“I can give you a six-word formula for success: Think things through - then follow through.” - Eddie Rickenbacker

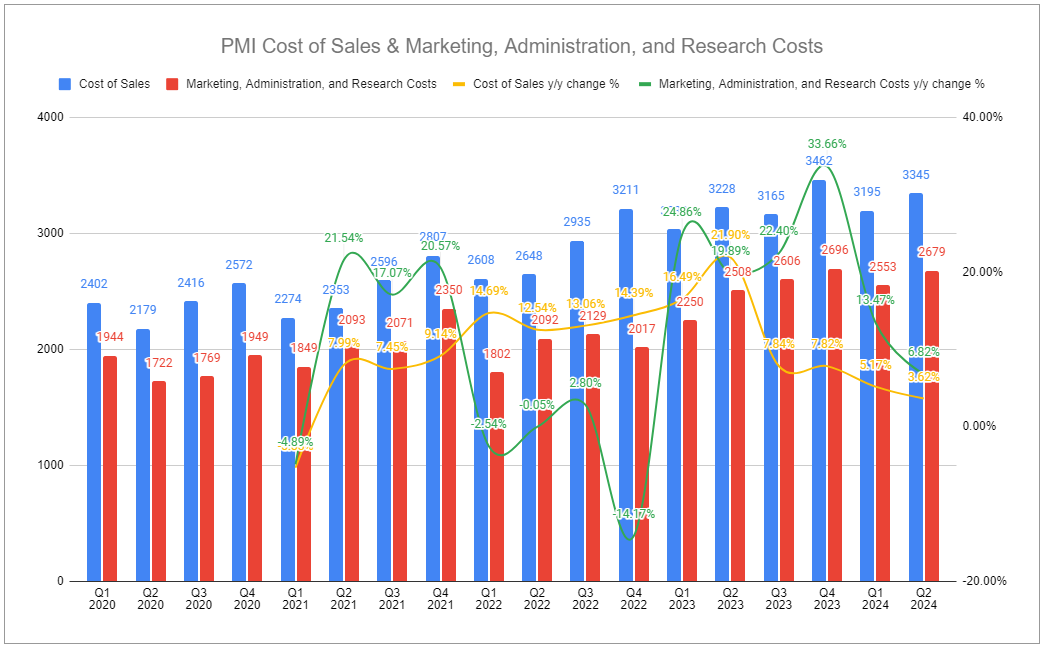

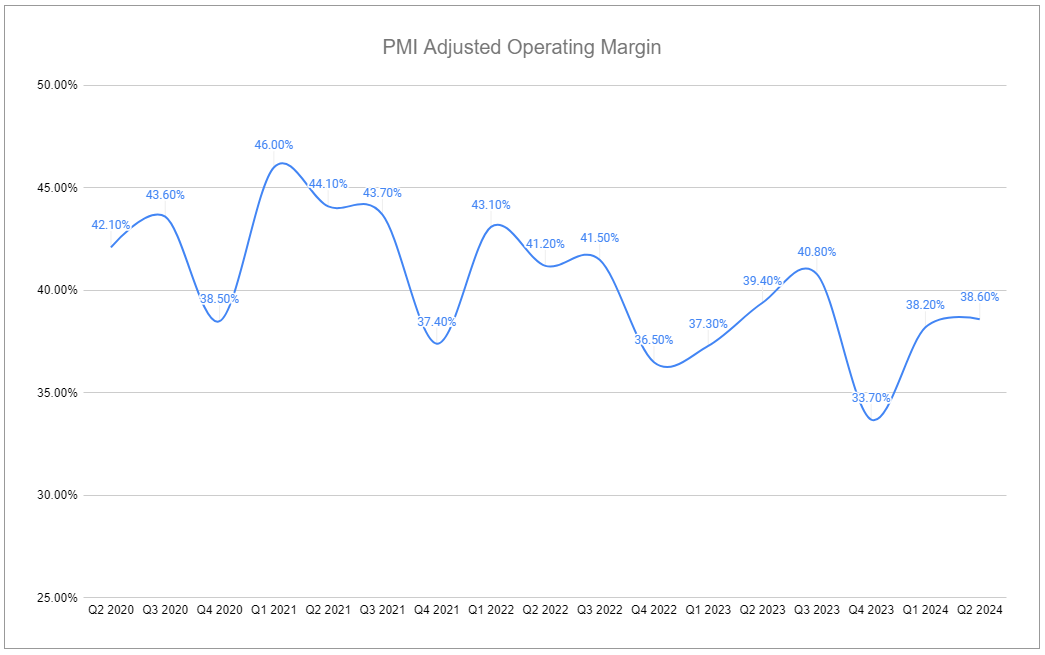

Q2’24 provided a consecutive quarter of salve. As the performance of cigarettes, heated tobacco, and nicotine pouches continue to impress, only faint scars remain from the considerable pressures previously felt, namely supply chain issues spurred by the pandemic coinciding with elevated costs of rolling out new product iterations. In addition, currency strains are seeming to lessen, and cost controls are materializing, reversing a much-unwanted trend and polishing the narrative all the much further. The company is following through on a strategy that is set to deliver profit growth in real terms.

Combustibles and IQOS

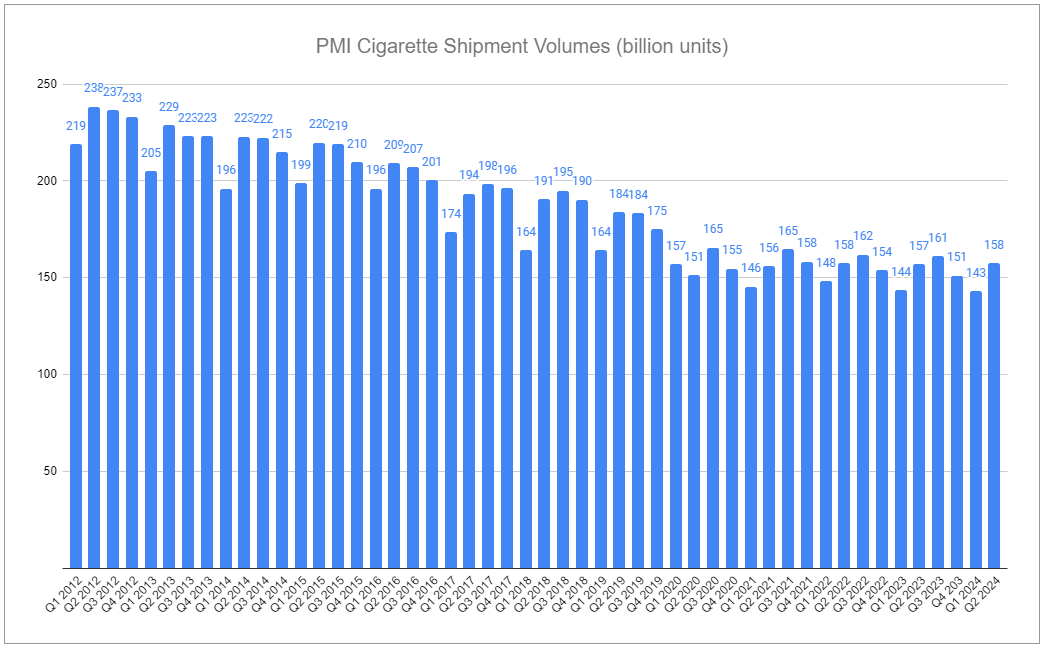

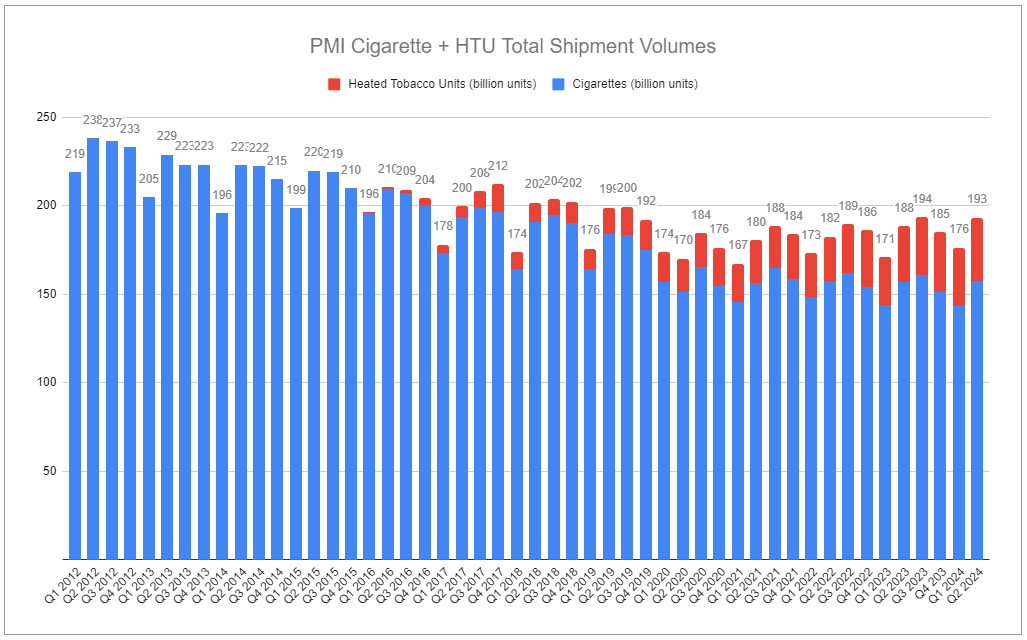

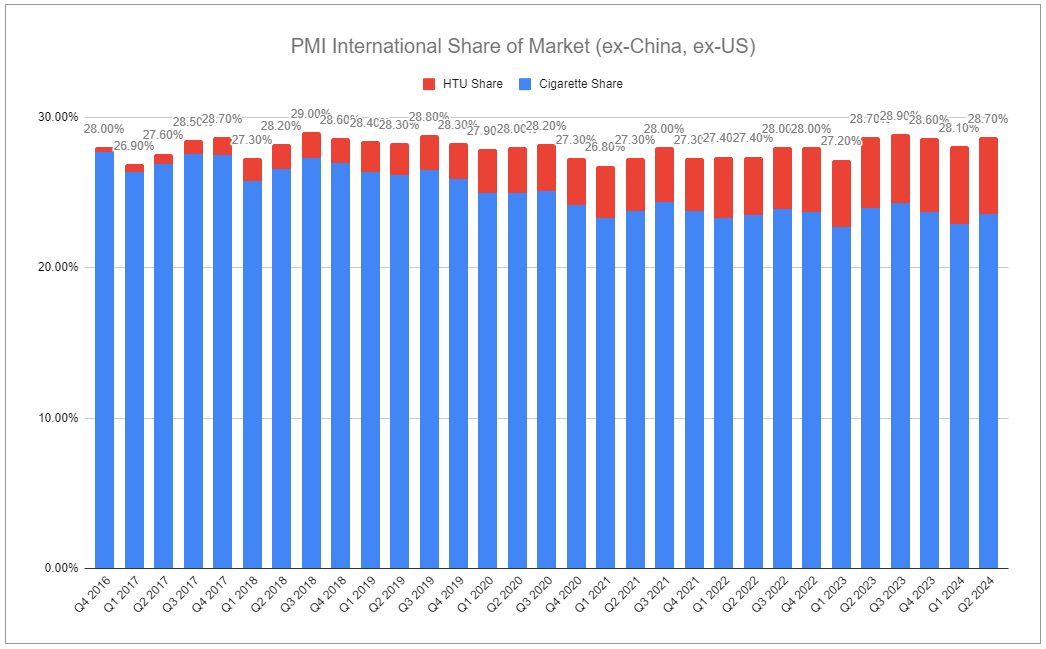

Perhaps it is not so surprising, as the company has stated its mission is to transition smokers to smoke-free products, but cigarettes continue to receive too little of the spotlight. It’s worth questioning the exact timeline management has in mind for disappearing the category, especially when the company’s combustible volumes are far from showing the precipitous decline that would be required for the supposedly desired outcome, in addition to the fact that pricing continues to drive tremendous profitability. FY’23 combustible pricing variance came in at +8.9%, far above prior years, and volumes were only down a small fraction. In my related note, I shared the expectation of combustible pricing variance likely falling toward a mid-single-digit level in coming periods. While directionally correct, the end result for the first half of 2024 highlights the power remaining within the legacy business. H1’24 pricing variance measured 8.3%. The elevated rate would leave one expecting volumes to have declined modestly. Yet, volumes were up 0.4% in Q2’24 and essentially flat in the first half.

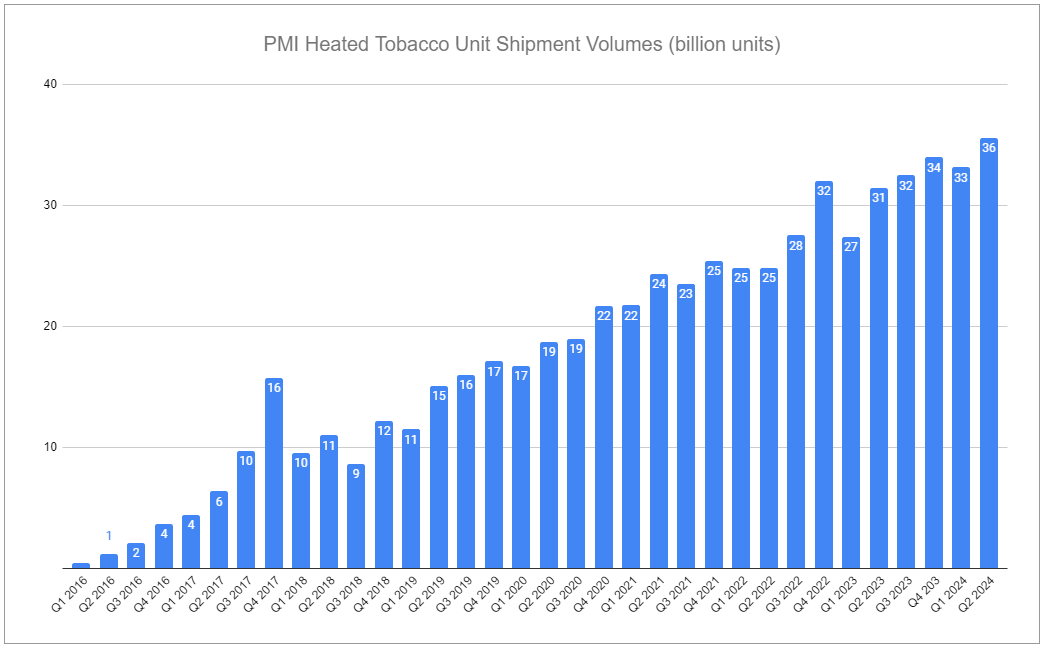

It could be argued that various inventory movements benefit or hinder the company, but on a quarter-by-quarter basis, those can be noisy. Truly, the strength of combustibles is all the more impressive considering the sustained growth of heated tobacco, with Q2’24 and H1’24 volumes up 13.1% and 16.8%, respectively. Granted, IMS—which better illustrates consumer offtake—measured considerably lower for the respective periods, at 10.2% and 11.4%, but we’re still talking about double-digit volume growth in a category that is partly cannibalizing legacy products. This performance is despite lapping the HTU flavor ban in Europe.

The key conclusion, stressed last quarter, is that switching between categories should not be assumed to be a 1:1 volume equivalent, as NGPs reduce all types of apprehension and friction and provide for far more usage occasions. PMI’s position illustrates widening share and aggregate HTU and cigarette volumes heading for a fourth year of growth, paired with price take and cost controls equating to a path for much wider margins on gross and operating levels. Mind you; this result is still discounting any positive movement of the US IQOS rollout, which now appears to be moving even slower—an expectation I expressed over a year ago and have repeated.

The pouch problem

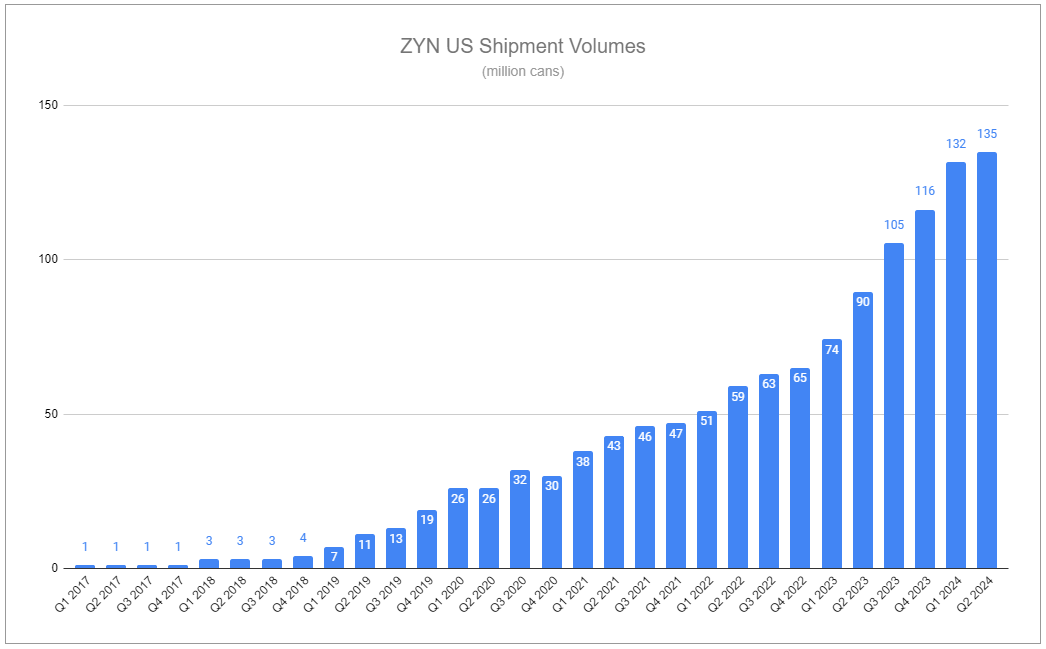

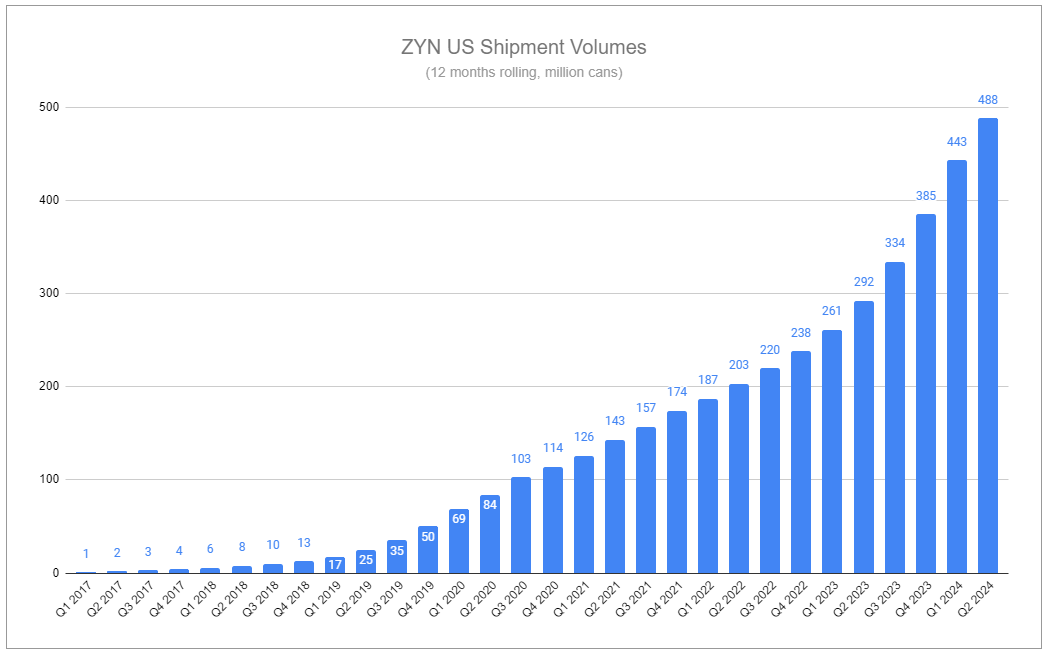

While combustible products continue to produce exceptional profits and IQOS maintains its growth towards gargantuan status, PMI’s modern oral nicotine pouch, ZYN, remains the talk of the town. The product is considerably smaller in total contribution but is remarkably high on a per-unit basis and is far faster growing. In Q2’24, ZYN volumes outside of the US grew more than 50%, and within the US, ZYN volumes grew by 50.3%. This is in stark contrast to Snus, Moist Snuff, and Other Oral, in which volumes changed by -6.2%, +0.2%, and -17%, respectively. Nonetheless, the result was that total oral product volumes grew by more than 20%.

Concerns rise from the fact that ZYN’s growth in the US, while exceptionally high, has meaningfully decelerated from the 79.7% rate in Q1. The problem is exactly what was first highlighted last quarter: Murmurs of ZYN shortages popping up across the US, the largest and fastest-growing pouch market. Prior conspiracies that the shortage was a result of mass sabotage or swift government action can now be confidently replaced with confirmation of capacity constraints due to the unrelenting demand for the product. While this could be framed as a problem, it is a problem to be envious of.

Let’s apply some numbers for context. At the end of 2023, guidance on full-year 2024 US pouch volumes was ~520m cans. Following Q1’24, the figure was modified upwards to ~560m cans. Guidance has now been further adjusted to a range of 560-580m cans in the US. PMI is taking two measures to increase ZYN manufacturing capacity, with a recent press release announcing a new production facility located in Colorado that is set to open at the end of next year and efforts to expand capacity at its Kentucky facility toward 900 million cans in 2025. If we were to simplify and assume that Q2’24 shipment volumes reflected maximum current capacity, the full-year potential would be 540m cans, implying incremental expansion in Kentucky that will materialize modest capacity improvements in Q4 to reach the new full-year range. If the company reaches the midpoint, it will represent a growth rate of 48% from last year and an increase of more than 139% compared to 2022 volumes.

While the ZYN capacity constraints do not present a monumental problem for volumes in the near term—considering volumes are still far over what could have been imagined just a few years ago at the time of the Swedish Match acquisition offer—the situation does present several important implications. First and foremost, while ZYN retained a retail value share of >75%, its volume share in the US fell in Q2 after having sequentially expanded over the year prior, suggesting competing products have taken advantage of the window to swoop in and fill the gap. This was confirmed by British American Tobacco’s H1’24 figures, showcasing US modern oral volume growth of +226%—a radical difference from its previous performance in which volumes continued to shrivel. A positive development is likely for Altria’s volumes, as well as other brands, such as the recently launched zone. While the sustained trajectory of each competitor can be (and will be) questioned, the real question for PMI is whether or not this shift in volume share will be maintained once ZYN regains ample capacity.

I previously highlighted that the US modern oral market is likely to be tested over the next few years by potential new entrants, new product iterations, and how the FDA ultimately proceeds to evaluate modern pouches categorically. Each day, we move closer toward rulings on all of the v1 PMTAs pending, and with the recent overturning of Chevron deference, the future regulatory landscape could shift dramatically—though, in my view, the FDA still holds a large toolbox to roadblock new products if it so chooses. As for the competitive aspect, due to the current pressures weighing on PMI, the next 18 months will act as a useful preview, providing a unique opportunity to witness to what extent ZYN is capable of reversing volume share loss and managing value share or if other products are able to continue building momentum against it. PMI could also face additional challenges, both competitively and legally speaking, hinted toward during the Q2’24 call:

Owen Bennett, Jeffries:

I hope you are well. I just have a couple of questions on the U.S. pouch dynamics. So first -- and I would assume this is due to certain retailers trying to fill the supply gap. I have been seeing some Scandinavian ZYN available in certain stores. So I was wondering how you can get on top of this to make sure that's not happening.

And then second, I'm also now seeing over more than oral brands appearing, I assume do not have a PMTA submitted. So how do you see the risk we could see a similar scenario developing in pouches in the U.S. and to what we're seeing in vape with the legal products?

Emmanuel Babeau, PMI CFO:

So you're alluding to product that would come from non-U.S. market, correct? That's what...

Owen Bennett, Jeffries:

In retail, the distributors are buying them online from Scandinavia to try and fill the supply gap. Just wondering how you can get on top of that to make sure that's not happening?

Emmanuel Babeau, PMI CFO:

Look, I don't have any information about that. So I cannot make any comment or report. I think we are doing everywhere we can, our utmost to ensure that the flows are appropriate and not going where they should not be going. And we are working very hard with this objective. And I don't have any data and I cannot react on that.

But our position is very clear. We are very strict on doing everything we can to make sure that this parallel flows are not happening.

On your question on -- if I understand you well, when could -- do we see the same kind of phenomenon on nicotine pouch than the one we are seeing on vaping, which is illicit parallel flow that would be entering the U.S. market?

Owen Bennett, Jeffries:

Yes. I'm starting to see brands that I'm assuming do not have the PMTA. Just wondering how you see the risk around that?

Emmanuel Babeau, PMI CFO:

Today, from what we can monitor in the market, we are not having the feeling that there is anything material at that stage. But of course, we are monitoring that very carefully. If it was to become material, I think what we are clearly seeing today is that the authorities take that seriously, and they are starting to have much more action and be much more alert on the topic. So I would expect them to have the same behavior when it comes to nicotine pouches.

So to summarize, I don't think we're seeing anything meaningful today to be certainly watched. And if it was to become the case, we would expect the authority to have the same, I would say, proactive behavior that they -- I think they are starting to implement on vaping.

There are a few direct ways to interpret the above exchange. The scary interpretation is that an illicit pouch market is rapidly growing, and because illicit volumes are sold through untracked channels, PMI has limited data on the extent to which this is occurring. The far less problematic interpretation is that, as Emmanuel Babeau stated, there is nothing occurring to a material extent, and therefore, there is no material data being produced. I lean towards the latter explanation for several reasons. Firstly, if PMI’s Scandinavian variant was entering the US unlawfully to a material extent, the company would indeed have data showing a divergence between shipment volumes across geographies and retail offtake over time. Secondly, while there are brick-and-mortar retailers selling illicit products, the majority appear linked to a number of online retailers, many of which received warning letters earlier in the year.

PMI appears well-situated to deal with these additional challenges. If its own Scandinavian variants begin to find their way into the US illegally to a material extent, the company will have an obligation to tackle it head-on and should be equipped to identify the parties responsible and sever access. If competing foreign variants find their way in illegally to a material extent, authorities will likely be much more proactive as they are beginning to establish a more comprehensive enforcement framework towards illicit vapor that can more easily be transitioned to fully encompass pouches as well. Across most potential futures, considering the evolving competitive scape, regulatory dynamics, enforcement, and current changes in volume share courtesy of ZYN capacity constraints, a potential major benefactor is online distributor Haypp Group.

The task at hand

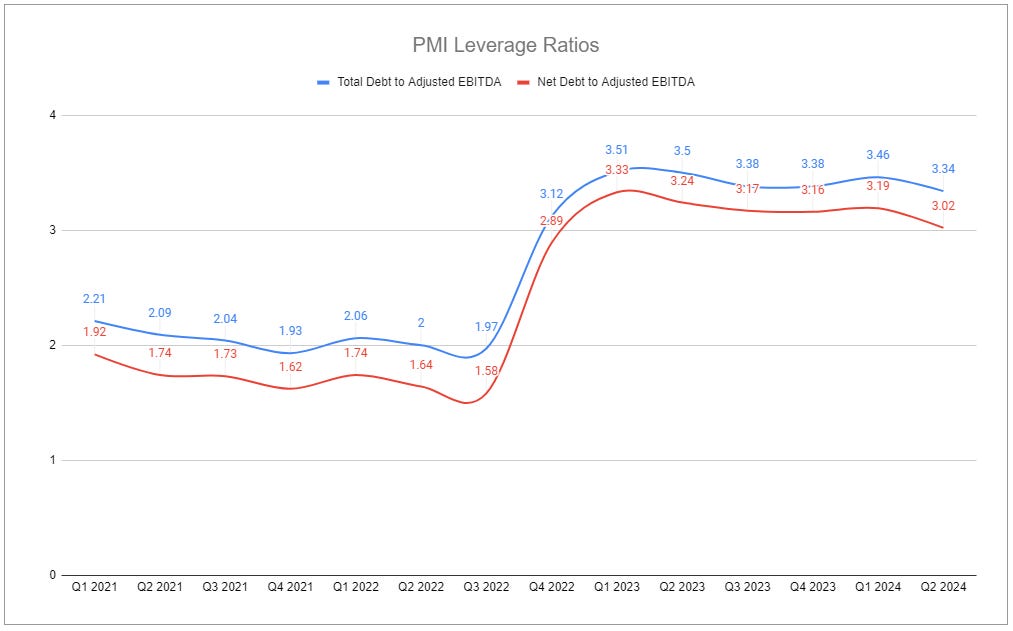

It is difficult to argue against the evidence showing the robust demand for PMI’s product portfolio. While volumes are looked at and focus on pricing remains paramount, the company’s true task at hand is to execute on both fronts while following through on controlling costs; no small feat. Despite the large ask, the company has demonstrated its ability to manage inputs and tighten the operational level, and it is now beginning to deleverage largely by growing the denominator of earnings. With additional measures taken to curb the effects of currency rates, which have been quite nasty in the past, the company is primed to produce earnings growth in the most real sense.

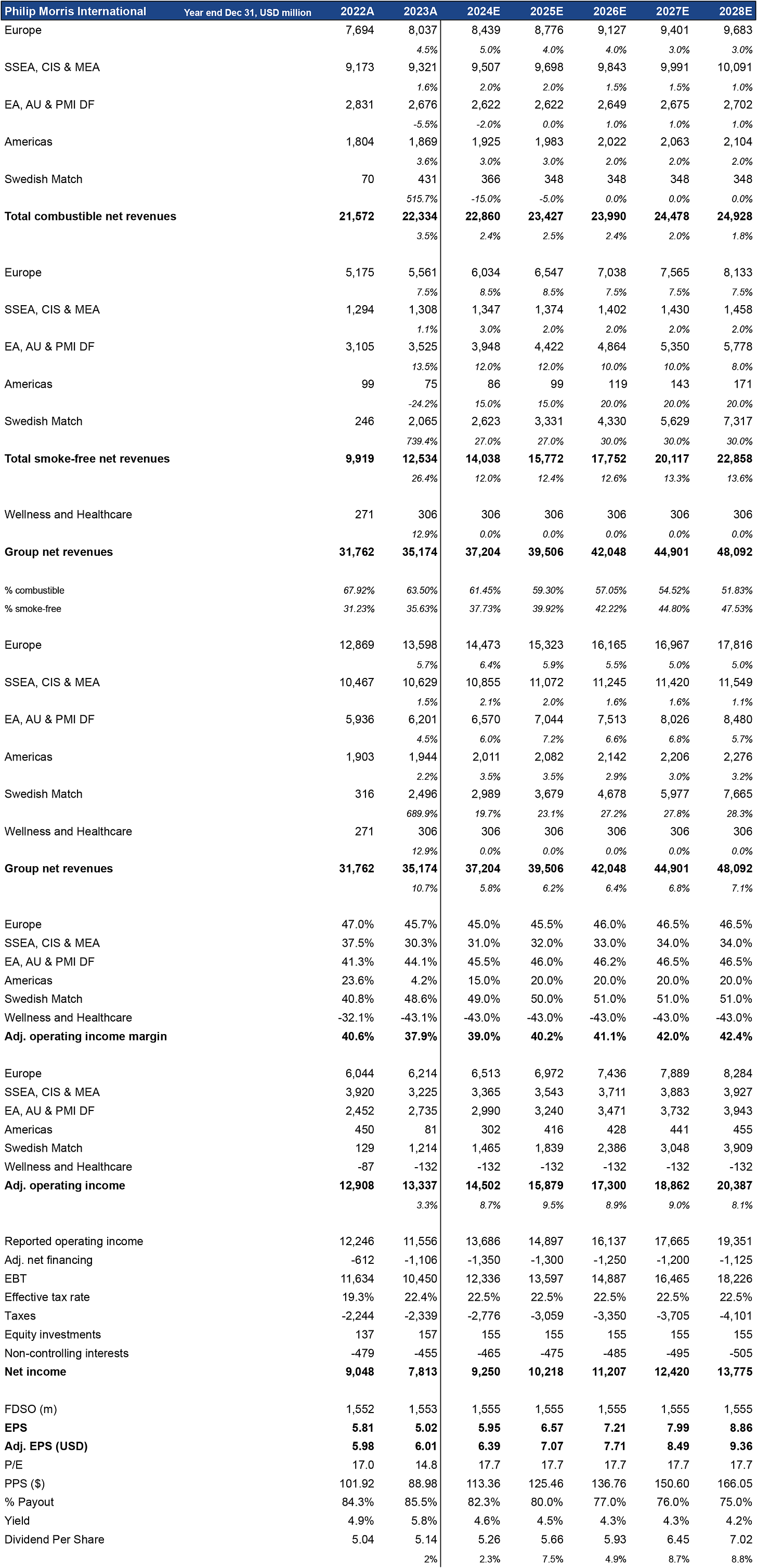

Attached is a model for illustrative purposes. As always, accuracy is not the goal. Assumptions include respectable growth of the topline and operating level. Figures are likely to look a bit off, considering SWMA remains segmented out rather than being tucked into the geographic segments. Nonetheless, even with the lingering pressures of FX rates, an ETR mildly elevated, and no assumption of future share repurchases, a future such as the one illustrated is most welcome. At the end of the day, my conclusion remains that Philip Morris International is an exceptionally above-average CPG company priced at multiples far under many of the world’s most popular names, despite profitability metrics that put most others to shame.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Philip Morris International and other tobacco companies such as Altria, British American Tobacco, Scandinavian Tobacco Group, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: PM 0.00%↑ BTI 0.00%↑ MO 0.00%↑

Additional Resources:

Philip Morris International - Reports and filings. Source

One of the best on substack.

Great discussion. I am glad to finally see the stock reflecting some of the good news.