“Basic common sense would have led anyone to investigate a situation where the company was quietly buying back everything it could” - Norbert Lou, Punch Card Capital, 2011

There is no riddle in asking why Imperial Brands receives little coverage and even less fanfare. When you tell your shareholders—and the world—that you are resetting your new product lines and shifting resources back to legacy products, you are inviting yourself to be portrayed as a lost cause. Stick to your plan for a few years, and you will be on course, but everyone will be sure your destination is the center of a black hole. Yet here we are, another half-year report later, and Imperial Brands has again demonstrated the soundness of its strategy. Old challenges have been met head-on. New challenges are certain, but management will not hide from those either. Execution has not been flawless—an impossible expectation—but net revenues remain robust, and they continue to turn into profits at a high rate. The only thing resembling a black hole is the rate at which the company is retiring its equity.

Far from over

There is no questioning the fact that legacy volumes, namely cigarettes, face heightened challenges. With a bump from COVID-related stay-at-home orders boosting usage occasions to the more recent knock, driven by heightened inflation and pressures on disposable income, there has always been something pressing against the industry to suggest the idea that the environment is not quite normal. With the introduction of next-gen products, including the more recent proliferation of disposable vapor products that have rapidly taken share, it would be easy to conclude that the cigarette is on its last puff. If that were to be true, it surely is not shown by the performance of Imperial’s core business.

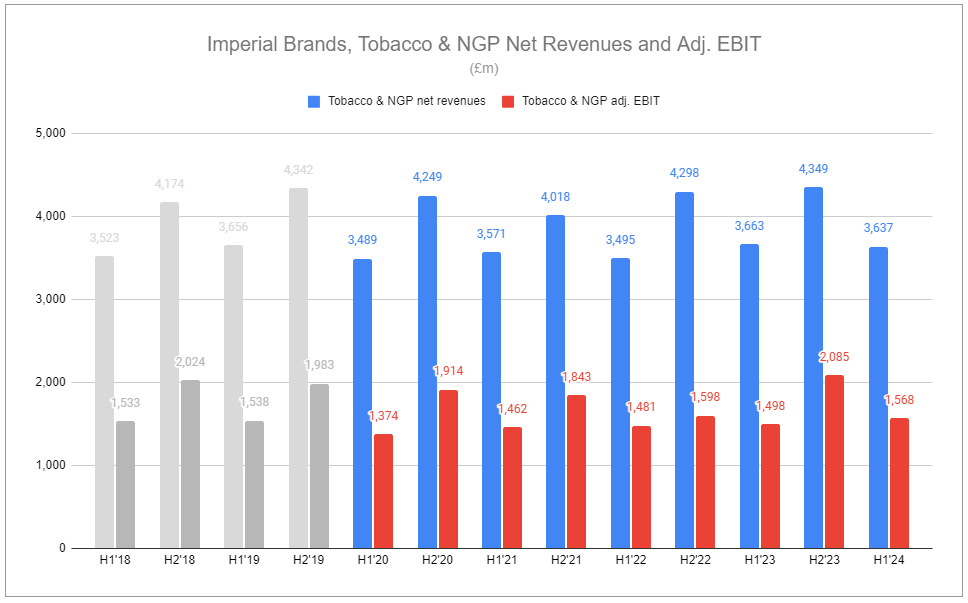

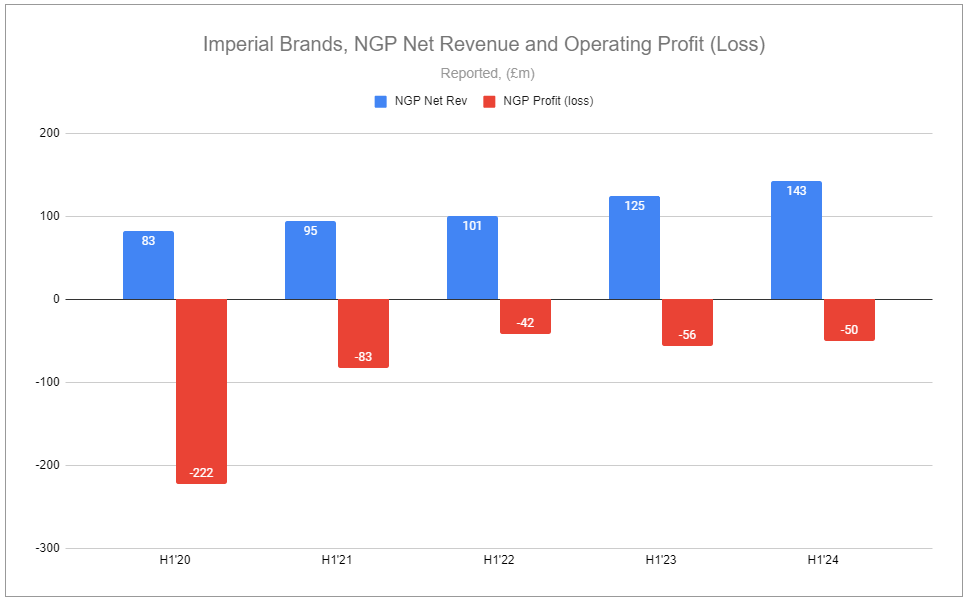

Not only has Imperial Brands shown remarkable consistency in the net revenues of its core business, but when you consider the timing of its strategic overhaul, it becomes more apparent that the business's strength has improved, evidenced by growing operating profits. Considering that NGPs have always negatively contributed, it is clear that the underlying profits of cigarettes and other legacy products have been even more robust.

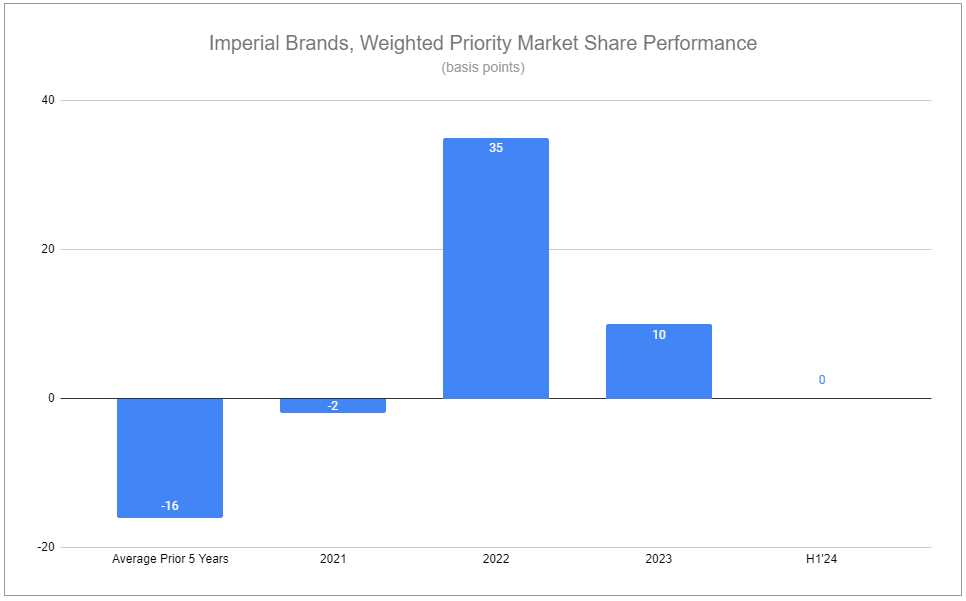

It is unlikely to garner headlines, but focusing resources on the legacy business in priority markets continues to prove fruitful. Loss of share in the UK in H1’24 would have certainly been worse otherwise—and now there appears to be a mild delay in moving forward with the generational smoking ban. Although share in Germany was lost in the period, the 25 bps decrease is a substantial narrowing compared to what has been continually experienced in the past. The United States, ever important, still sported a modest 5 bps increase. While the flat aggregate share in H1’24 looks less impressive than the last three years, it has nonetheless perpetuated the goal of stabilization.

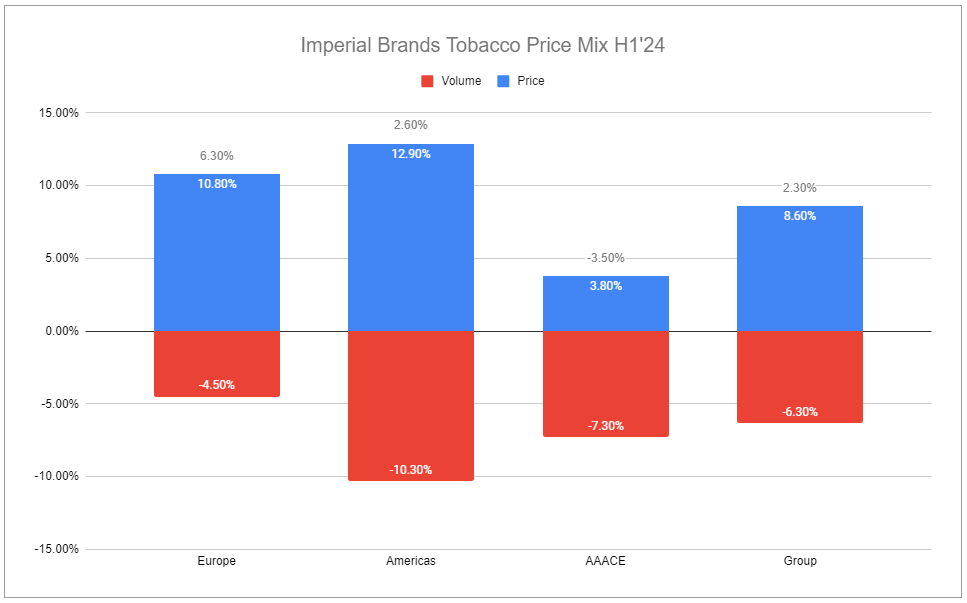

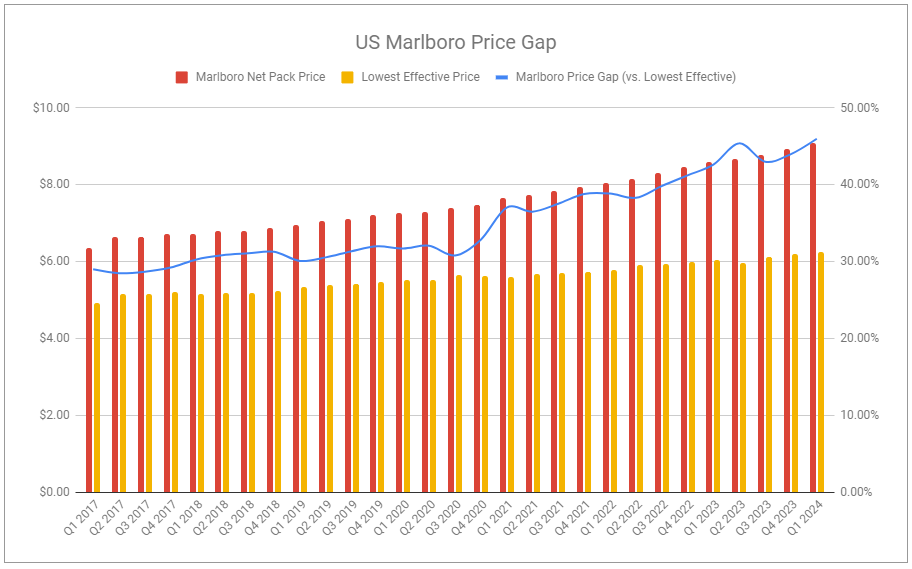

Volumes remain challenged. Yet pricing is still performing. Europe appears to be doing the heavy lifting while AAACE struggles to a higher degree, though is fortunately the smallest of the three geographical segments. The Americas have held their own despite the rampant growth of illicit vapor taking share in the United States, unquestionably aiding the 10.3% decline in volumes. The fact that pricing more than offset this degree of volume decline for the top line would suggest the company is far too aggressive, but two points in the wider scope point to the contrary. Disposable income in the US remains under pressure, but products within the market still remain some of the most affordable in the world—and the most lucrative. Equally important in understanding the future pricing runway is the consideration of relative affordability across brand portfolios. For this, we borrow the Marlboro price gap chart from Altria’s most recent figures:

Altria, holding the largest share within the United States, has continued to focus on premiumization and has steadily taken a share of the premium submarket. At the same time, over the last several years, Imperial’s continued taking of market share has partly been a function of having a more expansively laddered portfolio spanning toward the discount segment, benefitting from consumers’ downtrading. With this context, Imperial is well-positioned simply due to the fact that price increases, while aggressive and potentially larger on a percentage basis, are smaller in the absolute on a per-pack basis. So, although there may be a risk of uptrading away from parts of the company’s portfolio if pressures weighing on disposable income ease, the improvement ultimately benefits the industry as a whole so long as the group remains rational actors. The pricing runway is far from over.

Fourth mover advantage

Just as the diversion of resources toward legacy products was unlikely to score applause, Imperial’s decision to exit and reset its NGP business was met with dismay. This move was not driven by ego but by necessity. Previous attempts to break into new categories were simply not working, and the disproportionate allocation of resources was in no way justifiable. But to outsiders, ceding to that fact appeared to indicate that the company was destined to be left in the dust by its larger competitors, who were aggresively reinvesting into their next-gen products. After all, there is the definitive power of first mover advantage.

But what about the fourth-mover advantage?

Such a notion is assuredly counterintuitive, but Imperial’s rationale and subsequent execution over the last several years prove there is merit. Building up new brands is expensive. You are competing against the new and old competition alike, including your old self. You can gain momentum only to see it fizzle out, ceding share in new product categories. Adding insult to injury, it happens only after you’ve cannibalized part of your legacy volumes. Imperial, a significantly smaller company relative to Philip Morris International and British American Tobacco, has fewer resources. It can’t brute-force its way into building new markets. So why not wait?

Even when you do have the resources, they do not afford you a crystal ball. There is no exact precision in knowing which next-gen categories will be accepted by consumers in specific geographies. Historical precedent, social norms, and differences in disposable income all come into play, amongst other considerations. Layer in the myriad of regulatory frameworks evolving, and the chance of overestimating a particular product in a particular market becomes clearer.

A statement made during the H1’24 call by Stephen Bomhard, Imperial’s CEO, should register as music to the ears of shareholders:

We're always going to be smaller, but we can be more focused on operational performance and more focused on creating value for you, our shareholders.

Imperial’s strategy is sensible. It will never be the largest company in the industry, but it does not need to be. Strength lies in its ability to provide choice. Many consumers will gravitate towards the market-leading products owned by competitors. But those will not appeal to all, and Imperial’s differentiated options will appeal to some. And some, while small on a percentage basis of the total market, can still be quite large in terms of absolute profits when you show immense cost discipline in making that happen. Likewise, trade partners, wholesalers, distributors, and retailers want choice as well so that they are not beholden to any one customer and to safeguard themselves in preference changes within the market. This has been the company’s strength in legacy categories, and it only makes sense to stick to the playbook it has proven it can execute. Targeted rollouts in specific markets of specific NGP products, only when the landscape provides higher assurance of success, de-risks the route. While associated losses have only marginally narrowed, the top line remains steadily growing, and the gross margin has widened. The marginal narrowing in losses is more of a function of continued rollouts in additional markets. The path to profitability is there when looking more than a year out, but few respect the execution so far.

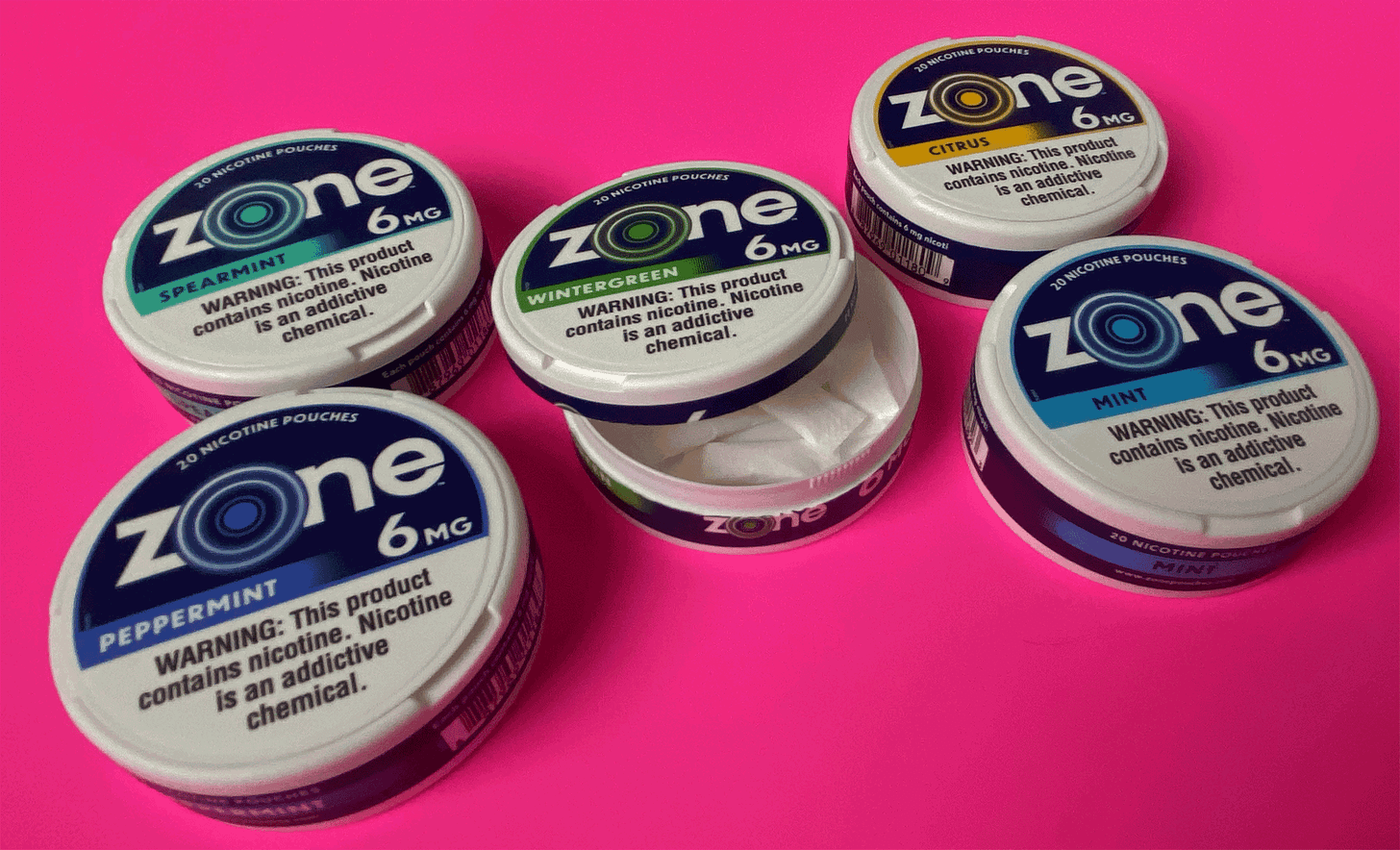

Imperials’ NGP portfolio grew revenue in the mid-teens in H1’24, while adjusted losses declined by 8.9%. NGPs now represent 7% of group net sales in Europe, and although specific European countries show strong momentum, one of the more interesting developments is occurring in the United States. In June of last year, Imperial acquired TJP’s nicotine pouch business. Imperial was already succeeding with Zone X and Skruf in Europe, and so, at the time, it was uncertain if this acquisition would end up looking more like the poorly performing US Velo or the respectable performance of on!. It is far too early to have any type of definitive conclusion, but there are reasons to be optimistic.

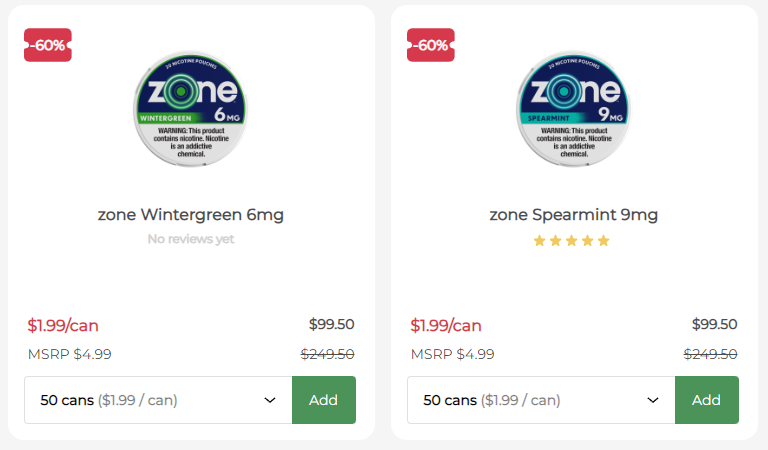

Under the zone brand, Imperial Brands launched the newly acquired pouch range in the United States market in February of this year. Distributed to nearly thirteen thousand stores, with more to come, the company’s product is also available online. Sites owned by the leading online retailer, Haypp Group, showed steep discounts in April, undoubtedly aiming to spur consumer trial and adoption.

Can zone win consumers over? In a way, it already has. Prior to being acquired by Imperial, TJP’s pouches were marketed under the L!X brand and, overall, had quite a few glowing reviews, though a small distribution footprint kept the product relatively unknown. The packaging is high-quality, and cans include a second compartment to place used pouches. When you open the main container, the aroma of the pouches is notably pungent. The pouches themselves are distinctly soft—gentle even—providing an extremely comfortable user experience. The initial release is, perhaps, a tad slow, but the consistency and duration of both nicotine delivery and flavor are outstanding. With strengths of only 6mg and 9mg, these are unlikely to appeal to new users, but anyone experienced with the category will likely find themselves impressed. All in all, this appears to be a high-quality product, and with time, will provide some valuable insights into answering how loyal users of leading pouch brands actually are and how big of an impact the relative distribution disparity represents when trying to build critical mass in the category.

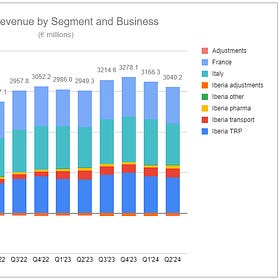

Logista laurels

Imperial’s distribution business, Logista, continues to impress with steady performance. Revenues, economic sales, and operating income remain strong, split between tobacco and non-tobacco sales. M&A continues. Tailwinds are poised to carry it further. The stake remains underappreciated, but that will not stop me from continuing to cover it as I did last week:

Logista: Steady as She Goes

A cold calculation

The legacy business continues to print cash, the measured approach to NGPs is progressing favorably, and distribution remains a benefit to the group. There is quite a bit to like in this story, but perhaps most of all, Imperial’s communication is far clearer and concise relative to its industry counterparts. Within that communication remains management’s commitment to retire share capital hand-over-fist. Ultimately, even if other components begin to weaken, that driver alone can be responsible for strong results on a per-share basis over the long term. The inverse is also true, as I stated in November of last year:

It is clear, at the rapid pace at which equity is being retired, that a lower share price is capable of having the greatest compounding effect on long-term returns. Conversely, a significant positive rerating would weigh down that exact dynamic; dampening repurchases, slowing the rate of absolute dividend reduction, and to an extent, limiting the group’s flexibility. Returns will be mechanical, and as I’ve said before, this animal feeds on continued pessimism.

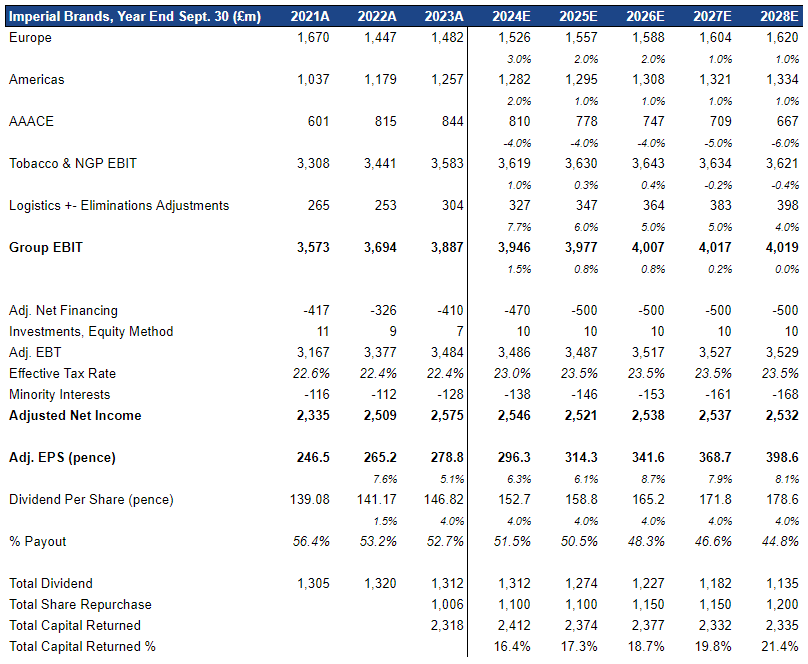

Perhaps investors are now waking up, splashed in the face by the cold calculation. The positive share price movement from that realization may continue to be the largest drag on performance. The new illustration includes a less doomed Europe and the Americas and sustained pressures in AAACE, while Logista remains unchanged, equating to a stable core. Elevated net financing and ETR provide conservative padding. Again, it is far from a precise outcome, but it is well within the realm of reason and provides unreasonably high results.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Imperial Brands and other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Scandinavian Tobacco Group. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ BTI 0.00%↑ PM 0.00%↑

Great write up

Buybacks are way to underpreciated also at MO and BAT, which I hope stays this way for longer

What do you think of the scale of volume declines in US (-10%), UK (two years of down mid-teens) and Australia -25%? The commentary around Australia seems to suggest that price hikes (excise) are driving greater adoption of illicit cigs/vapes. Are you comfortable with multiple years of high single digit/low double digit volume declines in these markets?