensive Haypp piece, extensive liberties were taken that can only be deemed beyond sensibly conservative, including minuscule improvements to gross margin over time, impossibly large net financing charges, an effective tax rate notably above reasonable, and steep applied dilution, critically, recognizing no proceeds from warrants, to name merely a few. Despite these inputs, the illustration showcased both enterprise and equity multiples shrinking to low single digits in just a few years’ time. If the assumptions of the nicotine pouch category’s evolution and Haypp’s leading position within the value chain are proven to be correct, reality will force a radical revision upward in the not-so-distant future.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Haypp Group, as well as positions in tobacco companies such as Altria, Philip Morris International, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Your subject knowledge on this stuff is aspirational.

Thank you. I enjoy owning this company!