“Permanence, perseverance and persistence in spite of all obstacles, discouragements, and impossibilities: It is this, that in all things distinguishes the strong soul from the weak.” - Thomas Carlyle

Success comes from having the decisiveness to act and the courage to abstain, weighing risk versus reward, and remaining disciplined in a framework that matches one’s disposition. And even if you feel fine-tuned, truly great opportunities are rare, which will perpetually test your patience and mettle.

I came across an opportunity so radically skewed to the upside that I had no choice but to invest considerable time and effort into it. Twenty-seven months ago, I launched Invariant. Its subscriber count is marching toward 7,000, with readers from over 120 countries, and despite being an entirely free publication over the period, it has provided me immense returns in the form of an ever-growing network, ranging from amateur to professional investors, supplying essential insights, feedback, and criticism. Most interestingly, despite most content focused on business and financial analysis, the article with the highest level of engagement has been Writing for the Long Run, which covered my respect for writing and process.

It is time to elaborate further on Invariant’s future.

What is a brand?

A name should be concise and memorable. The fewer words, the better.

Human nature. The driver of desire. The key to all innovation and productivity booms. The source of all busts.

It is constant. Unchanging. Invariant.

The name took considerable time to settle on, but once in hand, creating the mark was frictionless. Aggressive angles. Negative space rendering a distinct ‘i.’ In its entirety, the mark appears as the head of a fountain pen. It is distinct and recognizable.

While a name and mark are certainly part of branding, they are not a brand.

But what is a brand?

A brand is an unwavering promise.

Invariant’s promise

Invariant promises consistently distilled value.

I previously explained my writing rules:

Write for an audience of one.

Distill value.

Publish consistently.

Build roots. Gain allies.

Rule three is the most straightforward. I publish once a week, every Sunday. As of today, the archive houses 120 articles. I intend to continue this pace, barring unforeseen events.

Rule two is a function of clarity x relevancy x density x novelty.

Of all the ways to look at our world, finance offers a truly unique lens. Proper analysis requires storytelling and numbers. Value is a natural output of bridging the two: studying the world as it has been, as it is now, and what it could be, thinking in potential futures and probabilities. There is never total certainty, and the more I learn, the more I am reminded there will always be far more that I don’t know. My circle of incompetence will always dwarf my circle of competence. What I share on Invariant is merely the incremental widening of those diameters.

Rule one is unquestionably the most unconventional. While unintuitive, the best way to serve you, the reader of Invariant, is to focus on me—precisely, the gaps in my own knowledge. I’ll keep tumbling down as many rabbit holes as possible. Creativity is the art of connecting the seemingly unrelated.

Rule four is about building brand equity. The strongest brands grow slowly. A brand starts as a seed to sprout, and growth comes each time you show your commitment, extending and thickening the roots. Over time, Invariant will continue to produce substantial value, and its archive will showcase change in the world and my thinking. While I much prefer to be correct, it is inevitable that, at times, I will be wrong. I am most eager to hold myself accountable. Like many companies I write about, I am building something that can endure over the long term—not days, months, or years. Decades.

I encourage you to join me on this path.

The Invariant Path

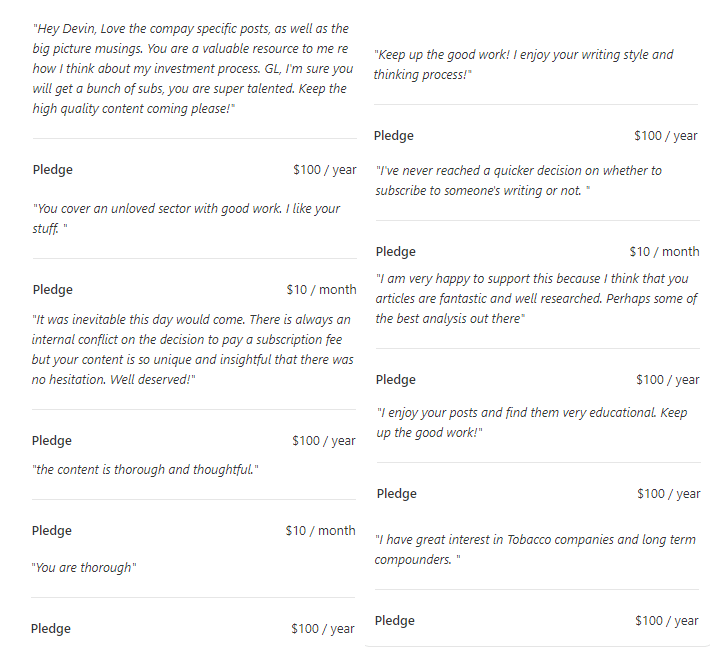

As of today, Invariant will begin operating as a paid model. The current archive and many future articles will remain completely free, while select articles and reports will be accessible only to paying subscribers. All pledges have been grandfathered in at the previous rates. Until next Sunday, subscriptions will be priced at $12/month and $120/year. Forseeably after, prices will be $15/month and $150/year. You can expect continued coverage of all the names I routinely write on, new coverage and reports, plus a sustained peppering of history, philosophy, and more. There is so much I look forward to sharing with you.

I want to thank you for the immense support you have provided. If you have been a long-time reader, consider upgrading to a paid subscription. If you have only been reading briefly, please explore a few pieces highlighting what Invariant represents:

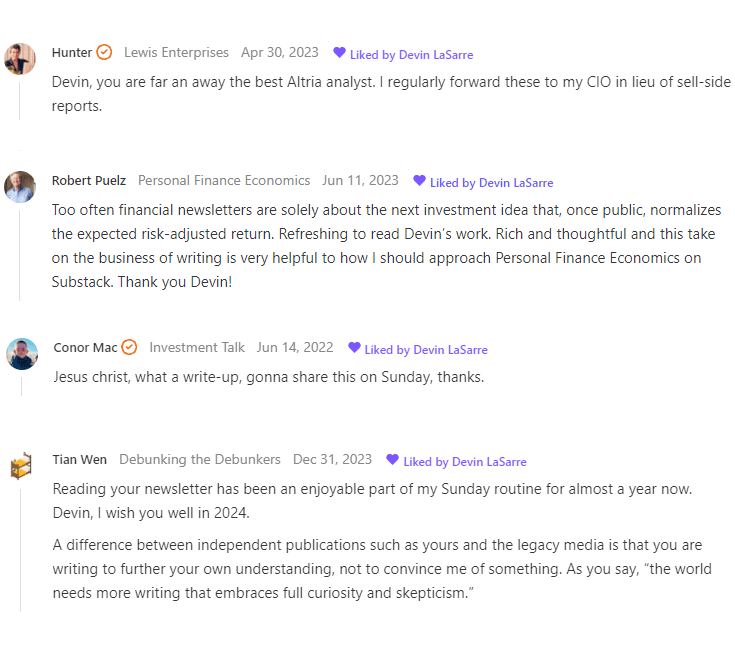

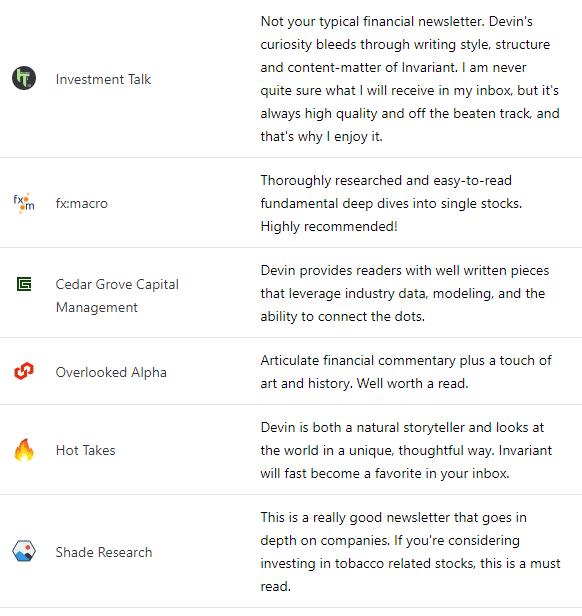

If you are still on the fence, please see what other readers and writers have to say about Invariant:

Thank you again for your support. I am beyond excited about Invariant’s future.

Questions or thoughts to add? Comment here or message me on Twitter.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Good luck, Devin. Your posts are always exceptional, so can only imagine this is the start of something special.

Good luck, Devin! Wishing you the best!