“I believe we are well positioned for success in 2023 and beyond. And while the external environment remains dynamic, I am confident that we have the tools in place to succeed.” - William Gifford, Altria CEO, Q1 2023 call

I was recently a guest on the Chit Chat Money podcast to discuss Altria’s operations, outlook, and valuation, as well as the most pressing opportunities and challenges facing the industry. The episode is accessible on Google Podcasts, Apple Podcasts, and Spotify.

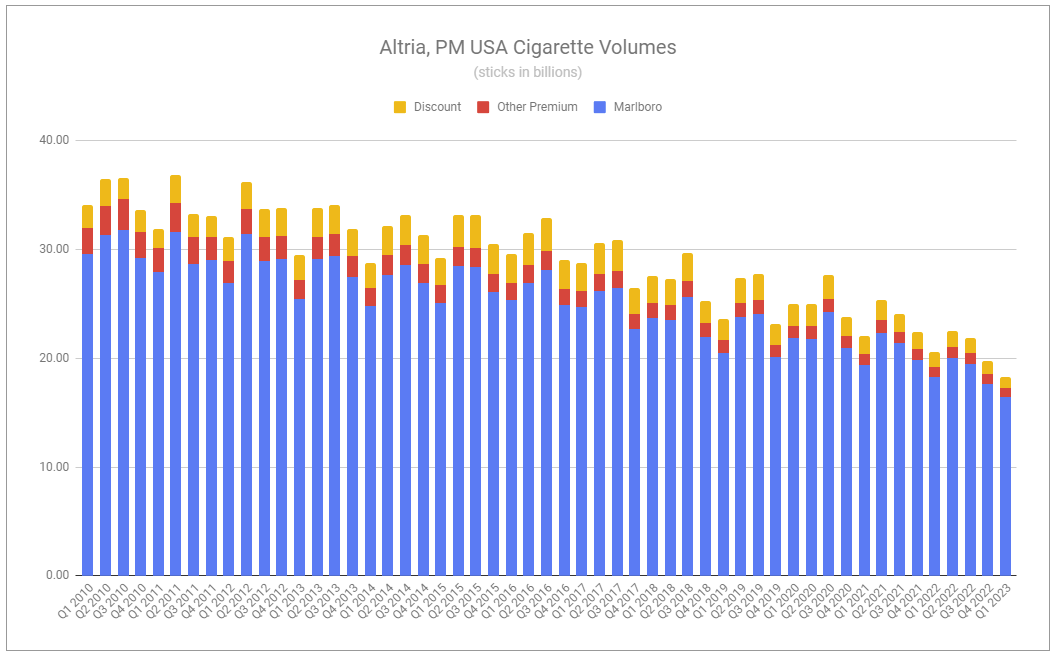

One issue with a pure audio format is that it does not allow visualization of the data discussed. There is a similar dissatisfaction when looking at Altria’s investor presentations. Altria’s Q1 2023 results were released last Thursday, and management spent quite a bit of time referencing their long-term focus. Yet much of the data and visuals used to explain operations only contain year-over-year comparables or a narrow timeframe of data. Other bits important are missing entirely.

That’s worth exploring in detail.

Altria Q1 2023

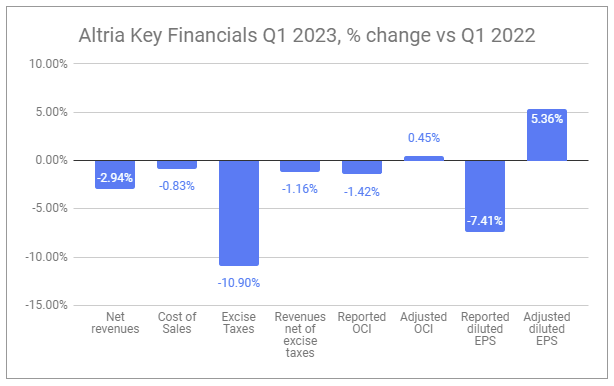

For Q1 2023, Altria’s headline numbers were:

Net revenues of $5.719 billion, -2.9% y/y

Revenues net of excise taxes of $4.763 billion, -1.2% y/y

A reported tax rate of 27.9%, +1.2pp y/y

An adjusted tax rate of 25%, -0.1pp y/y

Reported diluted EPS of $1.00, -7.4% y/y

Adjusted diluted EPS of $1.18, +5.4% y/y

Unlike the first 9 months of last year, we can’t blame part of the reported drop on the divestiture of the Ste. Michelle wine business in 2021. Altria continues to face elevated pressures. But is it all doom and gloom? Management has reaffirmed guidance to reach fulled-year adjusted diluted EPS of between $4.98 and $5.13, reflecting a growth rate of 3-6%. As always, one must examine deeper.

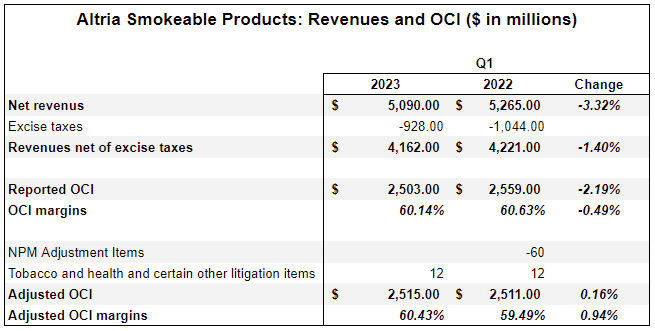

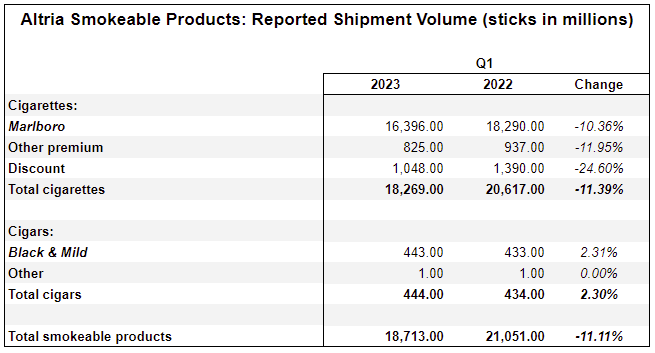

Smokeable Products

The Smokeable products segment saw net revenues down 3.32% and revenues net of excise taxes down by 1.4% y/y. Reported operating company income fell by an even greater degree, 2.19%. However, beyond TH&OL adjustments, which were even y/y, adjusting for the 2022 NPM benefit showed OCI growing, albeit negligibly, and OCI margin expanding. This is despite total company cigarette shipment volumes dropping by 11.39% y/y for the quarter. Is this a relative success to celebrate? Or should we be seriously asking what is truly behind the volume declines and whether will they continue? Yes to all.

Part of recent volume pressures relates to the late-2022 flavor ban in California, which caused state industry volumes to fall by 11.1% sequentially and 18.8% y/y. While alarming on its face, Altria’s state volumes were down less, at 12.8%. Note, this paints an incomplete picture, with the company citing increasing sales volumes in bordering states such as Nevada. It remains uncertain what the net impact will be long-term.

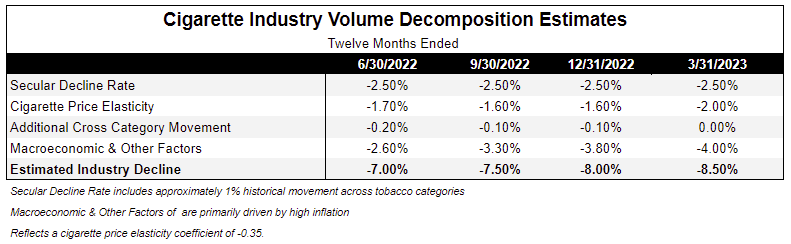

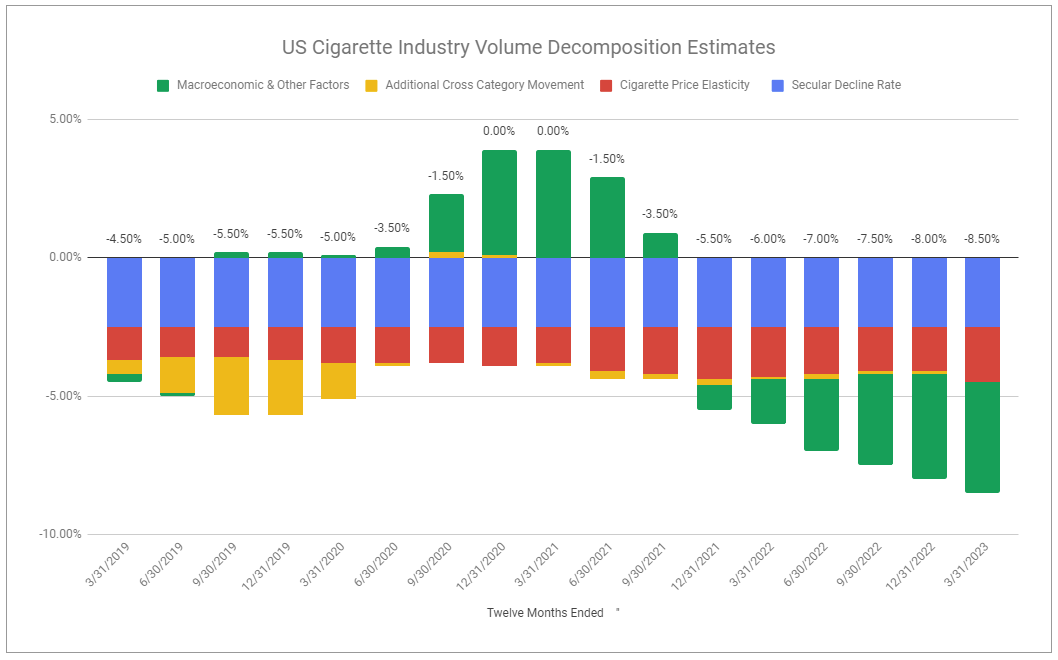

The chart above is the data most recently provided by Altria breaking down the trends in cigarette industry volumes. The biggest standout is that the total trailing twelve-month estimated industry decline has continued to grow. Continually throughout the last year, I have said that I believe this period’s volume decline is likely an outlier, opposite of covid, which led to greater time at home, a spike in consumer discretionary income, and larger stocking purchases. My insistence is grounded in looking at a longer-term trend.

Over the last year, Macroeconomic & other factors continue to be the greatest contributor to cigarette industry volume declines. While gas prices continue to come down from H1 2022, inflation, despite lessening, is still overall persistent. In addition, consumer discretionary income continues to be weighed on by interest rates. Altria CEO William Gifford elaborated on this during the Q&A:

So it's not just high inflation in the quarter, it's the cumulative impact of that through time. I think certainly, you're seeing interest rates climb, which is impacting consumers, mortgages, credit cards, car loans. And underneath all that, to respond to the consumer, we are seeing accelerated debt as well as decline of savings rates.

So they're using what they have available to them. But it's the cumulative impact of that. It's not new to the cigarette space. I think you can go back in history a bit, and we see other instances where the consumer came under extreme pressure. You can look at the '08, '09 period or '01, '02 period.

And you see where the consumer in those instances were under pressure because of the recessions that were taken place. Here, the other factors I described, we feel like we have the tools in place. I think you see the resiliency of Marlboro in the marketplace, gaining share in the premium space. Certainly, we've seen competitors, I'll call it using your term, Bonnie, running share at the bottom, where they're pricing some of their discount brands at deep discount levels.

And really, if you think about our strategy in the cigarette space, that's to maximize profitability over the long term while making appropriate investments in Marlboro and the growth areas. I think when you think about the question about price elasticity, yes, we made the minor investment at Investor Day. But if you look at even the decomposition that we provided in our metrics, you can see that's been pretty consistent over the past 4 periods that we showed on a 12-month moving. We really don't see anything there from a standpoint of the consumer -- any changes in the price elasticity other than the minor adjustment that we made going into Investor Day.

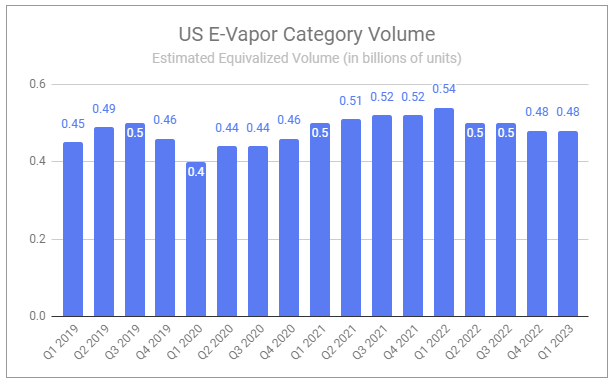

None of this is to say that the trend will fully mean-revert to the 4-5% annual decline rate we’ve seen historically. That should have never been expected. For starters, an additional concern related to the US cigarette industry volume declines is cross-category movement. The secular decline rate of -2.5% remains unchanged and automatically includes a 1% impact of cross-category movement, but Q1 2023 listed a 0% additional contribution. Can this be right? We know there is a cross-category shift occurring from legacy to modern oral, but according to Altria, the shift to e-vapor, which was for a time the largest driver, has been stunted. Gifford explained on the Q1 call:

We believe the category is continuing to undergo a significant reset, and we estimate that first-quarter e-vapor volumes decreased 11% versus a year ago and 1% sequentially. We have observed a decline in traditional multi-outlet and convenience channel volumes, which we believe is primarily a result of the FDA marketing denial orders issued for JUUL and MyBlu. This volume decline has been partially offset by increased volume in nontraditional channels, such as e-commerce and vape stores.

While Altria’s explanation makes sense and is supported by the category volume chart above, I think it’s still worth questioning. We’ve seen evidence of the proliferating popularity of disposable vapes, and many of the sales channels in which they’re sold simply aren’t tracked as well. And since e-vapor broadly is converting smokers and would-be smokers, this assuredly continues to impact legacy volumes. At the same time, increasing government enforcement against PMTA MDOs and the illicit market could result in a future cross-category shift benefit for cigarettes, which I highlighted in March:

Yet, even if cross-category movement turns into a temporary tailwind, we know that continued declines will be driven by a change in the price elasticity coefficient, which has been adjusted from -0.30 to -0.35. Gifford continued to explain:

recently wrote a good piece exploring consumer brands that have exercised large price hikes recently. Some companies are pausing further hikes after raising aggressively, while others are immediately feeling greater pressure on their volumes. I am less concerned about the long-term for most of the companies he mentions, but the piece helps further solidify the idea that tobacco remains in a league of its own when it comes to price inelasticity. Applying the decline rate of cigarettes to other products would spell disaster for almost all industries, but just as the product is uniquely challenged, it continues to boast supernormal profitability and exercisable pricing power that is practically unparalleled. There is also the rudimentary mechanic in which volume declines can be looked at positively. When fewer products are made and sold, there are naturally fewer production and sales costs. For a product such as cigarettes, which faces substantial excise taxes, the total value of the retail market can decrease while more of the remaining market simply shifts into the pockets of the manufacturers.And when you think about price elasticity, that's the nature of a negative 0.35, Is that for percent that you increase price, you expect that 0.35 impact on volume. So it's much, much lower than other industry categories in the CPG space. You can see in the decomposition we try to break down what's taking place in the cigarette category.

You see secular declines pretty steady. The big factor is macroeconomic that swings around.

I think if you go back in history, you'll see macroeconomic, the conditions that the consumer is under will swing it up or down.

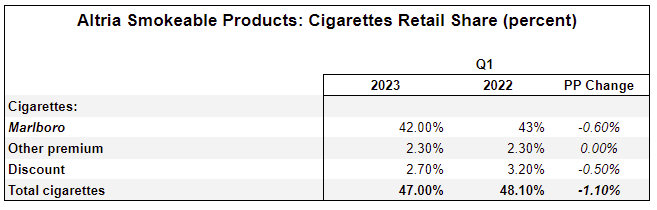

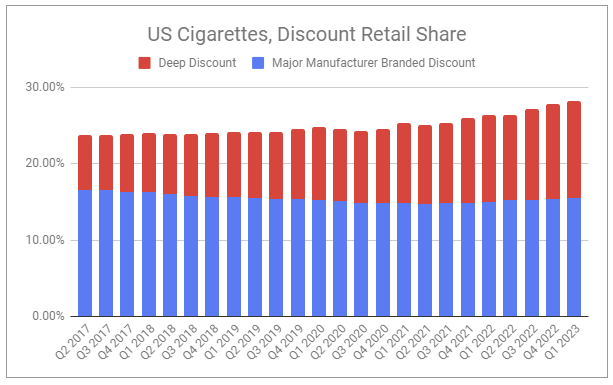

Though we can look at total cigarette industry volumes, a critical point is who exactly is selling those volumes. Recent volume declines for Altria’s cigarettes have been at a rate higher than the US industry as a whole. A portion of this has been caused by consumers downtrading to discount brands while facing heightened financial pressure, as illustrated below.

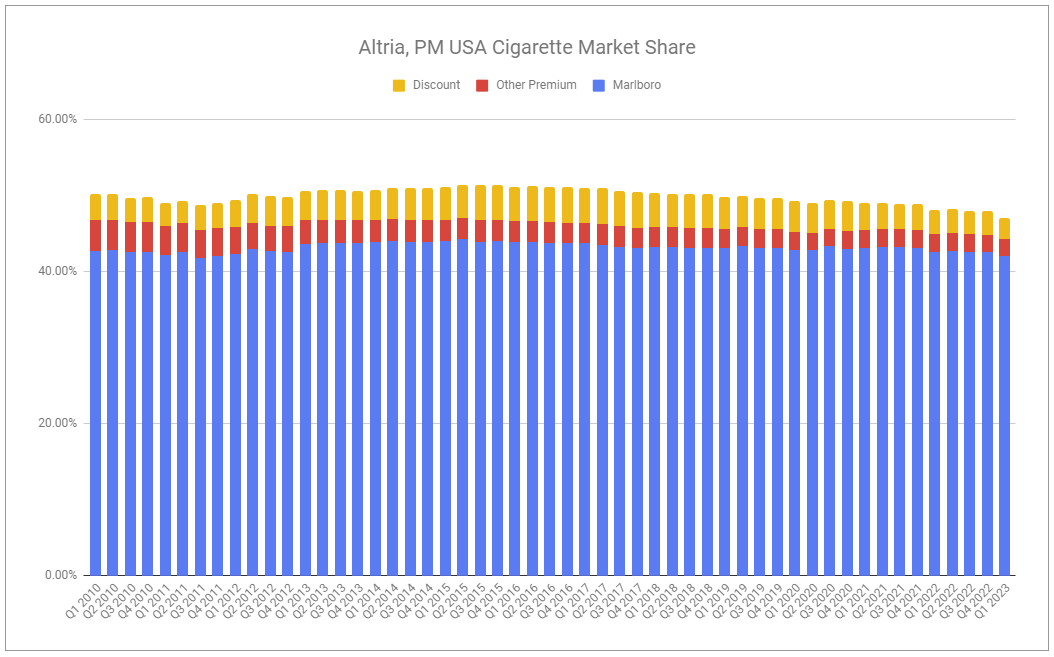

Yet Altria still retains a massive share of the total US market.

Zooming out might suggest that the current concern is less warranted.

After all, as cited during Altria Investor Day 2023, the company is aiming to maximize long-term profit over low-margin share gains and intends to reinforce Marlboro’s positioning as a premium product. Marlboro’s share of the premium subsegment has grown.

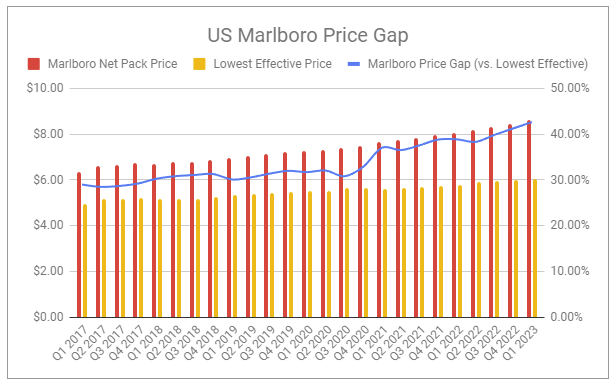

So long as consumers face increasing pressures on their discretionary income, it will be natural for Altria to cede incremental share as it continues to take price at an elevated rate, best illustrated by the price gap chart below.

An oddity is Altria’s pending rollout of Marlboro Black Gold, which the company’s CFO, Salvatore Mancuso, described during the Q1 call:

And we believe at PM USA has the appropriate tools to navigate this challenging environment. For example, we recently announced a series of investments behind the Marlboro Black family of products, which are intended to provide additional support for price-sensitive Marlboro smokers. Included in these investments is the introduction of Marlboro Black Gold pack non-menthol offerings with a smooth flavor and rich taste. These products are intended to bolster the offerings within the Marlboro Black family of products and will be available nationwide beginning in May. Our RGM and advanced analytics capabilities inform the geographies and promotional rates for these strategic investments, allowing us to be precise with our spend while supporting our overall strategy for the segment.

The price spectrum of Marlboro offerings will widen and present a product at a price point counter to their stated higher premium focus. This could be argued as hypocritical, however, keeping consumers engaged with the brand should allow the company to better move consumers up toward the highest premium offerings across economic cycles if they retain those relationships, especially with the ability to optimize offerings at a personal level via retail-owned apps.

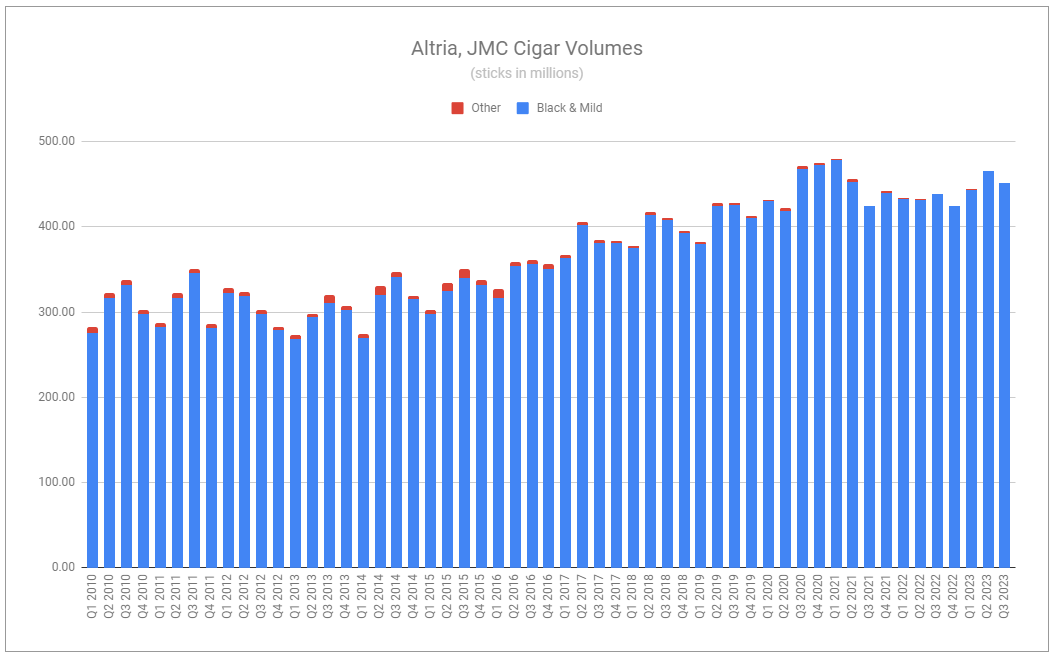

Alongside cigarettes within Altria’s Smokeable segment is John Middleton Company, the force behind Black & Mild machine-rolled cigars. While completely dwarfed by cigarette volumes, cigar volumes continue to grow and saw a 2.3% increase in Q1 2023 over Q1 2022. This is a continuation of the long-term trend, all while the company continues to raise prices every single year. While Altria does not granularly disclose the operating income contribution from cigars, rough math suggests that JMC has paid for itself several times over since its 2009 acquisition, which was explored in Altria’s Investment History.

Despite most discussions focusing nearly entirely on volumes, which can also be rather choppy, RNET per smokeable unit highlights the lock-step mechanics of the company’s pricing management.

Continued price hikes and cost efficiencies have predictable results on margins.

When you marry it all together, you have a formula that has allowed the company to grow operating income despite a clear erosion of total smokeable product volumes. Of course, there is no guarantee it continues. However, the factors above illustrate that the future of Altria’s smokeable segment is likely not as bleak as those strictly volume-focused believe.

Oral Tobacco Products

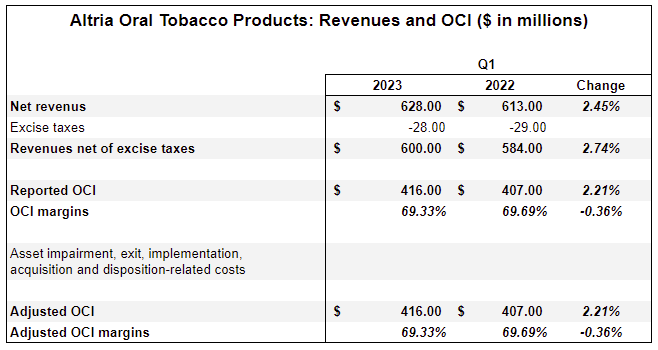

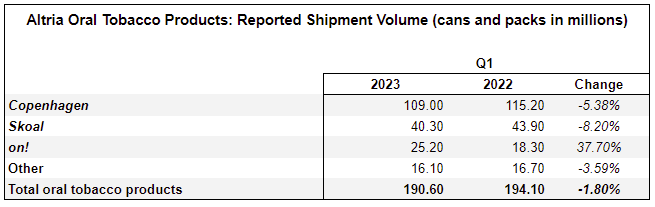

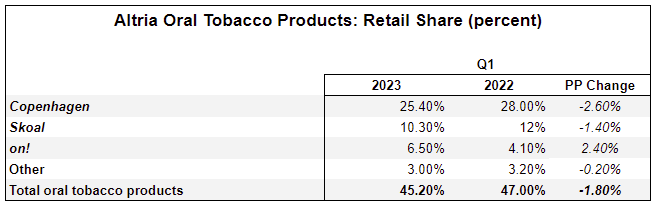

Altria’s Oral Tobacco segment, like cigars, continues to be underappreciated. Volumes of legacy products continue to decline driven by a shift to modern oral variants. Yet, even with total volumes down 1.8% for the quarter, revenue net of excise taxes increased by 2.74% and reported company operating income grew by 2.21%. This is despite losing 1.7% of total category market share, likely driven by the continued rapid growth of ZYN. Copenhagen, the largest contributor, may remain even more resilient, as it received authorization to be marketed as a modified risk tobacco product in March.

Total oral tobacco category volumes in the US remain strong as consumers switch to modern oral pouches, and Altria’s Helix Innovations saw volumes of its modern oral pouch, on!, grow 37.7% from Q1 the previous year and 10.04% sequentially. on! now holds a 6.5% share of the total oral tobacco category and a 24.6% share of the modern oral category, up 3.3pp from Q1 2022.

Volume growth of on! continues to impress despite promotional spending and aggressive discounting being reduced, with the average retail price growing 7% sequentially and 32% compared to Q1 2023. Management has stated expectations for Helix flipping to profitability in 2025, as well as on! Plus, a larger, stronger, moist pouch variant.

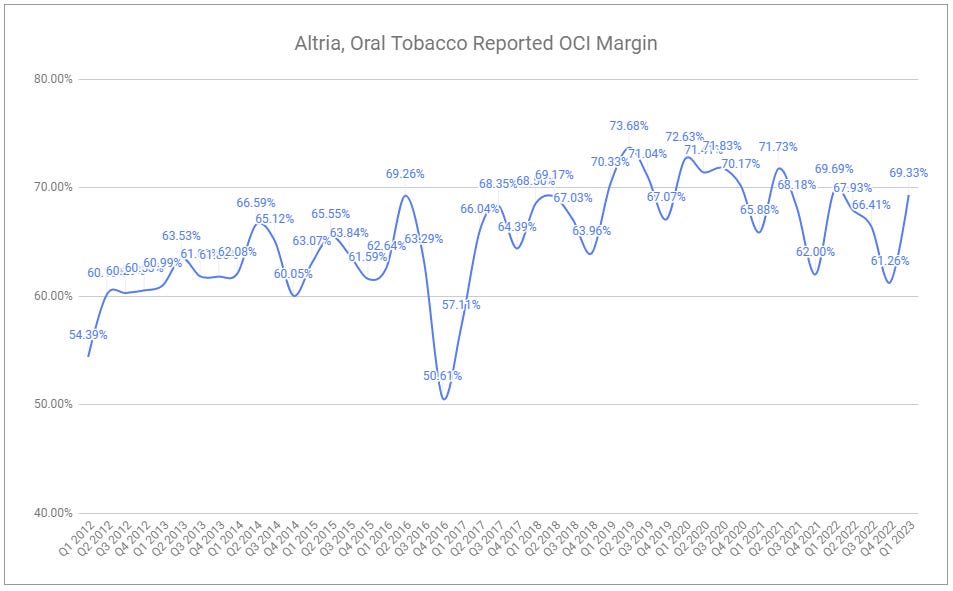

Segment margin performance has been equally impressive in recent years considering the loss-leading tactics paired with on! cannibalizing legacy volumes, and margins should continue to trend positively as price and promotional spending continue to be adjusted. And mind you, this segment is actually more profitable than the smokeable segment due to STMSA/MSA and excise tax dynamics, with an OCI margin ~10pp higher than the already absurdly high level of smokeables.

Like cigars, total oral volumes have grown over time, and the total market will likely see an incremental expansion. Not unlike smokeables, the mix of variables within the oral tobacco segment has allowed the company to continually exercise price each year which has not only widened margins but increased absolute profits at a steady clip.

Other developments

E-vapor

My overview of Altria’s acquisition of NJOY contained a mixed bag of pros and cons, with a special focus on comparing the NJOY ACE to the leading pod-based e-vapor products. While I still believe there are several strategic rationalizations supporting the deal, I’ve since collated additional user reviews and engaged with a number of users and retailers substantiating concerns around leakage; the same kind of concerns that Altria’s CEO quickly dismissed during the announcement conference call:

Yes. I appreciate the question. I think when you think about the consumer research we did, that didn't come up as an issue. I think all products in the marketplace have some slight leakage, but nothing of significance. And we didn't see that as a huge issue with the consumer feedback we had in the consumer research.

I think when you think about the authorization that's been granted, we would certainly keep the product in place. But as you saw in the release, this -- now, we would be excited to have this new platform and the IP related to it in our product development and innovation system. And that would allow us to build off of that, if you will, based IP to future iterations as we progress into the future.

My own research has substantiated that the Vuse Alto also has occasional pod leakage, but seemingly primarily during usage. While impossible to pinpoint the cause, it is likely that both the Vuse Alto and NJOY ACE experience this since they both use magnets to hold pods in the device instead of the snap-action JUUL relies on. However, something unique to NJOY ACE pod’s packaging is that each pod has a small plastic plug on each end. The mere existence of a plug suggests that a plug is necessary to prevent leakage (duh). This is absent in both the Vuse Alto pod and JUUL pod packaging and causes a secondary concerning issue, which is that NJOY ACE pods, with said leakage, can oxidize before usage. As NJOY ACE pod sales velocity is low, they can sit on shelves and become stale prior to purchase, and when consumed, are said to sometimes produce a spoiled/burnt taste. It should be noted that this is not for every single pod, and this does not seem like an insurmountable challenge to overcome, especially for a company with production expertise such as Altria. But it does require acknowledgment. A differentiated device will not win the market if it is inconsistent.

Speaking of inconsistency and the challenges facing the category, it is interesting that the entirety of this strategy runs counter to PMI’s recent comments questioning the overall viability of the e-vapor space. At the same time, if NJOY fails to gain traction and Vuse Alto remains the clear market leader in the U.S. space, Altria will still be set to benefit.

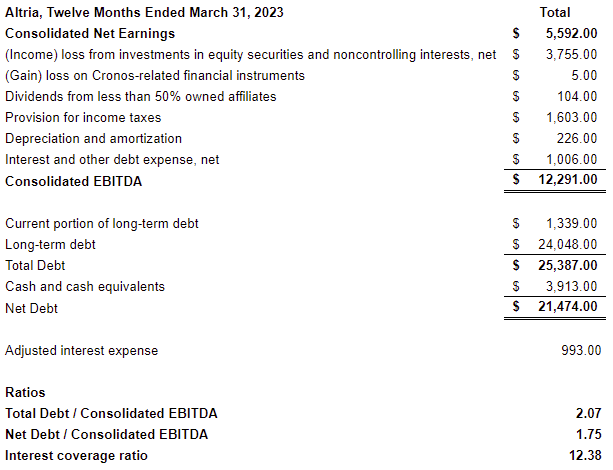

Leverage

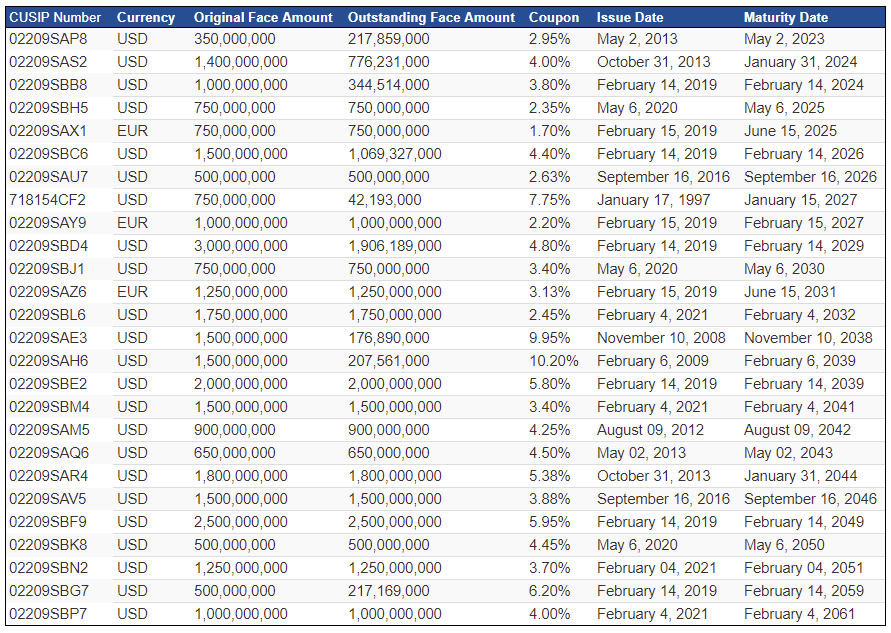

Altria repurchased 0 shares during Q1 2023 due to the pending NJOY deal. The company still holds $1 billion in authorized repurchases which it aims to complete by year-end. As of March 31, 2023, Altria’s weighted average coupon was 4.2%, and the company holds:

an interest coverage ratio of x12.38 (adjusted for note CUSIP 02209SAW3 retired in Q1 which came due in February)

a total debt/EBITDA ratio of x2.07

a net debt/EBITDA ratio of x1.75

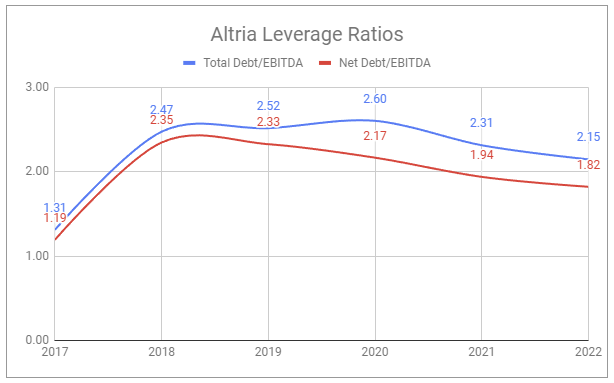

The company continues to make steady progress in deleveraging since its 2018 investment in JUUL and 2019 investment in Cronos.

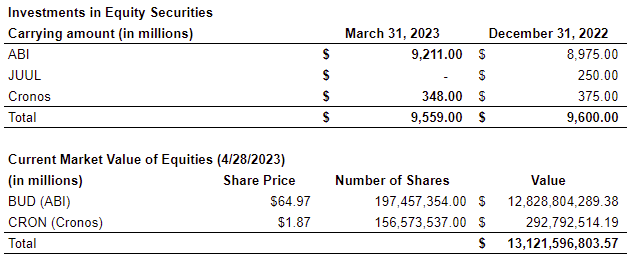

InBev + the deferred tax asset

Altria is currently recording a carrying value of its Anheuser-Busch (ABI) stake of $9.2 billion, and the current market value of the stake is $12.8 billion.

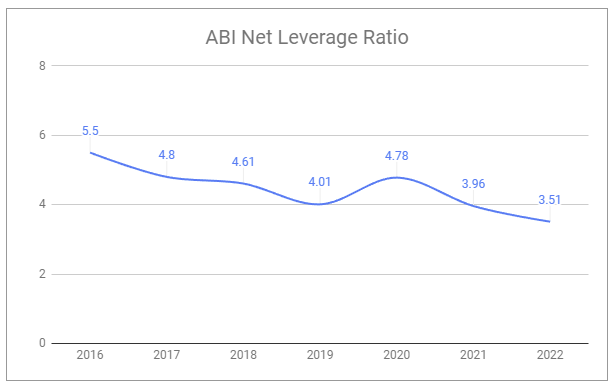

Anheuser-Busch’s contribution to Altria’s performance is always on a 1-quarter lag due to reporting timing, but it is worth looking at recent operational performance while zooming out further. ABI’s merger with SAB Miller in 2016 saddled the company with a tremendous amount of debt, which was crippling when covid hit.

Quickly glancing at some of ABI’s numbers over the last half-decade offers little excitement. FY 2022 revenues were $57.78 billion, barely up from the $56.44 billion generated in 2017. But for the full-year 2022, ABI saw total volumes increase by 2.3% and net revenue/hl increase by 8.6%, resulting in total revenue growth of 11.2%. EBITDA and EPS grew by 7.2% and 5.2%, respectively. While the growth in net revenue/hl was markedly higher than in previous years, it is a continuation of the trend.

And despite the devastating impact on operations from covid, Anheuser-Busch has continued to reduce its total debt by a significant level every single year since the merger.

Which is also reflected in the company’s net leverage ratio dropping.

Currently, ABI’s debt holds an average maturity of 15 years and an average pre-tax coupon of 4%, and the company is working towards an x3 net debt/EBITDA ratio. Provided the company executes, they should reach the level in ~18 months.

More recently, Anheuser-Busch has received a spike in publicity, driven by new advertising, public responses to said advertising, and responses to the responses to said advertising. I have no real opinion on the advertising itself, but there seem to be angry people in the world boycotting Bud Light and the company at large. While some claim a permanent impairment to volumes spelling the end of ABI, I think otherwise. If history is any indication, this whole ordeal is likely driven by a small vocal minority who in 6-12 months will be preoccupied with being outraged about something else entirely.

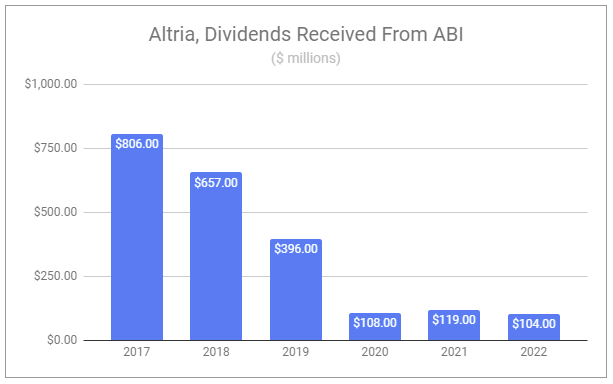

Nonetheless, should Altria sell its stake in Anheuser-Busch? The question comes up time and time again, especially in recent years as the steady steam of dividends Altria once received from the stake has shrunk due to the mix of high debt and covid.

Altria’s management continues to repeat that they believe holding onto the ABI stake is the best long-term course of action. That may be true, as ABI continues to deleverage, has a clear roadmap to create value, and shows a path to reraising its dividend payout in the future, thus increasing that stream of cash for Altria. On the other hand, Altria’s stake in ABI is currently 14.97% of its market cap. I wrote in The Ultimate Balancing Act:

There has been increasing questioning surrounding the stake and what management’s intentions are. Naturally, the response has been that the focus is long-term value creation, and the stake will continually be evaluated. Having originated from Altria’s (then Philip Morris) stake in Miller Brewing Company more than 50 years ago, I don’t see them rushing to sell, especially with tax implications present. Nonetheless, it’s not farfetched to envision such opportunities in the future. Any notable divergence in the relative performance of MO and BUD equity, contingent on fundamentals, could be used as a rationale for selling the stake to further delever or to simply retire a substantial portion of Altria's common equity.

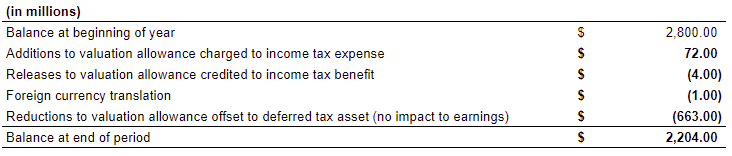

Only a few months have passed, but since Altria has entirely exited its equity stake in JUUL, Altria can utilize the deferred tax asset from the catastrophically bad investment. This would help counter the tax burden generated by selling the ABI stake.

Would further weakness in the share price convince management to sell? If Altria’s share price were to hit the mid-30s, the ABI stake would then be over 20% of Altria’s market cap. Proceeds from selling the ABI stake could retire notes maturing in the next few years 02209SAP8, 02209SAS2, 02209SBB8, 02209SBH5, 02209SBC6, 718154CF2, 02209SBD4, as well as 02209SAE3 and 02209SAH6, which carry coupons of 9.95% and 10.2%, respectively. The base cost of this would be approximately $5.5 billion, leaving enough proceeds for the company to retire around 10% of the equity. Altria would move down its debt/EBITDA to ~x1.6, reduce its interest expense by ~25%, and reach an interest coverage ratio of over x16. Reporting earnings would lose the contribution from the ABI stake. Cash flows would lose ~$100 million in annual associated dividends, which would be more than doubly offset by the reduced interest expense. The end result for the equity would be a double-digit increase in diluted EPS. With any further divergence, such as if BUD shares simply run higher, one could even argue to simply roll near-term maturities forward, increasing the interest expense but allowing a greater percentage of the stake sale proceeds to go towards buybacks, potentially allowing a teens-level percentage retirement.

Naturally, this comes with hesitation. While it deleverages the company, the company’s present debt levels aren’t all too concerning, and the performance of the remaining entity would be further concentrated on the core business. If the core business degrades, this type of maneuver would look foolish in hindsight. If the core business degrades while ABI flourishes after Altria were to sell its stake, it would look downright asinine. Nonetheless, the above exercise illustrates the mechanics at play. A substantial increase in the differential between MO and BUD shares leads to a substantial increase in the odds of a sale.

At the same time, perhaps this will be inevitable. Management has announced a shift in dividend policy, from an 80% target payout ratio of adjusted diluted EPS to a ‘progressive dividend goal’ targeting mid-single-digit dividend growth for the next half-decade. I find this concerning. This policy is clearly aimed at bolstering investor confidence but could cause management to perform short-term moves to reach their medium-term goal. A focus on value return is not the same as a focus on value creation, and there is no promise this would align with what is best for the long term. This is especially the case with the company investing in HTP SWIC, on! Plus, NJOY, and who knows what else in the coming years, all of which will face varying durations of unprofitability, further weighing on group results. In this light, maybe this avenue flips from an alluring opportunity to a scary proposition.

Valuation

The length of this piece may suggest otherwise but, just like my most recent update on Philip Morris International, very little has changed since my last published valuation of Altria. Headlines, new deals, and heightened pressures affecting the business are met with the same conservative approach to modeling that I believe presents a sizable margin of safety. I have long modeled the value of JUUL at 0, despite giving 0 value to the resulting DTA, habitually overstated the reinvestment needs of the core business while also aggressively discounting the value of the company’s equity investments, and even used a synthetic PT cost of debt notably above the company’s book. With that said, there should never be an expectation that the market wakes up and views this company less pessimistically than it does today, and there is a likelihood that consensus sours further. I wrote in February:

Throughout 2022, headlines were dominated by a circus of fears. Geopolitical strife. Supply chain woes. Persistent inflation. Altria, the U.S.-based holding company responsible for Marlboro and a range of other smokeable and smokeless products, was not entirely unscathed. However, even center stage, spotlights on, shackled by regulation as if impersonating Houdini, and caged in with lion-like legislatures, the only thing circus-like about the company has been its uncanny ability to walk the tightrope: managing its ever-growing pool of profits against an ever-shrinking pool of smokers - the same gravity-defying feat it has performed for decades.

The full year of 2023 will presumably be one more step forward on the tightrope. Though rest assured, eventually, Altria will lose its perfect balance, and profits will begin to fall. After all, nothing lasts forever. But I believe it’s important to see how high the tightrope is, and in the end, my conclusion stays that the remaining cash flows from this act are presently worth much more than the market is pricing.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Altria and other tobacco companies such as British American Tobacco and Philip Morris International.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Devin, you are far an away the best Altria analyst. I regularly forward these to my CIO in lieu of sell-side reports.

Thanks. Your pieces are addictively informative.