“We expect organic net sales of handmade cigars to increase compared to the last year. We have shown that the consumption of machine-rolled cigars and smoking tobacco in our European markets would develop close to their structural decline rates. However, the development during the first quarter of the year might be an early indicator, this could be too optimistic. As said, the first quarter is a small quarter and volume development has been volatile from quarter-to-quarter in the past, where we will monitor our development closely to act if required. Net sales from our NGO portfolio are expected to increase by more than 50%, driven by market share expansion and roll out to new markets.” - Marianne Rørslev Bock, STG CFO, Q1’24 Remarks

Scandinavian Tobacco Group’s operations are split down the middle, with half pressed by mounting challenges while the remainder excels. The problems facing the European machine-rolled business are not mild nor fleeting; elevated special expenses from investments persist; the contributions from the global expansion of premium handmade cigars will take far longer to become robust. At the same time, the performance of the retail division and new disclosures of the next-gen oral nicotine business far exceed expectations. Since first publishing on the company in July 2023, the argument has been that the normalized profits produced by this business are far more valuable than indicated by the market. We are now forced to revisit the principle question: What is normal?

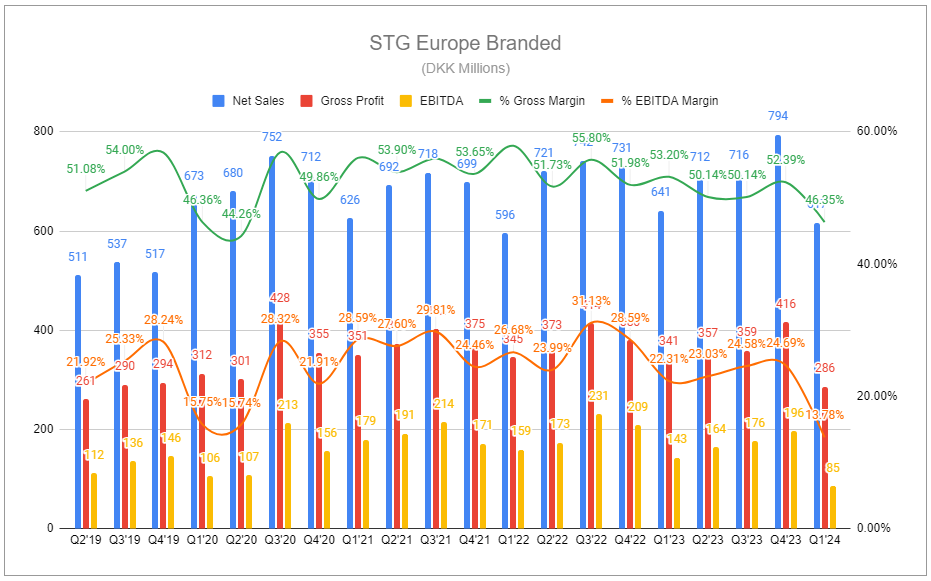

Europe Branded

The principal concern remains the relative performance of STG’s European machine-rolled cigar business. The structural dynamics of the European market for the category remain much more challenging, leading me to remain more upbeat about the leader in the US market. Moreover, my primary interest is in STG’s premium, handmade cigars and the long-tail earnings they will be able to produce. Nonetheless, Europe Branded remains a large part of STG’s business, and machine-rolled cigars make up the majority of the segment, responsible for a considerable portion of the company’s earnings. Previous assumptions that the company’s pricing strategy would continue to carry the segment forward with seemingly minimal effort were off base, and in November 2023, I noted the challenges facing the segment:

While not explicitly stated during the Q3 call or CMD, STG has faced competitive pressures from flavored machine-made cigars, a subsegment it lacks offerings. Additionally, the loss of market share was likely driven by relatively aggressive pricing, in which the group took MMCs up 7% y/y to combat volume declines on top of previous supply chain issues and excise tax increases—alongside a sizable and growing black market for smoking tobacco.

Now, despite the company’s category portfolio spanning value-for-money to premium and submarkets in which volumes have remained steady or even growing, it is clear that the aggressive pricing strategy was too heavy-handed, as affirmed by STG CEO Niels Frederiksen during the Q1’24 call (emphasis added):

Niklas Ekman, Carnegie:

Yes. The first question on the European machine-made cigars. Can you tell us a little bit here. I mean, this is a business that has been in a decline for quite a few years now, and I think you have done many efforts in the past to reverse this. Can you elaborate a little bit on what you see as the core problem?

And what makes you different this time? Why will the efforts that you're launching now be sufficient to reverse that trend? That's my first question.

Niels Frederiksen, STG CEO:

Okay. Sorry. Thank you, Niklas. So it is true that machine-rolled cigars have been in decline for a while. And I think that if we think back a few years, we had the supply issues and then we solved those and we came back in the Q2 last year and realized that as we were fixing distribution and visibilities in the stores, it still did not really help the market share turnaround. Then we have made various efforts in the course of 2023, and we saw in the fourth quarter, finally, an uptick in market share.

But as we can see in Q1 here, that market share was not sustainable, and it was replaced by another decline. So the efforts we have made have clearly not been enough. And the analysis we've done is concluding that we have been too aggressive on some of our price increases, and we need to take selected products down in price to be protecting volumes more. So these are the next steps we are looking at is primarily within the relative pricing of our brands versus competition, and you can say that we have been surprised not to see competition raising prices. And now we are taking the conclusion that we need to take a step back and get a better balance between pricing and volume. This is not unlike what we saw in the online business 12 months ago, and there, you can say that the initiatives we have done has worked. So we're also hoping that, that avenue will work for machine-rolled cigars. It's certainly one of our highest priorities for 2024.

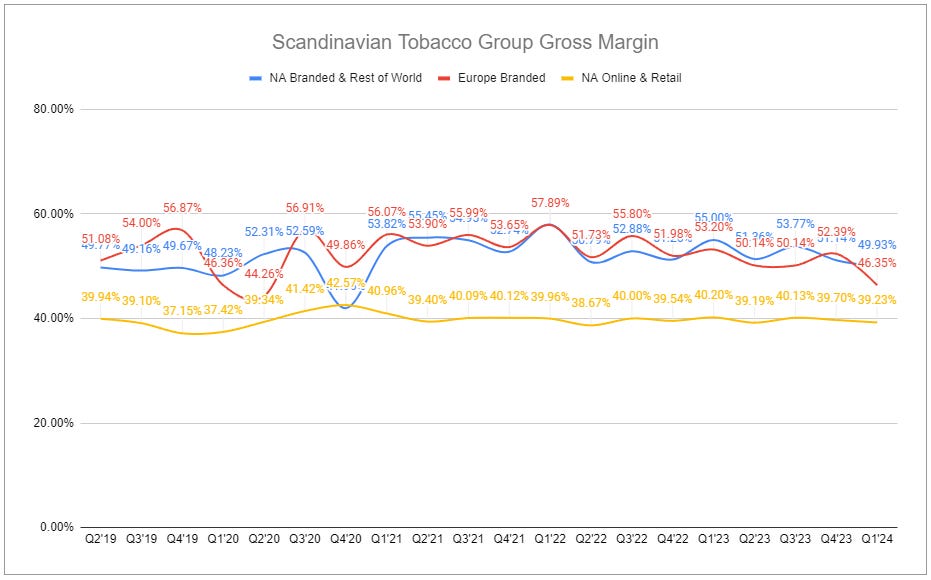

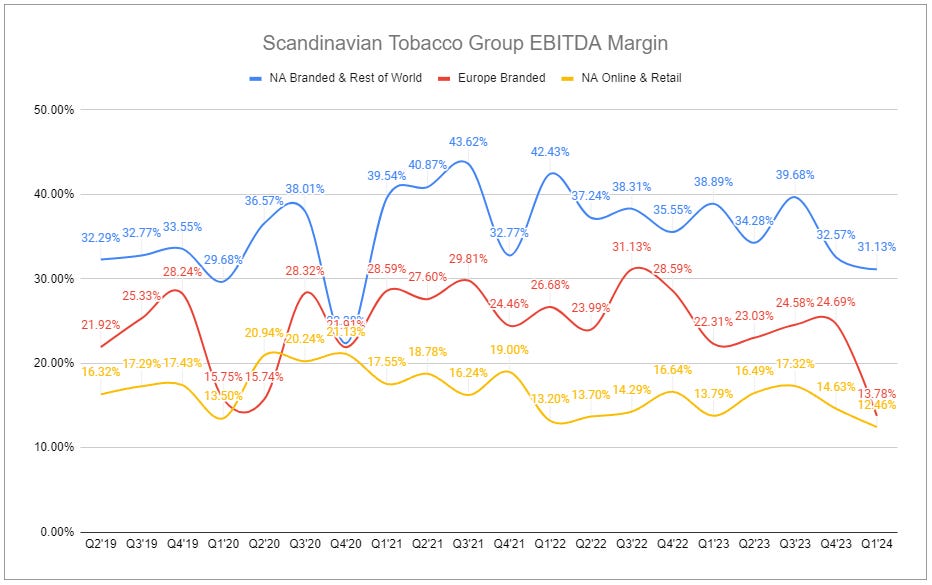

The impact of these challenges is unmistakable, with STG’s European Branded organic revenue down 8% year-over-year. More alarming was the segment’s margin development, with gross margin dropping by 684 bps y/y and EBITDA margin falling by 853 bps, leading to segment EBITDA 40.56% lower than Q1’23, at DKK 57m. However, this margin evolution is not wholly on the back of poor legacy performance and includes the company’s foray into the modern pouch category, or as the company refers to it, next-gen oral (NGO.) While the segment’s organic revenue was down sharply, acquisitions made up for half the shortfall, leading to reported revenues being down by 3.7% for the period and near flat in the trailing twelve months.

XQS, acquired by STG in May of last year, is the stand-out oral product. I recently touched on the product’s qualities, previously highlighted user testimonies, and its unique flavor profiles continue to set it apart from the pack. The brand has captured 7% of the highly competitive Swedish nicotine pouch market. It is certain that regardless of how EB’s legacy products perform, next-gen oral will continue to weigh on profitability as the company continues to reinvest in growing capacity and distribution. XQS was launched into the UK market at the start of May, and more European markets are sure to follow.

Specifically disclosed in Q1’24 was that NGOs, comprised of XQS, act!, STRÖM, and the 3PD of ZYN (NAOR segment), now make up 5% of group net sales. This is up from effectively zero just a few years ago, with organic growth of more than 100% from Q1’23. While reinvestment will weigh on performance in the interim, the long-term implications to group profits with further scale can not be understated considering the context provided by STG CFO Marianne Rørslev Bock during the Q1’24 call:

I would say the EBITDA contribution in Q1 is about [ 0 ] for this category. And if we look for the remaining year, we do expect the contribution to be negative because we are going into the U.K. market, and we are investing also with additional sales force. So that is part of our clarification on this category, how we should compete and whether we can compete. We will invest. And then over the next 18 months to 24 months, we need to establish where we believe we can be competitive in the longer run.

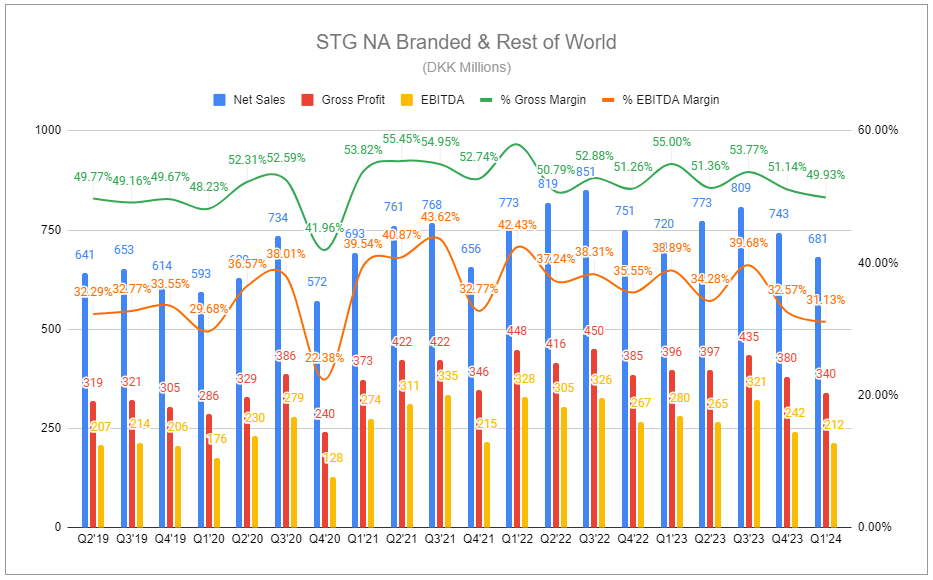

North America Branded & Rest of World

Not unlike European Branded, NABROW's performance was far from flawless. Q1’24’s organic net sales decline of 6% was compounded by a ~1% FX headwind courtesy of the USD, partly offset by acquisitions, leading to reported net sales declining by 5.4%. Segment EBITDA dropped from DKK 276 million for the same period to DKK 212 million. The primary driver of the declines was a double-digit decrease in machine-rolled volumes, predominantly in Canada, following the country’s draconian plain packaging laws extending to machine-rolled variants. This should be temporary as volumes adjust throughout the year, especially if precedent is to signal the effects. Canada’s plain packaging laws already existed for premium handmade products. Having traveled to the country, discussed the impact with retailers, and experienced the brilliance of the rules firsthand, it seems that plain packaging merely acts as an annoyance—for handmade variants, the plain bands are easy to peel off, revealing the regular bands underneath.

Despite the notable decline in MRC performance, handmade volumes in the United States, the largest market, were handily offset by pricing. International sales of handmade brands also continued to grow at a double-digit rate, though still only represent a low single digital percentage of total net sales.

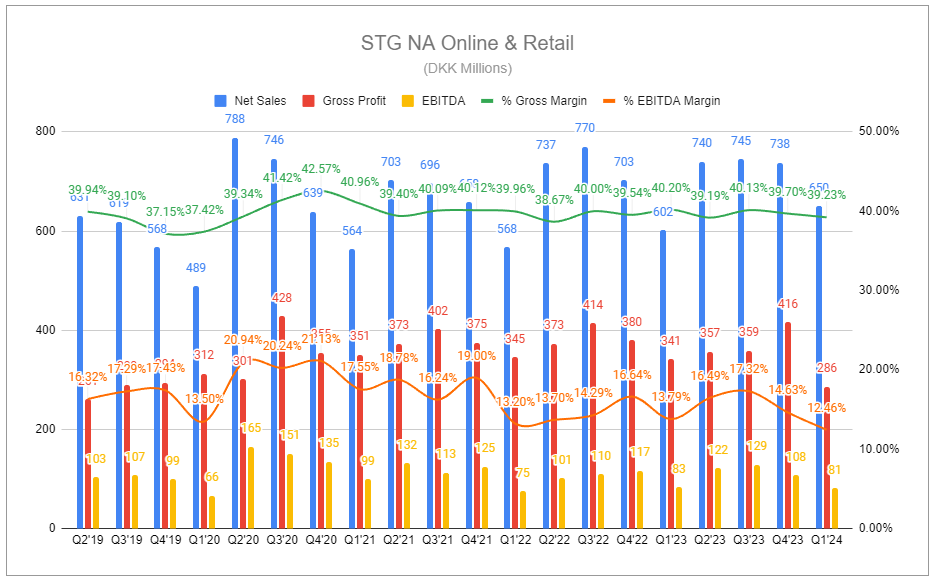

North America Online & Retail

The NAOR segment once again shined bright in Q1’24, with organic net sales increasing by 9% and reported sales up by 8%, marginally depressed by FX rates. The segment’s margin profile, always weaker in Q1, was lighter from the continued mix shift. Active consumers across the company’s portfolio of websites have stabilized following the post-COVID unwind. Same-store sales increased by 4%, and total retail store sales increased by double digits, driven by new store openings. The rate of new store openings has been disappointing, with one less opened in 2023 than expected, but three are planned for FY’24, and ideally, the pace will be matched in the following years.

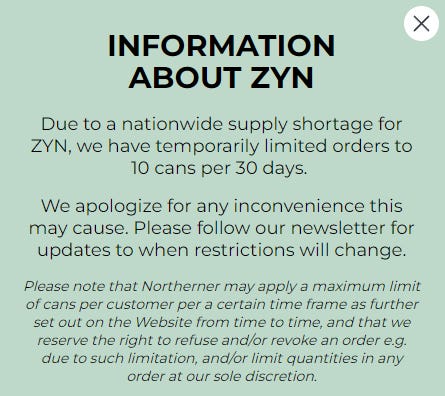

Further driving NAOR performance was the company’s US distribution of ZYN, which has continued to experience accelerated growth in the country, as noted recently in the PMI Q1’24 note. Also within the note was an exchange addressing retailers and wholesalers claiming product shortages, in which PMI CFO Emmanuel Babeau appeared to dismiss the severity of the impact. However, recent points show the shortage being more widespread, unresolved, and potentially lasting far longer.

ZYN (dot) com, directly concerning STG’s involvement, is currently backordering all products. Also, Northerner and Nicokick, owned by Haypp Group, have capped ZYN orders.

Nicokick has provided information concerning the immediate questions that come to mind:

Why is there a shortage of ZYN?

This is an issue of supply and unprecedented demand. ZYN’s customer base has seen a dramatic increase over the last few months and shows no signs of slowing down in what is an already fast-growing nicotine pouch category. Right now, Swedish Match are in the process of boosting their production to deal with the massive influx of US orders.

How long do you expect the ZYN shortage to last?

At this stage, we don’t know. Given current stock levels and early indications from Swedish Match, we believe the effects of a ZYN shortage may be felt in the US for a few months.

While fervent consumer demand for the product is unmistakably positive, we all must concede to the situation's limited visibility until PMI says and shows otherwise.

What is normal?

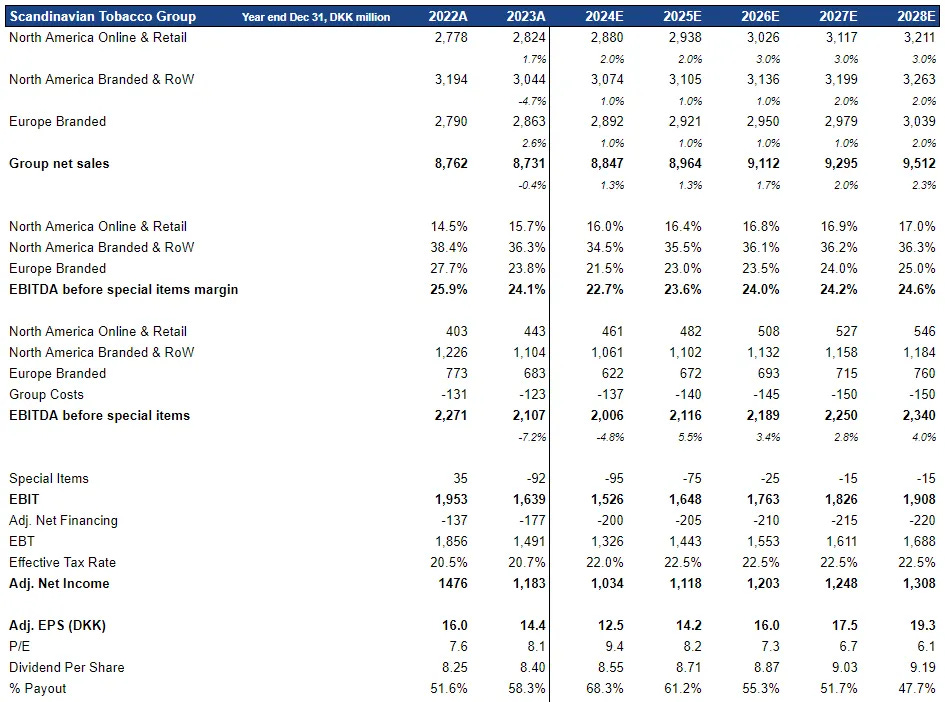

With every part of STG’s operations facing seemingly unusual circumstances, it may feel impossible to build meaningful confidence in what normal might look like in terms of earnings power. Yet, management has reaffirmed 2024 guidance, including:

Net sales: DKK 8.8-9.1bn

EBITDA Margin: 22-24%

Free Cash Flow: DKK 0.8-1bn

Adjusted EPS: DKK 12.5-14.5

Despite the reaffirmation, it must be accepted that the elevated pressures facing the EB segment running against the Growth Enablers offer a new degree of uncertainty, especially since the most rapid growth is coming from NGOs, in which the company has a shorter track record, and the market is far more competitive. Because of this, it may be tempting to apply additional brutish conservatism toward inputs to illustrate the company’s potential evolution over the next several years. However, the modeled illustration following FY’23 already applied considerable conservatism in embracing these dynamics. Muted NAOR growth. Compressed margins. Elevated Group Costs, Special Items, Financing, and ETR.

Even with higher reinvestment costs, the group remains uniquely positioned and holds multiple routes to bolster its top line and margins. At DKK 100.6 per share, the name currently trades at 8 times the low of 2024 adjusted earnings guidance. It could be argued that any specific pressures may weigh on the company more heavily in the next year or two, but such arguments miss the larger picture. Modest operational execution and changes in capital structure from further share repurchases are set to compress that figure markedly over the next several years.

If you enjoyed this piece, hit “♡ like” on the site and give it a share. To further show your support, consider pledging a paid subscription to Invariant.

Questions or thoughts to add? Comment on the site or message me on Twitter.

Ownership Disclaimer

I own positions in Scandinavian Tobacco Group and other tobacco companies such as Altria, Philip Morris International, British American Tobacco, and Imperial Brands. I also own positions in Haypp Group, a major online retailer of reduced-risk nicotine products.

Disclaimer

This publication’s content is for entertainment and educational purposes only. I am not a licensed investment professional. Nothing produced under the Invariant brand should be thought of as investment advice. Do your own research. All content is subject to interpretation.

Tags: MO 0.00%↑ PM 0.00%↑ BTI 0.00%↑

Marcet Cap 8.26B DKK

FCF 2024 0.9B DKK

= 10.9% FCF Yield + 2% Sales Growth = 12.9% p.a.

Not really impressive valuations in comparison with IMB or Bats.

Hi Devin. Curious to hear your thoughts on today’s announcement by STG? Thank you in advance.